Navigating the World of Private Equity Investment

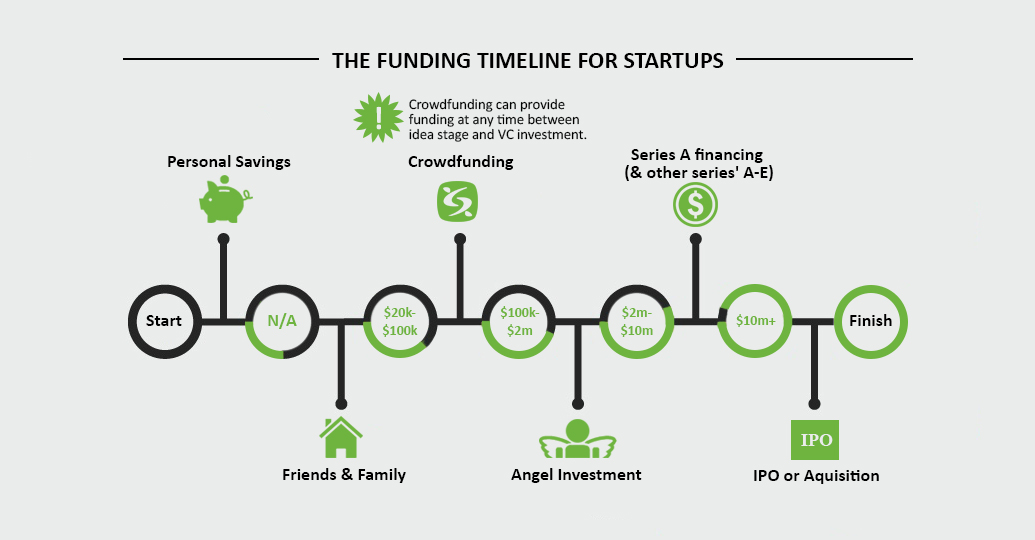

Private equity funding for startups is a crucial source of growth capital for companies looking to scale. Private equity firms invest in businesses with high growth potential, providing capital in exchange for equity. This investment model allows startups to access the funds needed to expand their operations, develop new products, and increase their market share. In return, private equity firms receive a stake in the company, providing them with a potential exit opportunity through an initial public offering (IPO) or acquisition.

The private equity investment process typically begins with a thorough evaluation of the startup’s business plan, management team, and market potential. Private equity firms seek companies with a strong competitive advantage, a clear growth strategy, and a talented management team. Once a startup has been identified as a potential investment opportunity, the private equity firm will conduct due diligence to assess the company’s financials, operations, and market position.

Private equity funding for startups can take various forms, including venture capital, growth equity, and leveraged buyouts. Venture capital investments typically focus on early-stage companies with high growth potential, while growth equity investments target more established businesses looking to expand their operations. Leveraged buyouts involve the acquisition of a company using a combination of debt and equity financing.

Private equity firms often bring significant expertise and resources to the table, providing startups with access to a network of industry contacts, operational expertise, and strategic guidance. This support can be invaluable for startups looking to navigate the challenges of rapid growth and expansion.

However, private equity funding for startups is not without its risks. Startups must carefully consider the terms of the investment, including the equity stake, valuation, and exit expectations. Private equity firms may also impose certain restrictions on the company’s operations, such as governance requirements or financial covenants.

Despite these risks, private equity funding for startups remains a vital source of growth capital for companies looking to scale. By understanding the private equity investment process and the various funding models available, startups can make informed decisions about their financing options and position themselves for long-term success.

How to Attract Private Equity Investors to Your Startup

To increase their chances of securing private equity funding, startups must demonstrate a solid business plan, a strong management team, and a clear growth strategy. A well-crafted business plan should outline the company’s mission, products or services, target market, competitive landscape, and financial projections. Private equity investors seek startups with a unique value proposition, a strong competitive advantage, and a clear path to scalability.

A strong management team is also essential for attracting private equity investors. Startups should have a experienced and skilled management team in place, with a proven track record of success. Private equity investors will assess the management team’s ability to execute the business plan, manage growth, and make strategic decisions.

A clear growth strategy is also critical for securing private equity funding. Startups should have a well-defined plan for expanding their operations, increasing revenue, and improving profitability. Private equity investors seek startups with a strong growth potential, and a clear plan for achieving that growth.

In addition to these key factors, startups can also increase their chances of securing private equity funding by demonstrating a strong financial position. This includes having a solid financial plan, a clear understanding of the company’s financials, and a demonstrated ability to manage cash flow.

Private equity investors also place a high value on startups with a strong network and connections. Startups should have a established relationships with key partners, suppliers, and customers, and a demonstrated ability to build and maintain these relationships.

Finally, startups should be prepared to demonstrate their unique value proposition and competitive advantage. Private equity investors seek startups that can differentiate themselves from the competition, and demonstrate a clear path to success.

By demonstrating a solid business plan, a strong management team, a clear growth strategy, a strong financial position, a strong network, and a unique value proposition, startups can increase their chances of securing private equity funding and achieving long-term success.

