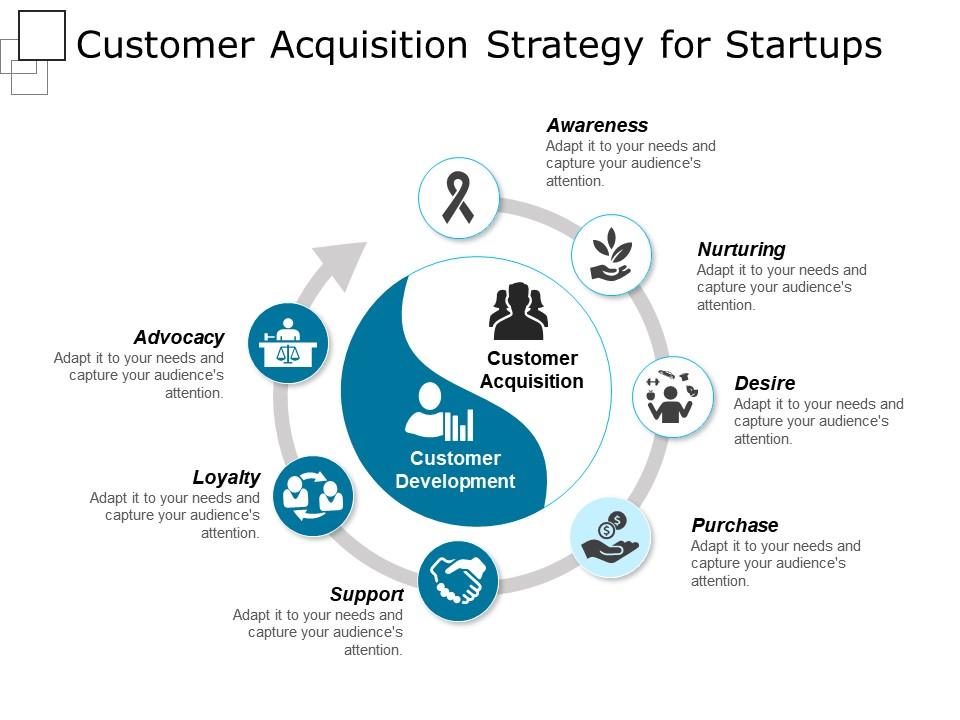

Why Acquisition Strategies Matter for Startup Success

Acquisition strategies play a vital role in the success of startups, enabling them to expand their customer base, increase revenue, and gain a competitive advantage in the market. A well-thought-out acquisition strategy can help startups to identify and capitalize on new opportunities, drive growth, and stay ahead of the competition. By acquiring other companies or technologies, startups can fill gaps in their product or service offerings, enhance their capabilities, and improve their overall market position.

In today’s fast-paced and rapidly evolving business landscape, startups need to be agile and adaptable to stay competitive. Acquisition strategies provide a means for startups to quickly respond to changing market conditions, capitalize on emerging trends, and stay ahead of the curve. By acquiring other companies or technologies, startups can gain access to new markets, customers, and revenue streams, which can help to drive growth and increase their valuation.

Moreover, acquisition strategies can help startups to overcome common challenges, such as limited resources, lack of expertise, and intense competition. By acquiring other companies or technologies, startups can gain access to new skills, expertise, and resources, which can help to drive innovation and improve their overall competitiveness. Additionally, acquisition strategies can provide a means for startups to mitigate risks, such as market volatility and regulatory changes, by diversifying their product or service offerings and reducing their dependence on a single market or revenue stream.

