Navigating the World of Venture Capital: What You Need to Know

Venture capital funding is a crucial source of financing for startups, providing the necessary capital to fuel growth, innovation, and scalability. However, the venture capital landscape can be complex and intimidating, especially for first-time entrepreneurs. To navigate this world successfully, it’s essential to understand the basics of venture capital funding and how it differs from other types of funding.

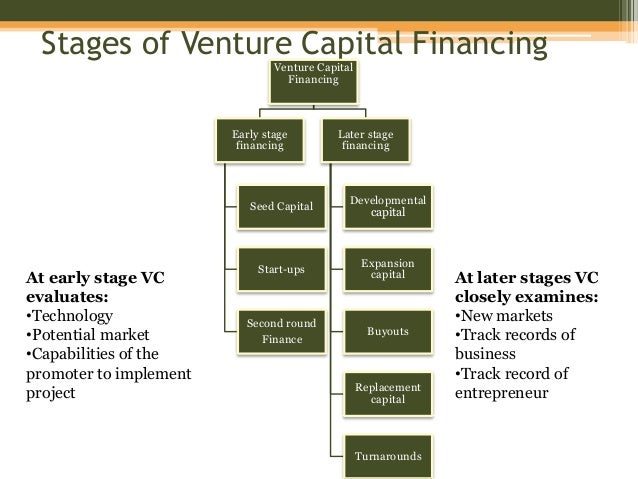

Venture capital funding is a type of private equity investment that is typically provided to early-stage, high-growth companies. Venture capitalists invest in startups in exchange for equity, with the goal of generating a return on investment through eventual exit, such as an initial public offering (IPO) or acquisition. This type of funding is often sought by startups that have a unique value proposition, a strong management team, and a clear path to scalability.

In contrast to venture capital funding, angel investors provide smaller amounts of capital to startups, typically in the seed or early stages. Crowdfunding, on the other hand, involves raising small amounts of capital from a large number of people, usually through online platforms. While these alternative funding options can be useful, venture capital funding offers a more substantial investment and often comes with valuable guidance and mentorship from experienced investors.

According to a report by CB Insights, venture capital funding for startups has been on the rise in recent years, with over $130 billion invested in 2020 alone. This trend is expected to continue, with many venture capitalists looking to invest in innovative startups that have the potential to disrupt industries and create new markets.

For startups seeking venture capital funding, it’s essential to understand the key factors that investors look for in a potential investment. These include a strong management team, a unique value proposition, a clear path to scalability, and a large addressable market. By understanding these factors and preparing accordingly, startups can increase their chances of securing venture capital funding and achieving long-term success.

How to Prepare Your Startup for Venture Capital Funding

Preparing your startup for venture capital funding requires a strategic approach. To increase your chances of securing funding, it’s essential to develop a solid business plan, build a strong team, and create a prototype or minimum viable product (MVP). A well-prepared startup is more likely to attract the attention of venture capitalists and secure the funding needed to drive growth and innovation.

A solid business plan is the foundation of a successful startup. It should outline your company’s mission, vision, and objectives, as well as provide a detailed analysis of your market, competition, and financial projections. A good business plan should also include a clear description of your product or service, your marketing and sales strategy, and your management team.

Building a strong team is also crucial for securing venture capital funding. Venture capitalists look for startups with a talented and experienced management team that can execute on their vision. Your team should have a mix of skills and expertise, including technical, marketing, and financial expertise. A strong team will be able to demonstrate a clear understanding of the market and the competition, and will be able to articulate a compelling vision for the company.

Creating a prototype or MVP is also essential for securing venture capital funding. A prototype or MVP demonstrates your company’s ability to execute on its vision and provides a tangible example of your product or service. It also allows you to test your product or service with potential customers and gather feedback, which can be used to refine and improve your offering.

In addition to these key elements, it’s also important to ensure that your startup is financially prepared for venture capital funding. This includes having a clear understanding of your company’s financials, including your revenue model, cost structure, and cash flow projections. You should also have a clear understanding of your company’s valuation and be prepared to negotiate with venture capitalists.

