How to Claim Your Electric Vehicle Tax Rebate

The federal tax credit on electric cars is a significant incentive for individuals and businesses to adopt eco-friendly vehicles. The tax credit can help reduce the cost of purchasing an electric vehicle, making it more affordable and attractive to potential buyers. To claim the electric vehicle tax rebate, individuals must meet specific requirements and follow a step-by-step process.

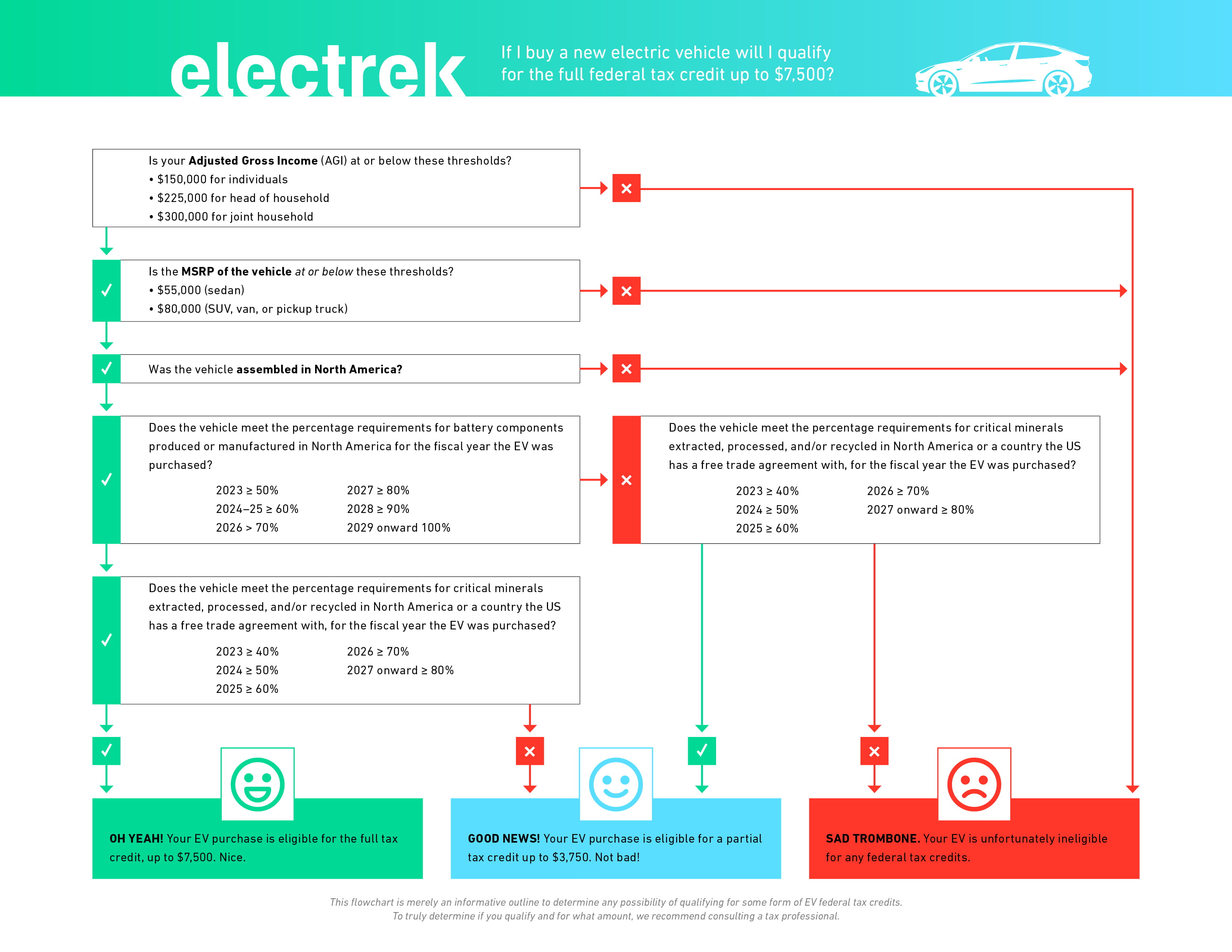

The maximum tax credit amount for electric vehicles is $7,500, but not all vehicles qualify for the full credit. The credit amount is based on the vehicle’s battery capacity, with vehicles having a minimum of 4 kWh of battery capacity qualifying for a partial credit. The IRS provides a list of eligible vehicles and their corresponding credit amounts, which can be found on their website.

