Unlocking Growth Potential through Venture Capital

Venture capital funding is a crucial catalyst for business growth, providing companies with the necessary resources to scale and achieve their goals. By injecting capital into promising ventures, venture capital firms enable entrepreneurs to accelerate their growth trajectory, expand their market reach, and enhance their competitiveness. Venture capital funding for growth is particularly essential for startups and early-stage companies, as it helps them navigate the challenges of rapid expansion and establish a strong foundation for long-term success.

When seeking venture capital funding, it’s essential to understand the role of strategic investment in fueling business growth. Venture capital firms invest in companies with high growth potential, providing them with the necessary capital to drive innovation, expand their customer base, and enhance their operational efficiency. In return, venture capital firms receive equity in the company, allowing them to participate in the company’s future growth and profits.

The relationship between venture capital funding and business growth is symbiotic. Venture capital firms provide companies with the necessary resources to scale, while companies provide venture capital firms with the potential for significant returns on investment. By partnering with a venture capital firm, companies can tap into a network of experienced investors, mentors, and industry experts who can provide valuable guidance and support.

Moreover, venture capital funding can help companies overcome common growth obstacles, such as limited resources, inadequate infrastructure, and insufficient talent. By providing companies with the necessary capital to invest in these areas, venture capital firms can help them build a strong foundation for long-term growth and success.

As the business landscape continues to evolve, the importance of venture capital funding for growth will only continue to increase. With the rise of new technologies, changing consumer behaviors, and shifting market trends, companies must be able to adapt quickly and efficiently to remain competitive. Venture capital funding provides companies with the necessary resources to stay ahead of the curve, drive innovation, and achieve their growth objectives

How to Prepare Your Business for Venture Capital Funding

Preparing a business for venture capital funding requires a strategic approach. To increase the chances of securing funding, entrepreneurs must refine their business model, build a strong management team, and develop a compelling pitch. A well-prepared business is more likely to attract the attention of venture capital firms and secure the funding needed to drive growth.

Refining the business model is a critical step in preparing for venture capital funding. This involves identifying the company’s unique value proposition, defining the target market, and developing a competitive strategy. A clear and concise business model will help entrepreneurs articulate their vision and demonstrate their potential for growth.

Building a strong management team is also essential for securing venture capital funding. Venture capital firms invest in people as much as they invest in ideas. A talented and experienced management team can help drive growth, navigate challenges, and make strategic decisions. Entrepreneurs should focus on building a team with a diverse set of skills, expertise, and experience.

Developing a compelling pitch is the final step in preparing for venture capital funding. A pitch should clearly articulate the company’s vision, highlight its unique value proposition, and demonstrate its potential for growth. Entrepreneurs should focus on creating a pitch that is concise, engaging, and persuasive. A well-crafted pitch can help entrepreneurs stand out from the competition and secure the funding they need to drive growth.

In addition to refining the business model, building a strong management team, and developing a compelling pitch, entrepreneurs should also focus on preparing their financials, building a strong network, and demonstrating traction. By taking a holistic approach to preparation, entrepreneurs can increase their chances of securing venture capital funding and driving growth.

By following these steps, entrepreneurs can prepare their business for venture capital funding and increase their chances of securing the funding they need to drive growth. Remember, venture capital funding for growth is a competitive process, and only the most prepared and promising businesses will succeed.

The Venture Capital Funding Process: What to Expect

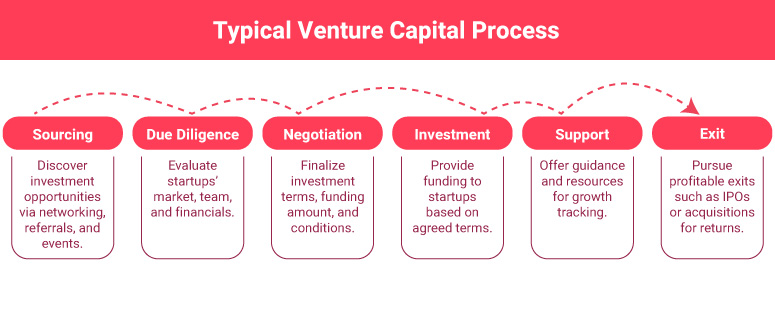

The venture capital funding process can be complex and time-consuming, but understanding what to expect can help entrepreneurs navigate the process with confidence. From initial outreach to due diligence and deal closure, each stage of the process requires careful preparation and attention to detail.

