Understanding the Venture Capital Landscape: Trends and Insights

The venture capital landscape has undergone significant changes in recent years, with shifting trends and insights that impact startup valuation. As the global economy continues to evolve, it’s essential to understand the current state of venture capital and its implications for startup valuation. According to a report by KPMG, global venture capital investment reached $254 billion in 2020, with the United States, China, and Europe leading the way. This surge in investment has led to increased competition among startups, making it crucial to understand the venture capital landscape and its impact on startup valuation.

One notable trend in the venture capital landscape is the rise of mega-deals, with investments exceeding $100 million becoming increasingly common. This shift towards larger deals has led to increased scrutiny of startup valuation, with investors seeking more robust financial projections and clearer paths to scalability. Additionally, the growth of emerging technologies such as artificial intelligence, blockchain, and cybersecurity has created new opportunities for startups, but also increased the complexity of valuation.

Despite these trends, venture capital and startup valuation remain closely intertwined. A well-crafted valuation can make or break a startup’s ability to secure funding, and investors are increasingly seeking startups with robust financials and clear growth potential. As the venture capital landscape continues to evolve, it’s essential for entrepreneurs and investors to stay informed about the latest trends and insights, and to develop a deep understanding of startup valuation and its role in securing funding.

Some notable deals in the venture capital space include the $1.1 billion investment in Uber’s self-driving car unit, the $500 million investment in Airbnb’s latest funding round, and the $100 million investment in Facebook’s acquisition of Instagram. These deals demonstrate the significant investment potential in the venture capital space, but also highlight the importance of careful valuation and due diligence.

As the venture capital landscape continues to shift, it’s essential for entrepreneurs and investors to stay ahead of the curve. By understanding the latest trends and insights, and developing a deep understanding of startup valuation, they can navigate the complex world of venture capital and secure the funding needed to drive growth and success.

How to Determine Your Startup’s Value: A Step-by-Step Approach

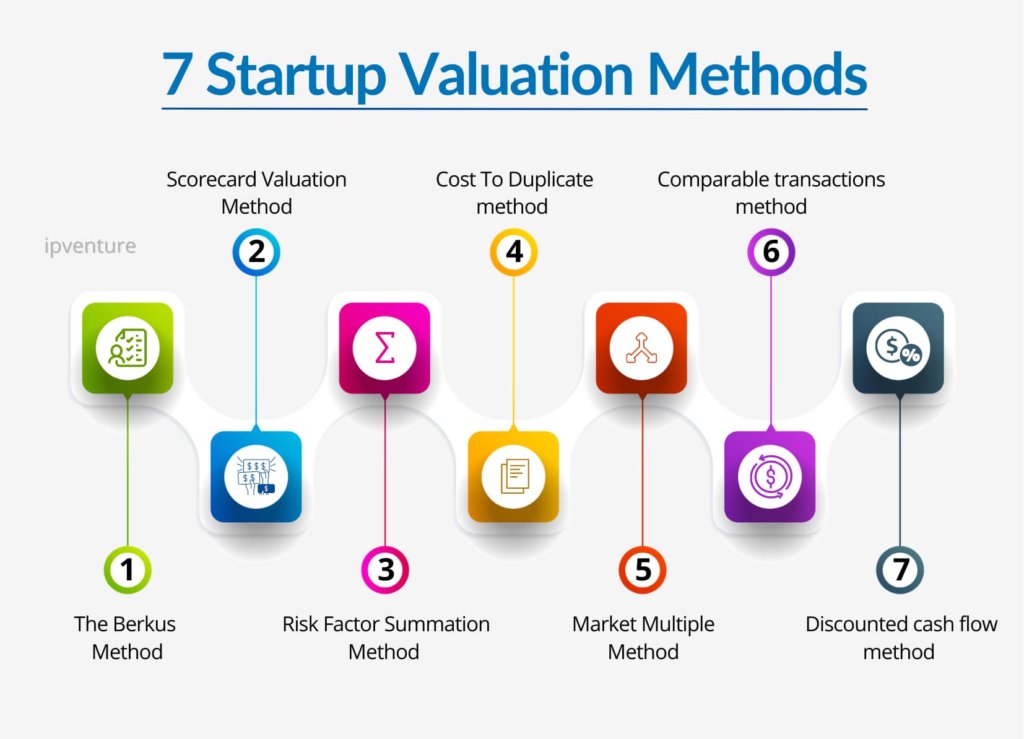

Determining a startup’s value is a crucial step in securing venture capital funding. There are several methods to determine a startup’s value, each with its own strengths and weaknesses. In this section, we will explore three common methods: comparable company analysis, discounted cash flow analysis, and the venture capital method.

