Understanding Simple IRA Contribution Limits for 2023

A Simple IRA, or Savings Incentive Match Plan for Employees Individual Retirement Account, is a type of retirement plan that allows employees and employers to contribute to a traditional IRA. Understanding Simple IRA contribution limits for 2023 is crucial for maximizing retirement savings and avoiding potential penalties. In this article, we will delve into the basics of Simple IRA contributions, including the definition, benefits, and eligibility requirements, as well as the importance of understanding contribution limits for 2023.

Simple IRA contributions are designed to provide a straightforward and affordable way for small businesses and self-employed individuals to offer retirement benefits to their employees. The benefits of Simple IRA contributions include ease of administration, flexibility in contribution amounts, and the ability to catch up on contributions for employees aged 50 and over. To be eligible for a Simple IRA, employees must have earned income from their employer and be under the age of 70 1/2.

For 2023, the Simple IRA contribution limits are $14,000 for employees under the age of 50, and $17,000 for employees aged 50 and over, including the $3,000 catch-up contribution. It is essential to note that these limits apply to the total contributions made by both the employee and the employer. Understanding these limits is vital to avoid exceeding the allowed contribution amount, which can result in penalties and fines.

In addition to the annual contribution limits, Simple IRA plans also have rules regarding employer matching contributions. Employers are required to make either a matching contribution or a non-elective contribution to each employee’s Simple IRA account. The matching contribution can be up to 3% of the employee’s compensation, while the non-elective contribution is 2% of the employee’s compensation.

By understanding the basics of Simple IRA contributions, including the definition, benefits, and eligibility requirements, individuals can make informed decisions about their retirement savings. Moreover, being aware of the Simple IRA contribution limits for 2023 can help individuals maximize their retirement savings and avoid potential penalties. In the next section, we will discuss how to calculate your Simple IRA contribution limit for 2023.

How to Calculate Your Simple IRA Contribution Limit for 2023

Calculating your Simple IRA contribution limit for 2023 is a straightforward process that requires considering a few key factors. To determine your contribution limit, you will need to consider your age, income, and employer matching contributions. In this section, we will provide a step-by-step guide on how to calculate your Simple IRA contribution limit for 2023.

Step 1: Determine Your Age

Your age plays a significant role in determining your Simple IRA contribution limit. If you are under the age of 50, your contribution limit is $14,000. However, if you are 50 or older, you are eligible for a catch-up contribution of $3,000, bringing your total contribution limit to $17,000.

Step 2: Calculate Your Income

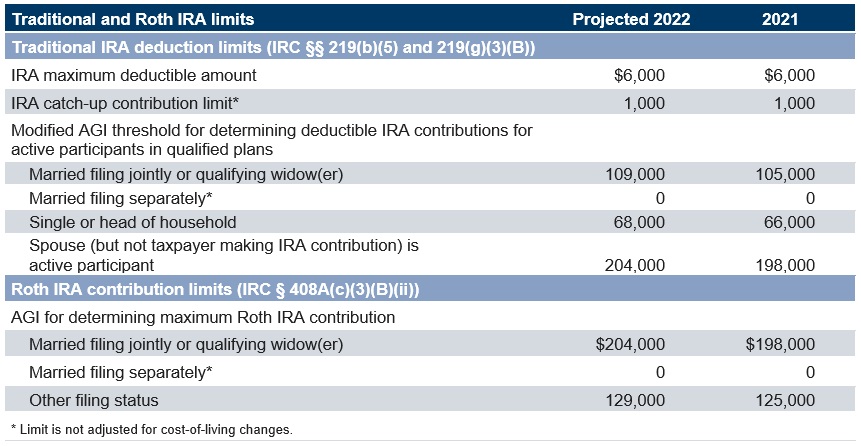

Your income also affects your Simple IRA contribution limit. The IRS sets income limits on who can contribute to a Simple IRA, and the limits vary based on filing status and income level. For 2023, the income limits are as follows:

- Single filers with a modified adjusted gross income (MAGI) below $68,000 can contribute up to the annual limit.

- Joint filers with a MAGI below $109,000 can contribute up to the annual limit.

- Self-employed individuals with a net earnings from self-employment below $68,000 can contribute up to the annual limit.

Step 3: Consider Employer Matching Contributions

If your employer offers matching contributions to your Simple IRA, you will need to consider these contributions when calculating your total contribution limit. Employer matching contributions are made by your employer to your Simple IRA account, and they do not affect your individual contribution limit. However, they do count towards your total contribution limit.

