Understanding the Risks: Why Small Businesses Need Liability Insurance

As a small business owner, it’s essential to understand the potential risks that can impact your company’s financial stability. One of the most significant risks is the possibility of being sued or held liable for damages or injuries. This is where small business liability insurance comes in – a crucial protection that can help mitigate the financial consequences of such events. The cost of liability insurance for small businesses can vary depending on several factors, including the type of business, location, and coverage limits.

Without adequate liability insurance, small businesses can face devastating financial losses in the event of a lawsuit or accident. For instance, if a customer slips and falls on your premises, you could be held liable for medical expenses, lost wages, and other related costs. Similarly, if your product causes harm to a consumer, you could be sued for damages. In such cases, liability insurance can provide the necessary financial protection to help your business recover from the losses.

Some common scenarios where liability insurance can protect a small business include accidents, product defects, and professional errors. For example, if you’re a contractor and one of your employees accidentally damages a client’s property, liability insurance can help cover the costs of repairs or replacement. Similarly, if you’re a manufacturer and one of your products causes harm to a consumer, liability insurance can help cover the costs of medical expenses and other related damages.

In addition to protecting against financial losses, liability insurance can also help small businesses maintain their reputation and credibility. By having adequate insurance coverage, you can demonstrate to your customers, partners, and stakeholders that you’re committed to responsible business practices and willing to take steps to mitigate potential risks.

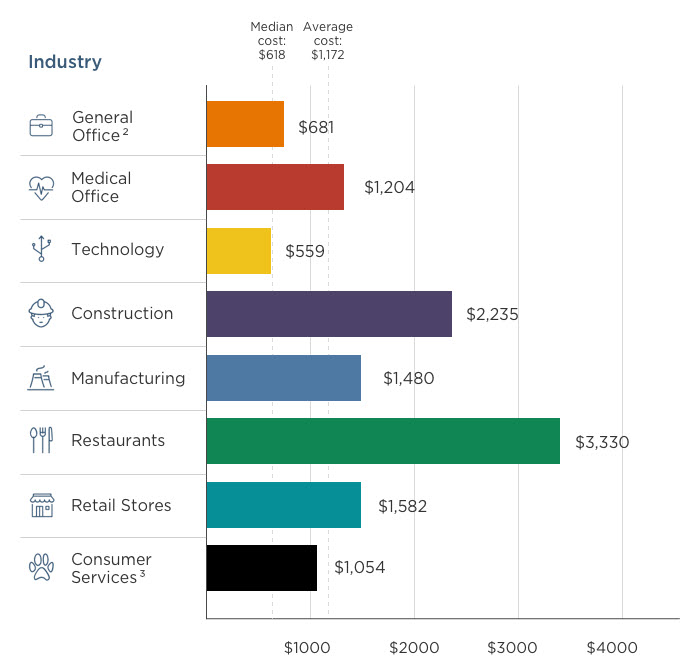

When it comes to the cost of liability insurance for small businesses, it’s essential to understand that the premiums can vary depending on several factors. These factors include the type of business, location, coverage limits, and claims history. For instance, businesses in high-risk industries such as construction or manufacturing may pay higher premiums than those in low-risk industries such as retail or services.

On average, the cost of liability insurance for small businesses can range from a few hundred to several thousand dollars per year. However, the exact cost will depend on your specific business needs and circumstances. It’s essential to work with a licensed insurance agent or broker who can help you assess your risks and find the right coverage at an affordable price.

How to Choose the Right Liability Insurance for Your Small Business

Choosing the right liability insurance policy for your small business can be a daunting task, especially with the numerous options available in the market. However, with a clear understanding of your business needs and the factors that affect liability insurance costs, you can make an informed decision that protects your business from potential risks.

One of the most critical factors to consider when selecting a liability insurance policy is the type of business you operate. Different industries have unique risks, and your insurance policy should reflect those risks. For example, if you’re a contractor, you’ll need a policy that covers accidents and injuries on the job site. On the other hand, if you’re a retailer, you’ll need a policy that covers product liability and customer injuries.

Another essential factor to consider is the size of your business. Small businesses with fewer employees and lower revenues may be eligible for lower premiums. However, it’s crucial to ensure that your policy provides adequate coverage for your business needs. A licensed insurance agent or broker can help you assess your risks and find the right coverage at an affordable price.