Comparable company analysis involves comparing a startup’s financial metrics to those of similar companies in the same industry. This method is useful for startups with limited financial data, as it allows them to benchmark their performance against industry peers. For example, a startup in the e-commerce space might compare its revenue growth to that of similar companies like Amazon or Shopify.

Discounted cash flow analysis, on the other hand, involves estimating a startup’s future cash flows and discounting them to their present value. This method is useful for startups with a clear path to profitability, as it allows them to demonstrate their potential for future growth. For example, a startup in the software space might estimate its future revenue growth and discount it to its present value using a discount rate.

The venture capital method involves estimating a startup’s value based on its potential for future growth and exit. This method is useful for startups with high growth potential, as it allows them to demonstrate their potential for future returns. For example, a startup in the fintech space might estimate its potential for future growth and exit, and use this to determine its value.

Regardless of the method used, it’s essential to consider multiple factors when determining a startup’s value. These factors might include revenue growth, profitability, market size, and competitive landscape. By considering these factors and using one or more of the methods outlined above, startups can determine a fair and accurate value for their business.

For example, let’s say a startup in the e-commerce space has revenue growth of 20% per year, and is projected to reach profitability within the next two years. Using the comparable company analysis method, the startup might determine its value to be $10 million, based on a comparison to similar companies in the industry. Alternatively, using the discounted cash flow analysis method, the startup might estimate its future cash flows and discount them to their present value, resulting in a value of $12 million.

Ultimately, determining a startup’s value is a complex process that requires careful consideration of multiple factors. By using one or more of the methods outlined above, startups can determine a fair and accurate value for their business, and secure the venture capital funding they need to grow and succeed.

The Art of Negotiation: Tips for Entrepreneurs and Investors

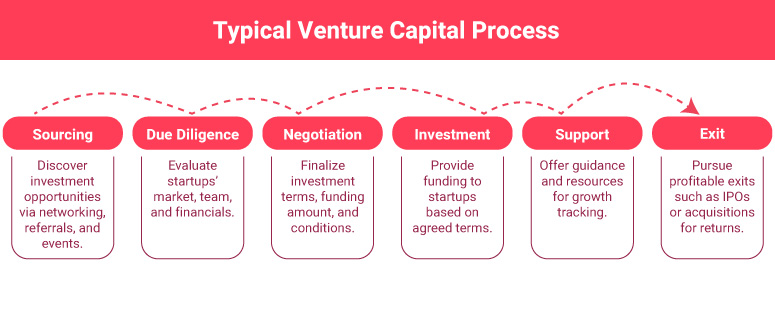

Negotiation is a critical component of venture capital deals, and can make or break a startup’s ability to secure funding. For entrepreneurs, negotiation is an opportunity to showcase their vision and value proposition, while for investors, it’s a chance to assess the startup’s potential for growth and returns. In this section, we’ll explore the art of negotiation in venture capital deals, and provide tips for entrepreneurs and investors on how to navigate the process.

Preparation is key to successful negotiation. Entrepreneurs should come to the table with a clear understanding of their startup’s value proposition, financials, and growth potential. This includes having a solid grasp of their startup’s valuation, and being able to articulate their vision and strategy. Investors, on the other hand, should come prepared with a clear understanding of their investment thesis, and a thorough analysis of the startup’s financials and market potential.

Building relationships is also critical to successful negotiation. Entrepreneurs should take the time to build a rapport with investors, and establish a connection based on shared values and goals. This can involve sharing their personal story, and highlighting their passion and commitment to their startup. Investors, on the other hand, should take the time to understand the entrepreneur’s vision and goals, and be willing to provide guidance and support.

Navigating term sheets can be a complex and daunting task, but it’s essential to getting the deal done. Entrepreneurs should be prepared to negotiate on key terms such as valuation, equity stake, and voting rights. Investors, on the other hand, should be willing to be flexible and accommodating, while also ensuring that their interests are protected.

One of the most common mistakes entrepreneurs make in negotiation is being too rigid or inflexible. This can lead to a breakdown in the negotiation process, and can ultimately result in a failed deal. Instead, entrepreneurs should be willing to listen to investors’ concerns, and be open to compromise and creative solutions.

