Understanding the Importance of a Well-Defined Exit Strategy

A well-defined exit strategy is crucial for tech startups seeking to maximize returns on their investment. A clear exit plan provides a roadmap for the company’s future, outlining the steps necessary to achieve a successful exit. This, in turn, increases valuation, improves investor confidence, and enhances competitiveness in the market. By having a well-defined exit strategy, tech startups can better navigate the complexities of the industry and make informed decisions that drive growth and profitability.

One of the primary benefits of a well-defined exit strategy is that it provides a clear direction for the company. This direction enables tech startups to focus their efforts on achieving specific goals, such as increasing revenue, expanding their customer base, or developing new products. By having a clear direction, tech startups can allocate their resources more effectively, prioritize their efforts, and make strategic decisions that drive growth.

A well-defined exit strategy also plays a critical role in attracting investors. Investors want to know that the companies they invest in have a clear plan for achieving a successful exit. By having a well-defined exit strategy, tech startups can demonstrate their commitment to delivering returns on investment, which can help to attract investors and secure funding.

In addition to attracting investors, a well-defined exit strategy can also enhance competitiveness in the market. By having a clear plan for achieving a successful exit, tech startups can differentiate themselves from their competitors and establish a strong market position. This, in turn, can help to drive growth, increase revenue, and improve profitability.

Furthermore, a well-defined exit strategy can also help tech startups to navigate the complexities of mergers and acquisitions. By having a clear plan for achieving a successful exit, tech startups can better navigate the due diligence process, negotiate more effectively, and integrate more smoothly with the acquiring company.

In the context of tech startup exit strategies, having a well-defined exit plan is essential for achieving a successful exit. By providing a clear direction, attracting investors, enhancing competitiveness, and navigating the complexities of mergers and acquisitions, a well-defined exit strategy can help tech startups to maximize returns on their investment and achieve long-term success.