To claim the tax credit, individuals must file Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, with their tax return. The form requires information about the vehicle, including its make, model, and Vehicle Identification Number (VIN). Additionally, individuals must provide documentation, such as a copy of the vehicle’s certification label and a receipt for the vehicle’s purchase.

It’s essential to note that the tax credit is non-refundable, meaning it can only reduce the individual’s tax liability to zero. If the credit amount exceeds the individual’s tax liability, the excess credit is not refundable. However, individuals can carry over any unused credit to future tax years.

The tax credit on electric cars is a valuable incentive for promoting the adoption of eco-friendly vehicles. By understanding the requirements and process for claiming the credit, individuals can take advantage of this opportunity and reduce their tax liability. As the demand for electric vehicles continues to grow, the tax credit will play a crucial role in encouraging individuals and businesses to make the switch to sustainable transportation.

Which Electric Cars Qualify for the Full Tax Credit?

The tax credit on electric cars is a significant incentive for individuals and businesses to adopt eco-friendly vehicles. To qualify for the full tax credit of $7,500, electric vehicles must meet specific requirements, including a minimum battery capacity of 16 kWh. Several popular electric vehicle models qualify for the full tax credit, including the Tesla Model 3, Chevrolet Bolt, and Nissan Leaf.

The Tesla Model 3, for example, qualifies for the full tax credit of $7,500. This model features a range of up to 325 miles on a single charge and a starting price of around $35,000. The Chevrolet Bolt, another popular electric vehicle, also qualifies for the full tax credit. This model has a range of up to 259 miles on a single charge and a starting price of around $36,000.

The Nissan Leaf is another electric vehicle that qualifies for the full tax credit. This model has a range of up to 226 miles on a single charge and a starting price of around $29,000. Other electric vehicles that qualify for the full tax credit include the Hyundai Kona Electric, the Audi e-tron, and the Jaguar I-PACE.

It’s essential to note that the tax credit amount may vary depending on the specific trim level and options chosen for the vehicle. Additionally, the tax credit is subject to phase-out, which means that the credit amount will be reduced as the manufacturer sells more electric vehicles. This phase-out period is triggered when the manufacturer sells 200,000 eligible vehicles, and the credit amount is reduced by 50% every six months thereafter.

By understanding which electric vehicles qualify for the full tax credit, individuals and businesses can make informed decisions when purchasing an eco-friendly vehicle. The tax credit on electric cars is a valuable incentive that can help reduce the cost of purchasing an electric vehicle, making it more affordable and attractive to potential buyers.

Understanding the Phase-Out Period: How It Affects Your Tax Credit

The tax credit on electric cars is subject to a phase-out period, which can significantly impact the credit amount. The phase-out period is triggered when a manufacturer sells 200,000 eligible vehicles, and the credit amount is reduced by 50% every six months thereafter. This means that the tax credit will be reduced to $3,750 for the first six months after the phase-out period begins, and then to $1,875 for the next six months.

For example, Tesla, one of the leading electric vehicle manufacturers, reached the 200,000-vehicle threshold in 2018. As a result, the tax credit for Tesla vehicles was reduced to $3,750 for the first six months of 2019, and then to $1,875 for the next six months. This phase-out period can have a significant impact on the tax credit amount, making it essential for buyers to understand the rules and plan accordingly.

Other manufacturers, such as General Motors and Nissan, are also approaching the 200,000-vehicle threshold. When they reach this milestone, the tax credit for their vehicles will also be subject to the phase-out period. Buyers should be aware of the phase-out period and its impact on the tax credit amount to make informed decisions when purchasing an electric vehicle.

It’s worth noting that the phase-out period only applies to the federal tax credit, and state and local incentives may still be available. Additionally, some manufacturers may offer their own incentives or discounts to help offset the reduced tax credit amount. By understanding the phase-out period and its impact on the tax credit, buyers can make the most of the available incentives and reduce the cost of purchasing an electric vehicle.