For example, let’s say an entrepreneur is negotiating a deal with an investor, and the investor is pushing for a higher equity stake. Instead of digging in their heels, the entrepreneur could propose a compromise, such as a performance-based vesting schedule. This would allow the investor to benefit from the startup’s growth, while also giving the entrepreneur more control over their equity.

Ultimately, negotiation is an art that requires skill, strategy, and creativity. By being prepared, building relationships, and navigating term sheets, entrepreneurs and investors can work together to create a successful deal that benefits both parties. Whether you’re an entrepreneur looking to secure funding, or an investor looking to make a smart investment, mastering the art of negotiation is essential to achieving your goals in the venture capital space.

Common Mistakes to Avoid in Startup Valuation

Startup valuation is a complex and nuanced process, and there are several common mistakes that entrepreneurs and investors make when determining a startup’s value. In this section, we’ll highlight some of the most common mistakes to avoid, and provide advice on how to steer clear of these pitfalls.

One of the most common mistakes is overvaluing a startup. This can happen when entrepreneurs are overly optimistic about their startup’s potential, or when investors are eager to get in on a hot deal. Overvaluing a startup can lead to unrealistic expectations, and can ultimately result in a failed investment. To avoid overvaluing, entrepreneurs and investors should take a realistic view of the startup’s financials, market potential, and competitive landscape.

Undervaluing a startup is another common mistake. This can happen when entrepreneurs are too conservative in their valuation, or when investors are too focused on minimizing their risk. Undervaluing a startup can lead to missed opportunities, and can ultimately result in a failed investment. To avoid undervaluing, entrepreneurs and investors should take a thorough view of the startup’s financials, market potential, and competitive landscape.

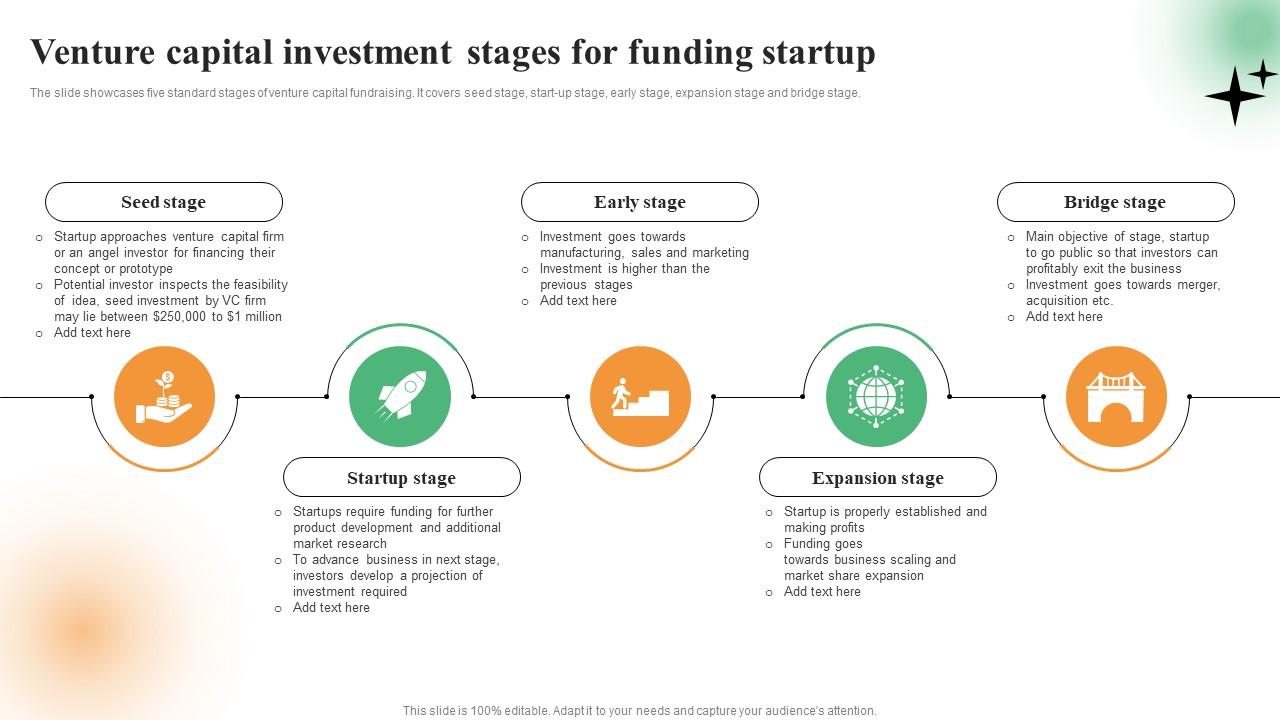

Another common mistake is failing to consider the startup’s stage of development. Startups in different stages of development have different valuation requirements. For example, a startup in the seed stage may require a different valuation approach than a startup in the growth stage. To avoid this mistake, entrepreneurs and investors should consider the startup’s stage of development when determining its value.