Understanding Private Equity Funding Models

Private equity funding for startups comes in various forms, each with its own unique characteristics and suitability for different startup stages. The three primary types of private equity funding models are venture capital, growth equity, and leveraged buyouts.

Venture capital investments are typically made in early-stage startups with high growth potential. Venture capital firms invest in companies that are still in the development stage, providing capital in exchange for equity. This type of funding is ideal for startups that require significant investment to develop their products or services.

Growth equity investments are made in startups that have already demonstrated significant growth and are looking to expand their operations. Growth equity firms invest in companies that have a proven business model and are looking to scale their operations. This type of funding is ideal for startups that require capital to expand their market reach, improve their operations, or make strategic acquisitions.

Leveraged buyouts involve the acquisition of a company using a combination of debt and equity financing. This type of funding is typically used for more mature startups that have a stable cash flow and are looking to make a significant acquisition or expand their operations.

Each of these private equity funding models has its own advantages and disadvantages. Venture capital investments provide startups with access to significant capital and expertise, but often come with high expectations for growth and returns. Growth equity investments provide startups with the capital needed to scale their operations, but may require startups to give up more control. Leveraged buyouts provide startups with the capital needed to make significant acquisitions, but may come with significant debt obligations.

Startups should carefully consider their funding options and choose the private equity funding model that best suits their needs. By understanding the different types of private equity funding models, startups can make informed decisions about their financing options and position themselves for long-term success.

For example, a startup that is still in the development stage may be well-suited for venture capital funding. A startup that has already demonstrated significant growth and is looking to expand its operations may be well-suited for growth equity funding. A startup that is looking to make a significant acquisition or expand its operations may be well-suited for a leveraged buyout.

The Benefits and Drawbacks of Private Equity Funding for Startups

Private equity funding for startups can be a highly effective way to access capital, expertise, and networks. However, it’s essential to understand the benefits and drawbacks of private equity funding to make an informed decision.

One of the primary benefits of private equity funding is access to capital. Private equity firms invest significant amounts of money in startups, providing the necessary funding to scale operations, develop new products, and expand into new markets.

Another benefit of private equity funding is expertise. Private equity firms often have extensive experience in the industry and can provide valuable guidance and mentorship to startup founders. This expertise can be particularly valuable for startups looking to navigate complex regulatory environments or develop new technologies.

Private equity funding also provides startups with access to networks. Private equity firms often have extensive connections in the industry and can introduce startups to potential customers, partners, and suppliers.

However, private equity funding also has its drawbacks. One of the primary concerns is loss of control. When a private equity firm invests in a startup, it typically acquires a significant equity stake, which can lead to a loss of control for the startup founders.

Another drawback of private equity funding is debt obligations. Private equity firms often use debt financing to fund their investments, which can lead to significant debt obligations for the startup.

Exit pressures are also a concern for startups that receive private equity funding. Private equity firms typically have a limited investment horizon and may pressure startups to exit the investment through an initial public offering (IPO) or acquisition.

Despite these drawbacks, private equity funding can be a highly effective way for startups to access capital, expertise, and networks. By understanding the benefits and drawbacks of private equity funding, startups can make informed decisions about their financing options and position themselves for long-term success.

For example, a startup that is looking to scale its operations quickly may find private equity funding to be an attractive option. However, a startup that is concerned about losing control may want to consider alternative funding options.

Preparing Your Startup for Private Equity Due Diligence

Private equity due diligence is a critical step in the investment process. It’s essential for startups to be prepared for this process to ensure a smooth and successful transaction. In this article, we’ll provide guidance on how startups can prepare for private equity due diligence, including financial statement preparation, market research, and competitive analysis.

Financial statement preparation is a critical component of private equity due diligence. Startups should ensure that their financial statements are accurate, complete, and up-to-date. This includes preparing balance sheets, income statements, and cash flow statements. Startups should also be prepared to provide detailed financial projections, including revenue growth, expense management, and cash flow projections.

Market research is also an essential component of private equity due diligence. Startups should have a deep understanding of their target market, including market size, growth potential, and competitive landscape. Startups should be prepared to provide market research reports, customer surveys, and competitive analysis.

Competitive analysis is another critical component of private equity due diligence. Startups should have a deep understanding of their competitors, including their strengths, weaknesses, and market position. Startups should be prepared to provide competitive analysis reports, including market share analysis, customer acquisition costs, and customer retention rates.

In addition to financial statement preparation, market research, and competitive analysis, startups should also be prepared to provide other information, including organizational charts, employee resumes, and intellectual property documentation.

Startups should also be prepared to answer questions from private equity investors, including questions about their business model, growth strategy, and competitive advantage. Startups should be prepared to provide detailed answers to these questions, including examples and case studies.

By being prepared for private equity due diligence, startups can increase their chances of securing private equity funding and achieving long-term success. Private equity investors are looking for startups that are well-prepared, well-organized, and well-positioned for growth.

For example, a startup that is looking to secure private equity funding should ensure that its financial statements are accurate and up-to-date. The startup should also have a deep understanding of its target market and competitive landscape. By being prepared for private equity due diligence, the startup can increase its chances of securing private equity funding and achieving long-term success.