Step 4: Calculate Your Total Contribution Limit

Once you have determined your age, income, and employer matching contributions, you can calculate your total Simple IRA contribution limit for 2023. Add your individual contribution limit to your employer matching contributions to determine your total contribution limit.

Example:

Let’s say you are 45 years old, have a MAGI of $50,000, and your employer offers a 3% matching contribution to your Simple IRA. Your individual contribution limit would be $14,000, and your employer matching contribution would be $1,500 (3% of $50,000). Your total contribution limit would be $15,500 ($14,000 + $1,500).

By following these steps, you can easily calculate your Simple IRA contribution limit for 2023 and make informed decisions about your retirement savings.

Simple IRA Contribution Limits for 2023: What You Need to Know

Understanding the Simple IRA contribution limits for 2023 is crucial for maximizing retirement savings. The annual limit for Simple IRA contributions in 2023 is $14,000, with an additional $3,000 catch-up contribution allowed for employees aged 50 and older. This represents a $1,000 increase from the 2022 limit, providing employees with more opportunities to save for their retirement.

The Simple IRA contribution limits for 2023 apply to all employees participating in a Simple IRA plan, regardless of their income level. However, the amount of the contribution limit may be affected by the employee’s compensation and the employer’s matching contributions. It is essential to review the plan documents and consult with the plan administrator to determine the specific contribution limits and rules that apply.

In addition to the annual limit, Simple IRA plans also have a maximum compensation limit, which is $305,000 in 2023. This means that employees with compensation above this limit may not be able to contribute the full $14,000 to their Simple IRA. Furthermore, the catch-up contribution limit of $3,000 is only available to employees who are 50 years old or older by the end of the plan year.

It is also important to note that Simple IRA contribution limits may be subject to cost-of-living adjustments (COLAs) in future years. The IRS typically announces the COLAs for the following year in October or November, so it is essential to stay informed about any changes to the contribution limits.

Employers who sponsor Simple IRA plans must also be aware of the contribution limits and ensure that their employees are not exceeding these limits. Exceeding the contribution limits can result in penalties and taxes, so it is crucial to monitor employee contributions and adjust them as necessary.

In summary, the Simple IRA contribution limits for 2023 are $14,000, with an additional $3,000 catch-up contribution allowed for employees aged 50 and older. Understanding these limits and how they apply to individual circumstances is essential for maximizing retirement savings and avoiding penalties. By staying informed and planning carefully, employees and employers can make the most of Simple IRA contributions in 2023.

Strategies for Maximizing Your Simple IRA Contributions in 2023

Maximizing Simple IRA contributions in 2023 requires a strategic approach. By taking advantage of employer matching, automating contributions, and considering catch-up contributions, individuals can make the most of their retirement savings.

One of the most effective ways to maximize Simple IRA contributions is to take advantage of employer matching. Many employers offer matching contributions to encourage employees to participate in the Simple IRA plan. By contributing enough to maximize the employer match, individuals can essentially receive free money that can add up over time.

Automating Simple IRA contributions is another strategy for maximizing retirement savings. By setting up automatic transfers from their paycheck or bank account, individuals can ensure that they contribute a fixed amount regularly, without having to think about it. This approach can help individuals avoid missing deadlines and make consistent progress towards their retirement goals.

Considering catch-up contributions is also an important strategy for maximizing Simple IRA contributions in 2023. Individuals aged 50 and older are eligible to make catch-up contributions of up to $3,000 in 2023, in addition to the annual limit of $14,000. By taking advantage of catch-up contributions, individuals can accelerate their retirement savings and make up for any lost time.

Another strategy for maximizing Simple IRA contributions is to prioritize contributions early in the year. By contributing a larger amount earlier in the year, individuals can take advantage of compound interest and potentially earn more returns on their investment.

It’s also essential to review and adjust Simple IRA contributions regularly. As income levels and employer matching contributions change, individuals may need to adjust their contribution amounts to maximize their retirement savings. Regularly reviewing and adjusting Simple IRA contributions can help individuals stay on track and achieve their retirement goals.

In addition to these strategies, individuals can also consider consolidating their retirement accounts to maximize their Simple IRA contributions. By consolidating multiple accounts into a single Simple IRA account, individuals can simplify their retirement savings and potentially reduce fees and administrative costs.

Finally, individuals should consider seeking professional guidance to maximize their Simple IRA contributions. A financial advisor can help individuals create a personalized retirement plan, optimize their Simple IRA contributions, and make informed investment decisions.

By implementing these strategies, individuals can maximize their Simple IRA contributions in 2023 and make progress towards their retirement goals. Remember to always review and adjust Simple IRA contributions regularly to ensure that you’re on track to meet your retirement objectives.