Ignoring the competitive landscape is another common mistake. The competitive landscape can have a significant impact on a startup’s valuation, and ignoring it can lead to unrealistic expectations. To avoid this mistake, entrepreneurs and investors should take a thorough view of the competitive landscape, and consider how it may impact the startup’s valuation.

For example, let’s say an entrepreneur is valuing their startup using the comparable company analysis method. However, they fail to consider the competitive landscape, and ignore the fact that their startup is operating in a highly competitive market. As a result, they overvalue their startup, and ultimately struggle to secure funding.

By avoiding these common mistakes, entrepreneurs and investors can ensure that they are determining a startup’s value in a fair and accurate way. This can help to build trust and confidence in the startup, and can ultimately lead to a successful investment.

In the world of venture capital and startup valuation, accuracy and fairness are key. By taking a thorough and realistic view of a startup’s financials, market potential, and competitive landscape, entrepreneurs and investors can avoid common mistakes and ensure that they are making informed investment decisions.

The Role of Financial Projections in Startup Valuation

Financial projections play a crucial role in startup valuation, as they provide a roadmap for the company’s future growth and profitability. In this section, we’ll explore the importance of financial projections in startup valuation, and provide guidance on how to create realistic projections, how to use them to determine valuation, and how to present them to investors.

Creating realistic financial projections is essential for startup valuation. This involves developing a comprehensive financial model that takes into account the company’s historical performance, industry trends, and market conditions. The financial model should include projections for revenue, expenses, profits, and cash flow, as well as key metrics such as customer acquisition costs, customer lifetime value, and retention rates.

When creating financial projections, it’s essential to be realistic and conservative. This means avoiding overly optimistic assumptions and ensuring that the projections are based on solid data and research. It’s also important to consider multiple scenarios, including best-case, worst-case, and most-likely-case scenarios, to provide a comprehensive view of the company’s potential performance.

Once the financial projections are complete, they can be used to determine the startup’s valuation. This involves using the financial projections to estimate the company’s future cash flows, and then discounting those cash flows to their present value. The present value of the future cash flows can then be used to determine the startup’s valuation.

When presenting financial projections to investors, it’s essential to be transparent and clear. This means providing a comprehensive overview of the financial model, including the assumptions and methodology used to create the projections. It’s also important to be prepared to answer questions and provide additional information as needed.

For example, let’s say a startup is seeking funding to launch a new product. The financial projections might include revenue projections of $1 million in the first year, growing to $5 million by the end of year three. The projections might also include expense projections, such as marketing and sales expenses, as well as profit projections. By using these projections to estimate the company’s future cash flows, the startup can determine its valuation and present a compelling case to investors.

In the world of venture capital and startup valuation, financial projections are a critical component of the valuation process. By creating realistic financial projections and using them to determine valuation, startups can provide a clear and compelling picture of their potential for growth and profitability. This can help to build trust and confidence with investors, and ultimately secure the funding needed to drive success.

Case Studies: Successful Startup Valuations and What We Can Learn

Startup valuation is a complex and nuanced process, and there is no one-size-fits-all approach. However, by analyzing successful startup valuations, we can gain insights into what works and what doesn’t. In this section, we’ll present case studies of successful startup valuations, including companies such as Uber, Airbnb, and Facebook.

Uber is a great example of a successful startup valuation. When Uber first launched, it was valued at just $60 million. However, through a series of successful funding rounds, Uber’s valuation grew to over $60 billion. So, what made Uber’s valuation so successful? One key factor was the company’s ability to demonstrate rapid growth and scalability. Uber’s valuation was also driven by its strong financial performance, including revenue growth of over 100% per year.

Airbnb is another example of a successful startup valuation. When Airbnb first launched, it was valued at just $20 million. However, through a series of successful funding rounds, Airbnb’s valuation grew to over $50 billion. So, what made Airbnb’s valuation so successful? One key factor was the company’s ability to demonstrate a strong and growing market demand. Airbnb’s valuation was also driven by its strong financial performance, including revenue growth of over 50% per year.

