What is a Living Wage and Why is it Important?

A living wage is the minimum income required for an individual to meet their basic needs and maintain a decent standard of living. It is a crucial concept in ensuring that workers earn a fair salary that allows them to afford the necessities of life, including housing, food, healthcare, and education. In many parts of the country, a $15 hourly wage is considered a living wage, as it provides a sufficient income for individuals to cover their expenses and enjoy a relatively comfortable lifestyle.

The significance of a living wage lies in its ability to improve the overall well-being of workers and their families. When individuals earn a living wage, they are more likely to experience reduced stress, improved health, and increased financial security. This, in turn, can lead to a range of positive outcomes, including higher productivity, better job satisfaction, and a reduced turnover rate.

Furthermore, a living wage can have a positive impact on the broader economy. When workers earn a decent salary, they are more likely to spend their money locally, supporting small businesses and contributing to the growth of their community. This can lead to a multiplier effect, where the increased spending power of workers stimulates economic activity and creates new job opportunities.

In the context of a $15 hourly wage, it is essential to recognize that this salary can provide a significant improvement in the standard of living for many workers. According to the MIT Living Wage Calculator, a $15 hourly wage can support a single person with no dependents in many cities across the United States. However, it is crucial to note that the cost of living varies significantly depending on the location, and a $15 hourly wage may not be sufficient in areas with a high cost of living.

Despite the challenges, a $15 hourly wage remains an important benchmark for workers and employers alike. It represents a commitment to fair compensation and a recognition of the value that workers bring to their jobs. As the cost of living continues to rise, it is essential to prioritize a living wage that allows workers to maintain a decent standard of living and enjoy a relatively comfortable lifestyle.

