What are Roth IRA Income Limits and Why Do They Matter?

Roth Individual Retirement Accounts (IRAs) offer a tax-free way to save for retirement, but there are income limits that affect who can contribute and how much they can contribute. Understanding these limits is crucial to maximizing retirement savings. The income limits for Roth IRAs are based on an individual’s Modified Adjusted Gross Income (MAGI), which is calculated using their taxable income, deductions, and exemptions.

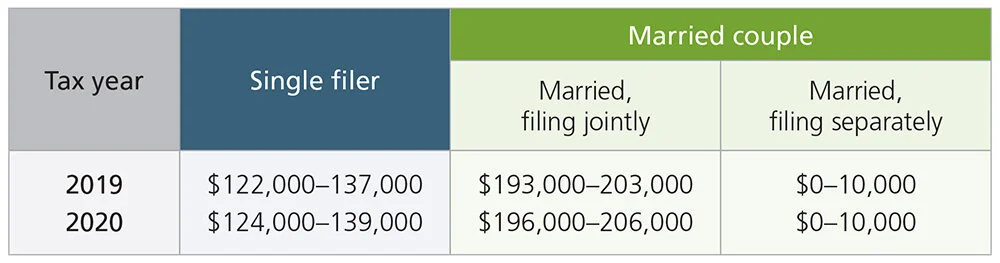

The Roth IRA income limits for 2023 are an essential consideration for those planning to contribute to a Roth IRA. These limits determine the amount that can be contributed to a Roth IRA, and exceeding them can result in penalties and taxes. For the 2023 tax year, the Roth IRA income limits are as follows: single filers with a MAGI below $138,500 and joint filers with a MAGI below $218,500 can contribute up to the annual limit.

It is essential to understand how the Roth IRA income limits impact contribution amounts. For example, if an individual’s MAGI is above the phase-out range, they may be able to contribute a reduced amount or not at all. Additionally, the income limits can affect the deductibility of traditional IRA contributions, making it essential to consider both types of accounts when planning for retirement.

Maximizing retirement savings requires a thorough understanding of the Roth IRA income limits and how they impact contributions. By understanding these limits, individuals can make informed decisions about their retirement savings strategy and ensure they are taking advantage of the tax benefits offered by Roth IRAs. This knowledge can help individuals create a comprehensive retirement plan that meets their needs and goals.

In the context of retirement planning, understanding the Roth IRA income limits is vital to making the most of these tax-advantaged accounts. By considering the income limits and how they impact contributions, individuals can optimize their retirement savings strategy and ensure a secure financial future. As the 2023 tax year approaches, it is essential to review the Roth IRA income limits and adjust retirement plans accordingly.

How to Determine Your Modified Adjusted Gross Income (MAGI)

To determine your eligibility to contribute to a Roth IRA, you need to calculate your Modified Adjusted Gross Income (MAGI). MAGI is your taxable income, adjusted for certain deductions and exemptions. The IRS uses MAGI to determine your eligibility for various tax benefits, including Roth IRA contributions.

To calculate your MAGI, start by gathering your tax documents, including your W-2 forms, 1099 forms, and Schedule C (if you’re self-employed). You’ll also need to gather information about your deductions and exemptions, such as mortgage interest, charitable donations, and student loan interest.

Next, follow these steps to calculate your MAGI:

1. Start with your total income from all sources, including wages, salaries, tips, and self-employment income.

2. Subtract any deductions you’re eligible for, such as mortgage interest, charitable donations, and student loan interest.

3. Add back any income that’s not subject to tax, such as tax-free interest and dividends.

4. Subtract any exemptions you’re eligible for, such as the standard deduction or personal exemptions.

5. The result is your MAGI.

For example, let’s say you have a taxable income of $100,000 and you’re eligible for a mortgage interest deduction of $10,000. Your MAGI would be $90,000 ($100,000 – $10,000).

Once you’ve calculated your MAGI, you can use the IRS’s Roth IRA contribution limits table to determine how much you can contribute to a Roth IRA. For the 2023 tax year, the Roth IRA contribution limits are as follows: single filers with a MAGI below $138,500 and joint filers with a MAGI below $218,500 can contribute up to the annual limit.

Understanding how to calculate your MAGI is crucial to determining your eligibility to contribute to a Roth IRA. By following these steps, you can ensure you’re taking advantage of the tax benefits offered by Roth IRAs and maximizing your retirement savings.

Roth IRA Income Limits for 2023: What You Need to Know

The Roth IRA income limits for 2023 are an essential consideration for individuals planning to contribute to a Roth IRA. These limits determine the amount that can be contributed to a Roth IRA, and exceeding them can result in penalties and taxes.