Facebook is a great example of a successful startup valuation. When Facebook first launched, it was valued at just $500,000. However, through a series of successful funding rounds, Facebook’s valuation grew to over $100 billion. So, what made Facebook’s valuation so successful? One key factor was the company’s ability to demonstrate rapid growth and scalability. Facebook’s valuation was also driven by its strong financial performance, including revenue growth of over 50% per year.

So, what can we learn from these successful startup valuations? One key takeaway is the importance of demonstrating rapid growth and scalability. This can be achieved through a combination of strong financial performance, a growing market demand, and a solid business model. Another key takeaway is the importance of having a strong and experienced management team. This can help to drive growth and scalability, and can also help to attract investors.

Finally, it’s worth noting that startup valuation is a complex and nuanced process, and there is no one-size-fits-all approach. However, by analyzing successful startup valuations, we can gain insights into what works and what doesn’t. By applying these insights to our own startup valuation, we can increase our chances of success and achieve a successful exit.

Industry Benchmarks: Understanding Valuation Multiples and Trends

Industry benchmarks and valuation multiples are essential tools for entrepreneurs and investors to understand the value of a startup. In this section, we’ll provide an overview of industry benchmarks and valuation multiples, including trends and insights from various sectors such as technology, healthcare, and fintech.

Valuation multiples are a common way to measure the value of a startup. They are calculated by dividing the startup’s value by a key metric, such as revenue or earnings. For example, a startup with a valuation of $10 million and revenue of $1 million would have a valuation multiple of 10x. Valuation multiples can vary widely depending on the industry, stage of development, and growth prospects of the startup.

Industry benchmarks are also important for understanding the value of a startup. They provide a framework for comparing the performance of a startup to its peers. For example, a startup in the technology sector might be compared to other startups in the same sector, using metrics such as revenue growth, customer acquisition costs, and retention rates.

Trends in valuation multiples and industry benchmarks can provide valuable insights for entrepreneurs and investors. For example, a trend towards higher valuation multiples in the technology sector might indicate a shift towards more aggressive growth strategies. Similarly, a trend towards lower valuation multiples in the healthcare sector might indicate a shift towards more conservative growth strategies.

Some of the key industry benchmarks and valuation multiples to consider include:

– Technology sector: 10-20x revenue multiple, 5-10x earnings multiple

– Healthcare sector: 5-10x revenue multiple, 3-5x earnings multiple

– Fintech sector: 10-20x revenue multiple, 5-10x earnings multiple

These are just a few examples of industry benchmarks and valuation multiples. The key is to understand the specific trends and insights in your industry, and to use this information to inform your startup valuation.

By understanding industry benchmarks and valuation multiples, entrepreneurs and investors can make more informed decisions about startup valuation. This can help to ensure that startups are valued fairly and accurately, and that investors are able to make informed investment decisions.

Conclusion: Mastering the Art of Startup Valuation for Long-Term Success

Mastering the art of startup valuation is crucial for long-term success in the venture capital landscape. By understanding the current trends and insights, determining a startup’s value, navigating negotiations, avoiding common mistakes, creating realistic financial projections, and understanding industry benchmarks, entrepreneurs and investors can make informed decisions and achieve their goals.

In this article, we have provided a comprehensive guide to startup valuation, covering the key concepts, methods, and best practices. We have also highlighted the importance of mastering the art of startup valuation for long-term success, and provided final tips and advice for entrepreneurs and investors.

Some key takeaways from this article include:

– Understanding the current venture capital landscape and trends is essential for making informed decisions.

– Determining a startup’s value requires a thorough analysis of the company’s financials, market potential, and competitive landscape.

– Negotiation is a critical component of venture capital deals, and requires a deep understanding of the startup’s value and the investor’s goals.

– Avoiding common mistakes, such as overvaluing or undervaluing a company, is crucial for achieving long-term success.

– Creating realistic financial projections is essential for determining a startup’s value and achieving long-term success.

– Understanding industry benchmarks and valuation multiples is crucial for making informed decisions and achieving long-term success.

By mastering the art of startup valuation, entrepreneurs and investors can achieve long-term success and create value in the venture capital landscape. Remember to stay up-to-date with the latest trends and insights, and to always keep a long-term perspective in mind.