Understanding the Different Startup Valuation Approaches

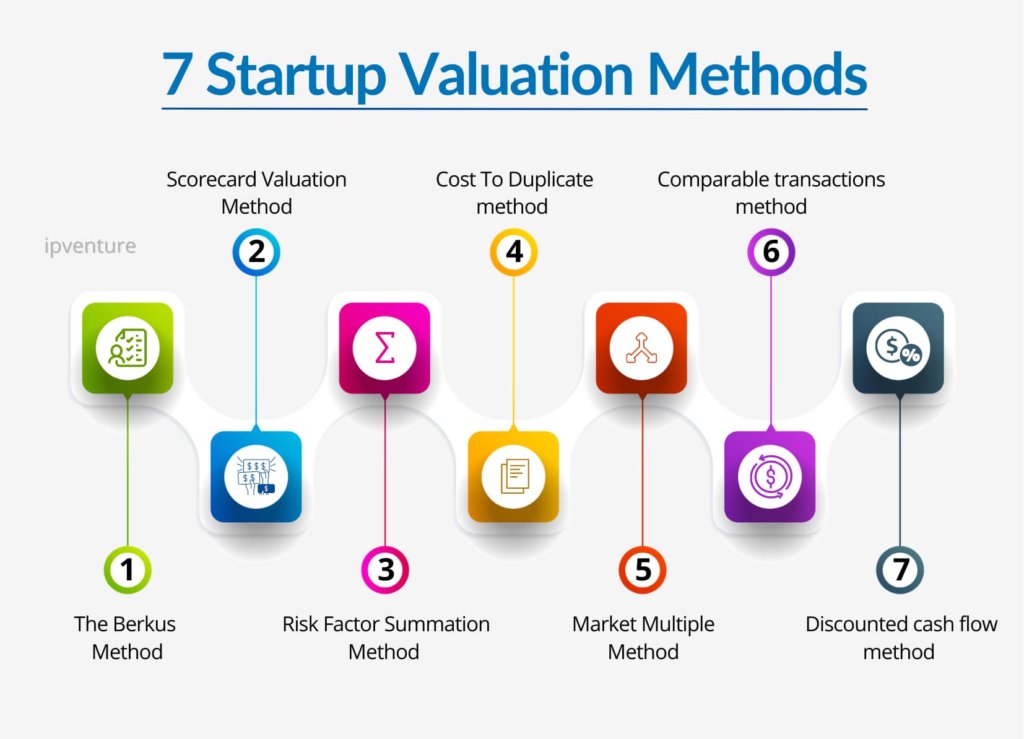

Startup valuation methodologies are diverse and complex, with various approaches suited to different stages of a company’s life cycle. The Venture Capital Method, Discounted Cash Flow (DCF) analysis, and the Berkus Method are three commonly used approaches in startup valuation.

The Venture Capital Method is a widely used approach that estimates a startup’s valuation based on its expected exit value and the required return on investment for venture capitalists. This method is particularly useful for early-stage startups with limited financial data. The DCF analysis, on the other hand, estimates a startup’s valuation by discounting its future cash flows to their present value. This approach is more suitable for startups with a clear revenue stream and a well-defined business model.

The Berkus Method is a more straightforward approach that estimates a startup’s valuation based on five key factors: soundness of the idea, strength of the management team, size of the market, competitive advantage, and financial projections. This method is often used for early-stage startups with limited financial data.

Each of these approaches has its underlying assumptions and limitations. For instance, the Venture Capital Method assumes that the startup will exit through an acquisition or initial public offering (IPO), while the DCF analysis assumes that the startup’s cash flows will grow at a steady rate. The Berkus Method, on the other hand, relies on subjective assessments of the startup’s strengths and weaknesses.

By understanding the different startup valuation approaches and their underlying assumptions, entrepreneurs and investors can make more informed decisions about a startup’s valuation. In the next section, we will discuss how to choose the right valuation method for your startup, considering factors such as the company’s stage, industry, and financial performance.

How to Choose the Right Valuation Method for Your Startup

Selecting the right startup valuation methodology is crucial for entrepreneurs and investors alike. With various approaches available, it’s essential to consider the company’s stage, industry, and financial performance when choosing a valuation method. In this section, we’ll discuss the pros and cons of each approach and provide examples of when to use each method.

For early-stage startups with limited financial data, the Venture Capital Method is often a suitable choice. This approach estimates a startup’s valuation based on its expected exit value and the required return on investment for venture capitalists. However, this method assumes that the startup will exit through an acquisition or initial public offering (IPO), which may not be the case for all startups.

For startups with a clear revenue stream and a well-defined business model, the Discounted Cash Flow (DCF) analysis is a more suitable approach. This method estimates a startup’s valuation by discounting its future cash flows to their present value. However, this approach requires accurate financial projections and a deep understanding of the startup’s financial performance.

The Berkus Method is a more straightforward approach that estimates a startup’s valuation based on five key factors: soundness of the idea, strength of the management team, size of the market, competitive advantage, and financial projections. This method is often used for early-stage startups with limited financial data, but it relies on subjective assessments of the startup’s strengths and weaknesses.

