Unlocking Growth Potential with Strategic Funding

Securing the right funding is crucial for startup growth and success. However, navigating the complex funding landscape can be a daunting task for many entrepreneurs. With numerous funding options available, it’s essential to develop a well-planned funding strategy that aligns with your startup’s goals and objectives. This strategy should take into account the various startup growth funding options, including venture capital, angel investors, crowdfunding, and bootstrapping.

A well-planned funding strategy can help startups scale their operations, expand their customer base, and increase revenue. It can also provide access to valuable resources, such as mentorship, networking opportunities, and expertise. Moreover, a strategic funding approach can help startups mitigate risks, manage cash flow, and maintain control over their business.

According to a recent survey, startups that secure funding through strategic partnerships and investments are more likely to achieve significant growth and success. In fact, startups that receive funding from venture capital firms and angel investors are more likely to experience rapid growth and expansion. However, it’s essential to note that funding alone is not a guarantee of success. Startups must also focus on developing a solid business plan, building a strong team, and creating a unique value proposition.

By understanding the various startup growth funding options and developing a strategic funding approach, entrepreneurs can unlock their startup’s growth potential and achieve long-term success. In the following sections, we’ll explore the different funding options available to startups, including alternative funding routes, bootstrapping, venture capital, and government funding options.

Exploring Alternative Funding Routes for Startups

While traditional funding options like venture capital and angel investors can be effective, they may not be the best fit for every startup. In recent years, alternative funding routes have emerged as viable options for startups seeking to raise capital. These alternative funding routes include crowdfunding, incubators, and accelerators.

Crowdfunding platforms, such as Kickstarter and Indiegogo, have democratized access to funding for startups. By leveraging a large network of potential investors, startups can raise significant amounts of capital without sacrificing equity. For example, the startup Pebble Watch raised over $10 million on Kickstarter in 2012, allowing it to bring its innovative smartwatch to market.

Incubators and accelerators also provide valuable resources for startups, including mentorship, networking opportunities, and access to funding. These programs typically offer a structured environment for startups to grow and develop, with many providing seed funding or connections to investors. For instance, the startup Airbnb graduated from the Y Combinator accelerator program in 2009, which helped it secure funding and scale its business.

Another alternative funding route is revenue-based financing, which allows startups to raise capital without sacrificing equity. This type of financing is based on a startup’s revenue growth, providing a more flexible and sustainable funding option. For example, the startup Lighter Capital provides revenue-based financing to startups, allowing them to raise capital without giving up equity.

These alternative funding routes offer startups more options for raising capital and achieving growth. By understanding the different startup growth funding options available, entrepreneurs can make informed decisions about which funding route is best for their business. In the next section, we’ll explore the benefits and challenges of bootstrapping, a funding strategy that allows startups to maintain control and avoid debt.

How to Leverage Bootstrapping for Sustainable Growth

Bootstrapping is a funding strategy that allows startups to maintain control and avoid debt by relying on internal funding sources. This approach requires careful financial management, cost reduction, and revenue growth. By bootstrapping, startups can conserve cash, build a strong financial foundation, and make informed decisions about their business.

To successfully bootstrap a startup, it’s essential to manage finances effectively. This includes creating a detailed budget, tracking expenses, and making adjustments as needed. Startups should also focus on reducing costs by implementing cost-saving measures, such as outsourcing non-core functions or negotiating with suppliers.

Increasing revenue is also critical to bootstrapping success. Startups can achieve this by developing a solid business model, creating a unique value proposition, and building a strong sales and marketing strategy. By focusing on revenue growth, startups can generate the cash needed to fund their operations and achieve sustainable growth.

Bootstrapping also allows startups to maintain control and avoid debt. By relying on internal funding sources, startups can avoid the burden of debt repayment and maintain ownership of their business. This approach also enables startups to make informed decisions about their business, without the influence of external investors.

Examples of successful bootstrapped startups include Mailchimp, which grew to $700 million in revenue without taking any external funding, and Airtable, which reached $100 million in revenue through bootstrapping. These startups demonstrate the potential of bootstrapping as a viable funding strategy for sustainable growth.

By leveraging bootstrapping, startups can achieve sustainable growth, maintain control, and avoid debt. In the next section, we’ll explore the role of venture capital in startup funding, including the different stages of investment and the benefits and drawbacks of VC funding.

