Navigating the Complex World of Startup Financing

Securing funding is a crucial step in the growth and development of a SaaS startup. However, the process can be daunting, especially for entrepreneurs who are new to the world of startup financing. With various funding options available, including venture capital, angel investors, and crowdfunding, it’s essential to understand the pros and cons of each to make informed decisions. SaaS startup funding is a highly competitive space, and entrepreneurs need to be prepared to navigate this complex world to succeed.

One of the primary challenges of securing funding is understanding the different types of investors and their expectations. Venture capitalists, for example, typically invest in startups with high growth potential, while angel investors may focus on smaller, more niche markets. Crowdfunding platforms, on the other hand, offer a more democratic approach to funding, allowing entrepreneurs to raise money from a large number of people, typically in exchange for rewards or equity.

Another critical aspect of securing funding is preparing a solid financial foundation. This includes developing a comprehensive business plan, creating a robust financial model, and establishing a clear understanding of key metrics such as customer acquisition cost, lifetime value, and churn rate. By having a deep understanding of these metrics, entrepreneurs can make informed decisions about funding and growth, ultimately increasing their chances of securing the funding they need to succeed.

In addition to understanding funding options and preparing a solid financial foundation, entrepreneurs need to be aware of the current market trends and conditions. This includes staying up-to-date on the latest developments in the SaaS industry, as well as understanding the competitive landscape and identifying potential opportunities for growth and differentiation.

By taking the time to understand the complex world of startup financing, preparing a solid financial foundation, and staying informed about market trends and conditions, entrepreneurs can increase their chances of securing the funding they need to grow and develop their SaaS startup. Whether through venture capital, angel investors, or crowdfunding, securing funding is a critical step in the journey to success, and entrepreneurs who are prepared and informed will be better equipped to navigate this complex world and achieve their goals.

How to Craft a Compelling Pitch to Attract Investors

Crafting a compelling pitch is a crucial step in securing SaaS startup funding. A well-crafted pitch can make all the difference in attracting investors and standing out from the competition. To create a persuasive pitch, it’s essential to understand the key elements that investors look for in a SaaS startup.

First and foremost, investors want to see a clear and concise value proposition. This means clearly articulating the problem that the SaaS startup solves, and how it solves it in a unique and innovative way. The pitch should also highlight the market potential, including the size of the market, the growth prospects, and the competitive landscape.

In addition to a strong value proposition, investors also want to see a clear understanding of the business model and revenue growth prospects. This includes a detailed breakdown of the revenue streams, customer acquisition costs, and customer lifetime value. The pitch should also highlight the competitive advantage, including any unique features or intellectual property that sets the SaaS startup apart from the competition.

Another critical element of a compelling pitch is a strong team. Investors want to see a team that is passionate, dedicated, and has the necessary skills and expertise to execute on the business plan. The pitch should highlight the key team members, their backgrounds, and their roles in the company.

Finally, the pitch should include a clear ask. This means clearly articulating the amount of funding required, how it will be used, and what the expected return on investment is. The pitch should also include a detailed breakdown of the milestones and timelines, including key performance indicators and metrics that will be used to measure success.

By including these key elements, SaaS startups can create a compelling pitch that attracts investors and sets them up for success. Remember, the pitch is often the first impression that investors have of the company, so it’s essential to make it count. With a clear and concise value proposition, a strong business model, a talented team, and a clear ask, SaaS startups can increase their chances of securing the funding they need to grow and succeed.

Bootstrapping vs. Seeking External Funding: Weighing the Pros and Cons

When it comes to SaaS startup funding, entrepreneurs often face a difficult decision: whether to bootstrap or seek external funding. Both options have their pros and cons, and the right choice depends on the specific needs and goals of the business.

Bootstrapping, or self-funding, can be a great option for SaaS startups that want to maintain control and equity. By using personal savings, revenue from early customers, or loans from friends and family, entrepreneurs can avoid giving up ownership and decision-making power to external investors. Bootstrapping also allows for greater flexibility and agility, as entrepreneurs can make decisions quickly without needing to consult with investors.

However, bootstrapping can also limit the growth potential of a SaaS startup. Without external funding, entrepreneurs may not have the resources to invest in marketing, hiring, and product development, which can slow down growth and make it harder to compete with larger, better-funded competitors.

On the other hand, seeking external funding can provide the necessary resources to drive growth and scalability. Venture capital, angel investors, and crowdfunding can provide the capital needed to invest in marketing, hiring, and product development, which can help a SaaS startup quickly gain traction and market share.

However, external funding also comes with its own set of challenges. Entrepreneurs may need to give up equity and control, which can limit their ability to make decisions and shape the direction of the company. External funding can also create pressure to meet investor expectations, which can be stressful and distracting for entrepreneurs.