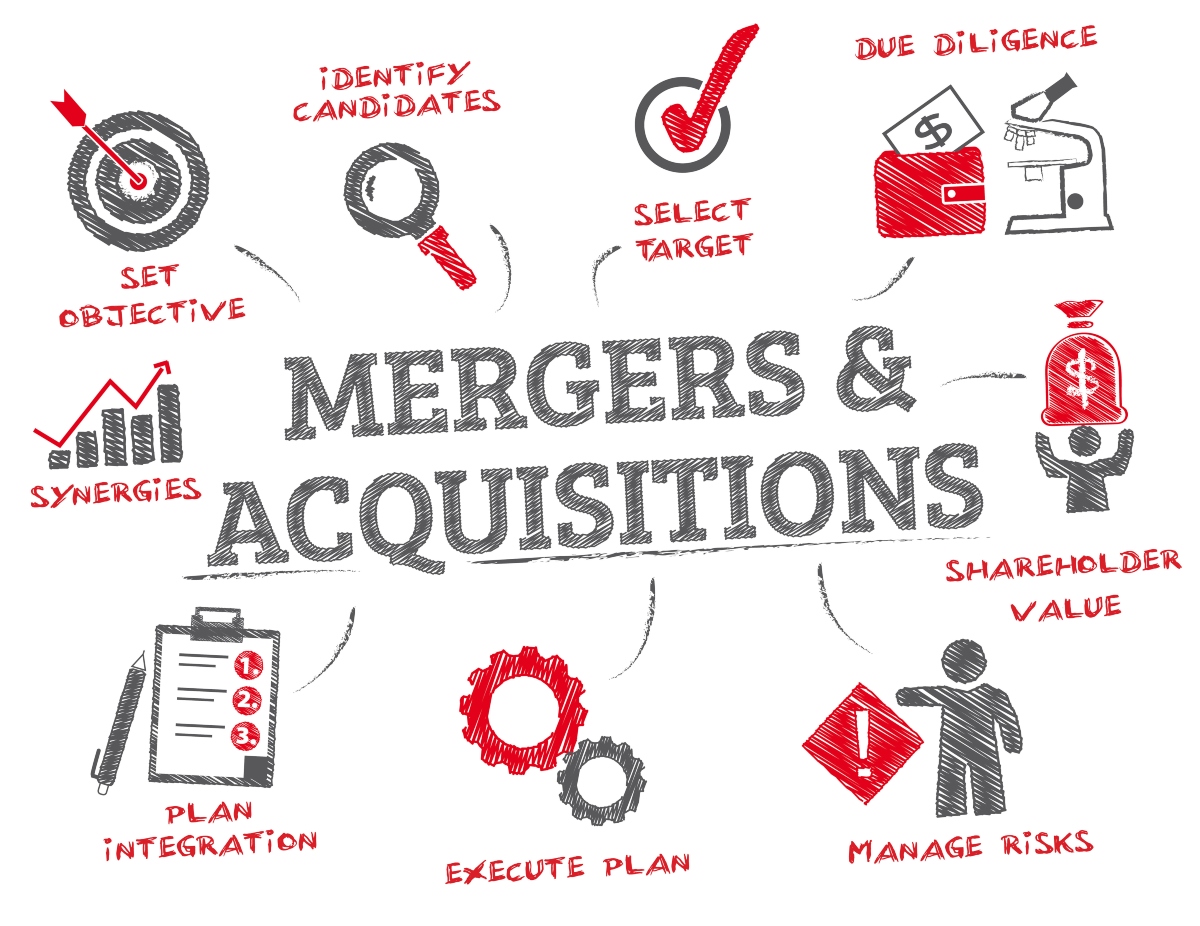

However, developing an effective acquisition strategy requires careful planning, research, and execution. Startups need to identify their goals and objectives, assess their resources and capabilities, and evaluate potential acquisition targets. They also need to consider factors, such as cultural fit, integration challenges, and potential synergies, to ensure that the acquisition is successful and delivers the desired outcomes.

By incorporating acquisition strategies into their overall business plan, startups can drive growth, increase their competitiveness, and achieve long-term success. Whether it’s acquiring a complementary business, technology, or talent, a well-executed acquisition strategy can provide a startup with the resources, expertise, and capabilities needed to stay ahead of the competition and achieve its goals.

How to Identify Potential Acquisition Targets

Identifying potential acquisition targets is a critical step in the startup acquisition process. To find the right targets, startups need to evaluate market trends, assess competition, and analyze financial performance. This involves conducting thorough market research, analyzing industry reports, and reviewing financial statements to identify potential targets that align with the startup’s acquisition strategy.

One effective way to identify potential acquisition targets is to use a combination of quantitative and qualitative criteria. Quantitative criteria may include financial metrics such as revenue growth, profitability, and cash flow, while qualitative criteria may include factors such as market position, competitive advantage, and cultural fit. By using a combination of these criteria, startups can identify potential targets that meet their acquisition goals and objectives.

Another approach is to use data analytics and machine learning algorithms to identify potential acquisition targets. This involves analyzing large datasets to identify patterns and trends that may indicate a potential target’s suitability for acquisition. For example, a startup may use data analytics to identify companies with similar product offerings, customer bases, or geographic locations.