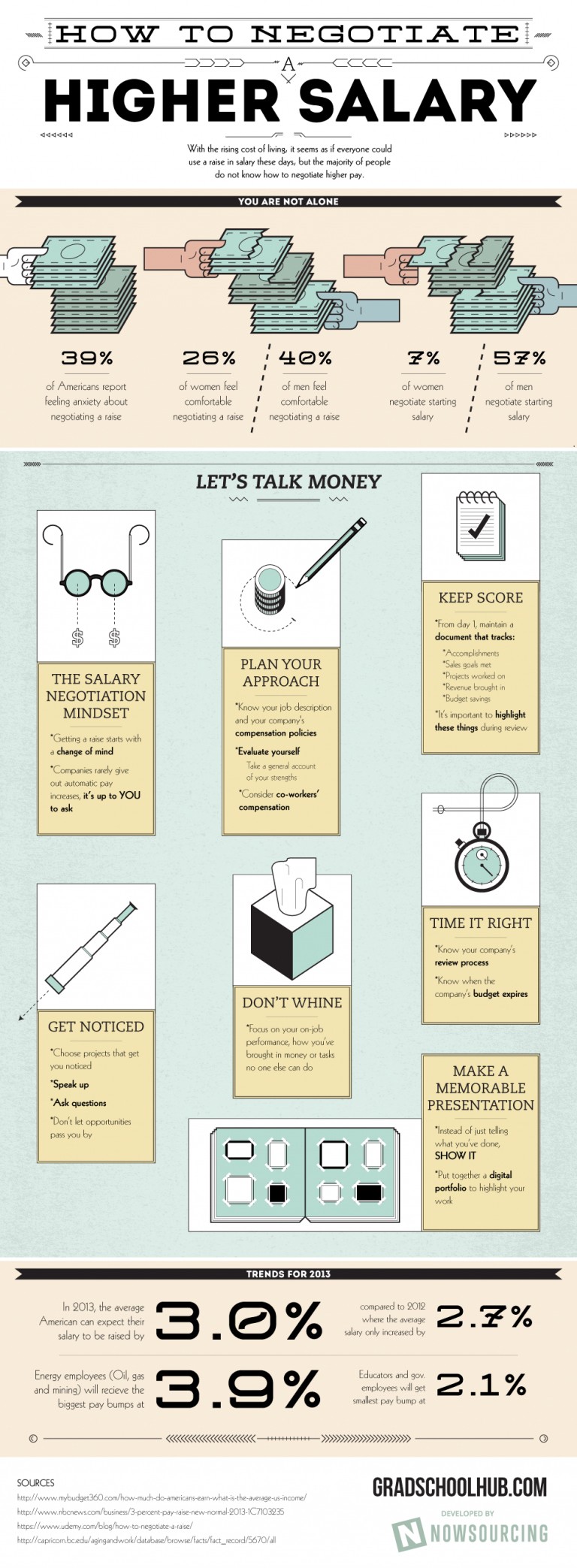

How to Negotiate a Higher Salary: Tips and Strategies

Negotiating a higher salary can be a daunting task, but it is a crucial step in ensuring that you are fairly compensated for your work. When it comes to negotiating a salary of $15 dollars an hour or more, it is essential to be prepared and confident. Here are some tips and strategies to help you negotiate a higher salary:

Research the market rate: Before entering into salary negotiations, it is essential to research the market rate for your position. This will give you a basis for your negotiation and ensure that you are asking for a fair salary. Websites such as Glassdoor and Payscale can provide valuable insights into the average salary for your position in your area.

Highlight your skills and experience: When negotiating a higher salary, it is essential to highlight your skills and experience. Make a list of your achievements and qualifications, and be prepared to explain how they will benefit the company. This will demonstrate your value to the employer and make a strong case for a higher salary.

Make a strong case for a raise: When asking for a raise, it is essential to make a strong case for why you deserve one. Explain how your contributions to the company have positively impacted the business, and highlight any additional responsibilities you have taken on. This will demonstrate your value to the employer and make a strong case for a higher salary.

Be confident and assertive: Negotiating a higher salary requires confidence and assertiveness. Be prepared to make a strong case for your desired salary, and be willing to walk away if the offer is not acceptable. Remember, the worst that can happen is that the employer says no, but the best that can happen is that you get the salary you deserve.

Consider the benefits: When negotiating a salary, it is essential to consider the benefits that come with the job. This can include health insurance, retirement plans, and paid time off. Make sure to factor these benefits into your negotiation, as they can significantly impact your overall compensation.

Be open to negotiation: Negotiating a salary is a give-and-take process. Be open to negotiation and willing to compromise. Remember, the goal is to find a mutually beneficial agreement that works for both you and the employer.

By following these tips and strategies, you can effectively negotiate a higher salary, including a salary of $15 dollars an hour or more. Remember to stay confident, assertive, and open to negotiation, and you will be well on your way to securing the salary you deserve.

The Impact of a $15 Hourly Wage on Quality of Life

Earning a salary of $15 dollars an hour can have a significant impact on one’s quality of life. With a higher hourly wage, individuals can enjoy increased financial security, reduced stress, and more free time to pursue their interests. In this section, we will explore the ways in which a $15 hourly wage can improve one’s quality of life.

Increased Financial Security: A $15 hourly wage can provide individuals with a sense of financial security, allowing them to cover their basic needs and enjoy some discretionary income. With a higher hourly wage, individuals can afford to pay their bills on time, save for the future, and enjoy some luxuries. This can lead to reduced stress and anxiety, as individuals feel more secure in their financial situation.

Reduced Stress: Earning a $15 hourly wage can also lead to reduced stress and anxiety. When individuals are financially secure, they are less likely to experience stress and anxiety related to money. This can lead to improved mental and physical health, as individuals are better able to manage their stress and anxiety.

More Free Time: With a higher hourly wage, individuals can enjoy more free time to pursue their interests. Whether it’s spending time with family and friends, pursuing hobbies, or simply relaxing, a $15 hourly wage can provide individuals with the financial freedom to enjoy their lives. This can lead to improved overall well-being, as individuals are able to pursue their passions and interests.

Improved Work-Life Balance: A $15 hourly wage can also lead to improved work-life balance. When individuals are financially secure, they are more likely to be able to balance their work and personal life. This can lead to improved relationships, improved mental and physical health, and improved overall well-being.

Increased Opportunities: Finally, a $15 hourly wage can provide individuals with increased opportunities. With a higher hourly wage, individuals can afford to pursue further education or training, start their own business, or pursue other opportunities that may not have been available to them otherwise. This can lead to improved career prospects, improved financial security, and improved overall well-being.