For the 2023 tax year, the Roth IRA income limits are as follows:

Single filers:

– Full contribution limit: $138,500 or less

– Partial contribution limit: $138,501 – $153,000

– No contribution limit: $153,001 or more

Joint filers:

– Full contribution limit: $218,500 or less

– Partial contribution limit: $218,501 – $228,000

– No contribution limit: $228,001 or more

It’s essential to note that these limits apply to your Modified Adjusted Gross Income (MAGI), which is calculated using your taxable income, deductions, and exemptions.

The Roth IRA income limits for 2023 also impact the amount that can be contributed to a Roth IRA. For example, if you’re a single filer with a MAGI of $120,000, you can contribute up to the annual limit of $6,000. However, if your MAGI is $150,000, your contribution limit will be reduced.

Understanding the Roth IRA income limits for 2023 is crucial to maximizing your retirement savings. By knowing these limits, you can plan your contributions accordingly and avoid any potential penalties or taxes.

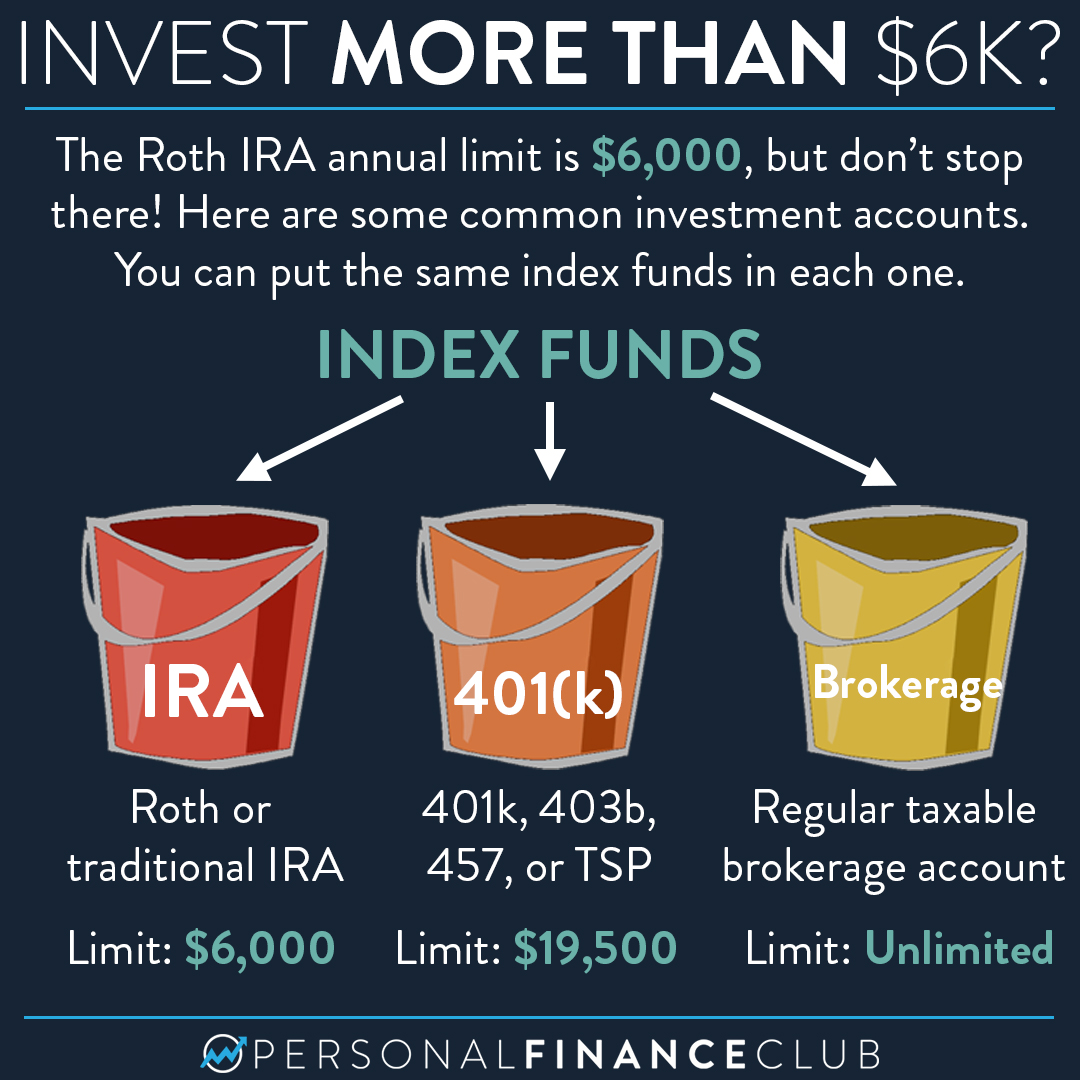

In addition to the income limits, it’s also essential to consider the annual contribution limits for Roth IRAs. For the 2023 tax year, the annual contribution limit is $6,000, or $7,000 if you’re 50 or older.