Understanding the Role of Venture Capital in Startup Funding

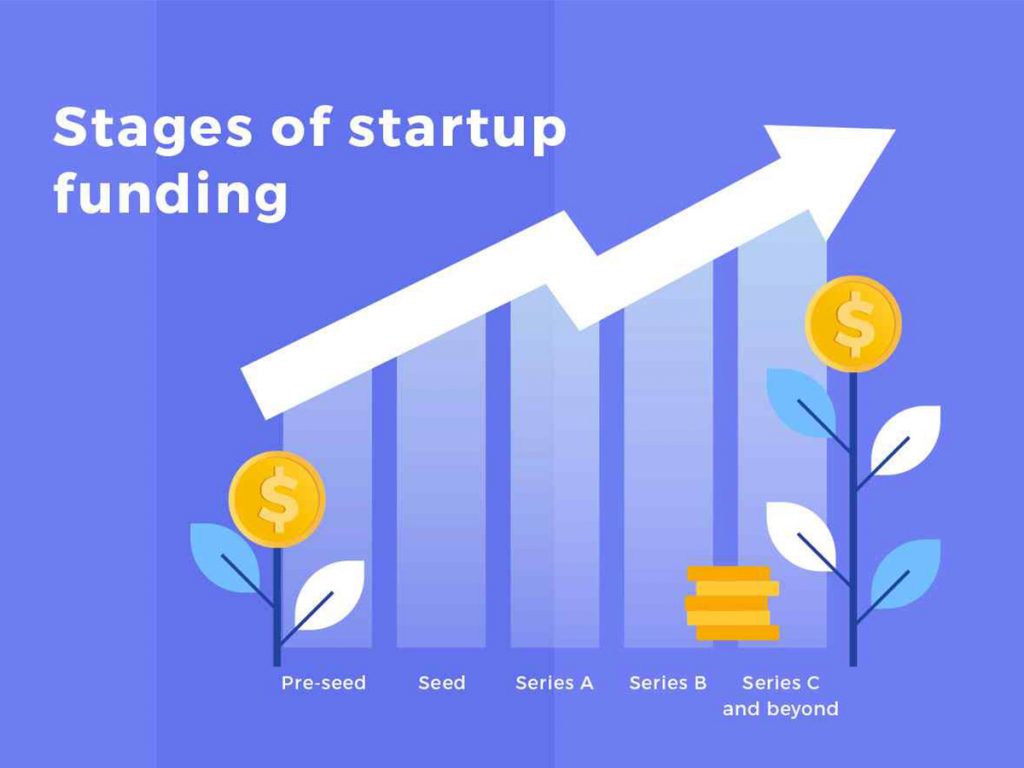

Venture capital (VC) funding is a crucial component of startup growth funding options, providing the necessary capital for scaling and expansion. The VC funding process involves multiple stages, each with its own set of requirements and expectations. Understanding these stages and the types of VC firms can help startups navigate the complex world of venture capital.

The first stage of VC funding is typically the seed round, where investors provide initial capital to support the development of a product or service. This is followed by the Series A round, where investors provide additional funding to support the launch and growth of the startup. Subsequent rounds, such as Series B and Series C, provide further funding to support expansion and scaling.

There are several types of VC firms, each with its own investment strategy and focus. Early-stage VC firms focus on investing in startups at the seed or Series A stage, while growth-stage VC firms invest in startups that have already demonstrated significant growth and traction. Sector-specific VC firms focus on investing in startups within a specific industry or sector.

The benefits of VC funding include access to significant capital, expertise, and networking opportunities. VC firms often have extensive networks and can provide valuable introductions and connections to help startups grow. However, VC funding also comes with drawbacks, including loss of control and equity dilution.

Successful startups that have secured VC funding include Uber, Airbnb, and Slack. These companies have used VC funding to scale and expand their operations, achieving significant growth and success. However, it’s worth noting that VC funding is not suitable for all startups, and alternative funding options may be more appropriate for some businesses.

To secure VC funding, startups must demonstrate a strong value proposition, a clear business plan, and significant growth potential. They must also be prepared to provide detailed financial projections, market analysis, and competitive landscape assessments. Startups must also be prepared to negotiate equity stakes and valuation, which can be a challenging and complex process.

In conclusion, VC funding is a critical component of startup growth funding options, providing the necessary capital for scaling and expansion. By understanding the VC funding process and the types of VC firms, startups can navigate the complex world of venture capital and secure the funding they need to achieve success.