In conclusion, earning a salary of $15 dollars an hour can have a significant impact on one’s quality of life. With increased financial security, reduced stress, more free time, improved work-life balance, and increased opportunities, a $15 hourly wage can provide individuals with the financial freedom to enjoy their lives and pursue their passions.

Jobs That Pay $15 an Hour: A Look at the Top Industries

While a salary of $15 dollars an hour may seem like a lofty goal, there are many industries and jobs that commonly pay this rate or more. In this section, we will explore some of the top industries and jobs that pay $15 an hour or more.

Healthcare: The healthcare industry is one of the fastest-growing industries in the country, and it offers a wide range of jobs that pay $15 an hour or more. Some examples of healthcare jobs that pay this rate include medical assistants, dental hygienists, and pharmacy technicians.

Technology: The technology industry is another field that offers many jobs that pay $15 an hour or more. Some examples of tech jobs that pay this rate include software developers, data analysts, and IT project managers.

Finance: The finance industry is also a good source of jobs that pay $15 an hour or more. Some examples of finance jobs that pay this rate include financial analysts, accountants, and investment bankers.

Manufacturing: The manufacturing industry is another field that offers many jobs that pay $15 an hour or more. Some examples of manufacturing jobs that pay this rate include production supervisors, quality control inspectors, and maintenance technicians.

Education: The education industry is also a good source of jobs that pay $15 an hour or more. Some examples of education jobs that pay this rate include teachers, tutors, and education administrators.

Government: The government industry is another field that offers many jobs that pay $15 an hour or more. Some examples of government jobs that pay this rate include administrative assistants, data analysts, and policy analysts.

These are just a few examples of industries and jobs that commonly pay $15 an hour or more. Remember that salaries can vary widely depending on factors such as location, experience, and industry, so it’s always a good idea to research the market rate for your specific job and location.

In addition to these industries, there are many other fields that offer jobs that pay $15 an hour or more. Some examples include:

– Non-profit organizations

– Consulting firms

– Marketing agencies

– Sales companies

– Human resources departments

These are just a few examples of the many industries and jobs that pay $15 an hour or more. Remember to always research the market rate for your specific job and location, and to consider factors such as benefits, job security, and opportunities for advancement when evaluating a job offer.

The Pros and Cons of a $15 Minimum Wage

The debate over a $15 minimum wage has been ongoing for several years, with proponents arguing that it would help to reduce poverty and income inequality, while opponents claim that it would lead to job losses and increased costs for businesses. In this section, we will explore the pros and cons of a $15 minimum wage.

Pros:

– Increased earnings for low-wage workers: A $15 minimum wage would provide a significant increase in earnings for low-wage workers, who are often struggling to make ends meet.

– Reduced poverty and income inequality: By increasing the minimum wage, more people would be lifted out of poverty and income inequality would be reduced.

– Boost to the economy: When low-wage workers earn more, they are more likely to spend their money locally, which can boost the economy and create jobs.

– Improved productivity: Higher wages can lead to improved productivity, as workers are more motivated and engaged in their work.

Cons:

– Job losses: Some businesses may be forced to lay off workers or reduce hours to offset the increased costs of a higher minimum wage.

– Increased costs for businesses: A $15 minimum wage would require businesses to pay their employees more, which could lead to increased costs and reduced profits.

– Inflation: Some economists argue that a higher minimum wage could lead to inflation, as businesses pass on the increased costs to consumers.

– Reduced competitiveness: A $15 minimum wage could make it more difficult for businesses to compete with companies in other countries that have lower labor costs.

It’s worth noting that the impact of a $15 minimum wage would vary depending on the location and industry. Some cities and states have already implemented a $15 minimum wage, and the results have been mixed. While some businesses have reported increased costs and reduced profits, others have seen improved productivity and reduced turnover.

Ultimately, the decision to implement a $15 minimum wage would depend on a variety of factors, including the state of the economy, the cost of living in a particular area, and the impact on businesses and workers. It’s a complex issue that requires careful consideration of the pros and cons.

How to Make the Most of a $15 Hourly Wage

Earning a salary of $15 dollars an hour can provide a significant improvement in one’s standard of living. However, to make the most of this wage, it’s essential to manage one’s finances effectively. In this section, we will provide tips on how to budget, save, and invest a $15 hourly wage.

