Unlocking the Power of Fintech: Why SaaS Startups Need to Innovate

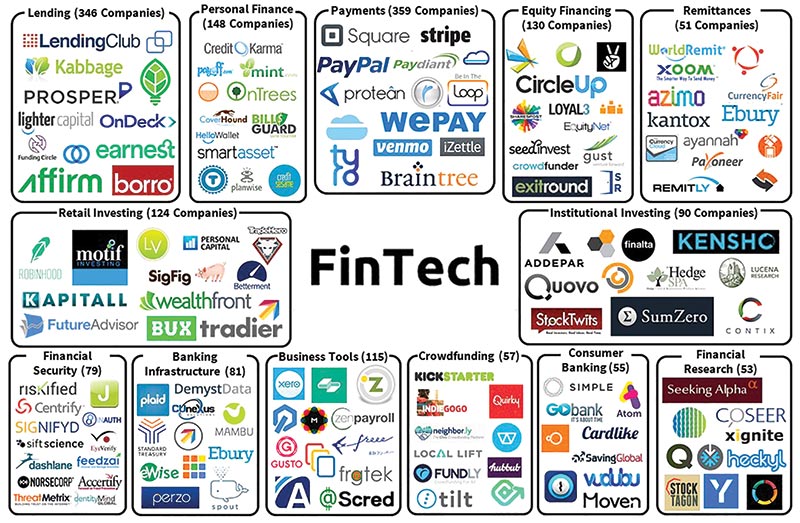

The fintech industry is undergoing a significant transformation, driven by the increasing demand for digital financial services. As a result, SaaS startups are under pressure to innovate and stay competitive in this rapidly evolving landscape. Fintech innovation is no longer a luxury, but a necessity for SaaS startups to survive and thrive. By embracing fintech innovation, SaaS startups can increase efficiency, reduce costs, and improve customer experiences.

According to a recent report, the global fintech market is expected to reach $324 billion by 2026, growing at a compound annual growth rate (CAGR) of 23.4%. This growth is driven by the increasing adoption of digital payment systems, mobile wallets, and online lending platforms. However, this growth also presents a challenge for SaaS startups, as they need to innovate and adapt to changing customer needs and technological advancements.

To stay ahead of the curve, SaaS startups need to develop effective fintech innovation strategies. This involves leveraging emerging technologies, such as blockchain, artificial intelligence, and machine learning, to develop new products and services. It also requires a deep understanding of customer needs and preferences, as well as the ability to collaborate with other stakeholders in the fintech ecosystem.

By adopting a culture of innovation, SaaS startups can unlock the power of fintech and drive business growth. This involves fostering a culture of experimentation, encouraging risk-taking, and providing resources and support for innovation initiatives. It also requires leaders who can champion innovation and provide a clear vision for the organization.

In the next section, we will explore how SaaS startups can leverage emerging technologies to drive fintech innovation. We will examine the role of blockchain, artificial intelligence, and machine learning in fintech innovation and provide examples of how SaaS startups can use these technologies to develop new products and services.

How to Leverage Emerging Technologies to Drive Fintech Innovation

Emerging technologies such as blockchain, artificial intelligence, and machine learning are transforming the fintech industry. SaaS startups can leverage these technologies to develop new products and services, improve operational efficiency, and enhance customer experiences. In this section, we will explore the role of these emerging technologies in fintech innovation and provide examples of how SaaS startups can use them to drive growth.

Blockchain technology, for instance, offers a secure and transparent way to conduct financial transactions. SaaS startups can use blockchain to develop secure payment systems, reduce transaction costs, and improve the speed of transactions. For example, Ripple, a blockchain-based payment network, has partnered with several banks to enable fast and secure cross-border payments.

Artificial intelligence (AI) and machine learning (ML) are also being used in fintech innovation to improve customer experiences and reduce operational costs. SaaS startups can use AI and ML to develop chatbots that provide customer support, analyze customer behavior, and offer personalized financial services. For example, Digit, a fintech startup, uses AI to analyze customer spending habits and provide personalized savings recommendations.

Machine learning can also be used to detect and prevent financial crimes such as money laundering and fraud. SaaS startups can use ML algorithms to analyze transaction data and identify suspicious activity. For example, Feedzai, a fintech startup, uses ML to detect and prevent financial crimes in real-time.

To leverage these emerging technologies, SaaS startups need to develop a strategic approach to fintech innovation. This involves identifying the right technologies to invest in, developing a clear understanding of customer needs, and building partnerships with other stakeholders in the fintech ecosystem.

In the next section, we will explore the role of design thinking in fintech innovation. We will discuss how SaaS startups can use design thinking to develop user-centered products and services that meet the needs of their customers.