By understanding the Roth IRA income limits and annual contribution limits, you can make informed decisions about your retirement savings strategy and ensure you’re taking advantage of the tax benefits offered by Roth IRAs.

Strategies for Maximizing Roth IRA Contributions Despite Income Limits

While Roth IRA income limits can restrict the amount individuals can contribute, there are strategies to maximize contributions and make the most of this retirement savings option. For those who exceed the Roth IRA AGI limits 2023, considering alternative methods can help optimize retirement savings.

One approach is the backdoor Roth IRA, which involves contributing to a traditional IRA and then converting it to a Roth IRA. This method allows individuals to bypass the income limits, but it’s essential to follow the IRS rules and guidelines to avoid any penalties or taxes. It’s recommended to consult with a financial advisor to ensure the process is executed correctly.

Another strategy is to explore other retirement savings options, such as a traditional IRA or a 401(k) plan. While these options may not offer the same tax benefits as a Roth IRA, they can still provide a way to save for retirement and reduce taxable income. Additionally, some employers may offer Roth 401(k) plans, which allow after-tax contributions and potentially provide higher contribution limits.

For those who are eligible to contribute to a Roth IRA but are limited by the income phase-out ranges, it’s crucial to contribute as much as possible within the allowed limits. This can be achieved by adjusting income or exploring ways to reduce taxable income, such as increasing charitable donations or maximizing tax deductions.

It’s also essential to consider the long-term benefits of a Roth IRA, including tax-free growth and withdrawals. By contributing to a Roth IRA, individuals can create a tax-free income stream in retirement, which can be particularly valuable in higher-tax environments.

In summary, while Roth IRA income limits can be restrictive, there are strategies to maximize contributions and make the most of this retirement savings option. By exploring alternative methods, such as the backdoor Roth IRA, and optimizing contributions within the allowed limits, individuals can create a robust retirement savings plan and achieve their long-term financial goals.

How to Choose the Right Roth IRA Provider

When selecting a Roth IRA provider, it’s essential to consider several factors to ensure you find the best fit for your retirement savings needs. With the Roth IRA AGI limits 2023 in mind, choosing the right provider can help you maximize your contributions and optimize your retirement savings strategy.

Fees are a critical consideration when selecting a Roth IRA provider. Look for providers that offer low or no fees for maintenance, management, and transactions. Some providers may charge fees for services like investment advice or portfolio management, so it’s crucial to understand the fee structure before opening an account.

Investment options are another vital factor to consider. A good Roth IRA provider should offer a range of investment options, including stocks, bonds, ETFs, and mutual funds. Consider a provider that offers a broad range of investment options to help you diversify your portfolio and achieve your retirement goals.

Customer service is also an essential aspect to consider when choosing a Roth IRA provider. Look for providers that offer 24/7 customer support, online account management, and mobile access. A provider with excellent customer service can help you navigate any issues or questions you may have about your account.

Reputation and stability are also critical factors to consider. Research the provider’s reputation online, and check for any regulatory issues or complaints. A stable and reputable provider can help ensure your retirement savings are secure and protected.

Minimums and contribution limits are also important to consider. Some providers may have minimum balance requirements or contribution limits, so it’s essential to understand these requirements before opening an account.

Finally, consider the provider’s mobile and online platform. A user-friendly platform can make it easy to manage your account, track your investments, and make contributions. Look for providers that offer a seamless online experience and mobile app.

By considering these factors, you can choose the right Roth IRA provider for your retirement savings needs. Remember to always research and compare providers before making a decision, and don’t hesitate to reach out to customer support if you have any questions or concerns.

Common Mistakes to Avoid When Contributing to a Roth IRA

When contributing to a Roth IRA, it’s essential to avoid common mistakes that can result in penalties, fines, or even disqualification of the account. Understanding the Roth IRA AGI limits 2023 and following the rules can help individuals maximize their retirement savings and avoid costly errors.

One common mistake is exceeding the income limits. For the 2023 tax year, the Roth IRA income limits are $137,500 for single filers and $208,500 for joint filers. Contributing to a Roth IRA above these limits can result in penalties and fines. It’s crucial to check the income limits before contributing to a Roth IRA.

Another mistake is neglecting to report contributions. Roth IRA contributions must be reported on the tax return, and failure to do so can result in penalties and fines. It’s essential to keep accurate records of contributions and report them on the tax return.

Not meeting the eligibility requirements is another common mistake. To be eligible for a Roth IRA, individuals must have earned income and meet the income limits. Not meeting these requirements can result in disqualification of the account.

Contributing too much to a Roth IRA is also a common mistake. The annual contribution limit for Roth IRAs is $6,000 in 2023, or $7,000 if the individual is 50 or older. Contributing more than this limit can result in penalties and fines.