Budgeting: Creating a budget is the first step in managing one’s finances effectively. Start by tracking your income and expenses to understand where your money is going. Make a list of your essential expenses, such as rent/mortgage, utilities, and groceries, and allocate your income accordingly. Consider using the 50/30/20 rule, where 50% of your income goes towards essential expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Saving: Saving is an essential part of managing one’s finances effectively. Consider setting up an emergency fund to cover 3-6 months of living expenses in case of unexpected events. You can also save for long-term goals, such as retirement or a down payment on a house. Take advantage of tax-advantaged savings options, such as 401(k) or IRA accounts.

Investing: Investing can help your money grow over time. Consider investing in a diversified portfolio of stocks, bonds, and other assets. You can also take advantage of tax-advantaged investment options, such as a Roth IRA or a tax-loss harvesting strategy.

Other tips: In addition to budgeting, saving, and investing, there are several other tips to make the most of a $15 hourly wage. Consider taking advantage of employee benefits, such as health insurance or a 401(k) match. You can also look for ways to increase your income, such as taking on a side job or pursuing additional education or training.

By following these tips, you can make the most of a $15 hourly wage and achieve financial stability and security. Remember to always prioritize your financial goals and make adjustments as needed to stay on track.

Success Stories: People Who Have Benefited from a $15 Hourly Wage

While the concept of a $15 hourly wage may seem abstract, there are many individuals who have seen significant improvements in their lives as a result of earning this wage. In this section, we will share some success stories of people who have benefited from a $15 hourly wage.

Meet Sarah, a single mother who works as a nurse in a hospital. Before earning a $15 hourly wage, Sarah struggled to make ends meet, working multiple jobs just to provide for her family. However, after her hospital implemented a $15 hourly wage, Sarah was able to quit her second job and focus on her family. She was also able to start saving for her children’s education and plan for a more secure financial future.

Meet John, a software engineer who works for a tech startup. Before earning a $15 hourly wage, John felt undervalued and overworked, often putting in long hours without adequate compensation. However, after his company implemented a $15 hourly wage, John felt more confident in his worth and was able to negotiate better benefits and a more sustainable work-life balance.

Meet Maria, a retail worker who has been advocating for a $15 hourly wage for years. Before earning this wage, Maria struggled to make ends meet, working multiple jobs just to provide for her family. However, after her employer implemented a $15 hourly wage, Maria was able to quit her second job and focus on her family. She was also able to start saving for her children’s education and plan for a more secure financial future.

These success stories demonstrate the positive impact that a $15 hourly wage can have on individuals and families. By earning a living wage, people are able to improve their standard of living, reduce stress and anxiety, and plan for a more secure financial future.

While these stories are inspiring, it’s essential to note that a $15 hourly wage is not a one-size-fits-all solution. Different industries, locations, and individuals have different needs and requirements. However, by sharing these success stories, we hope to highlight the potential benefits of a $15 hourly wage and encourage more employers to consider implementing this wage.

Conclusion: The Future of the $15 Hourly Wage

The concept of a $15 hourly wage has been a topic of discussion in recent years, with many arguing that it is a necessary step to ensure a decent standard of living for workers. As we have seen in this article, a $15 hourly wage can have a significant impact on one’s quality of life, including increased financial security, reduced stress, and more free time.

While there are valid arguments for and against a $15 minimum wage, it is clear that this wage can have a positive impact on individuals and families. By earning a living wage, people are able to improve their standard of living, reduce stress and anxiety, and plan for a more secure financial future.

As the workforce and economy continue to evolve, it is likely that the concept of a $15 hourly wage will continue to be a topic of discussion. With the rise of automation and artificial intelligence, it is possible that the nature of work will change significantly in the coming years. However, one thing is certain: workers will continue to need a living wage to support themselves and their families.

In conclusion, a $15 hourly wage is not just a number, but a symbol of a decent standard of living. It represents a commitment to fairness, equality, and the well-being of workers. As we move forward, it is essential that we prioritize the needs of workers and ensure that they are paid a wage that reflects their value and contributions to society.

By doing so, we can create a more equitable and sustainable economy that benefits everyone, not just the wealthy few. The future of the $15 hourly wage is uncertain, but one thing is clear: it is a necessary step towards creating a better future for workers and their families.