In addition to these approaches, startups can also use their professional networks and industry connections to identify potential acquisition targets. This may involve attending industry conferences, networking with other entrepreneurs and investors, and engaging with potential targets through social media and other online channels.

When evaluating potential acquisition targets, startups should also consider factors such as the target’s management team, product offerings, and competitive position. This involves conducting thorough due diligence to assess the target’s strengths and weaknesses, as well as its potential for growth and profitability.

By using a combination of these approaches, startups can identify potential acquisition targets that align with their acquisition strategy and goals. This is a critical step in the startup acquisition process, as it enables startups to make informed decisions about which targets to pursue and how to structure the acquisition.

Effective identification of potential acquisition targets is a key component of successful startup acquisition strategies. By using a combination of quantitative and qualitative criteria, data analytics, and professional networks, startups can identify targets that meet their acquisition goals and objectives, and drive long-term growth and profitability.

The Role of Due Diligence in Startup Acquisitions

Due diligence is a critical component of startup acquisitions, playing a vital role in ensuring that the acquisition is successful and delivers the desired outcomes. Due diligence involves a thorough examination of the target company’s financial statements, intellectual property, management team, and other key aspects to identify potential risks and opportunities.

Financial due diligence is a key aspect of the acquisition process, involving a review of the target company’s financial statements, including its income statement, balance sheet, and cash flow statement. This helps to identify potential financial risks, such as debt, liabilities, and cash flow issues, and to assess the target company’s financial performance and potential for growth.

Intellectual property due diligence is also crucial, involving a review of the target company’s patents, trademarks, copyrights, and other intellectual property assets. This helps to identify potential risks and opportunities related to the target company’s intellectual property, such as infringement claims, licensing agreements, and potential for future innovation.

Management team due diligence is another important aspect of the acquisition process, involving a review of the target company’s management team, including their experience, skills, and track record. This helps to assess the target company’s leadership and management capabilities, and to identify potential risks and opportunities related to the management team.

Due diligence also involves a review of the target company’s operations, including its business model, products, and services. This helps to identify potential risks and opportunities related to the target company’s operations, such as supply chain issues, regulatory risks, and potential for future growth.

By conducting thorough due diligence, startups can gain a comprehensive understanding of the target company’s strengths and weaknesses, and make informed decisions about the acquisition. Due diligence can also help to identify potential risks and opportunities, and to develop strategies to mitigate or capitalize on them.

In the context of startup acquisition strategies, due diligence is a critical component of the acquisition process, helping to ensure that the acquisition is successful and delivers the desired outcomes. By conducting thorough due diligence, startups can gain a competitive advantage, drive growth and innovation, and achieve long-term success.

Effective due diligence requires a combination of technical expertise, business acumen, and industry knowledge. Startups should work with experienced professionals, including lawyers, accountants, and industry experts, to conduct thorough due diligence and ensure that the acquisition is successful.

Strategies for Negotiating Acquisition Deals

Negotiating acquisition deals can be a complex and challenging process, requiring careful planning, preparation, and execution. To successfully negotiate an acquisition deal, startups need to set clear goals, understand valuation methods, and manage relationships with sellers.

Setting clear goals is essential in negotiating acquisition deals. Startups need to define their objectives, including the target company’s valuation, deal structure, and integration plan. This helps to ensure that the acquisition aligns with the startup’s overall strategy and goals.

Understanding valuation methods is also critical in negotiating acquisition deals. Startups need to understand the different valuation methods, including the discounted cash flow (DCF) method, the comparable company analysis (CCA) method, and the precedent transaction analysis (PTA) method. This helps to ensure that the startup pays a fair price for the target company.

Managing relationships with sellers is also important in negotiating acquisition deals. Startups need to build trust and rapport with the seller, including the target company’s management team and shareholders. This helps to ensure that the acquisition process is smooth and successful.

Effective communication is also key in negotiating acquisition deals. Startups need to communicate clearly and transparently with the seller, including providing regular updates on the acquisition process. This helps to build trust and ensure that the acquisition is successful.

In addition to these strategies, startups can also use various tactics to negotiate acquisition deals, including using data and analytics to inform the negotiation process, leveraging the startup’s network and relationships to gain an advantage, and using creative deal structures to achieve the desired outcome.

By using these strategies and tactics, startups can successfully negotiate acquisition deals and achieve their goals. Negotiating acquisition deals requires a combination of technical expertise, business acumen, and industry knowledge. Startups should work with experienced professionals, including lawyers, accountants, and investment bankers, to ensure that the acquisition is successful.