The process typically begins with an initial outreach, where entrepreneurs introduce their business to potential venture capital firms. This can be done through a variety of channels, including networking events, online platforms, and referrals. The goal of this stage is to generate interest and spark a conversation about potential funding opportunities.

Once a venture capital firm has expressed interest, the next stage is due diligence. This involves a thorough review of the business, including its financials, market position, and competitive landscape. Venture capital firms will also conduct interviews with key team members and assess the company’s growth potential.

After due diligence, the venture capital firm will present a term sheet outlining the proposed investment terms. This document will include details such as the investment amount, valuation, and equity stake. Entrepreneurs should carefully review the term sheet and negotiate the terms to ensure they align with their goals and expectations.

Once the term sheet is agreed upon, the next stage is deal closure. This involves finalizing the investment agreement and completing any necessary paperwork. The venture capital firm will also conduct a final review of the business and ensure that all conditions are met before releasing the funds.

Throughout the venture capital funding process, entrepreneurs should be prepared to provide detailed information about their business, including financial projections, market analysis, and competitive strategy. They should also be prepared to answer tough questions and demonstrate their expertise and vision.

By understanding the venture capital funding process and being prepared for each stage, entrepreneurs can increase their chances of securing the funding they need to drive growth and achieve their goals. Venture capital funding for growth can be a powerful catalyst for success, but it requires careful planning, preparation, and execution.

Evaluating Venture Capital Firms: A Guide for Entrepreneurs

When seeking venture capital funding for growth, it’s essential to evaluate potential venture capital firms carefully. With so many firms to choose from, entrepreneurs need to consider several factors to ensure they partner with the right firm. In this article, we’ll provide guidance on how to evaluate venture capital firms, including factors to consider such as investment focus, portfolio companies, and partner expertise.

Investment focus is a critical factor to consider when evaluating venture capital firms. Entrepreneurs should look for firms that have a clear investment strategy and focus on specific industries or sectors. This ensures that the firm has a deep understanding of the market and can provide valuable insights and guidance.

Portfolio companies are another important factor to consider. Entrepreneurs should research the firm’s existing portfolio companies to understand their investment approach and success rate. This can provide valuable insights into the firm’s ability to support growth and drive returns.

Partner expertise is also a key factor to consider. Entrepreneurs should look for firms with partners who have relevant industry experience and a track record of success. This ensures that the firm can provide valuable guidance and support to help drive growth.

In addition to these factors, entrepreneurs should also consider the firm’s reputation, network, and resources. A firm with a strong reputation, extensive network, and significant resources can provide valuable support and guidance to help drive growth.

When evaluating venture capital firms, entrepreneurs should also consider their own needs and goals. What type of support and guidance do they need to drive growth? What are their long-term goals, and how can the firm help them achieve them?

By carefully evaluating venture capital firms and considering these factors, entrepreneurs can increase their chances of securing the right funding and support to drive growth. Venture capital funding for growth can be a powerful catalyst for success, but it requires careful planning and evaluation.

Ultimately, the key to success is finding a venture capital firm that aligns with your goals, values, and vision. By doing your research, evaluating potential firms carefully, and considering your own needs and goals, you can increase your chances of securing the right funding and support to drive growth and achieve your goals.

Common Mistakes to Avoid When Seeking Venture Capital Funding

When seeking venture capital funding for growth, entrepreneurs often make mistakes that can harm their chances of securing funding. In this article, we’ll identify common mistakes entrepreneurs make when seeking venture capital funding and provide guidance on how to avoid them.