By developing a solid business plan, building a strong team, and creating a prototype or MVP, you can increase your chances of securing venture capital funding for your startup. Remember to stay focused on your vision and be prepared to adapt to changing market conditions. With the right preparation and mindset, you can attract the attention of venture capitalists and secure the funding needed to drive growth and innovation.

Understanding the Venture Capital Funding Process: From Pitch to Investment

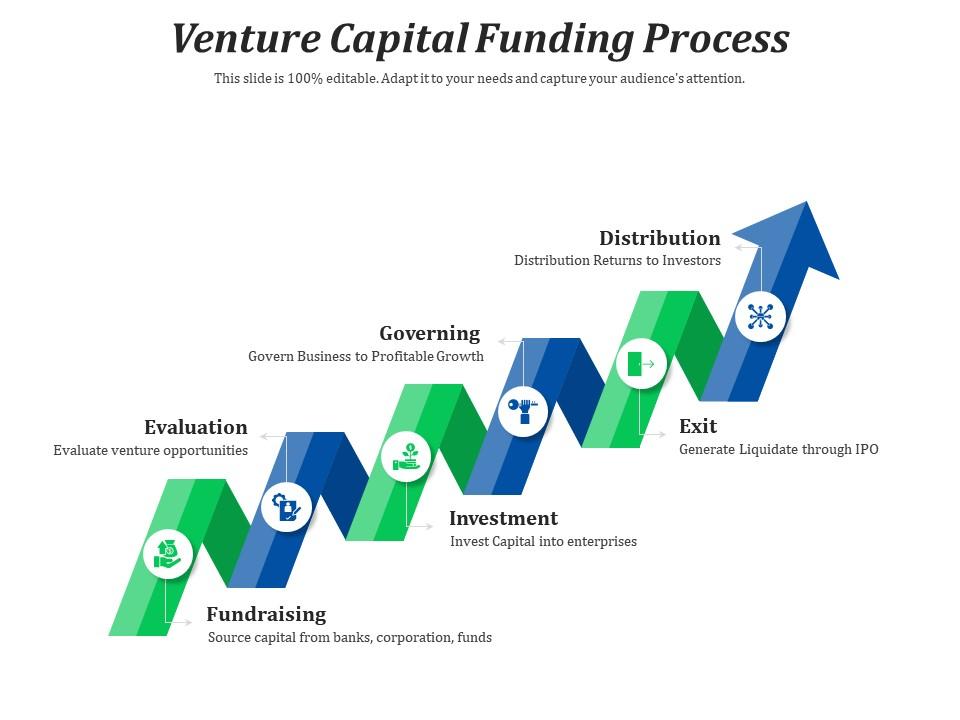

The venture capital funding process can be complex and time-consuming, but understanding the key steps involved can help startups navigate the process more effectively. From creating a persuasive pitch to securing investment, the venture capital funding process involves several critical stages that require careful preparation and execution.

The first step in the venture capital funding process is to create a persuasive pitch. This involves developing a clear and compelling presentation that showcases the startup’s vision, mission, and value proposition. The pitch should highlight the startup’s unique strengths and competitive advantages, as well as its growth potential and scalability. A well-crafted pitch can help startups stand out from the competition and grab the attention of venture capitalists.

Once the pitch is prepared, the next step is to network with venture capitalists. This involves attending industry events, conferences, and networking sessions, as well as leveraging social media and other online platforms to connect with potential investors. Building relationships with venture capitalists can take time, but it’s essential for securing funding and getting valuable feedback and guidance.

After networking with venture capitalists, the next step is to submit a proposal or application for funding. This typically involves providing detailed financial information, market research, and other supporting documentation. Venture capitalists will review the proposal carefully and may request additional information or clarification before moving forward.

If the proposal is successful, the next step is due diligence. This involves a thorough review of the startup’s financials, operations, and management team. Venture capitalists will also conduct market research and analyze the competitive landscape to assess the startup’s potential for growth and returns. Due diligence can be a lengthy and intensive process, but it’s essential for ensuring that the investment is sound and viable.