Ultimately, the decision to bootstrap or seek external funding depends on the specific needs and goals of the SaaS startup. Entrepreneurs should carefully weigh the pros and cons of each option and consider factors such as growth potential, competition, and personal goals before making a decision.

For SaaS startups that do decide to seek external funding, it’s essential to have a solid understanding of the funding options available and the process of securing funding. This includes understanding the different types of investors, the typical investment stages, and the due diligence process. By being prepared and informed, entrepreneurs can increase their chances of securing the funding they need to drive growth and success.

Understanding the Role of Venture Capital in SaaS Funding

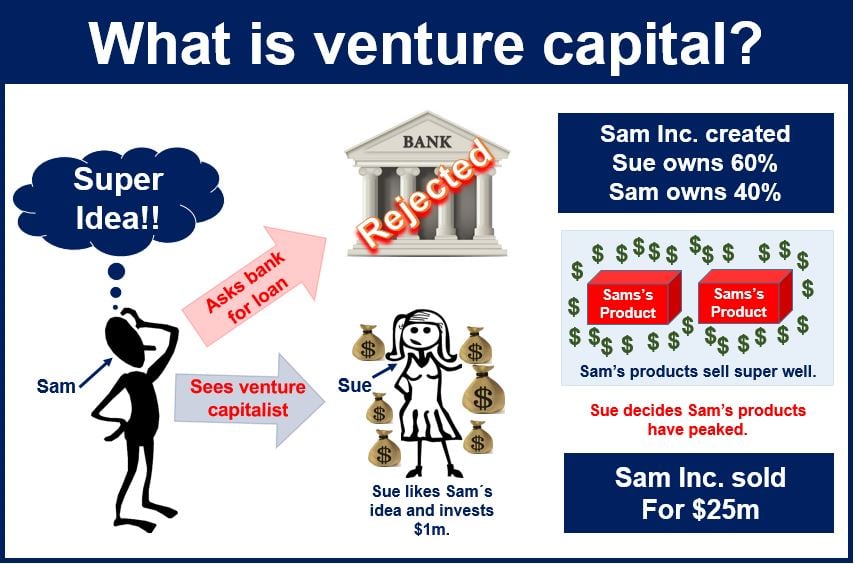

Venture capital (VC) funding is a popular option for SaaS startups looking to scale their business. VC firms invest money in exchange for equity, providing the necessary capital to drive growth and expansion. However, the process of securing VC funding can be complex and time-consuming.

The typical investment stages for VC funding include seed, early-stage, and growth-stage investments. Seed investments are usually smaller, ranging from $500,000 to $2 million, and are used to validate the business model and product-market fit. Early-stage investments are larger, ranging from $2 million to $10 million, and are used to scale the business and expand the team. Growth-stage investments are the largest, ranging from $10 million to $50 million, and are used to accelerate growth and expand into new markets.

Due diligence is a critical part of the VC funding process. VC firms will conduct extensive research on the SaaS startup, including reviewing financial statements, assessing the competitive landscape, and evaluating the management team. This process can take several weeks to several months, and requires a significant amount of time and effort from the startup.

Term sheet negotiations are also an important part of the VC funding process. A term sheet outlines the terms and conditions of the investment, including the valuation, equity stake, and voting rights. SaaS startups should carefully review the term sheet and negotiate the terms to ensure they are fair and reasonable.

VC funding can provide significant benefits for SaaS startups, including access to capital, expertise, and networks. However, it’s essential to carefully consider the pros and cons of VC funding and ensure it’s the right fit for the business. SaaS startups should also be prepared to provide regular updates and reporting to the VC firm, and be transparent about their financial performance and growth prospects.

By understanding the role of VC funding in SaaS startup funding, entrepreneurs can make informed decisions about their funding options and create a successful growth strategy. Whether through VC funding or alternative funding options, securing the right funding is critical to driving growth and success in the competitive SaaS market.

Alternative Funding Options for SaaS Startups: Exploring Crowdfunding and More

While venture capital and angel investors are popular funding options for SaaS startups, they’re not the only game in town. Alternative funding options, such as crowdfunding, incubators, and accelerators, can provide SaaS startups with the capital they need to grow and succeed.

Crowdfunding platforms, such as Kickstarter and Indiegogo, allow SaaS startups to raise money from a large number of people, typically in exchange for rewards or equity. This option can be particularly useful for SaaS startups that have a strong product or service, but may not have the traction or network to attract traditional investors.