Design Thinking for Fintech: A Human-Centered Approach to Innovation

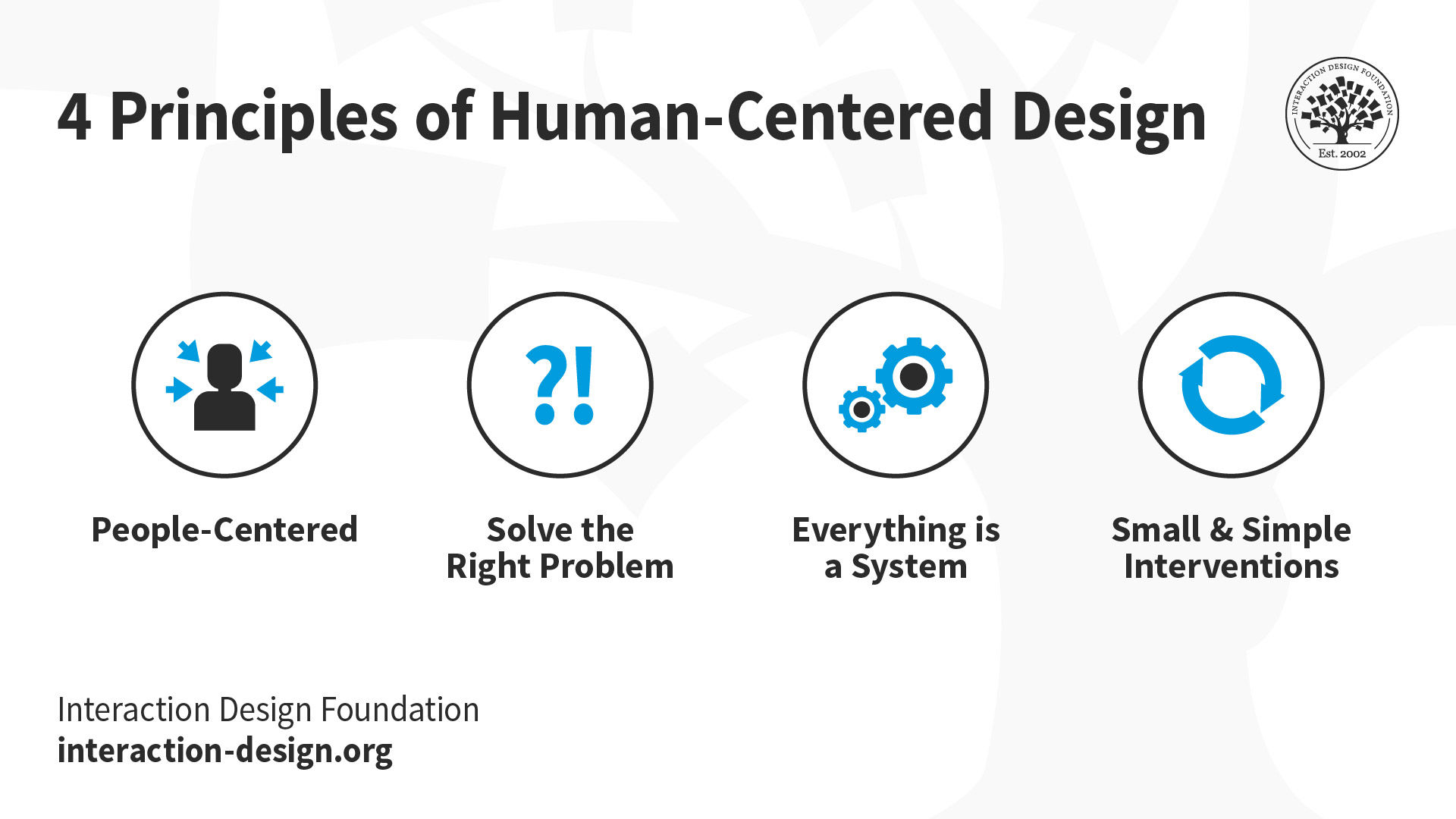

Design thinking is a human-centered approach to innovation that involves understanding customer needs, empathizing with their pain points, and developing solutions that meet their needs. In the context of fintech, design thinking can be used to develop user-centered products and services that improve customer experiences and drive business growth.

Design thinking involves a five-stage process: empathize, define, ideate, prototype, and test. In the empathize stage, fintech companies gather data and insights about their customers, including their needs, pain points, and behaviors. In the define stage, companies define the problem they are trying to solve and identify the key challenges they need to address.