Not considering the five-year rule is another mistake. Roth IRA withdrawals are tax-free and penalty-free if the account has been open for at least five years and the individual is 59 1/2 or older. Not considering this rule can result in penalties and taxes on withdrawals.

Finally, not monitoring and adjusting contributions is a common mistake. Roth IRA contributions can be adjusted annually, and it’s essential to monitor and adjust contributions to ensure they are within the limits and meet the individual’s retirement savings goals.

By avoiding these common mistakes, individuals can maximize their retirement savings and ensure their Roth IRA is working effectively for them. It’s essential to understand the rules and regulations surrounding Roth IRAs and to seek professional advice if needed.

The Benefits of Converting a Traditional IRA to a Roth IRA

Converting a traditional IRA to a Roth IRA can be a strategic move for individuals looking to optimize their retirement savings. Understanding the Roth IRA AGI limits 2023 and the benefits of conversion can help individuals make informed decisions about their retirement planning.

One of the primary benefits of converting a traditional IRA to a Roth IRA is tax-free growth and withdrawals. With a traditional IRA, withdrawals are taxed as ordinary income, which can increase taxable income in retirement. In contrast, Roth IRA withdrawals are tax-free and penalty-free if the account has been open for at least five years and the individual is 59 1/2 or older.

Another benefit of converting to a Roth IRA is the elimination of required minimum distributions (RMDs). Traditional IRAs require individuals to take RMDs starting at age 72, which can increase taxable income and reduce the account balance. Roth IRAs do not have RMDs, allowing individuals to keep the money in the account for as long as they want without having to take withdrawals.

Converting to a Roth IRA can also provide estate planning benefits. Roth IRAs are generally more inheritance-friendly than traditional IRAs, as beneficiaries can take tax-free withdrawals from the account. Additionally, Roth IRAs are not subject to the same RMD rules as traditional IRAs, allowing beneficiaries to keep the money in the account for longer.

It’s essential to note that converting a traditional IRA to a Roth IRA can trigger taxes on the converted amount. However, this tax liability can be mitigated by spreading the conversion over several years or by converting smaller amounts each year.

To convert a traditional IRA to a Roth IRA, individuals can use a process called a “rollover” or “conversion.” This involves transferring the funds from the traditional IRA to a new Roth IRA account, and paying taxes on the converted amount. It’s recommended to consult with a financial advisor or tax professional to determine the best conversion strategy and to ensure compliance with IRS rules and regulations.

Overall, converting a traditional IRA to a Roth IRA can be a valuable strategy for individuals looking to optimize their retirement savings and reduce taxes in retirement. By understanding the benefits and rules surrounding Roth IRA conversions, individuals can make informed decisions about their retirement planning and create a more sustainable income stream in retirement.

Planning for the Future: How to Make the Most of Your Roth IRA

Once you’ve established a Roth IRA and understand the Roth IRA AGI limits 2023, it’s essential to plan for the future to maximize your retirement savings. A well-planned Roth IRA can provide a sustainable income stream in retirement, and with the right strategies, you can optimize your account for long-term growth and tax-free withdrawals.

One key strategy is to prioritize contributions. Contributing to a Roth IRA regularly can help you build a substantial nest egg over time. Consider setting up automatic transfers from your paycheck or bank account to make contributions easier and less prone to being neglected.

Investment selection is also crucial for long-term growth. A diversified portfolio with a mix of low-risk and higher-risk investments can help you balance returns and minimize losses. Consider consulting with a financial advisor to determine the best investment strategy for your Roth IRA.

Withdrawal planning is another essential aspect of optimizing your Roth IRA. Since Roth IRA withdrawals are tax-free and penalty-free after age 59 1/2, it’s essential to plan your withdrawals carefully to minimize taxes and maximize your retirement income. Consider creating a withdrawal strategy that takes into account your income needs, tax obligations, and other sources of retirement income.

Estate planning is also an important consideration for Roth IRA owners. Since Roth IRAs are generally more inheritance-friendly than traditional IRAs, it’s essential to consider how you want to pass your account to beneficiaries. Consider naming beneficiaries and creating a trust to ensure that your Roth IRA is distributed according to your wishes.

Finally, it’s essential to review and adjust your Roth IRA plan regularly. As your income, expenses, and financial goals change, your Roth IRA plan may need to adapt to ensure that you’re maximizing your retirement savings. Consider reviewing your plan annually and making adjustments as needed to stay on track.

By prioritizing contributions, investing wisely, planning withdrawals carefully, and considering estate planning, you can optimize your Roth IRA for long-term growth and retirement income. Remember to stay informed about the Roth IRA AGI limits 2023 and adjust your plan accordingly to ensure that you’re making the most of your retirement savings.

+1000px.jpg)