Inadequate preparation is a common mistake entrepreneurs make when seeking venture capital funding. This includes failing to refine the business model, not having a clear understanding of the market, and not having a solid financial plan in place. Venture capital firms want to invest in companies that have a clear vision and a well-defined strategy for growth.

Unrealistic valuations are another common mistake entrepreneurs make when seeking venture capital funding. This includes overvaluing the company or expecting too much funding. Venture capital firms want to invest in companies that have a realistic understanding of their worth and are willing to negotiate a fair valuation.

Poor communication is also a common mistake entrepreneurs make when seeking venture capital funding. This includes failing to articulate the company’s vision and strategy, not being transparent about the company’s financials, and not being responsive to the venture capital firm’s questions and concerns. Venture capital firms want to invest in companies that have a clear and compelling story to tell.

Not having a strong management team is another common mistake entrepreneurs make when seeking venture capital funding. Venture capital firms want to invest in companies that have a talented and experienced management team that can execute the company’s strategy and drive growth.

Not having a clear understanding of the venture capital firm’s investment strategy is also a common mistake entrepreneurs make when seeking venture capital funding. Venture capital firms have different investment strategies and focus areas, and entrepreneurs need to understand these before approaching them for funding.

By avoiding these common mistakes, entrepreneurs can increase their chances of securing venture capital funding for growth. It’s essential to be prepared, have a clear understanding of the market and the venture capital firm’s investment strategy, and have a strong management team in place.

Additionally, entrepreneurs should also be prepared to answer tough questions from venture capital firms, such as “What is your unique value proposition?”, “How do you plan to use the funding?”, and “What are your growth projections?”. By being prepared and having a clear understanding of the company’s vision and strategy, entrepreneurs can increase their chances of securing venture capital funding for growth.

Alternatives to Venture Capital Funding: Exploring Other Options

While venture capital funding for growth can be a powerful catalyst for success, it’s not the only option for businesses looking to scale. In this article, we’ll explore alternative funding options for businesses, including angel investors, crowdfunding, and debt financing.

Angel investors are high-net-worth individuals who invest in startups and early-stage companies in exchange for equity. Angel investors can provide valuable guidance and support, as well as access to their network of contacts. However, angel investors typically invest smaller amounts of money than venture capital firms, and may have less influence over the company’s direction.

Crowdfunding is another alternative to venture capital funding. Crowdfunding platforms allow businesses to raise money from a large number of people, typically in exchange for rewards or equity. Crowdfunding can be a great way to validate a product or service, and can also provide valuable marketing and branding opportunities. However, crowdfunding can be time-consuming and may not provide the same level of support and guidance as venture capital funding.

Debt financing is another option for businesses looking to scale. Debt financing involves borrowing money from a lender, such as a bank or credit union, and repaying it with interest. Debt financing can provide quick access to capital, but can also be expensive and may require collateral. Additionally, debt financing may not provide the same level of support and guidance as venture capital funding.

Other alternative funding options for businesses include incubators and accelerators, which provide resources and support to early-stage companies in exchange for equity. There are also government programs and grants that provide funding for businesses that meet certain criteria.

When considering alternative funding options, businesses should carefully evaluate the pros and cons of each option. It’s essential to consider the company’s goals, financial situation, and growth potential when choosing a funding option. Additionally, businesses should carefully review the terms and conditions of any funding agreement to ensure they understand the obligations and responsibilities involved.

By exploring alternative funding options, businesses can find the right fit for their needs and goals. Whether it’s angel investors, crowdfunding, debt financing, or another option, there are many ways for businesses to access the capital they need to scale and succeed.

Ultimately, the key to success is finding a funding option that aligns with the company’s vision and strategy. By carefully evaluating the pros and cons of each option, businesses can make informed decisions and find the right funding partner to help them achieve their goals.

Measuring Success: Key Performance Indicators for Venture-Backed Companies

When it comes to venture capital funding for growth, measuring success is crucial to understanding the effectiveness of the investment. Venture-backed companies need to track key performance indicators (KPIs) to evaluate their progress, identify areas for improvement, and make data-driven decisions. In this article, we will explore the importance of KPIs for venture-backed companies and highlight the most critical metrics to track.