In the context of startup acquisition strategies, negotiating acquisition deals is a critical component of the acquisition process. By setting clear goals, understanding valuation methods, and managing relationships with sellers, startups can successfully negotiate acquisition deals and achieve their goals.

Startup acquisition strategies require a deep understanding of the acquisition process, including negotiating acquisition deals. By using the strategies and tactics outlined above, startups can successfully negotiate acquisition deals and achieve their goals.

Integrating Acquired Startups into Your Business

Integrating acquired startups into your business is a critical step in the acquisition process. It requires careful planning, execution, and management to ensure that the acquired startup is successfully integrated into your business and that the acquisition delivers the desired outcomes.

Retaining key employees is a crucial aspect of post-acquisition integration. Key employees are often the driving force behind the acquired startup’s success, and their retention is essential to ensure that the acquisition delivers the desired outcomes. To retain key employees, startups should offer competitive compensation packages, provide opportunities for growth and development, and foster a positive and inclusive company culture.

Managing cultural differences is also important in post-acquisition integration. Acquired startups often have different cultures, values, and ways of working, and these differences can create challenges in the integration process. To manage cultural differences, startups should establish clear communication channels, provide training and development programs, and foster a culture of innovation and collaboration.

Leveraging acquired technology is another key aspect of post-acquisition integration. Acquired startups often have unique technologies, products, or services that can be leveraged to drive growth and innovation in the acquiring company. To leverage acquired technology, startups should establish clear technology integration plans, provide training and development programs, and foster a culture of innovation and experimentation.

Effective communication is also essential in post-acquisition integration. Startups should communicate clearly and transparently with the acquired startup’s employees, customers, and stakeholders to ensure that everyone is informed and aligned with the integration plan.

In addition to these strategies, startups can also use various tools and techniques to facilitate post-acquisition integration, including project management software, integration teams, and change management programs.

By using these strategies and tools, startups can successfully integrate acquired startups into their business and achieve the desired outcomes. Post-acquisition integration is a critical step in the acquisition process, and it requires careful planning, execution, and management to ensure that the acquisition is successful.

In the context of startup acquisition strategies, post-acquisition integration is a key component of the acquisition process. By retaining key employees, managing cultural differences, leveraging acquired technology, and communicating effectively, startups can successfully integrate acquired startups into their business and achieve the desired outcomes.

Startup acquisition strategies require a deep understanding of the acquisition process, including post-acquisition integration. By using the strategies and tools outlined above, startups can successfully integrate acquired startups into their business and achieve their goals.

Common Mistakes to Avoid in Startup Acquisitions

Startup acquisitions can be a complex and challenging process, and there are several common mistakes that can be made along the way. By understanding these mistakes and taking steps to avoid them, startups can increase their chances of success and achieve their acquisition goals.

One common mistake to avoid is overpaying for targets. This can happen when startups get caught up in the excitement of the acquisition process and lose sight of the target’s true value. To avoid overpaying, startups should conduct thorough due diligence and negotiate a fair price based on the target’s financial performance, market position, and other relevant factors.

Another mistake to avoid is underestimating integration challenges. Integrating a new company into an existing business can be a complex and time-consuming process, and startups should plan carefully to ensure a smooth transition. This includes developing a clear integration plan, communicating effectively with employees and stakeholders, and providing training and support to ensure a successful integration.

Neglecting due diligence is another common mistake to avoid. Due diligence is a critical step in the acquisition process, and startups should conduct thorough research and analysis to ensure that the target is a good fit for their business. This includes reviewing financial statements, assessing intellectual property, and evaluating management teams.

Not having a clear acquisition strategy is also a common mistake to avoid. Startups should develop a clear acquisition strategy that aligns with their business goals and objectives. This includes identifying key targets, developing a negotiation plan, and establishing a clear integration plan.

Not considering cultural differences is another mistake to avoid. Acquired companies often have different cultures, values, and ways of working, and startups should plan carefully to ensure a smooth integration. This includes communicating effectively with employees and stakeholders, providing training and support, and fostering a culture of innovation and collaboration.

By avoiding these common mistakes, startups can increase their chances of success and achieve their acquisition goals. Startup acquisition strategies require careful planning, execution, and management to ensure that the acquisition is successful and delivers the desired outcomes.

In the context of startup acquisition strategies, avoiding common mistakes is critical to achieving success. By understanding the common mistakes to avoid and taking steps to prevent them, startups can ensure a successful acquisition and achieve their business goals.

