Understanding the Basics of Short-Term Capital Gains Tax

Short-term capital gains tax is a type of tax levied on the profits made from the sale of investments held for a year or less. This type of tax is typically applied to investments such as stocks, bonds, mutual funds, and real estate investment trusts (REITs). The tax rates associated with short-term capital gains tax vary depending on the taxpayer’s income tax bracket, ranging from 10% to 37%. For example, if an individual sells a stock they held for six months and makes a profit of $1,000, they may be subject to short-term capital gains tax on that amount.

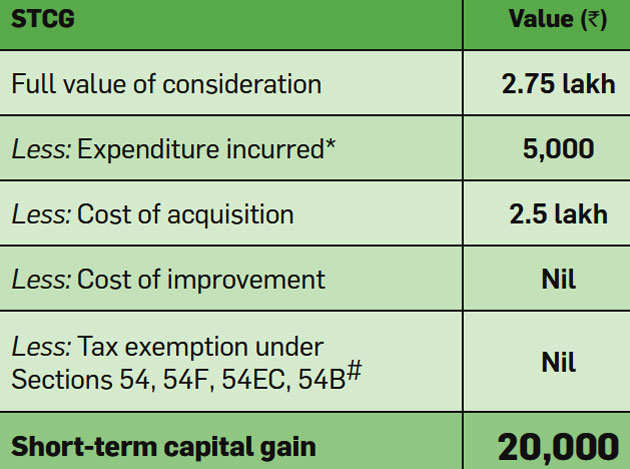

To calculate short-term capital gains tax, taxpayers need to determine the gain or loss from the sale of their investment. This is typically done by subtracting the original purchase price from the sale price. If the result is a gain, the taxpayer will be subject to short-term capital gains tax. For instance, if an individual buys a stock for $500 and sells it for $700, their gain would be $200, which would be subject to short-term capital gains tax.

It’s essential to note that short-term capital gains tax rates are generally higher than long-term capital gains tax rates. This is because the government incentivizes long-term investing by offering lower tax rates on investments held for more than a year. However, short-term capital gains tax can still be a significant burden for taxpayers who frequently buy and sell investments.

A short-term capital gains tax calculator can be a valuable tool for taxpayers looking to estimate their tax liability. These calculators take into account the taxpayer’s income tax bracket, the type of investment, and the gain or loss from the sale. By using a short-term capital gains tax calculator, taxpayers can get an accurate estimate of their tax liability and plan accordingly.

In addition to using a calculator, taxpayers can also consult with a tax professional to ensure they are taking advantage of all the tax savings available to them. A tax professional can help taxpayers navigate the complexities of short-term capital gains tax and provide guidance on how to minimize their tax liability.

How to Calculate Your Short-Term Capital Gains Tax Using a Calculator

Calculating short-term capital gains tax can be a complex process, but using a short-term capital gains tax calculator can simplify the task. To use a calculator, you’ll need to gather the necessary information, including the investment dates, sale prices, and holding periods. This information will help the calculator determine the gain or loss from the sale of your investment.

Popular short-term capital gains tax calculators like TurboTax or H&R Block can guide you through the process. These calculators typically ask for the following information:

- Investment type (e.g., stock, bond, mutual fund)

- Purchase date and price

- Sale date and price

- Holding period (i.e., the length of time you held the investment)

- Tax filing status (e.g., single, married, head of household)

Once you’ve entered this information, the calculator will determine the gain or loss from the sale of your investment and calculate the short-term capital gains tax liability. The calculator may also provide additional information, such as the tax rate applied to the gain and any potential tax savings.

When using a short-term capital gains tax calculator, it’s essential to ensure that you’re using the correct information and following the calculator’s instructions carefully. This will help you avoid errors and ensure that you’re accurately calculating your short-term capital gains tax liability.

In addition to using a calculator, you may also want to consult with a tax professional to ensure that you’re taking advantage of all the tax savings available to you. A tax professional can help you navigate the complexities of short-term capital gains tax and provide guidance on how to minimize your tax liability.

By using a short-term capital gains tax calculator and consulting with a tax professional, you can ensure that you’re accurately calculating your short-term capital gains tax liability and taking advantage of all the tax savings available to you.

Factors That Affect Your Short-Term Capital Gains Tax Liability

Several factors can impact your short-term capital gains tax liability, making it essential to understand how each factor affects your tax calculation. The type of investment, holding period, and tax filing status are just a few of the key factors that can influence your short-term capital gains tax liability.