In the ideate stage, companies generate ideas for solutions that meet the needs of their customers. This involves brainstorming, mind mapping, and other creative techniques to generate a wide range of ideas. In the prototype stage, companies develop a prototype of their solution and test it with a small group of customers. Finally, in the test stage, companies refine their solution based on customer feedback and iterate until they have a solution that meets the needs of their customers.

Design thinking can be applied to a wide range of fintech products and services, including mobile payments, digital wallets, and online lending platforms. For example, a fintech company might use design thinking to develop a mobile payment app that is easy to use, secure, and convenient. The company might start by gathering data about customer behavior and preferences, and then use that data to develop a prototype of the app.

Design thinking can also be used to improve the customer experience in fintech. For example, a fintech company might use design thinking to develop a chatbot that provides customer support and helps customers navigate the company’s products and services. The company might start by gathering data about customer pain points and then use that data to develop a chatbot that addresses those pain points.

By using design thinking, fintech companies can develop products and services that meet the needs of their customers and drive business growth. Design thinking can also help fintech companies to differentiate themselves from their competitors and establish a strong brand identity.

In the next section, we will explore the importance of partnerships and collaborations in fintech innovation. We will discuss how SaaS startups can partner with established financial institutions to drive innovation and growth.

Partnerships and Collaborations: Key to Fintech Innovation Success

Partnerships and collaborations are essential for SaaS startups to drive fintech innovation and growth. By partnering with established financial institutions, SaaS startups can gain access to new markets, customers, and technologies, while also reducing the risk of innovation.

One example of a successful partnership in fintech is the collaboration between Stripe and Visa. Stripe, a SaaS startup, partnered with Visa to launch a new payment platform that enables businesses to accept online payments. The partnership allowed Stripe to leverage Visa’s vast network of merchants and customers, while also providing Visa with access to Stripe’s innovative payment technology.

Another example of a successful partnership in fintech is the collaboration between Square and JPMorgan Chase. Square, a SaaS startup, partnered with JPMorgan Chase to launch a new mobile payment platform that enables businesses to accept online payments. The partnership allowed Square to leverage JPMorgan Chase’s vast network of merchants and customers, while also providing JPMorgan Chase with access to Square’s innovative payment technology.

Partnerships and collaborations can also help SaaS startups to overcome regulatory hurdles in fintech. By partnering with established financial institutions, SaaS startups can gain access to regulatory expertise and compliance resources, while also reducing the risk of regulatory non-compliance.

In addition to partnerships with established financial institutions, SaaS startups can also collaborate with other fintech companies to drive innovation and growth. For example, SaaS startups can participate in fintech accelerators and incubators, which provide access to funding, mentorship, and networking opportunities.

Furthermore, SaaS startups can also collaborate with fintech industry associations and organizations to drive innovation and growth. For example, SaaS startups can participate in industry conferences and events, which provide access to networking opportunities, industry insights, and best practices.

In the next section, we will explore the importance of overcoming regulatory hurdles in fintech innovation. We will discuss the regulatory challenges faced by SaaS startups in the fintech industry and provide strategies for navigating these challenges and ensuring compliance with relevant regulations.

Overcoming Regulatory Hurdles: Strategies for SaaS Startups in Fintech

Regulatory compliance is a critical aspect of fintech innovation, and SaaS startups must navigate a complex landscape of regulations to ensure compliance. In this section, we will discuss the regulatory challenges faced by SaaS startups in the fintech industry and provide strategies for overcoming these challenges.

One of the key regulatory challenges faced by SaaS startups in fintech is the need to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. These regulations require fintech companies to implement robust customer due diligence and monitoring systems to prevent financial crimes.

To overcome these regulatory challenges, SaaS startups can implement a range of strategies, including partnering with regulatory compliance experts, investing in compliance technology, and developing robust compliance policies and procedures.

Another regulatory challenge faced by SaaS startups in fintech is the need to comply with data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union. These regulations require fintech companies to implement robust data protection measures to protect customer data.

To overcome these regulatory challenges, SaaS startups can implement a range of strategies, including investing in data protection technology, developing robust data protection policies and procedures, and partnering with data protection experts.

In addition to these strategies, SaaS startups can also leverage regulatory sandboxes to test and refine their fintech innovations in a controlled environment. Regulatory sandboxes provide a safe space for fintech companies to test their innovations without fear of regulatory repercussions.

Finally, SaaS startups can also engage with regulatory bodies and industry associations to stay up-to-date with the latest regulatory developments and best practices. This can help fintech companies to anticipate and prepare for regulatory changes, and to ensure compliance with relevant regulations.

In the next section, we will explore the importance of measuring success in fintech innovation. We will discuss the key performance indicators (KPIs) that SaaS startups can use to evaluate the effectiveness of their innovation strategies.