Startup acquisition strategies require a deep understanding of the acquisition process, including the common mistakes to avoid. By using the strategies and best practices outlined above, startups can avoid common mistakes and achieve their acquisition goals.

Real-World Examples of Successful Startup Acquisitions

There are many examples of successful startup acquisitions that demonstrate the potential benefits of a well-executed acquisition strategy. One notable example is Facebook’s acquisition of Instagram in 2012. Instagram was a rapidly growing photo-sharing app with a strong user base, and Facebook saw an opportunity to expand its reach and capabilities in the mobile market.

Facebook’s acquisition of Instagram was a strategic move to expand its user base and improve its mobile offerings. The acquisition was successful, and Instagram continued to grow and evolve as a standalone app within Facebook. Today, Instagram is one of the most popular social media platforms in the world, with over 1 billion active users.

Another example of a successful startup acquisition is Google’s acquisition of Android in 2005. Android was a small startup that developed an open-source operating system for mobile devices. Google saw the potential for Android to become a major player in the mobile market and acquired the company to expand its reach and capabilities.

Google’s acquisition of Android was a strategic move to expand its presence in the mobile market and improve its offerings in the space. The acquisition was successful, and Android went on to become one of the most popular mobile operating systems in the world. Today, Android is used by millions of devices worldwide, and Google continues to evolve and improve the platform.

Amazon’s acquisition of Zappos in 2009 is another example of a successful startup acquisition. Zappos was an online shoe retailer that was known for its strong customer service and unique company culture. Amazon saw an opportunity to expand its e-commerce offerings and improve its customer service capabilities, and acquired Zappos to achieve these goals.

Amazon’s acquisition of Zappos was a strategic move to expand its e-commerce offerings and improve its customer service capabilities. The acquisition was successful, and Zappos continued to operate as a standalone company within Amazon. Today, Zappos is one of the largest online shoe retailers in the world, and Amazon continues to evolve and improve its e-commerce offerings.

These examples demonstrate the potential benefits of a well-executed acquisition strategy, including expanded reach, improved capabilities, and increased competitiveness. By studying these examples and learning from the experiences of other companies, startups can develop effective acquisition strategies that drive growth and success.

In the context of startup acquisition strategies, real-world examples can provide valuable insights and lessons. By studying the experiences of other companies, startups can develop effective acquisition strategies that drive growth and success.

Startup acquisition strategies require a deep understanding of the acquisition process, including the potential benefits and challenges of acquiring another company. By studying real-world examples and learning from the experiences of other companies, startups can develop effective acquisition strategies that drive growth and success.

Best Practices for Building a Strong Acquisition Team

Building a strong acquisition team is crucial for successful startup acquisitions. A well-structured team can help identify potential targets, navigate complex negotiations, and ensure seamless integration. To build a strong acquisition team, it’s essential to identify key roles and responsibilities, develop a clear acquisition strategy, and foster a culture of innovation.

Key Roles and Responsibilities:

A strong acquisition team typically consists of a combination of the following roles:

- Acquisition Lead: Responsible for overseeing the entire acquisition process, from target identification to integration.

- Financial Analyst: Provides financial analysis and due diligence support to ensure the target company’s financial health and growth potential.

- Market Researcher: Conducts market research to identify trends, assess competition, and evaluate the target company’s market position.

- Legal Counsel: Ensures compliance with regulatory requirements and provides guidance on contractual negotiations.

- Integration Specialist: Oversees the post-acquisition integration process, ensuring a smooth transition and minimizing disruption to the business.

Developing a Clear Acquisition Strategy:

A clear acquisition strategy is essential for guiding the team’s efforts and ensuring alignment with the company’s overall goals. This strategy should include:

- Defining the target market and ideal acquisition candidate

- Establishing clear valuation criteria and deal parameters

- Identifying potential risks and mitigation strategies

- Developing a comprehensive integration plan

Fostering a Culture of Innovation:

A culture of innovation is critical for driving growth and success in startup acquisitions. This can be achieved by:

- Encouraging experimentation and calculated risk-taking

- Fostering open communication and collaboration across teams

- Providing opportunities for professional development and growth

- Recognizing and rewarding innovative thinking and achievements

By following these best practices, companies can build a strong acquisition team that is well-equipped to navigate the complexities of startup acquisitions and drive long-term growth and success. By incorporating these strategies into their startup acquisition strategies, companies can stay ahead of the competition and achieve their goals.