When choosing a valuation method, entrepreneurs and investors should consider the following factors:

- Company stage: Early-stage startups may require different valuation methods than later-stage startups.

- Industry: Different industries have different valuation norms and expectations.

- Financial performance: Startups with a clear revenue stream and well-defined business model may require more sophisticated valuation methods.

By considering these factors and choosing the right valuation method, entrepreneurs and investors can make more informed decisions about a startup’s valuation. In the next section, we’ll discuss the role of financial projections in startup valuation and how to create accurate financial projections.

The Role of Financial Projections in Startup Valuation

Financial projections play a crucial role in startup valuation, as they provide a roadmap for a company’s future financial performance. Accurate financial projections are essential for determining a startup’s valuation, as they help investors and entrepreneurs understand the company’s potential for growth and returns.

When creating financial projections, startups should focus on developing realistic revenue and expense forecasts. This involves analyzing market trends, customer behavior, and industry benchmarks to estimate future revenue growth. Startups should also consider their cost structure, including salaries, marketing expenses, and research and development costs, to estimate future expenses.

There are several key components to include in financial projections, such as:

- Revenue growth: Estimate future revenue growth based on market trends and customer behavior.

- Expense forecasting: Estimate future expenses, including salaries, marketing expenses, and research and development costs.

- Break-even analysis: Determine when the startup will break even and become profitable.

- Cash flow projections: Estimate future cash inflows and outflows to determine the startup’s liquidity.

Financial projections should be regularly updated and refined as the startup grows and evolves. This involves monitoring actual financial performance and adjusting projections accordingly. By creating accurate financial projections, startups can make informed decisions about their business and attract investors who are confident in the company’s potential for growth and returns.

In the context of startup valuation methodologies, financial projections are used to estimate a startup’s future cash flows and determine its valuation. For example, the Discounted Cash Flow (DCF) analysis uses financial projections to estimate a startup’s future cash flows and discount them to their present value. By creating accurate financial projections, startups can ensure that their valuation is based on realistic assumptions and reflects their true potential for growth and returns.

Common Mistakes to Avoid in Startup Valuation

Startup valuation can be a complex and nuanced process, and even experienced entrepreneurs and investors can make mistakes that can lead to inaccurate valuations. In this section, we’ll highlight some common pitfalls to avoid when valuing a startup, and provide examples of how these mistakes can lead to inaccurate valuations.

One common mistake is overestimating revenue growth. Startups often have high growth rates in the early stages, but this growth may not be sustainable in the long term. Overestimating revenue growth can lead to an inflated valuation, which can be difficult to justify to investors.

Another mistake is underestimating expenses. Startups often have high expenses in the early stages, including salaries, marketing expenses, and research and development costs. Underestimating these expenses can lead to an inaccurate valuation, as the startup may not have enough cash to cover its expenses.

Ignoring market conditions is another common mistake. Startups operate in a dynamic market, and market conditions can change quickly. Ignoring market conditions can lead to an inaccurate valuation, as the startup may not be able to adapt to changes in the market.

Using the wrong valuation method is another mistake. Different valuation methods are suited to different types of startups, and using the wrong method can lead to an inaccurate valuation. For example, the Venture Capital Method is suited to early-stage startups, while the Discounted Cash Flow (DCF) analysis is suited to later-stage startups.

Not considering the competitive landscape is another mistake. Startups operate in a competitive market, and the competitive landscape can impact the startup’s valuation. Not considering the competitive landscape can lead to an inaccurate valuation, as the startup may not be able to compete with other companies in the market.

By avoiding these common mistakes, entrepreneurs and investors can ensure that their startup valuation is accurate and reflects the true value of the company. In the next section, we’ll present real-world examples of startups that have successfully navigated the valuation process, and analyze the valuation methods used and the factors that contributed to their success.

Case Studies: Real-World Examples of Startup Valuation

Startup valuation is a complex process that requires careful consideration of various factors, including the company’s stage, industry, financial performance, and market conditions. In this section, we’ll present real-world examples of startups that have successfully navigated the valuation process, and analyze the valuation methods used and the factors that contributed to their success.

Airbnb, for example, used the Venture Capital Method to determine its valuation in its early stages. The company’s founders, Brian Chesky and Joe Gebbia, estimated that the company would reach $100 million in revenue by the end of 2015, and used this estimate to determine the company’s valuation. Airbnb’s valuation was later confirmed by investors, who invested $112 million in the company at a valuation of $1.3 billion.

Uber, on the other hand, used the Discounted Cash Flow (DCF) analysis to determine its valuation. The company’s founders, Travis Kalanick and Garrett Camp, estimated that the company would reach $10 billion in revenue by the end of 2020, and used this estimate to determine the company’s valuation. Uber’s valuation was later confirmed by investors, who invested $1.2 billion in the company at a valuation of $40 billion.

Slack, a communication platform for teams, used the Berkus Method to determine its valuation. The company’s founders, Stewart Butterfield and Eric Costello, estimated that the company would reach $100 million in revenue by the end of 2015, and used this estimate to determine the company’s valuation. Slack’s valuation was later confirmed by investors, who invested $160 million in the company at a valuation of $2.8 billion.