The type of investment is a critical factor in determining your short-term capital gains tax liability. For example, investments in stocks, bonds, and mutual funds are subject to short-term capital gains tax, while investments in real estate or collectibles may be subject to different tax rates or rules. Understanding the tax implications of each investment type can help you make informed decisions and minimize your tax liability.

The holding period is another essential factor in determining your short-term capital gains tax liability. Investments held for one year or less are subject to short-term capital gains tax, while investments held for more than one year are subject to long-term capital gains tax. The holding period can significantly impact your tax liability, as short-term capital gains tax rates are generally higher than long-term capital gains tax rates.

Tax filing status is also a critical factor in determining your short-term capital gains tax liability. Your tax filing status can affect your tax rates, deductions, and exemptions, all of which can impact your short-term capital gains tax liability. For example, married couples filing jointly may be eligible for a lower tax rate than single individuals, while head of household filers may be eligible for a higher standard deduction.

Other factors that can impact your short-term capital gains tax liability include the sale price and purchase price of the investment, as well as any commissions or fees associated with the sale. Understanding how each of these factors affects your tax calculation can help you make informed decisions and minimize your tax liability.

Using a short-term capital gains tax calculator can help you navigate the complexities of short-term capital gains tax and ensure that you’re accurately calculating your tax liability. These calculators take into account the various factors that affect your tax liability, providing you with a comprehensive and accurate calculation of your short-term capital gains tax.

Common Mistakes to Avoid When Calculating Short-Term Capital Gains Tax

Calculating short-term capital gains tax can be complex, and mistakes can lead to incorrect tax liability and potential penalties. To avoid these mistakes, it’s essential to understand the common errors that taxpayers make when calculating their short-term capital gains tax liability.

One common mistake is incorrect holding periods. The holding period is the length of time you held the investment, and it’s crucial in determining whether the gain is short-term or long-term. If you incorrectly report the holding period, you may end up paying more tax than necessary. To avoid this mistake, make sure to keep accurate records of your investment dates and holding periods.

Another common mistake is failure to account for wash sales. A wash sale occurs when you sell a security at a loss and buy a substantially identical security within 30 days. If you don’t account for wash sales, you may end up paying more tax than necessary. To avoid this mistake, make sure to keep track of your wash sales and adjust your tax calculation accordingly.

Other common mistakes include incorrect calculation of gains and losses, failure to report all sales, and incorrect tax rates. To avoid these mistakes, it’s essential to use a short-term capital gains tax calculator or consult with a tax professional. These calculators and professionals can help you navigate the complexities of short-term capital gains tax and ensure that you’re accurately calculating your tax liability.

Additionally, it’s essential to keep accurate records of your investments, including purchase and sale dates, prices, and holding periods. This will help you avoid mistakes and ensure that you’re accurately calculating your short-term capital gains tax liability.

By avoiding these common mistakes, you can ensure that you’re accurately calculating your short-term capital gains tax liability and minimizing your tax liability. Remember to use a short-term capital gains tax calculator or consult with a tax professional to ensure that you’re getting the most accurate calculation possible.

Short-Term Capital Gains Tax Strategies to Minimize Your Liability

Minimizing short-term capital gains tax liability requires a strategic approach to investing and tax planning. By implementing the right strategies, you can reduce your tax liability and keep more of your investment gains. Here are some effective strategies to consider:

Tax-loss harvesting is a popular strategy for minimizing short-term capital gains tax liability. This involves selling securities that have declined in value to offset gains from other investments. By doing so, you can reduce your overall tax liability and minimize the impact of short-term capital gains tax.

Charitable donations are another effective way to minimize short-term capital gains tax liability. By donating securities that have appreciated in value to a qualified charity, you can avoid paying capital gains tax on the gain. Additionally, you may be eligible for a tax deduction for the fair market value of the securities donated.

Investing in tax-efficient funds is also a great way to minimize short-term capital gains tax liability. These funds are designed to minimize turnover and capital gains distributions, which can help reduce your tax liability. Look for funds with low turnover rates and a focus on long-term investing.

Other strategies for minimizing short-term capital gains tax liability include investing in index funds or ETFs, which tend to have lower turnover rates than actively managed funds. You can also consider investing in municipal bonds or other tax-exempt securities, which are exempt from federal income tax.

It’s essential to note that each of these strategies has its own set of rules and regulations. It’s crucial to consult with a tax professional or financial advisor to determine the best approach for your specific situation. By working with a professional, you can ensure that you’re implementing the most effective strategies to minimize your short-term capital gains tax liability.

Using a short-term capital gains tax calculator can also help you identify opportunities to minimize your tax liability. These calculators can help you determine the impact of different strategies on your tax liability and provide you with a clear understanding of your tax situation.