Incubators and accelerators, on the other hand, provide SaaS startups with a supportive environment, resources, and mentorship to help them grow and succeed. These programs often offer funding, office space, and access to a network of entrepreneurs, investors, and industry experts.

Other alternative funding options for SaaS startups include revenue-based financing, invoice financing, and lines of credit. Revenue-based financing, for example, provides funding based on a percentage of the SaaS startup’s monthly revenue, while invoice financing allows SaaS startups to borrow money against outstanding invoices.

While alternative funding options can provide SaaS startups with the capital they need to grow and succeed, they also come with their own set of challenges and drawbacks. Crowdfunding, for example, can be time-consuming and requires a significant amount of marketing and promotion to be successful. Incubators and accelerators, on the other hand, may require SaaS startups to give up equity or control in exchange for funding and resources.

Ultimately, the key to securing alternative funding for a SaaS startup is to understand the different options available and to choose the one that best fits the business needs and goals. By exploring alternative funding options, SaaS startups can increase their chances of securing the funding they need to grow and succeed in the competitive SaaS market.

Building a Strong Financial Foundation: Key Metrics for SaaS Startups

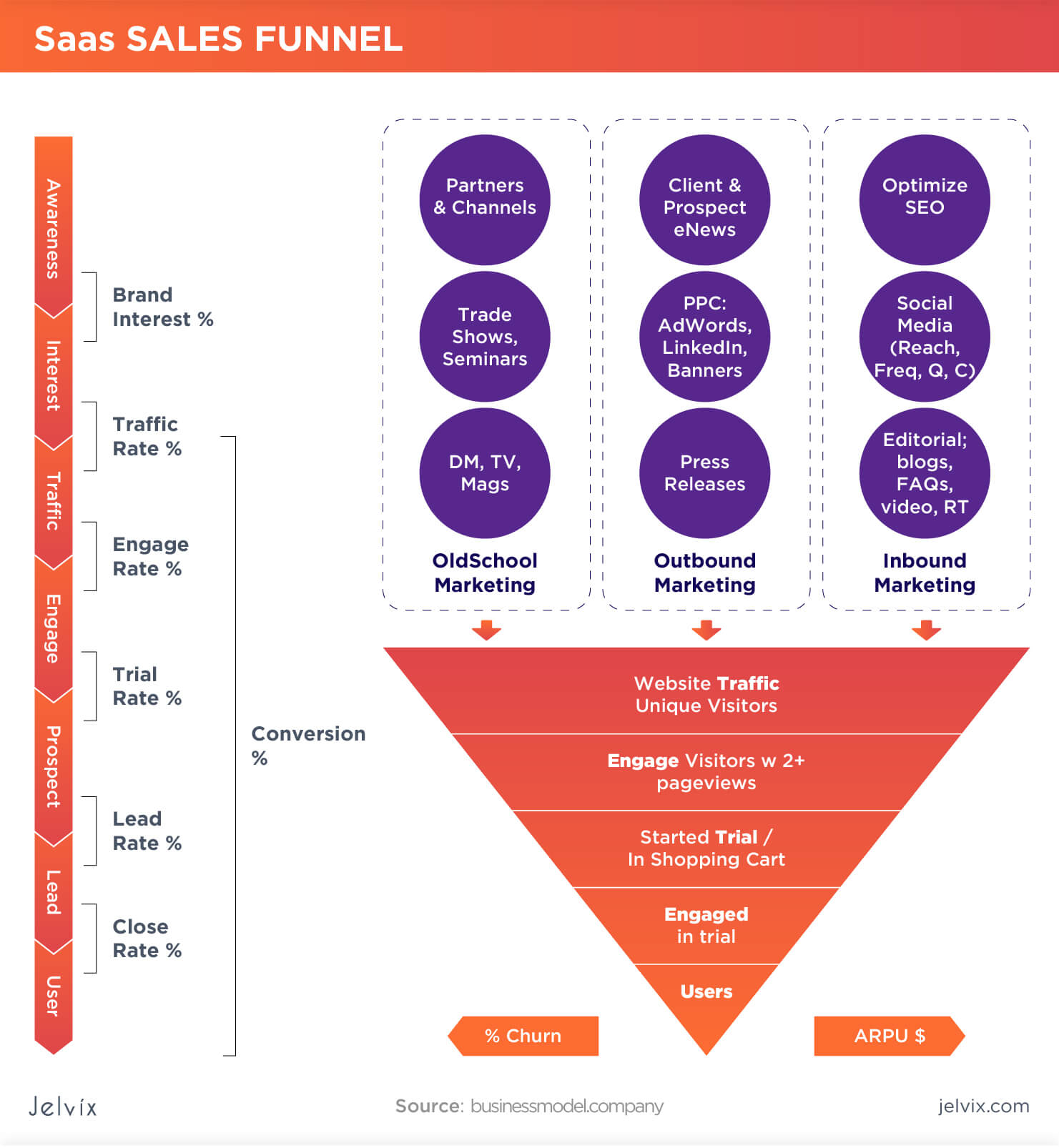

When it comes to securing funding for a SaaS startup, having a strong financial foundation is crucial. This means understanding and tracking key financial metrics that can inform funding decisions and drive growth. In this section, we’ll explore the essential financial metrics for SaaS startups, including customer acquisition cost, lifetime value, and churn rate.