Identifying the Right Exit Options for Your Tech Startup

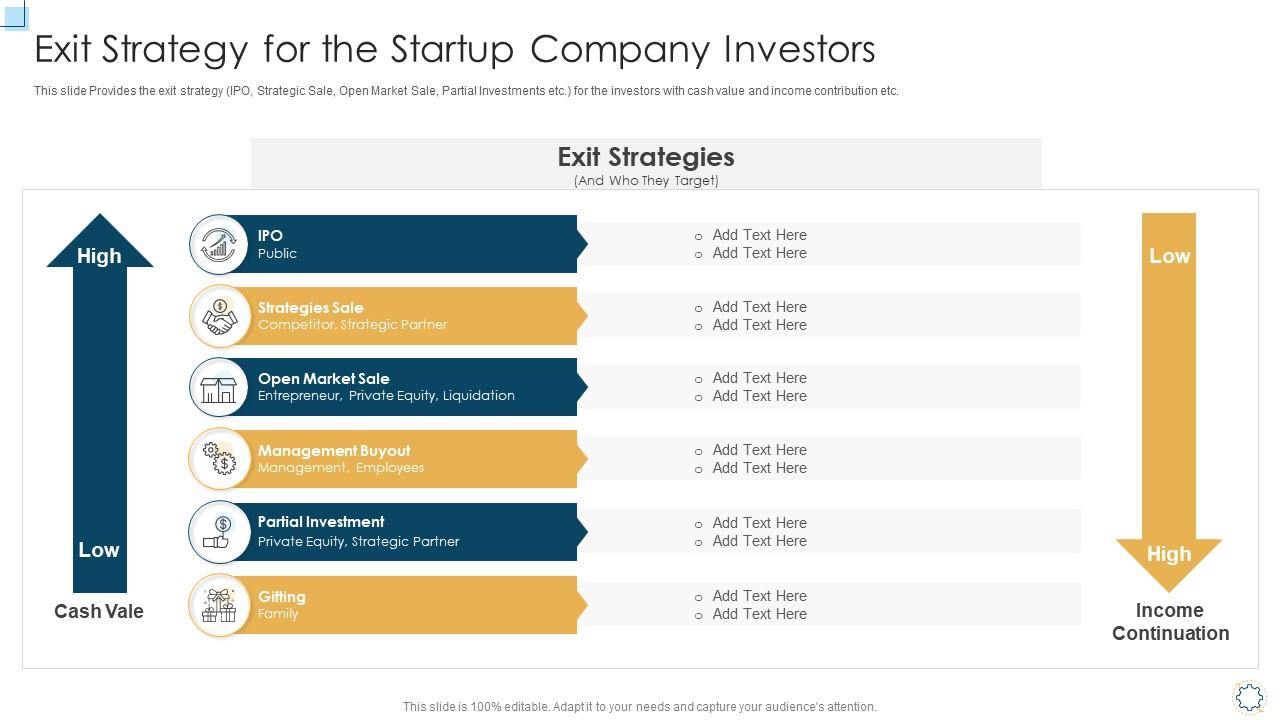

When it comes to tech startup exit strategies, there are several options available. The right exit option for your tech startup will depend on various factors, including the company’s size, industry, financial performance, and growth prospects. In this section, we will explore the different types of exit strategies available to tech startups, including acquisition, initial public offering (IPO), merger, and liquidation.

Acquisition is a popular exit option for tech startups. This involves selling the company to another business, often a larger corporation. Acquisition can provide a lucrative exit for tech startup founders and investors, as well as access to new resources and expertise. For example, Facebook’s acquisition of Instagram in 2012 for $1 billion is a notable example of a successful acquisition exit.

Initial Public Offering (IPO) is another exit option for tech startups. This involves listing the company’s shares on a public stock exchange, allowing the public to buy and sell shares. IPOs can provide a significant influx of capital for tech startups, as well as increased visibility and credibility. However, IPOs can also be a complex and time-consuming process. For example, Airbnb’s IPO in 2020 raised $3.5 billion, valuing the company at $47 billion.

Mergers are another type of exit strategy for tech startups. This involves combining two or more companies to form a new entity. Mergers can provide a strategic exit for tech startups, allowing them to expand their offerings and reach new markets. For example, the merger between AOL and Time Warner in 2001 created a media giant with a combined market value of $164 billion.

Liquidation is a less common exit option for tech startups. This involves selling off the company’s assets and winding down operations. Liquidation can provide a quick exit for tech startup founders and investors, but it can also result in significant losses. For example, the liquidation of Theranos in 2018 resulted in a loss of over $1 billion for investors.

When evaluating exit options, tech startups should consider their unique circumstances and goals. It’s essential to weigh the pros and cons of each exit option and consider factors such as valuation, growth prospects, and cultural fit. By choosing the right exit option, tech startups can maximize returns and achieve long-term success.

In the context of tech startup exit strategies, identifying the right exit option is crucial. By understanding the different types of exit strategies available, tech startups can make informed decisions that drive growth, increase valuation, and achieve a successful exit.

How to Prepare Your Tech Startup for a Successful Exit

Preparing a tech startup for a successful exit requires careful planning, strategic positioning, and operational optimization. In this section, we will provide practical advice on how to prepare your tech startup for a successful exit, including tips on financial planning, operational optimization, and strategic positioning.

Financial planning is a critical component of preparing a tech startup for a successful exit. This includes creating a comprehensive financial plan that outlines projected revenue, expenses, and cash flow. A well-planned financial strategy can help tech startups to increase valuation, attract potential buyers, and achieve a successful exit. For example, a tech startup can create a financial plan that outlines a path to profitability, including revenue growth, cost reduction, and cash flow management.

Operational optimization is also essential for preparing a tech startup for a successful exit. This includes streamlining operations, reducing costs, and improving efficiency. By optimizing operations, tech startups can increase productivity, reduce waste, and improve overall performance. For example, a tech startup can implement lean manufacturing techniques, automate manual processes, and outsource non-core functions.

Strategic positioning is another key component of preparing a tech startup for a successful exit. This includes identifying a unique value proposition, differentiating the company from competitors, and creating a competitive advantage. By strategically positioning the company, tech startups can increase valuation, attract potential buyers, and achieve a successful exit. For example, a tech startup can create a unique value proposition by developing a proprietary technology, building a strong brand, and establishing strategic partnerships.