Crowdfunding for Startups: A Guide to Success

Crowdfunding has become a popular startup growth funding option, allowing entrepreneurs to raise capital from a large number of people, typically through online platforms. This approach has democratized access to funding, enabling startups to raise money from a diverse range of investors, rather than relying on traditional venture capital or angel investors.

There are several types of crowdfunding platforms, each with its own unique features and benefits. Reward-based platforms, such as Kickstarter and Indiegogo, offer backers a reward or product in exchange for their contribution. Equity-based platforms, such as Seedrs and Crowdfunder, allow investors to purchase equity in the startup. Lending-based platforms, such as Funding Circle and Zopa, provide loans to startups, which are repaid with interest.

The benefits of crowdfunding include increased visibility and marketing opportunities, as well as the ability to validate product demand and gather feedback from potential customers. However, crowdfunding also comes with its own set of challenges, including the need to create a compelling campaign and rewards, as well as the potential for failure to meet funding goals.

To create a successful crowdfunding campaign, startups should focus on building a strong community and network of supporters, as well as developing a clear and compelling pitch. This should include a detailed business plan, financial projections, and a clear explanation of how the funds will be used. Startups should also be prepared to offer rewards or equity that are attractive to potential backers.

Examples of successful startups that have used crowdfunding include Pebble, which raised over $10 million on Kickstarter, and BrewDog, which raised over £1 million on Crowdfunder. These startups have demonstrated the potential of crowdfunding to raise significant capital and build a community of supporters.

When choosing a crowdfunding platform, startups should consider factors such as fees, reach, and support. Some platforms, such as Kickstarter, have a large and established community of backers, while others, such as Seedrs, offer more flexible funding options. Startups should also be aware of the potential risks and challenges associated with crowdfunding, including the potential for failure to meet funding goals.

By understanding the benefits and challenges of crowdfunding, startups can use this startup growth funding option to raise capital, build a community of supporters, and achieve their goals. Whether through reward-based, equity-based, or lending-based platforms, crowdfunding offers a unique and innovative way for startups to access the funding they need to succeed.

As the crowdfunding landscape continues to evolve, startups should stay up-to-date with the latest trends and best practices. This includes monitoring platform fees, understanding the terms and conditions of each platform, and being prepared to adapt to changes in the market. By doing so, startups can maximize their chances of success and achieve their funding goals.

Incubators and Accelerators: Nurturing Startup Growth

Incubators and accelerators play a vital role in supporting startup growth, providing a nurturing environment that fosters innovation and success. These programs offer a range of benefits, including mentorship, networking, and access to resources, which can help startups overcome the challenges of early-stage growth.

Incubators typically provide a physical space for startups to work, as well as access to shared resources such as office equipment, meeting rooms, and high-speed internet. They may also offer mentorship and guidance from experienced entrepreneurs and industry experts. Accelerators, on the other hand, provide a more intensive program of support, often including funding, mentorship, and networking opportunities.

The benefits of incubators and accelerators include access to a network of experienced entrepreneurs and industry experts, as well as the opportunity to connect with potential investors and partners. Startups that participate in these programs also gain access to resources such as office space, equipment, and software, which can help them to reduce costs and increase efficiency.

Examples of successful startups that have graduated from incubators and accelerators include Airbnb, Dropbox, and Reddit. These companies have demonstrated the potential of these programs to support startup growth and success.

When selecting an incubator or accelerator, startups should consider factors such as the program’s focus and expertise, the quality of the mentorship and networking opportunities, and the level of funding and resources provided. Startups should also be aware of the potential costs and commitments involved, including equity stakes and program fees.

Some of the most well-known incubators and accelerators include Y Combinator, 500 Startups, and Techstars. These programs have a strong track record of supporting startup growth and success, and offer a range of benefits and resources to participating startups.

In addition to the benefits of incubators and accelerators, startups should also be aware of the potential drawbacks. These programs can be highly competitive, and the application process can be rigorous and time-consuming. Startups should also be prepared to commit to the program’s requirements and expectations, including regular meetings and milestones.

By understanding the benefits and drawbacks of incubators and accelerators, startups can make informed decisions about whether these programs are right for them. With the right support and resources, startups can overcome the challenges of early-stage growth and achieve success.