Measuring Success: Key Performance Indicators for Fintech Innovation

Measuring the success of fintech innovation strategies is crucial for SaaS startups to evaluate the effectiveness of their innovation efforts and make data-driven decisions. In this section, we will discuss the importance of measuring success in fintech innovation and introduce key performance indicators (KPIs) that SaaS startups can use to evaluate their innovation strategies.

One of the key KPIs for fintech innovation is customer acquisition cost (CAC). CAC measures the cost of acquiring a new customer, and it is a critical metric for SaaS startups to evaluate the effectiveness of their marketing and sales efforts.

Another key KPI for fintech innovation is customer lifetime value (CLV). CLV measures the total value of a customer over their lifetime, and it is a critical metric for SaaS startups to evaluate the effectiveness of their customer retention strategies.

In addition to CAC and CLV, SaaS startups can also use other KPIs such as return on investment (ROI), net promoter score (NPS), and customer satisfaction (CSAT) to evaluate the effectiveness of their innovation strategies.

ROI measures the return on investment of a particular innovation strategy, and it is a critical metric for SaaS startups to evaluate the financial effectiveness of their innovation efforts.

NPS measures the likelihood of a customer to recommend a product or service to a friend or colleague, and it is a critical metric for SaaS startups to evaluate the effectiveness of their customer experience strategies.

CSAT measures the satisfaction of a customer with a product or service, and it is a critical metric for SaaS startups to evaluate the effectiveness of their customer support strategies.

By using these KPIs, SaaS startups can evaluate the effectiveness of their innovation strategies and make data-driven decisions to drive fintech innovation and growth.

In the next section, we will explore the role of leadership in cultivating a culture of innovation within SaaS startups. We will discuss strategies for leaders to foster a culture of innovation and experimentation.

Cultivating a Culture of Innovation: Leadership Strategies for SaaS Startups

Leadership plays a critical role in cultivating a culture of innovation within SaaS startups. A culture of innovation is essential for driving fintech innovation and growth, and leaders must foster an environment that encourages experimentation, creativity, and risk-taking.

One key strategy for leaders to foster a culture of innovation is to empower employees to take ownership of innovation initiatives. This can be achieved by providing employees with the autonomy to experiment with new ideas, and by providing resources and support to help them bring those ideas to life.

Another key strategy for leaders is to encourage a culture of experimentation and learning. This can be achieved by creating a safe space for employees to try new things, and by encouraging them to learn from their failures.

Leaders can also foster a culture of innovation by encouraging collaboration and communication across different teams and departments. This can be achieved by creating cross-functional teams, and by encouraging employees to share their ideas and expertise with one another.

In addition to these strategies, leaders can also foster a culture of innovation by leading by example. This can be achieved by demonstrating a commitment to innovation and experimentation, and by encouraging employees to do the same.

By fostering a culture of innovation, leaders can drive fintech innovation and growth, and help their SaaS startups to stay ahead of the competition.

In the next section, we will explore real-world examples of successful fintech innovation strategies from SaaS startups such as Stripe, Square, and Revolut. We will analyze the key factors that contributed to their success, and offer lessons for other SaaS startups.

Real-World Examples of Fintech Innovation: Lessons from Successful SaaS Startups

Stripe, Square, and Revolut are just a few examples of successful SaaS startups that have driven fintech innovation and growth. In this section, we will analyze the key factors that contributed to their success and offer lessons for other SaaS startups.

Stripe, for example, has been successful in driving fintech innovation through its focus on developer-friendly APIs and its ability to provide a seamless payment experience for customers. Stripe’s success can be attributed to its ability to identify a gap in the market and develop a solution that meets the needs of its customers.

Square, on the other hand, has been successful in driving fintech innovation through its focus on mobile payments and its ability to provide a seamless payment experience for customers. Square’s success can be attributed to its ability to identify a gap in the market and develop a solution that meets the needs of its customers.

Revolut, a digital banking platform, has been successful in driving fintech innovation through its focus on providing a seamless and cost-effective banking experience for customers. Revolut’s success can be attributed to its ability to identify a gap in the market and develop a solution that meets the needs of its customers.

These examples demonstrate the importance of identifying a gap in the market and developing a solution that meets the needs of customers. They also highlight the importance of focusing on innovation and experimentation, and of being willing to take risks to drive growth and success.

By analyzing the success of these SaaS startups, other fintech companies can gain valuable insights into the key factors that drive fintech innovation and growth. They can also learn from the mistakes and successes of these companies and apply these lessons to their own businesses.

In conclusion, fintech innovation is a critical component of success for SaaS startups in the fintech industry. By focusing on innovation and experimentation, and by being willing to take risks, SaaS startups can drive growth and success in the fintech industry.