In addition to financial planning, operational optimization, and strategic positioning, tech startups should also focus on building a strong management team, developing a robust financial plan, and navigating the complexities of mergers and acquisitions. By taking a holistic approach to preparing for a successful exit, tech startups can increase their chances of achieving a successful exit and maximizing returns.

When preparing for a successful exit, tech startups should also consider the importance of creating a competitive advantage. This can be achieved by developing a unique value proposition, building a strong brand, and establishing strategic partnerships. By creating a competitive advantage, tech startups can differentiate themselves from competitors, increase valuation, and attract potential buyers.

In the context of tech startup exit strategies, preparing for a successful exit is crucial. By following the tips outlined in this section, tech startups can increase their chances of achieving a successful exit and maximizing returns. Whether through financial planning, operational optimization, or strategic positioning, tech startups can take a proactive approach to preparing for a successful exit and achieving long-term success.

Building a Strong Management Team to Attract Potential Buyers

A strong management team is essential for attracting potential buyers and investors to a tech startup. A well-structured and experienced management team can increase the confidence of potential buyers and investors, ultimately leading to a successful exit. In this section, we will discuss the importance of having a strong management team in place and provide guidance on how to build and retain a talented team.

A strong management team should have a clear understanding of the company’s vision, mission, and goals. They should be able to communicate effectively with potential buyers and investors, showcasing the company’s value proposition and growth potential. A strong management team should also have a proven track record of success, with a deep understanding of the industry and market trends.

To build a strong management team, tech startups should focus on recruiting talented individuals with a proven track record of success. This can be achieved by offering competitive salaries and benefits, as well as opportunities for growth and development. Tech startups should also prioritize diversity and inclusion, ensuring that the management team reflects the company’s values and mission.

Retaining a talented management team is also crucial for tech startups. This can be achieved by providing opportunities for growth and development, as well as recognizing and rewarding outstanding performance. Tech startups should also prioritize open communication and transparency, ensuring that the management team is aligned with the company’s vision and goals.

In addition to building and retaining a strong management team, tech startups should also focus on developing a robust financial plan, navigating the complexities of mergers and acquisitions, and creating a competitive advantage to drive exit success. By taking a holistic approach to exit planning, tech startups can increase their chances of achieving a successful exit and maximizing returns.

When building a strong management team, tech startups should also consider the importance of cultural fit. A management team that is aligned with the company’s culture and values can increase the chances of a successful exit. By prioritizing cultural fit, tech startups can ensure that the management team is committed to the company’s mission and vision, ultimately leading to a successful exit.

In the context of tech startup exit strategies, building a strong management team is crucial. By following the guidance outlined in this section, tech startups can increase their chances of achieving a successful exit and maximizing returns. Whether through recruiting talented individuals, prioritizing diversity and inclusion, or recognizing and rewarding outstanding performance, tech startups can build a strong management team that drives exit success.

Developing a Robust Financial Plan to Increase Valuation

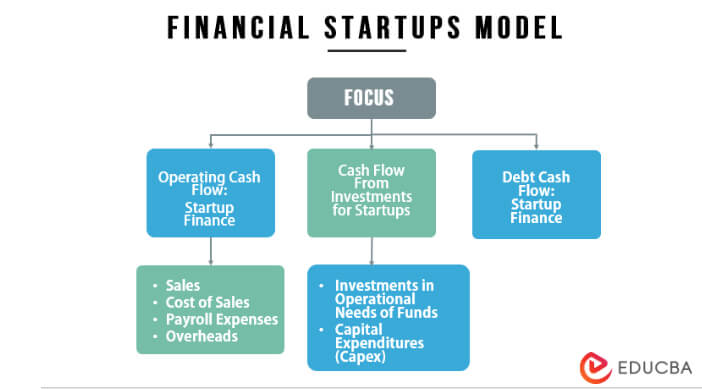

A robust financial plan is essential for increasing valuation and attracting potential buyers to a tech startup. A well-structured financial plan can provide a clear roadmap for growth, increase investor confidence, and ultimately drive exit success. In this section, we will discuss the importance of having a robust financial plan in place and provide tips on how to create a comprehensive financial plan.

