Understanding the Benefits of Standard Deductions

The standard deduction for single filers is a fixed amount that can be subtracted from taxable income, reducing the amount of taxes owed. This deduction is available to single individuals who do not itemize their deductions, and it can provide significant tax savings. One of the primary benefits of claiming the standard deduction is its simplicity. Unlike itemizing deductions, which requires keeping track of receipts and expenses throughout the year, the standard deduction is a straightforward and hassle-free option.

In addition to its simplicity, the standard deduction can also provide a higher deduction amount than itemizing for many single filers. For the 2022 tax year, the standard deduction for single filers is $12,950, which is a significant increase from previous years. This means that single filers who claim the standard deduction can reduce their taxable income by nearly $13,000, resulting in lower taxes owed.

Another benefit of the standard deduction is that it is adjusted annually for inflation. This means that the deduction amount will increase over time to keep pace with rising costs of living. For example, the standard deduction for single filers in 2020 was $12,400, which increased to $12,950 in 2022. This inflation adjustment helps to ensure that the standard deduction remains a valuable tax savings opportunity for single filers.

Furthermore, claiming the standard deduction can also help to reduce the complexity of the tax filing process. When itemizing deductions, taxpayers must complete additional forms and schedules, which can be time-consuming and prone to errors. In contrast, claiming the standard deduction requires only a simple entry on the tax return, making it a more streamlined and efficient option.

Overall, the standard deduction for single filers is a valuable tax savings opportunity that can provide significant benefits. Its simplicity, higher deduction amount, and inflation adjustment make it an attractive option for many single individuals. By understanding the benefits of the standard deduction, single filers can make informed decisions about their tax strategy and maximize their tax savings.

How to Claim the Single Filer Standard Deduction

To claim the standard deduction for single filers, taxpayers must meet certain eligibility requirements and follow specific steps when preparing their tax return. The first step is to determine if you are eligible to claim the standard deduction. Generally, single filers who do not itemize their deductions and have a taxable income below a certain threshold are eligible.

Once you have determined your eligibility, you can claim the standard deduction on your tax return. The standard deduction is claimed on Line 12 of Form 1040, which is the standard form used for personal income tax returns. You will need to enter the standard deduction amount for single filers, which is $12,950 for the 2022 tax year.

In addition to claiming the standard deduction on your tax return, you may also need to complete other forms and schedules. For example, if you have income from self-employment or investments, you may need to complete Schedule C or Schedule D. However, if you only have income from a job and do not have any other sources of income, you may only need to complete Form 1040.

It is also important to note that the standard deduction is subject to certain phase-outs and limitations. For example, if you have a high income or claim certain deductions, such as the qualified business income deduction, you may be subject to a reduced standard deduction. Therefore, it is essential to review the instructions for Form 1040 and consult with a tax professional if you are unsure about your eligibility or the amount of your standard deduction.

Furthermore, the IRS offers free tax filing options for eligible taxpayers, including the Free File program. This program allows taxpayers to prepare and file their tax return online for free, which can help to reduce errors and ensure that you claim the correct standard deduction.

By following these steps and meeting the eligibility requirements, single filers can claim the standard deduction and reduce their taxable income. It is essential to review the instructions for Form 1040 and consult with a tax professional if you are unsure about your eligibility or the amount of your standard deduction.

What is the Standard Deduction Amount for Single Filers?

The standard deduction amount for single filers is a fixed amount that can be subtracted from taxable income, reducing the amount of taxes owed. For the 2022 tax year, the standard deduction amount for single filers is $12,950. This amount is adjusted annually for inflation, which means that it will increase over time to keep pace with rising costs of living.

Historically, the standard deduction amount for single filers has increased steadily over the years. For example, in 2017, the standard deduction amount was $6,350, which increased to $12,000 in 2018, and then to $12,400 in 2020. The significant increase in 2018 was due to the Tax Cuts and Jobs Act (TCJA), which nearly doubled the standard deduction amount for single filers.

The standard deduction amount is influenced by various factors, including inflation and tax law changes. The IRS uses the Consumer Price Index (CPI) to adjust the standard deduction amount for inflation. This means that as the CPI increases, the standard deduction amount will also increase. Additionally, tax law changes, such as the TCJA, can also impact the standard deduction amount.