Industry is also a significant factor in determining liability insurance costs. Businesses in high-risk industries such as construction, manufacturing, and healthcare may pay higher premiums than those in low-risk industries such as retail, services, and technology. However, this doesn’t mean that businesses in low-risk industries don’t need liability insurance. Even in low-risk industries, accidents can still happen, and liability insurance can provide financial protection.

When shopping for liability insurance, it’s essential to work with a licensed insurance agent or broker who has experience in your industry. They can help you navigate the complex world of liability insurance and find a policy that meets your business needs. Additionally, they can help you identify potential risks and provide guidance on how to mitigate those risks.

Some other factors to consider when choosing a liability insurance policy include the policy limits, deductible, and coverage exclusions. Policy limits refer to the maximum amount of coverage provided by the policy. Deductible refers to the amount you must pay out of pocket before the insurance policy kicks in. Coverage exclusions refer to the types of risks that are not covered by the policy.

By considering these factors and working with a licensed insurance agent or broker, you can find a liability insurance policy that protects your small business from potential risks and helps you achieve your business goals.

The Cost of Liability Insurance: What Small Businesses Can Expect to Pay

The cost of liability insurance for small businesses can vary widely depending on several factors, including business size, industry, and location. On average, small businesses can expect to pay between $500 and $2,000 per year for liability insurance, with some policies costing as much as $5,000 or more.

Business size is a significant factor in determining liability insurance costs. Small businesses with fewer employees and lower revenues tend to pay lower premiums. For example, a small retail business with 5 employees and $500,000 in annual revenue might pay around $500 per year for liability insurance. On the other hand, a larger business with 20 employees and $2 million in annual revenue might pay around $2,000 per year.

Industry is also a crucial factor in determining liability insurance costs. Businesses in high-risk industries such as construction, manufacturing, and healthcare tend to pay higher premiums than those in low-risk industries such as retail, services, and technology. For example, a construction company might pay around $3,000 per year for liability insurance, while a retail business might pay around $1,000 per year.

Location is another factor that can affect liability insurance costs. Businesses located in areas with high crime rates or natural disaster risks tend to pay higher premiums than those located in safer areas. For example, a business located in a hurricane-prone area might pay around $2,500 per year for liability insurance, while a business located in a safer area might pay around $1,500 per year.

Some examples of liability insurance costs for different types of businesses include:

- Retail business: $500-$1,500 per year

- Service-based business: $1,000-$3,000 per year

- Construction company: $2,000-$5,000 per year

- Manufacturing company: $3,000-$6,000 per year

- Healthcare provider: $5,000-$10,000 per year

It’s essential to note that these are just rough estimates, and the actual cost of liability insurance for your small business may be higher or lower depending on your specific circumstances. The best way to get an accurate quote is to work with a licensed insurance agent or broker who can assess your risks and provide a customized quote.

Factors That Affect Liability Insurance Costs for Small Businesses

Liability insurance costs for small businesses can be influenced by a variety of factors, including business size, industry, claims history, and coverage limits. Understanding these factors can help small business owners manage their liability insurance costs and find affordable coverage.

Business size is a significant factor in determining liability insurance costs. Larger businesses tend to pay higher premiums due to the increased risk of accidents and lawsuits. However, small businesses can take steps to reduce their liability insurance costs by implementing safety protocols and risk management strategies.

Industry is another important factor in determining liability insurance costs. Businesses in high-risk industries such as construction, manufacturing, and healthcare tend to pay higher premiums than those in low-risk industries such as retail, services, and technology. However, even businesses in low-risk industries can benefit from liability insurance to protect against unexpected events.

Claims history is also a critical factor in determining liability insurance costs. Businesses with a history of claims tend to pay higher premiums due to the increased risk of future claims. However, small business owners can take steps to reduce their claims history by implementing safety protocols and risk management strategies.

Coverage limits are another factor that can affect liability insurance costs. Businesses with higher coverage limits tend to pay higher premiums due to the increased risk of large claims. However, small business owners can balance their coverage limits with their budget to find affordable liability insurance.

Other factors that can affect liability insurance costs for small businesses include:

- Location: Businesses located in areas with high crime rates or natural disaster risks tend to pay higher premiums.

- Employee count: Businesses with more employees tend to pay higher premiums due to the increased risk of accidents and lawsuits.

- Revenue: Businesses with higher revenues tend to pay higher premiums due to the increased risk of large claims.

- Policy deductibles: Businesses with lower policy deductibles tend to pay higher premiums due to the increased risk of claims.

By understanding these factors, small business owners can take steps to manage their liability insurance costs and find affordable coverage. This can include implementing safety protocols, reducing coverage limits, and shopping around for quotes.