How to Report Short-Term Capital Gains Tax on Your Tax Return

Reporting short-term capital gains tax on your tax return can be a complex process, but it’s essential to ensure that you’re accurately reporting your tax liability. To report short-term capital gains tax, you’ll need to complete Form 8949 and Schedule D.

Form 8949 is used to report the sale of capital assets, including stocks, bonds, and mutual funds. You’ll need to list each sale separately, including the date of sale, the proceeds from the sale, and the cost basis of the asset. You’ll also need to calculate the gain or loss from each sale and report it on the form.

Schedule D is used to report the total gain or loss from all of your capital asset sales. You’ll need to add up the gains and losses from each sale and report the total on Schedule D. You’ll also need to calculate the tax liability from the gain or loss and report it on the schedule.

When completing Form 8949 and Schedule D, it’s essential to ensure that you’re accurately reporting all of the required information. This includes the date of sale, the proceeds from the sale, and the cost basis of the asset. You’ll also need to calculate the gain or loss from each sale and report it on the form.

Using a short-term capital gains tax calculator can help you accurately calculate your tax liability and ensure that you’re reporting the correct information on your tax return. These calculators can help you determine the gain or loss from each sale and calculate the tax liability from the gain or loss.

It’s also essential to keep accurate records of your capital asset sales, including the date of sale, the proceeds from the sale, and the cost basis of the asset. This will help you ensure that you’re accurately reporting all of the required information on your tax return.

By accurately reporting your short-term capital gains tax on your tax return, you can ensure that you’re in compliance with tax laws and regulations. It’s always a good idea to consult with a tax professional or financial advisor to ensure that you’re accurately reporting your tax liability and taking advantage of all the tax savings available to you.

Short-Term Capital Gains Tax Calculator Tools and Resources

There are many short-term capital gains tax calculator tools and resources available to help you accurately calculate your tax liability. These tools can range from online calculators to software and mobile apps. Here are some popular options:

TurboTax is a popular tax preparation software that includes a short-term capital gains tax calculator. This calculator can help you determine your tax liability and provide you with a detailed report of your calculations.

H&R Block is another well-known tax preparation software that includes a short-term capital gains tax calculator. This calculator can help you determine your tax liability and provide you with a detailed report of your calculations.

Investopedia’s Capital Gains Tax Calculator is a free online calculator that can help you determine your short-term capital gains tax liability. This calculator takes into account the type of investment, holding period, and tax filing status to provide an accurate calculation.

NerdWallet’s Capital Gains Tax Calculator is another free online calculator that can help you determine your short-term capital gains tax liability. This calculator takes into account the type of investment, holding period, and tax filing status to provide an accurate calculation.

Mobile apps such as TaxAct and Credit Karma also offer short-term capital gains tax calculators. These apps can provide you with a quick and easy way to calculate your tax liability on the go.

When choosing a short-term capital gains tax calculator, it’s essential to consider the features and pricing of each option. Some calculators may be more comprehensive than others, and some may offer additional features such as tax planning and investment tracking.

Using a short-term capital gains tax calculator can help you accurately calculate your tax liability and ensure that you’re in compliance with tax laws and regulations. It’s always a good idea to consult with a tax professional or financial advisor to ensure that you’re using the calculator correctly and taking advantage of all the tax savings available to you.

Conclusion: Accurately Calculating Your Short-Term Capital Gains Tax Liability

Accurately calculating your short-term capital gains tax liability is crucial to ensure that you’re in compliance with tax laws and regulations. By understanding the basics of short-term capital gains tax, using a calculator, and avoiding common mistakes, you can minimize your tax liability and maximize your investment returns.

Using a short-term capital gains tax calculator can help you accurately calculate your tax liability and ensure that you’re taking advantage of all the tax savings available to you. These calculators can provide you with a detailed report of your calculations and help you identify areas where you can minimize your tax liability.

It’s also essential to consult with a tax professional or financial advisor to ensure that you’re accurately calculating your short-term capital gains tax liability. They can provide you with personalized advice and help you develop a tax strategy that meets your specific needs and goals.

By accurately calculating your short-term capital gains tax liability, you can avoid costly mistakes and ensure that you’re in compliance with tax laws and regulations. Remember to always consult with a tax professional or financial advisor if you’re unsure about any aspect of your tax calculation.

In conclusion, accurately calculating your short-term capital gains tax liability is crucial to ensure that you’re maximizing your investment returns and minimizing your tax liability. By using a calculator, avoiding common mistakes, and consulting with a tax professional or financial advisor, you can ensure that you’re in compliance with tax laws and regulations and achieving your financial goals.