It’s essential to note that the standard deduction amount is not the same for all filing statuses. For example, the standard deduction amount for married couples filing jointly is $25,900 for the 2022 tax year, while the standard deduction amount for head of household is $19,400. Understanding the standard deduction amount for your specific filing status is crucial to ensure you are taking advantage of the correct deduction amount.

Furthermore, the standard deduction amount can also impact other tax-related calculations, such as the alternative minimum tax (AMT) and the qualified business income deduction. Therefore, it’s essential to consider the standard deduction amount when planning your tax strategy to ensure you are minimizing your tax liability.

Who is Eligible for the Single Filer Standard Deduction?

To be eligible for the standard deduction for single filers, taxpayers must meet certain requirements. First, they must be single, meaning they are not married or are considered unmarried for tax purposes. This includes individuals who are divorced, separated, or widowed.

In addition to being single, taxpayers must also have a taxable income below a certain threshold. For the 2022 tax year, the standard deduction for single filers is available to taxpayers with a taxable income of $12,950 or less. However, this amount may be adjusted for inflation in future tax years.

Other factors that may impact eligibility for the standard deduction for single filers include filing status and income type. For example, taxpayers who are claimed as a dependent on someone else’s tax return may not be eligible for the standard deduction. Additionally, taxpayers who have certain types of income, such as self-employment income or investment income, may need to complete additional forms and schedules to claim the standard deduction.

Examples of individuals who may be eligible for the standard deduction for single filers include:

- Single individuals with a taxable income below $12,950

- Divorced or separated individuals who are not claimed as a dependent on someone else’s tax return

- Widowed individuals who do not have any dependents

On the other hand, examples of individuals who may not be eligible for the standard deduction for single filers include:

- Married couples filing jointly or separately

- Individuals who are claimed as a dependent on someone else’s tax return

- Individuals with a taxable income above $12,950

It’s essential to review the eligibility requirements carefully to ensure you are eligible for the standard deduction for single filers. If you are unsure about your eligibility, consult with a tax professional or contact the IRS for guidance.

How Does the Standard Deduction Compare to Itemizing?

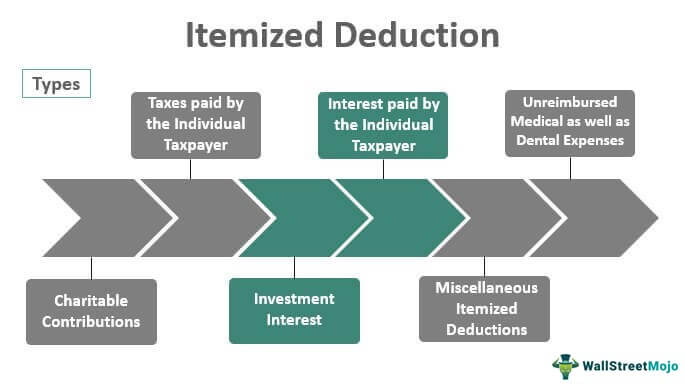

The standard deduction for single filers is a fixed amount that can be subtracted from taxable income, reducing the amount of taxes owed. However, some taxpayers may be able to deduct more by itemizing their deductions. Itemizing involves listing out individual expenses, such as mortgage interest, charitable donations, and medical expenses, and deducting the total amount from taxable income.

One of the main advantages of itemizing is that it allows taxpayers to deduct more than the standard deduction amount. For example, if a single filer has a large mortgage and pays a significant amount of interest each year, they may be able to deduct more by itemizing their mortgage interest. Similarly, if a taxpayer has high medical expenses, they may be able to deduct more by itemizing their medical expenses.

However, itemizing also has some disadvantages. For one, it requires taxpayers to keep track of their expenses throughout the year and to have receipts and records to support their deductions. This can be time-consuming and may require the help of a tax professional. Additionally, itemizing may not always result in a larger deduction than the standard deduction. If a taxpayer’s expenses are relatively low, they may not be able to deduct more by itemizing.

Scenarios where itemizing may be more beneficial include:

- High mortgage interest payments

- Large charitable donations

- High medical expenses

- Significant business expenses

On the other hand, scenarios where the standard deduction may be more beneficial include:

- Low mortgage interest payments

- Minimal charitable donations

- Low medical expenses

- No business expenses

Ultimately, whether to claim the standard deduction or to itemize depends on a taxpayer’s individual circumstances. Taxpayers should carefully review their expenses and consider seeking the help of a tax professional to determine which approach is best for them.