A robust financial plan should include a detailed breakdown of projected revenue, expenses, and cash flow. This can be achieved by creating a comprehensive financial model that takes into account various scenarios and assumptions. The financial plan should also include a clear outline of the company’s funding requirements, including the amount of capital needed to achieve growth and the expected return on investment.

To create a comprehensive financial plan, tech startups should start by defining their financial goals and objectives. This can include increasing revenue, reducing costs, and improving profitability. The financial plan should also include a detailed analysis of the company’s financial performance, including key performance indicators (KPIs) such as revenue growth, gross margin, and cash flow.

In addition to defining financial goals and analyzing financial performance, tech startups should also prioritize financial planning and budgeting. This can be achieved by creating a comprehensive budget that takes into account various expenses, including salaries, marketing, and research and development. The budget should also include a clear outline of the company’s funding requirements, including the amount of capital needed to achieve growth.

When creating a robust financial plan, tech startups should also consider the importance of financial modeling. Financial modeling can provide a clear roadmap for growth, increase investor confidence, and ultimately drive exit success. By using financial modeling, tech startups can create a comprehensive financial plan that takes into account various scenarios and assumptions.

In the context of tech startup exit strategies, developing a robust financial plan is crucial. By following the tips outlined in this section, tech startups can increase their chances of achieving a successful exit and maximizing returns. Whether through creating a comprehensive financial model, defining financial goals and objectives, or prioritizing financial planning and budgeting, tech startups can develop a robust financial plan that drives exit success.

By having a robust financial plan in place, tech startups can increase their valuation, attract potential buyers, and ultimately drive exit success. A well-structured financial plan can provide a clear roadmap for growth, increase investor confidence, and ultimately drive exit success. By prioritizing financial planning and budgeting, tech startups can create a comprehensive financial plan that takes into account various scenarios and assumptions.

Navigating the Complexities of Mergers and Acquisitions

Mergers and acquisitions (M&A) can be a complex and challenging process for tech startups. However, with the right guidance and preparation, M&A can be a successful exit strategy for tech startups. In this section, we will provide guidance on how to navigate the complexities of M&A, including due diligence, negotiation, and integration.

Due diligence is a critical component of the M&A process. It involves a thorough examination of the target company’s financials, operations, and management team. Tech startups should prioritize due diligence to ensure that they are making an informed decision about the acquisition. This can include reviewing financial statements, assessing the company’s competitive position, and evaluating the management team’s experience and expertise.

Negotiation is another key aspect of the M&A process. Tech startups should prioritize negotiation to ensure that they are getting the best possible deal. This can include negotiating the purchase price, discussing the terms of the acquisition, and agreeing on the integration plan. Tech startups should also prioritize communication and transparency during the negotiation process to ensure that all parties are aligned and informed.

Integration is the final stage of the M&A process. It involves combining the two companies into a single entity, which can be a complex and challenging process. Tech startups should prioritize integration to ensure that the acquisition is successful and that the combined company is well-positioned for growth. This can include developing an integration plan, assigning responsibilities and roles, and establishing a timeline for completion.

In addition to due diligence, negotiation, and integration, tech startups should also prioritize cultural fit during the M&A process. Cultural fit refers to the alignment of the two companies’ values, mission, and culture. Tech startups should prioritize cultural fit to ensure that the acquisition is successful and that the combined company is well-positioned for growth.

When navigating the complexities of M&A, tech startups should also consider the importance of seeking professional advice. This can include hiring a financial advisor, a lawyer, or a consultant to provide guidance and support throughout the process. By seeking professional advice, tech startups can ensure that they are making an informed decision about the acquisition and that they are well-positioned for success.

In the context of tech startup exit strategies, navigating the complexities of M&A is crucial. By following the guidance outlined in this section, tech startups can increase their chances of achieving a successful exit and maximizing returns. Whether through due diligence, negotiation, integration, or cultural fit, tech startups can navigate the complexities of M&A and achieve a successful exit.

Creating a Competitive Advantage to Drive Exit Success

Creating a competitive advantage is crucial for tech startups to drive exit success. A competitive advantage can help tech startups differentiate themselves in a crowded market, increase their valuation, and attract potential buyers. In this section, we will discuss the importance of creating a competitive advantage and provide examples of how tech startups can differentiate themselves.