Common Mistakes to Avoid When Making Simple IRA Contributions in 2023

When making Simple IRA contributions in 2023, it’s essential to avoid common mistakes that can result in penalties, fines, and lost opportunities. By understanding these mistakes, individuals can take steps to prevent them and maximize their retirement savings.

One of the most common mistakes is exceeding Simple IRA contribution limits. For 2023, the annual limit is $14,000, and individuals aged 50 and older can make catch-up contributions of up to $3,000. Exceeding these limits can result in a 6% excise tax on the excess amount, which can be costly and unnecessary.

Missing deadlines is another mistake to avoid. Simple IRA contributions must be made by the tax filing deadline, which is typically April 15th. Missing this deadline can result in lost opportunities for retirement savings and potential penalties.

Failing to report Simple IRA contributions accurately is also a common mistake. Individuals must report their contributions on their tax return, using Form 5498. Failing to report contributions accurately can result in penalties and fines, as well as delayed or lost refunds.

Not taking advantage of employer matching is another mistake to avoid. Many employers offer matching contributions to encourage employees to participate in the Simple IRA plan. By not contributing enough to maximize the employer match, individuals can essentially leave free money on the table.

Not reviewing and adjusting Simple IRA contributions regularly is also a mistake. As income levels and employer matching contributions change, individuals may need to adjust their contribution amounts to maximize their retirement savings. Regularly reviewing and adjusting Simple IRA contributions can help individuals stay on track and achieve their retirement goals.

Not considering catch-up contributions is another mistake to avoid. Individuals aged 50 and older can make catch-up contributions of up to $3,000 in 2023, which can help accelerate their retirement savings. By not considering catch-up contributions, individuals may miss out on opportunities to boost their retirement savings.

Finally, not seeking professional guidance is a mistake to avoid. A financial advisor can help individuals create a personalized retirement plan, optimize their Simple IRA contributions, and make informed investment decisions. By not seeking professional guidance, individuals may miss out on opportunities to maximize their retirement savings and achieve their long-term goals.

By avoiding these common mistakes, individuals can maximize their Simple IRA contributions in 2023 and make progress towards their retirement goals. Remember to always review and adjust Simple IRA contributions regularly to ensure that you’re on track to meet your retirement objectives.

How to Report Simple IRA Contributions on Your Taxes for 2023

Reporting Simple IRA contributions on taxes for 2023 is a crucial step in ensuring that you’re in compliance with IRS regulations and taking advantage of the tax benefits associated with these contributions. Here’s a step-by-step guide on how to report Simple IRA contributions on your taxes for 2023.

The first step is to gather the necessary forms and documents. You’ll need to obtain a copy of Form 5498, which is the IRA Contribution Information form. This form will show the amount of contributions made to your Simple IRA account for the tax year. You’ll also need to gather any other relevant documents, such as your W-2 form and any other tax-related documents.

Next, you’ll need to report your Simple IRA contributions on your tax return. You’ll report these contributions on Form 1040, which is the standard form for personal income tax returns. You’ll enter the amount of contributions

How to Report Simple IRA Contributions on Your Taxes for 2023

Reporting Simple IRA contributions on taxes for 2023 is a crucial step in ensuring that you’re in compliance with IRS regulations and taking advantage of the tax benefits associated with these contributions. Here’s a step-by-step guide on how to report Simple IRA contributions on your taxes for 2023.

The first step is to gather the necessary forms and documents. You’ll need to obtain a copy of Form 5498, which is the IRA Contribution Information form. This form will show the amount of contributions made to your Simple IRA account for the tax year. You’ll also need to gather any other relevant documents, such as your W-2 form and any other tax-related documents.

Next, you’ll need to report your Simple IRA contributions on your tax return. You’ll report these contributions on Form 1040, which is the standard form for personal income tax returns. You’ll enter the amount of contributions

How to Report Simple IRA Contributions on Your Taxes for 2023

Reporting Simple IRA contributions on taxes for 2023 is a crucial step in ensuring that you’re in compliance with IRS regulations and taking advantage of the tax benefits associated with these contributions. Here’s a step-by-step guide on how to report Simple IRA contributions on your taxes for 2023.

The first step is to gather the necessary forms and documents. You’ll need to obtain a copy of Form 5498, which is the IRA Contribution Information form. This form will show the amount of contributions made to your Simple IRA account for the tax year. You’ll also need to gather any other relevant documents, such as your W-2 form and any other tax-related documents.

Next, you’ll need to report your Simple IRA contributions on your tax return. You’ll report these contributions on Form 1040, which is the standard form for personal income tax returns. You’ll enter the amount of contributions