The phase-out period is an essential aspect of the tax credit on electric cars, and buyers should be aware of its implications. By understanding the rules and planning accordingly, buyers can maximize their tax credit and make the most of the available incentives.

State and Local Incentives: Additional Savings for Electric Vehicle Owners

In addition to the federal tax credit on electric cars, many states and cities offer their own incentives for electric vehicle owners. These incentives can include rebates, tax credits, and exemptions from certain fees, providing additional savings for electric vehicle owners.

For example, California offers a rebate of up to $5,000 for the purchase of an electric vehicle, while New York offers a rebate of up to $2,000. Other states, such as Oregon and Washington, offer exemptions from certain fees, such as registration fees and parking fees.

Some cities also offer their own incentives for electric vehicle owners. For example, Los Angeles offers a rebate of up to $1,000 for the purchase of an electric vehicle, while San Francisco offers a rebate of up to $500. Additionally, some cities offer free or discounted parking for electric vehicles, providing an added incentive for owners.

It’s worth noting that these incentives can vary widely depending on the state and city, so it’s essential to research the specific incentives available in your area. By combining these incentives with the federal tax credit, electric vehicle owners can save even more money on their purchase.

Some popular state and local incentives for electric vehicle owners include:

- California: Rebate of up to $5,000 for the purchase of an electric vehicle

- New York: Rebate of up to $2,000 for the purchase of an electric vehicle

- Oregon: Exemption from registration fees for electric vehicles

- Washington: Exemption from parking fees for electric vehicles

- Los Angeles: Rebate of up to $1,000 for the purchase of an electric vehicle

- San Francisco: Rebate of up to $500 for the purchase of an electric vehicle

By taking advantage of these state and local incentives, electric vehicle owners can save even more money on their purchase and enjoy the many benefits of owning an electric vehicle.

How to Maximize Your Electric Vehicle Tax Credit

To maximize the electric vehicle tax credit, it’s essential to understand the rules and regulations surrounding the credit. Here are some tips and strategies to help you make the most of the tax credit:

First, make sure you purchase an eligible vehicle. The IRS provides a list of eligible vehicles on their website, so be sure to check it before making a purchase. Additionally, ensure that the vehicle is used for personal or business purposes, as the credit is only available for vehicles used for these purposes.

Next, claim the credit on your tax return. You’ll need to complete Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, and attach it to your tax return. Be sure to keep records of your purchase, including the sales contract and any other documentation, as you’ll need these to support your claim.

Another way to maximize the tax credit is to combine it with other incentives. Many states and cities offer their own incentives for electric vehicle owners, such as rebates and exemptions from certain fees. By combining these incentives with the federal tax credit, you can save even more money on your purchase.

Finally, consider purchasing an electric vehicle during a time when the tax credit is at its highest. The tax credit is subject to a phase-out period, which means that the credit amount will be reduced as the manufacturer sells more electric vehicles. By purchasing an electric vehicle during a time when the credit is at its highest, you can maximize your savings.

Some popular electric vehicles that qualify for the full tax credit include:

- Tesla Model 3

- Chevrolet Bolt

- Nissan Leaf

- Hyundai Kona Electric

- BMW i3

By following these tips and strategies, you can maximize your electric vehicle tax credit and save even more money on your purchase.

Electric Vehicle Tax Credit: A Comparison of Different Models

The electric vehicle tax credit is a valuable incentive for individuals and businesses looking to purchase an eco-friendly vehicle. However, the credit amount can vary depending on the specific model and manufacturer. In this section, we’ll compare the tax credit amounts for different electric vehicle models, including the Tesla Model S, BMW i3, and Hyundai Kona Electric.

The Tesla Model S is a popular luxury electric vehicle that qualifies for a tax credit of up to $7,500. This vehicle features a range of up to 373 miles on a single charge and a starting price of around $79,000. The BMW i3 is another popular electric vehicle that qualifies for a tax credit of up to $7,500. This vehicle features a range of up to 114 miles on a single charge and a starting price of around $44,000.

The Hyundai Kona Electric is a more affordable option that qualifies for a tax credit of up to $7,500. This vehicle features a range of up to 258 miles on a single charge and a starting price of around $36,000. Other electric vehicle models that qualify for the tax credit include the Nissan Leaf, Chevrolet Bolt, and Audi e-tron.