Customer acquisition cost (CAC) is the cost of acquiring a new customer, including marketing and sales expenses. This metric is critical for SaaS startups, as it can help determine the effectiveness of marketing and sales strategies. By tracking CAC, SaaS startups can identify areas for improvement and optimize their customer acquisition process.

Lifetime value (LTV) is the total value of a customer over their lifetime, including revenue and retention. This metric is essential for SaaS startups, as it can help determine the potential return on investment for customer acquisition and retention strategies. By tracking LTV, SaaS startups can identify opportunities to increase revenue and improve customer retention.

Churn rate is the percentage of customers who cancel their subscription or stop using the service over a given period. This metric is critical for SaaS startups, as it can help determine the effectiveness of customer retention strategies. By tracking churn rate, SaaS startups can identify areas for improvement and optimize their customer retention process.

Other key financial metrics for SaaS startups include monthly recurring revenue (MRR), annual recurring revenue (ARR), and gross margin. By tracking these metrics, SaaS startups can gain a deeper understanding of their financial performance and make informed decisions about funding and growth.

By building a strong financial foundation and tracking key financial metrics, SaaS startups can increase their chances of securing funding and driving growth. Whether through venture capital, angel investors, or crowdfunding, having a solid financial foundation is essential for securing the funding needed to succeed in the competitive SaaS market.

Real-Life Examples of Successful SaaS Funding Strategies

While securing funding for a SaaS startup can be challenging, there are many examples of successful funding strategies that can provide valuable insights and inspiration. In this section, we’ll explore some real-life examples of SaaS startups that have successfully secured funding, highlighting their strategies and outcomes.

One notable example is Zoom, a video conferencing platform that secured $3 million in seed funding from investors such as Yahoo co-founder Jerry Yang and former Cisco Systems executive Dan Scheinman. Zoom’s successful funding strategy was built on a strong pitch that highlighted the company’s unique value proposition, market potential, and competitive advantage.

Another example is Slack, a communication platform that secured $1.4 million in seed funding from investors such as Accel Partners and Andreessen Horowitz. Slack’s successful funding strategy was built on a strong pitch that highlighted the company’s unique value proposition, market potential, and competitive advantage, as well as a successful crowdfunding campaign that raised an additional $1 million.

Other notable examples of successful SaaS funding strategies include Dropbox, which secured $7.2 million in seed funding from investors such as Sequoia Capital and Accel Partners, and Airbnb, which secured $7.2 million in seed funding from investors such as Sequoia Capital and Greylock Partners.

These examples demonstrate that securing funding for a SaaS startup requires a strong pitch, a solid financial foundation, and a clear understanding of the funding options available. By studying these examples and learning from their strategies and outcomes, SaaS startups can increase their chances of securing the funding they need to grow and succeed.

By understanding the different funding options available, building a strong financial foundation, and creating a compelling pitch, SaaS startups can increase their chances of securing funding and achieving success in the competitive SaaS market.

Conclusion: A Roadmap to Securing Funding for Your SaaS Startup

Securing funding for a SaaS startup can be a challenging and complex process, but by understanding the different funding options available, building a strong financial foundation, and creating a compelling pitch, SaaS startups can increase their chances of securing the funding they need to grow and succeed.

In this article, we’ve explored the various funding options available to SaaS startups, including venture capital, angel investors, and crowdfunding. We’ve also discussed the importance of building a strong financial foundation, including understanding key financial metrics such as customer acquisition cost, lifetime value, and churn rate.

Additionally, we’ve provided tips on creating a persuasive pitch that showcases the unique value proposition of the SaaS startup, including advice on highlighting market potential, competitive advantage, and revenue growth prospects.

By following the roadmap outlined in this article, SaaS startups can increase their chances of securing funding and achieving success in the competitive SaaS market. Remember to stay focused on your goals, be prepared to adapt to changing market conditions, and always keep your customers in mind.

With the right funding and support, SaaS startups can achieve great things and make a lasting impact on the world. So don’t be afraid to take the leap and pursue your dreams – with hard work and determination, you can make your SaaS startup a success.