Liability Insurance Options for Small Businesses: A Comparison

Small businesses have several liability insurance options to choose from, each with its own unique benefits and drawbacks. Understanding the different types of liability insurance policies can help small business owners make informed decisions about their coverage needs.

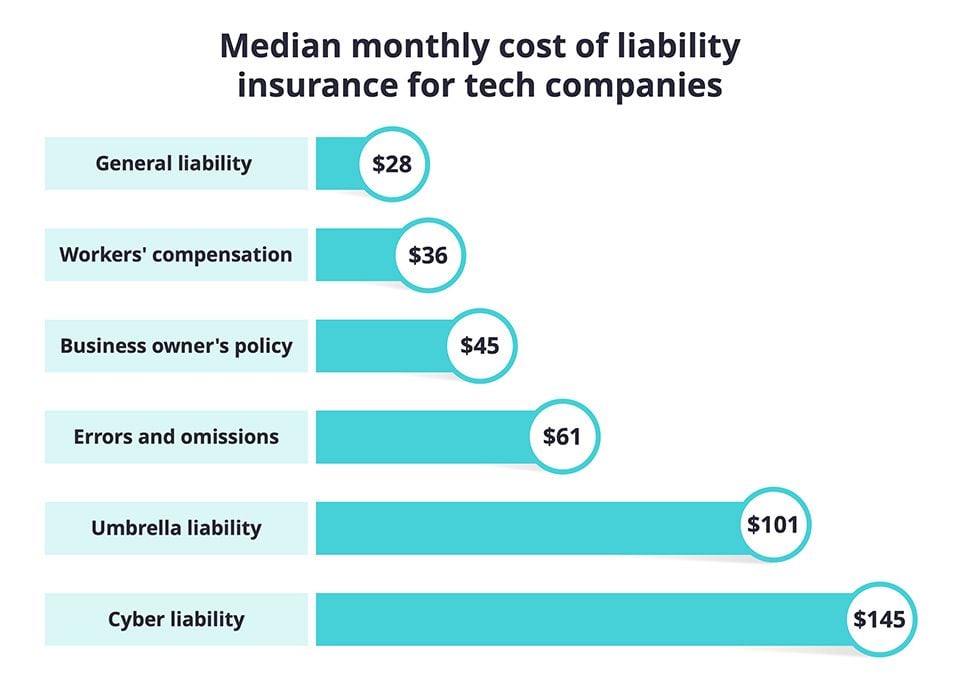

General liability insurance is one of the most common types of liability insurance policies for small businesses. This type of policy provides coverage for accidents, injuries, and property damage that occur on the business premises or as a result of business operations. General liability insurance is often required by law for businesses in certain industries, such as construction or manufacturing.

Professional liability insurance, also known as errors and omissions insurance, is another type of liability insurance policy that is designed for businesses that provide professional services, such as lawyers, doctors, or accountants. This type of policy provides coverage for mistakes or negligence that result in financial losses for clients or customers.

Product liability insurance is a type of liability insurance policy that is designed for businesses that manufacture or sell products. This type of policy provides coverage for injuries or damages that result from defective or faulty products.

Other types of liability insurance policies that may be relevant for small businesses include:

- Employment practices liability insurance (EPLI): This type of policy provides coverage for employment-related claims, such as wrongful termination or discrimination.

- Directors and officers liability insurance (D&O): This type of policy provides coverage for claims made against directors and officers of a company.

- Cyber liability insurance: This type of policy provides coverage for data breaches and other cyber-related risks.

When choosing a liability insurance policy, small business owners should consider the following factors:

- Coverage limits: Make sure the policy provides sufficient coverage limits to protect the business in the event of a claim.

- Deductible: Choose a policy with a deductible that is affordable for the business.

- Policy exclusions: Understand what is excluded from the policy and make sure it does not leave the business vulnerable to certain types of claims.

- Claims process: Choose a policy with a straightforward claims process that is easy to navigate.

By understanding the different types of liability insurance policies and considering the factors mentioned above, small business owners can make informed decisions about their coverage needs and protect their businesses from potential risks.

Real-Life Examples: How Liability Insurance Saved Small Businesses from Financial Ruin

Liability insurance can be a lifesaver for small businesses in the event of a lawsuit or accident. Here are some real-life examples of how liability insurance saved small businesses from financial ruin:

Example 1: A small retail store was sued by a customer who slipped and fell on the premises. The customer claimed that the store was negligent in maintaining the floor and sought damages of $100,000. The store’s liability insurance policy covered the cost of the lawsuit and the settlement, which was $50,000.