Here’s a summary of the key features and benefits of each model:

- Tesla Model S: Range of up to 373 miles, starting price of around $79,000, tax credit of up to $7,500

- BMW i3: Range of up to 114 miles, starting price of around $44,000, tax credit of up to $7,500

- Hyundai Kona Electric: Range of up to 258 miles, starting price of around $36,000, tax credit of up to $7,500

- Nissan Leaf: Range of up to 226 miles, starting price of around $29,000, tax credit of up to $7,500

- Chevrolet Bolt: Range of up to 259 miles, starting price of around $36,000, tax credit of up to $7,500

- Audi e-tron: Range of up to 246 miles, starting price of around $75,000, tax credit of up to $7,500

By comparing the tax credit amounts for different electric vehicle models, individuals and businesses can make informed decisions when purchasing an eco-friendly vehicle. The tax credit on electric cars is a valuable incentive that can help reduce the cost of purchasing an electric vehicle, making it more affordable and attractive to potential buyers.

The Future of Electric Vehicle Incentives: What to Expect

The electric vehicle tax credit has been a crucial incentive for promoting the adoption of eco-friendly vehicles. However, the credit is subject to change, and there are several proposed legislation and regulatory updates that could impact the credit in the future.

One of the most significant changes on the horizon is the potential extension of the electric vehicle tax credit. The credit is currently set to expire in 2025, but there are efforts underway to extend it until 2030. This would provide a significant boost to the electric vehicle industry, as it would continue to incentivize the purchase of eco-friendly vehicles.

Another potential change is the expansion of the credit to include more types of vehicles. Currently, the credit only applies to plug-in electric vehicles, but there are proposals to expand it to include other types of eco-friendly vehicles, such as hydrogen fuel cell vehicles.

Additionally, there are several states that are considering implementing their own electric vehicle incentives. For example, California is considering a proposal to offer a rebate of up to $5,000 for the purchase of an electric vehicle. Other states, such as New York and Oregon, are also considering similar incentives.

It’s also worth noting that the electric vehicle industry is rapidly evolving, and new technologies and innovations are emerging all the time. As the industry continues to grow and mature, we can expect to see new incentives and policies emerge to support the adoption of eco-friendly vehicles.

Some of the potential changes to the electric vehicle tax credit and other incentives include:

- Extension of the credit until 2030

- Expansion of the credit to include more types of vehicles

- Implementation of state-level incentives, such as rebates and tax credits

- Emergence of new technologies and innovations in the electric vehicle industry

By staying informed about the latest developments and changes to the electric vehicle tax credit and other incentives, individuals and businesses can make informed decisions about their transportation options and take advantage of the available incentives.

Conclusion: Making the Most of Electric Vehicle Tax Credits

In conclusion, the tax credit on electric cars is a valuable incentive for individuals and businesses looking to purchase an eco-friendly vehicle. By understanding the basics of the federal tax credit, including the maximum credit amount and the types of vehicles that qualify, individuals and businesses can make informed decisions about their transportation options.

Additionally, by exploring the various state and local incentives available, individuals and businesses can maximize their savings and make the most of the tax credit. Whether you’re looking to purchase a Tesla Model 3, a Chevrolet Bolt, or a Nissan Leaf, there are incentives available to help make your purchase more affordable.

As the electric vehicle industry continues to evolve, it’s essential to stay informed about the latest developments and changes to the tax credit and other incentives. By doing so, individuals and businesses can take advantage of the available incentives and make the most of their purchase.

Some key takeaways from this article include:

- The federal tax credit on electric cars is a valuable incentive for individuals and businesses looking to purchase an eco-friendly vehicle.

- The credit is worth up to $7,500, depending on the type of vehicle and the manufacturer.

- There are various state and local incentives available, including rebates, tax credits, and exemptions from certain fees.

- Individuals and businesses can maximize their savings by combining the federal tax credit with state and local incentives.

- It’s essential to stay informed about the latest developments and changes to the tax credit and other incentives.

By following these tips and staying informed, individuals and businesses can make the most of the tax credit on electric cars and enjoy the many benefits of owning an eco-friendly vehicle.