Private Equity Funding Success Stories: Lessons from the Field

Private equity funding has been instrumental in the success of many startups. In this article, we’ll share case studies of successful startups that have secured private equity funding, highlighting the key factors that contributed to their success.

One such example is Airbnb, a startup that revolutionized the hospitality industry. Airbnb secured private equity funding from investors such as Sequoia Capital and Greylock Partners, which helped the company scale its operations and expand its user base.

Another example is Uber, a startup that disrupted the transportation industry. Uber secured private equity funding from investors such as SoftBank and Google Ventures, which helped the company expand its services and enter new markets.

These success stories demonstrate the importance of private equity funding for startups. By securing private equity funding, startups can access the capital and expertise they need to scale their operations and achieve long-term success.

So, what are the key factors that contributed to the success of these startups? First and foremost, they had a solid business plan and a strong management team. They also had a clear growth strategy and a deep understanding of their target market.

Additionally, these startups were able to demonstrate a strong competitive advantage and a unique value proposition. They were also able to build a strong network of partners and suppliers, which helped them scale their operations and expand their user base.

By studying these success stories, startups can learn valuable lessons about how to secure private equity funding and achieve long-term success. By following in the footsteps of these successful startups, startups can increase their chances of securing private equity funding and achieving their growth goals.

For example, a startup that is looking to secure private equity funding should focus on building a strong management team and developing a solid business plan. The startup should also have a clear growth strategy and a deep understanding of its target market.

By following these best practices, startups can increase their chances of securing private equity funding and achieving long-term success. Private equity funding can be a powerful tool for startups, providing them with the capital and expertise they need to scale their operations and achieve their growth goals.

Common Mistakes Startups Make When Seeking Private Equity Funding

When seeking private equity funding, startups often make mistakes that can harm their chances of securing investment. In this article, we’ll identify common pitfalls that startups should avoid when pursuing private equity funding.

One common mistake is inadequate preparation. Startups should have a solid business plan, a strong management team, and a clear growth strategy before approaching private equity investors. Without these essential elements, startups may struggle to convince investors of their potential for growth and returns.

Another mistake is unrealistic valuations. Startups should have a realistic understanding of their valuation and be prepared to negotiate with investors. Unrealistic valuations can lead to a lack of interest from investors or, worse, a failed investment round.

Poor communication is also a common mistake. Startups should be able to clearly articulate their vision, mission, and growth strategy to investors. Poor communication can lead to misunderstandings and a lack of trust between the startup and the investor.

Additionally, startups should avoid being too rigid in their negotiations. Private equity investors often have specific requirements and expectations, and startups should be willing to negotiate and compromise to secure investment.

Startups should also avoid seeking private equity funding too early. Private equity investors typically invest in startups that have a proven track record of growth and revenue. Seeking investment too early can lead to a lack of interest from investors or, worse, a failed investment round.

Finally, startups should avoid ignoring the terms and conditions of the investment. Private equity investors often have specific requirements and expectations, and startups should carefully review the terms and conditions of the investment before signing.

By avoiding these common mistakes, startups can increase their chances of securing private equity funding and achieving long-term success. Private equity funding can be a powerful tool for startups, providing them with the capital and expertise they need to scale their operations and achieve their growth goals.

For example, a startup that is seeking private equity funding should ensure that it has a solid business plan, a strong management team, and a clear growth strategy. The startup should also have a realistic understanding of its valuation and be prepared to negotiate with investors.

Alternatives to Private Equity Funding for Startups

While private equity funding can be a powerful tool for startups, it’s not the only option. In this article, we’ll discuss alternative funding options for startups, including crowdfunding, angel investors, and debt financing.

Crowdfunding is a popular alternative to private equity funding. Platforms like Kickstarter and Indiegogo allow startups to raise funds from a large number of people, typically in exchange for rewards or equity. Crowdfunding can be a great option for startups that have a strong product or service and a clear marketing strategy.

Angel investors are another alternative to private equity funding. Angel investors are high-net-worth individuals who invest in startups in exchange for equity. Angel investors can provide valuable guidance and mentorship to startups, in addition to capital.

Debt financing is also an alternative to private equity funding. Debt financing involves borrowing money from a lender, typically in the form of a loan. Debt financing can be a good option for startups that have a strong credit history and a clear plan for repayment.

These alternative funding options can be more suitable than private equity funding for startups that are in the early stages of development or have a limited track record of growth. For example, a startup that is just launching its product or service may find crowdfunding or angel investors to be a more suitable option than private equity funding.

Additionally, startups that have a strong credit history and a clear plan for repayment may find debt financing to be a more suitable option than private equity funding. By considering these alternative funding options, startups can find the best fit for their needs and goals.

It’s also worth noting that these alternative funding options can be used in combination with private equity funding. For example, a startup may use crowdfunding to raise initial funds and then seek private equity funding to scale its operations.

By considering all of the available funding options, startups can make informed decisions about their financing strategy and achieve their growth goals.

For example, a startup that is looking to raise $1 million in funding may consider using a combination of crowdfunding and private equity funding. The startup may use crowdfunding to raise $500,000 and then seek private equity funding to raise the remaining $500,000.

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)