Incubators and accelerators are just one of the many startup growth funding options available to entrepreneurs. By combining these

Government Funding Options for Startups: A Overview

Government funding options are a vital source of support for startups, providing access to capital, resources, and expertise that can help drive growth and innovation. These funding options can be particularly useful for startups that are struggling to secure funding from traditional sources, such as venture capital or angel investors.

One of the most common government funding options for startups is grants. Grants are non-repayable funds that are provided to support specific projects or initiatives. They can be used to cover a range of expenses, including research and development, marketing, and hiring. To be eligible for a grant, startups typically need to meet specific criteria, such as being a small business or having a specific type of technology.

Loans are another type of government funding option for startups. These loans are typically provided at a lower interest rate than traditional loans, and may have more flexible repayment terms. They can be used to cover a range of expenses, including working capital, equipment purchases, and expansion. To be eligible for a loan, startups typically need to meet specific criteria, such as having a solid business plan and a good credit history.

Tax incentives are also a type of government funding option for startups. These incentives can provide a reduction in taxes owed, or a credit against taxes owed. They can be used to support a range of activities, including research and development, hiring, and expansion. To be eligible for tax incentives, startups typically need to meet specific criteria, such as being a small business or having a specific type of technology.

Examples of government funding options for startups include the Small Business Innovation Research (SBIR) program, the Small Business Technology Transfer (STTR) program, and the Advanced Technology Program (ATP). These programs provide funding and resources to support startups in a range of industries, including technology, healthcare, and energy.

To access government funding options, startups typically need to go through an application process. This process can be complex and time-consuming, and may require significant documentation and paperwork. Startups should be prepared to provide detailed information about their business, including their business plan, financial statements, and management team.

Government funding options can be a valuable source of support for startups, providing access to capital, resources, and expertise that can help drive growth and innovation. By understanding the different types of government funding options available, startups can make informed decisions about which options are best for their business.

Government funding options are just one of the many startup growth funding options available to entrepreneurs. By combining these options with other funding sources, such as crowdfunding and venture capital, startups can create a comprehensive funding strategy that supports their growth and success.

In addition to government funding options, startups should also consider other sources of funding, such as incubators and accelerators, and corporate venture capital. These sources can provide access to capital, resources, and expertise that can help drive growth and innovation.

Measuring Funding Success: Key Performance Indicators for Startups

Measuring the success of funding efforts is crucial for startups to evaluate the effectiveness of their funding strategies and make informed decisions about future funding options. Key performance indicators (KPIs) are metrics that help startups track their progress and measure the success of their funding efforts.

Revenue growth is a key KPI for startups, as it indicates the increase in revenue over a specific period of time. This metric can be used to evaluate the success of funding efforts, such as the impact of a new marketing campaign or the effectiveness of a new sales strategy.

Customer acquisition is another important KPI for startups, as it measures the number of new customers acquired over a specific period of time. This metric can be used to evaluate the success of funding efforts, such as the impact of a new marketing campaign or the effectiveness of a new sales strategy.

Burn rate is a KPI that measures the rate at which a startup is spending its funding. This metric can be used to evaluate the success of funding efforts, such as the effectiveness of cost-cutting measures or the impact of a new revenue stream.

Other KPIs that startups can use to measure the success of their funding efforts include customer retention, customer lifetime value, and return on investment (ROI). These metrics can provide valuable insights into the effectiveness of funding strategies and help startups make informed decisions about future funding options.

Startups can use data to inform their funding strategies by tracking their KPIs and adjusting their strategies accordingly. For example, if a startup is experiencing a high burn rate, it may need to adjust its cost-cutting measures or explore new revenue streams.

Examples of startups that have successfully used data to inform their funding strategies include Airbnb, which used data to optimize its pricing strategy and increase revenue, and Uber, which used data to optimize its route optimization algorithm and reduce costs.

By tracking KPIs and using data to inform their funding strategies, startups can make informed decisions about future funding options and optimize their funding efforts for maximum impact.

Startup growth funding options are numerous, and each option has its own set of benefits and drawbacks. By understanding the different funding options available and using data to inform their funding strategies, startups can make informed decisions about which options are best for their business.

In addition to tracking KPIs and using data to inform their funding strategies, startups should also consider other factors when evaluating funding options, such as the terms and conditions of the funding, the potential risks and rewards, and the alignment of the funding with their business goals.