A competitive advantage can be achieved through various means, including innovation, unique value proposition, and strategic partnerships. Tech startups can innovate by developing new products or services that meet the needs of their target market. They can also create a unique value proposition by offering a combination of products or services that are not available elsewhere. Strategic partnerships can also help tech startups create a competitive advantage by providing access to new markets, technologies, or expertise.

One example of a tech startup that created a competitive advantage through innovation is Airbnb. Airbnb developed a unique platform that allows homeowners to rent out their properties to travelers. This innovation created a new market and disrupted the traditional hospitality industry. As a result, Airbnb was able to attract millions of users and achieve a valuation of over $50 billion.

Another example of a tech startup that created a competitive advantage through strategic partnerships is Uber. Uber partnered with various companies, including Google and Toyota, to develop its self-driving car technology. This partnership provided Uber with access to new technologies and expertise, which helped the company to create a competitive advantage in the market.

In addition to innovation and strategic partnerships, tech startups can also create a competitive advantage through unique value proposition. For example, a tech startup can offer a combination of products or services that are not available elsewhere. This can include offering a subscription-based service that provides access to exclusive content or offering a product that is tailored to the specific needs of a particular market.

When creating a competitive advantage, tech startups should also prioritize customer satisfaction. Customer satisfaction can help tech startups to build a loyal customer base, which can drive repeat business and positive word-of-mouth. This can be achieved by offering high-quality products or services, providing excellent customer support, and engaging with customers through social media and other channels.

In the context of tech startup exit strategies, creating a competitive advantage is crucial. By differentiating themselves in a crowded market, tech startups can increase their valuation, attract potential buyers, and achieve a successful exit. Whether through innovation, unique value proposition, or strategic partnerships, tech startups can create a competitive advantage that drives exit success.

Measuring and Optimizing Exit Strategy Performance

Measuring and optimizing exit strategy performance is crucial for tech startups to achieve a successful exit. By tracking key performance indicators (KPIs) and adjusting the exit strategy accordingly, tech startups can increase their chances of achieving a successful exit and maximizing returns. In this section, we will discuss the importance of measuring and optimizing exit strategy performance and provide guidance on how to track KPIs and adjust the exit strategy.

There are several KPIs that tech startups can use to measure exit strategy performance, including revenue growth, customer acquisition costs, customer lifetime value, and retention rates. By tracking these KPIs, tech startups can gain insights into their exit strategy performance and identify areas for improvement. For example, if a tech startup is tracking revenue growth and finds that it is not meeting its targets, it can adjust its exit strategy to focus on increasing revenue.

In addition to tracking KPIs, tech startups should also prioritize regular review and analysis of their exit strategy performance. This can include conducting regular review meetings with the management team and board of directors, as well as seeking feedback from investors and advisors. By regularly reviewing and analyzing exit strategy performance, tech startups can identify areas for improvement and make adjustments to their exit strategy accordingly.

Another important aspect of measuring and optimizing exit strategy performance is benchmarking against industry peers. By comparing their exit strategy performance to that of industry peers, tech startups can gain insights into their relative performance and identify areas for improvement. For example, if a tech startup is tracking revenue growth and finds that it is below the industry average, it can adjust its exit strategy to focus on increasing revenue.

In the context of tech startup exit strategies, measuring and optimizing exit strategy performance is crucial. By tracking KPIs, regularly reviewing and analyzing exit strategy performance, and benchmarking against industry peers, tech startups can increase their chances of achieving a successful exit and maximizing returns. Whether through revenue growth, customer acquisition costs, or retention rates, tech startups can measure and optimize their exit strategy performance to drive exit success.

By prioritizing measuring and optimizing exit strategy performance, tech startups can also increase their attractiveness to potential buyers and investors. By demonstrating a clear understanding of their exit strategy performance and a commitment to continuous improvement, tech startups can increase their valuation and attract potential buyers and investors.

In conclusion, measuring and optimizing exit strategy performance is a critical component of tech startup exit planning. By tracking KPIs, regularly reviewing and analyzing exit strategy performance, and benchmarking against industry peers, tech startups can increase their chances of achieving a successful exit and maximizing returns.