Common Mistakes to Avoid When Claiming the Standard Deduction

When claiming the standard deduction for single filers, it’s essential to avoid common mistakes that can lead to errors or even an audit. One of the most common mistakes is failing to meet the eligibility requirements. For example, single filers who are claimed as a dependent on someone else’s tax return are not eligible for the standard deduction.

Another mistake is failing to report all income. Single filers must report all income, including wages, tips, and self-employment income, to ensure they are eligible for the standard deduction. Additionally, failing to keep accurate records of expenses can lead to errors when claiming the standard deduction.

Other common mistakes include:

- Miscalculating the standard deduction amount

- Failing to claim the standard deduction on the correct form

- Not meeting the filing status requirements

- Not reporting all sources of income

To avoid these mistakes, single filers should carefully review the eligibility requirements and ensure they meet all the necessary conditions. They should also keep accurate records of their expenses and income, and consult with a tax professional if they are unsure about any aspect of the standard deduction.

Tips for avoiding mistakes when claiming the standard deduction include:

- Reviewing the IRS website for the latest information on the standard deduction

- Consulting with a tax professional if unsure about eligibility or calculation

- Keeping accurate records of income and expenses

- Double-checking calculations and forms before submitting

By avoiding common mistakes and taking the necessary precautions, single filers can ensure they are taking advantage of the standard deduction and minimizing their tax liability.

How to Adjust Your Withholding to Maximize Your Standard Deduction

Single filers can adjust their withholding to minimize taxes owed and maximize their standard deduction. To do this, they should review their withholding throughout the year and make adjustments as needed. One way to adjust withholding is to complete a new W-4 form and submit it to their employer.

When completing the W-4 form, single filers should consider their expected income and expenses for the year. They should also consider any changes to their tax situation, such as a change in filing status or the addition of dependents. By adjusting their withholding, single filers can ensure they are not overpaying or underpaying their taxes throughout the year.

Another way to adjust withholding is to make estimated tax payments throughout the year. Single filers who are self-employed or have other sources of income that are not subject to withholding may need to make estimated tax payments to avoid penalties. By making estimated tax payments, single filers can ensure they are meeting their tax obligations and maximizing their standard deduction.

It’s also important for single filers to review their withholding at the end of the year to ensure they are not overpaying or underpaying their taxes. They can do this by reviewing their W-2 forms and 1099 forms to ensure they are reporting all income and making the correct withholding adjustments.

Tips for adjusting withholding to maximize the standard deduction include:

- Reviewing withholding throughout the year and making adjustments as needed

- Completing a new W-4 form and submitting it to their employer

- Making estimated tax payments throughout the year

- Reviewing W-2 forms and 1099 forms at the end of the year to ensure accurate reporting

By following these tips, single filers can adjust their withholding to minimize taxes owed and maximize their standard deduction.

Planning Ahead: How the Standard Deduction May Change in the Future

The standard deduction for single filers is subject to change over time due to various factors, including inflation, tax law changes, and regulatory updates. To stay ahead of these changes, single filers should plan ahead and stay informed about potential changes to the standard deduction.

One way to stay informed is to regularly check the IRS website for updates on the standard deduction. The IRS typically announces changes to the standard deduction in the fall of each year, and these changes take effect on January 1 of the following year. Single filers can also sign up for IRS email updates to receive notifications about changes to the standard deduction.

In addition to staying informed, single filers can also plan ahead by reviewing their tax situation and adjusting their withholding accordingly. For example, if a single filer expects their income to increase in the future, they may want to adjust their withholding to avoid underpaying their taxes. Similarly, if a single filer expects their income to decrease, they may want to adjust their withholding to avoid overpaying their taxes.

Some potential changes to the standard deduction that single filers should be aware of include:

- Increases to the standard deduction amount due to inflation

- Changes to the eligibility requirements for claiming the standard deduction

- Repeal or modification of the Tax Cuts and Jobs Act (TCJA)

- Implementation of new tax laws or regulations

By staying informed and planning ahead, single filers can ensure they are taking advantage of the standard deduction and minimizing their tax liability.

Tips for planning ahead include:

- Regularly checking the IRS website for updates on the standard deduction

- Signing up for IRS email updates to receive notifications about changes to the standard deduction

- Reviewing tax situation and adjusting withholding accordingly

- Staying informed about potential changes to the standard deduction

By following these tips, single filers can stay ahead of changes to the standard deduction and ensure they are maximizing their tax savings.