These case studies demonstrate the importance of using the right valuation method for a startup, and the need to consider various factors, including the company’s stage, industry, financial performance, and market conditions. By using the right valuation method and considering these factors, startups can determine their valuation accurately and attract investors who are confident in the company’s potential for growth and returns.

Best Practices for Startup Valuation: Lessons from the Experts

Startup valuation is a complex process that requires careful consideration of various factors, including the company’s stage, industry, financial performance, and market conditions. In this section, we’ll gather insights from experienced investors, entrepreneurs, and valuation experts on best practices for startup valuation.

Transparency is key in startup valuation. Investors and entrepreneurs should be transparent about the company’s financial performance, growth prospects, and market conditions. This transparency helps to build trust and ensures that all parties are on the same page.

Communication is also crucial in startup valuation. Investors and entrepreneurs should communicate clearly and regularly about the company’s progress, challenges, and opportunities. This communication helps to ensure that all parties are aligned and that the valuation process is smooth and efficient.

Flexibility is also important in startup valuation. Investors and entrepreneurs should be flexible and adaptable when it comes to the valuation process. This flexibility helps to ensure that the valuation is accurate and reflects the company’s true value.

According to David Cummings, founder of Pardot and Atlanta Tech Village, “Startup valuation is an art, not a science. It’s a combination of metrics, market conditions, and gut instinct.” Cummings emphasizes the importance of considering multiple factors when determining a startup’s valuation.

Mark Suster, partner at Upfront Ventures, agrees. “Startup valuation is a negotiation between the entrepreneur and the investor. It’s a dance, and both parties need to be flexible and adaptable.” Suster emphasizes the importance of communication and transparency in the valuation process.

By following these best practices, startups can ensure that their valuation is accurate and reflects their true value. By being transparent, communicative, and flexible, startups can build trust with investors and ensure a smooth and efficient valuation process.

Conclusion: Mastering the Art of Startup Valuation

Startup valuation is a complex and nuanced process that requires careful consideration of various factors, including the company’s stage, industry, financial performance, and market conditions. By understanding the different startup valuation methodologies and best practices, entrepreneurs and investors can make informed decisions and achieve their business goals.

In this article, we have discussed the importance of accurate valuation for startups, including its impact on fundraising, investment decisions, and strategic partnerships. We have also introduced the various startup valuation methodologies, including the Venture Capital Method, Discounted Cash Flow (DCF) analysis, and the Berkus Method.

We have provided guidance on selecting the most suitable valuation method for a startup, considering factors such as the company’s stage, industry, and financial performance. We have also emphasized the importance of financial projections in startup valuation, including the development of realistic revenue and expense forecasts.

Additionally, we have highlighted common pitfalls to avoid when valuing a startup, such as overestimating revenue growth, underestimating expenses, or ignoring market conditions. We have also presented real-world examples of startups that have successfully navigated the valuation process, including companies like Airbnb, Uber, and Slack.

Finally, we have gathered insights from experienced investors, entrepreneurs, and valuation experts on best practices for startup valuation, including the importance of transparency, communication, and flexibility in the valuation process.

By mastering the art of startup valuation, entrepreneurs and investors can achieve their business goals and create successful startups that drive innovation and growth. We encourage readers to continue learning and refining their valuation skills to achieve their business goals.

Conclusion: Mastering the Art of Startup Valuation

Startup valuation is a complex and nuanced process that requires careful consideration of various factors, including the company’s stage, industry, financial performance, and market conditions. By understanding the different startup valuation methodologies and best practices, entrepreneurs and investors can make informed decisions and achieve their business goals.

In this article, we have discussed the importance of accurate valuation for startups, including its impact on fundraising, investment decisions, and strategic partnerships. We have also introduced the various startup valuation methodologies, including the Venture Capital Method, Discounted Cash Flow (DCF) analysis, and the Berkus Method.

We have provided guidance on selecting the most suitable valuation method for a startup, considering factors such as the company’s stage, industry, and financial performance. We have also emphasized the importance of financial projections in startup valuation, including the development of realistic revenue and expense forecasts.

Additionally, we have highlighted common pitfalls to avoid when valuing a startup, such as overestimating revenue growth, underestimating expenses, or ignoring market conditions. We have also presented real-world examples of startups that have successfully navigated the valuation process, including companies like Airbnb, Uber, and Slack.

Finally, we have gathered insights from experienced investors, entrepreneurs, and valuation experts on best practices for startup valuation, including the importance of transparency, communication, and flexibility in the valuation process.

By mastering the art of startup valuation, entrepreneurs and investors can achieve their business goals and create successful startups that drive innovation and growth. We encourage readers to continue learning and refining their valuation skills to achieve their business goals.

In conclusion, startup valuation is a critical component of startup success, and accurate valuation is essential for making informed decisions and achieving business goals. By understanding the different startup valuation methodologies and best practices, entrepreneurs and investors can master the art of startup valuation and create successful startups that drive innovation and growth.