Revenue growth is a fundamental KPI for venture-backed companies. It indicates the company’s ability to scale and increase its top-line revenue. Venture capital firms typically look for companies with high growth potential, and revenue growth is a key metric to measure this potential. Companies should track revenue growth on a quarterly and annual basis to ensure they are meeting their growth targets.

Customer acquisition and retention are also critical KPIs for venture-backed companies. Customer acquisition costs (CAC) and customer lifetime value (CLV) are essential metrics to track. CAC measures the cost of acquiring a new customer, while CLV measures the total value of a customer over their lifetime. Companies should aim to keep CAC low and CLV high to ensure a positive return on investment.

Other important KPIs for venture-backed companies include gross margin, operating expenses, and cash burn rate. Gross margin measures the profitability of a company’s products or services, while operating expenses measure the company’s overhead costs. Cash burn rate measures the rate at which a company is using its cash reserves. Companies should track these metrics to ensure they are operating efficiently and effectively.

In addition to financial metrics, venture-backed companies should also track non-financial KPIs such as customer satisfaction, employee engagement, and product development milestones. These metrics provide valuable insights into the company’s overall health and progress towards its goals.

Regularly reviewing and analyzing KPIs is essential for venture-backed companies to measure their success and make informed decisions. Companies should establish a dashboard or reporting system to track their KPIs and provide regular updates to their venture capital firm. This ensures transparency and accountability, and helps to build trust between the company and its investors.

By tracking the right KPIs, venture-backed companies can optimize their operations, drive growth, and achieve their goals. Venture capital firms can also use KPIs to evaluate the performance of their portfolio companies and provide guidance and support where needed. In the world of venture capital funding for growth, KPIs are a critical component of success.

Long-Term Partnership: Building a Strong Relationship with Your Venture Capital Firm

When it comes to venture capital funding for growth, building a strong, long-term relationship with your venture capital firm is crucial for success. A good partnership can provide valuable guidance, support, and resources to help your business scale and achieve its goals. In this article, we will explore the importance of building a strong relationship with your venture capital firm and provide tips on how to maintain a healthy partnership.

Communication is key to any successful partnership, and this is especially true when it comes to venture capital funding. Regular communication with your venture capital firm can help to build trust, resolve issues quickly, and ensure that everyone is on the same page. This can include regular meetings, updates, and progress reports.

Transparency is also essential for a healthy partnership. Venture-backed companies should be open and transparent about their operations, finances, and challenges. This can help to build trust and ensure that the venture capital firm is well-informed to provide guidance and support.

Mutual support is another critical aspect of a successful partnership. Venture capital firms can provide valuable guidance, resources, and networks to help their portfolio companies grow. In return, venture-backed companies should be willing to listen to feedback, take advice, and work collaboratively with their venture capital firm.

A strong partnership can also help to mitigate risks and overcome challenges. Venture capital firms have a wealth of experience and expertise, and can provide valuable guidance on how to navigate complex issues. By working together, venture-backed companies can tap into this expertise and reduce the risk of failure.

In addition to these benefits, a strong partnership can also help to drive growth and innovation. Venture capital firms can provide access to valuable networks, resources, and expertise, which can help to drive innovation and growth. By working together, venture-backed companies can leverage these resources to achieve their goals.

Building a strong relationship with your venture capital firm takes time and effort, but it is essential for success. By prioritizing communication, transparency, and mutual support, venture-backed companies can build a healthy partnership that drives growth, innovation, and success.

Some best practices for building a strong relationship with your venture capital firm include:

- Regular communication and updates

- Transparency and openness about operations, finances, and challenges

- Mutual support and collaboration

- Active listening and feedback

- Clear goals and expectations

By following these best practices, venture-backed companies can build a strong, long-term relationship with their venture capital firm and drive growth, innovation, and success.