Example 2: A small manufacturing company was sued by a supplier who claimed that the company had breached their contract. The supplier sought damages of $200,000. The company’s liability insurance policy covered the cost of the lawsuit and the settlement, which was $100,000.

Example 3: A small restaurant was sued by a customer who claimed that they had been served food that was contaminated with bacteria. The customer sought damages of $50,000. The restaurant’s liability insurance policy covered the cost of the lawsuit and the settlement, which was $25,000.

These examples illustrate the importance of having liability insurance for small businesses. Without liability insurance, these businesses may have been forced to pay out of pocket for the damages, which could have led to financial ruin.

In addition to these examples, there are many other scenarios where liability insurance can protect small businesses from financial ruin. For example, if a small business is sued by an employee for wrongful termination, liability insurance can cover the cost of the lawsuit and the settlement. If a small business is sued by a customer for a defective product, liability insurance can cover the cost of the lawsuit and the settlement.

It’s essential for small businesses to understand the importance of liability insurance and to take steps to protect themselves from potential risks. This can include purchasing liability insurance, implementing safety protocols, and providing training to employees on how to handle customer complaints.

By taking these steps, small businesses can reduce their risk of being sued and protect themselves from financial ruin. Liability insurance can provide peace of mind for small business owners, knowing that they are protected in the event of a lawsuit or accident.

Common Mistakes Small Businesses Make When Buying Liability Insurance

When purchasing liability insurance, small businesses often make mistakes that can lead to inadequate coverage or unnecessary expenses. Here are some common mistakes to avoid:

Underestimating coverage needs: Small businesses often underestimate the amount of coverage they need, which can lead to inadequate protection in the event of a lawsuit or accident. It’s essential to assess your business’s specific risks and choose a policy that provides sufficient coverage.

Failing to read policy terms: Small businesses often fail to read the terms and conditions of their liability insurance policy, which can lead to misunderstandings about what is covered and what is not. It’s essential to carefully review your policy and ask questions if you’re unsure about any aspect of the coverage.

Not shopping around for quotes: Small businesses often fail to shop around for quotes, which can lead to higher premiums than necessary. It’s essential to compare quotes from multiple insurance providers to find the best rates and coverage for your business.

Not considering additional coverage options: Small businesses often fail to consider additional coverage options, such as umbrella insurance or cyber insurance, which can provide extra protection in the event of a lawsuit or accident. It’s essential to assess your business’s specific risks and choose additional coverage options that provide adequate protection.

Not reviewing policy limits: Small businesses often fail to review their policy limits, which can lead to inadequate coverage in the event of a lawsuit or accident. It’s essential to regularly review your policy limits and adjust them as necessary to ensure adequate coverage.

Not considering the deductible: Small businesses often fail to consider the deductible when purchasing liability insurance, which can lead to unexpected expenses in the event of a claim. It’s essential to carefully review the deductible and choose a policy that provides a deductible that is affordable for your business.

By avoiding these common mistakes, small businesses can ensure that they have adequate liability insurance coverage and avoid unnecessary expenses.

Conclusion: Protecting Your Small Business with Affordable Liability Insurance

As a small business owner, it’s essential to prioritize protecting your business from potential risks and financial losses. Liability insurance is a crucial investment that can provide peace of mind and financial security in the event of an accident, lawsuit, or other unforeseen circumstances. By understanding the importance of liability insurance, choosing the right policy, and managing costs, small businesses can ensure they have adequate coverage without breaking the bank.

When shopping for small business liability insurance, it’s crucial to consider factors such as business type, size, and industry to determine the right level of coverage. Working with a licensed insurance agent or broker can also help small businesses navigate the complex world of liability insurance and find the most affordable options.

While the cost of liability insurance can vary depending on several factors, including business size, industry, and location, there are ways to manage premiums and find affordable coverage. By maintaining a good claims history, choosing the right coverage limits, and shopping around for quotes, small businesses can reduce their liability insurance costs and ensure they have the protection they need.

In conclusion, small business liability insurance is a vital investment that can protect businesses from financial ruin in the event of an accident or lawsuit. By understanding the importance of liability insurance, choosing the right policy, and managing costs, small businesses can ensure they have the protection they need to succeed. Don’t wait until it’s too late – take action today and protect your small business with affordable liability insurance.