Finally, if the due diligence process is successful, the venture capitalist will extend an offer to invest in the startup. This typically involves negotiating the terms of the investment, including the valuation, equity stake, and other conditions. Once the terms are agreed upon, the investment is finalized, and the startup receives the funding it needs to drive growth and innovation.

Throughout the venture capital funding process, it’s essential for startups to be prepared, flexible, and responsive. This involves being open to feedback and guidance, as well as being willing to adapt and pivot as needed. By understanding the key steps involved in the venture capital funding process, startups can increase their chances of securing funding and achieving long-term success.

What Venture Capitalists Look for in a Startup: Key Factors for Success

Venture capitalists look for startups that have the potential to generate significant returns on investment. To achieve this, they focus on several key factors that indicate a startup’s potential for success. These factors include market potential, competitive advantage, and scalability.

Market potential refers to the size and growth prospects of the market in which the startup operates. Venture capitalists look for startups that are addressing a large and growing market, with a clear understanding of the target audience and their needs. A strong market potential is essential for generating significant revenue and returns on investment.

Competitive advantage refers to the unique strengths and advantages that a startup has over its competitors. This can include innovative technology, a strong brand, or a unique business model. Venture capitalists look for startups that have a clear competitive advantage, as this indicates a higher potential for success and returns on investment.

Scalability refers to the ability of a startup to grow and expand its operations quickly and efficiently. Venture capitalists look for startups that have a clear plan for scaling, including a strong management team, a scalable business model, and a clear understanding of the resources required to drive growth.

Examples of successful startups that have secured venture capital funding include Airbnb, Uber, and LinkedIn. These startups have demonstrated strong market potential, competitive advantage, and scalability, and have gone on to achieve significant success and returns on investment.

In addition to these key factors, venture capitalists also look for startups with a strong management team, a clear vision and mission, and a well-defined business plan. They also consider the startup’s financials, including revenue growth, profitability, and cash flow.

By understanding the key factors that venture capitalists look for in a startup, entrepreneurs can better prepare their businesses for venture capital funding. This includes developing a strong business plan, building a talented management team, and creating a unique value proposition that sets the startup apart from its competitors.

Ultimately, securing venture capital funding requires a deep understanding of the startup’s strengths and weaknesses, as well as a clear vision for growth and success. By focusing on the key factors that venture capitalists look for, entrepreneurs can increase their chances of securing funding and achieving long-term success.

How to Build Relationships with Venture Capitalists: Networking and Outreach

Building relationships with venture capitalists is a crucial step in securing venture capital funding for your startup. By establishing a strong network of contacts and connections, you can increase your chances of getting noticed and securing funding. In this article, we will explore the importance of networking and outreach in building relationships with venture capitalists.

One of the most effective ways to build relationships with venture capitalists is to attend industry events and conferences. These events provide a platform for startups to showcase their products and services, and for venture capitalists to discover new investment opportunities. By attending these events, you can meet venture capitalists in person, learn about their investment interests, and establish a connection.

Another way to build relationships with venture capitalists is to leverage social media. Social media platforms such as LinkedIn and Twitter provide a great way to connect with venture capitalists, share your startup’s story, and establish a presence in the industry. By engaging with venture capitalists on social media, you can build a relationship and establish a connection that can lead to funding opportunities.

Crafting a compelling email pitch is also an effective way to build relationships with venture capitalists. A well-written email pitch can help you stand out from the competition, showcase your startup’s unique value proposition, and establish a connection with venture capitalists. When crafting an email pitch, make sure to keep it concise, clear, and compelling, and include a clear call to action.

In addition to these strategies, it’s also important to build relationships with venture capitalists through referrals and introductions. By getting introduced to venture capitalists through a mutual connection, you can establish a relationship and increase your chances of getting noticed. This can be done through networking events, industry conferences, or online platforms such as LinkedIn.

Building relationships with venture capitalists takes time and effort, but it’s a crucial step in securing venture capital funding for your startup. By attending industry events, leveraging social media, crafting a compelling email pitch, and building relationships through referrals and introductions, you can establish a strong network of contacts and connections that can lead to funding opportunities.

Remember, building relationships with venture capitalists is not just about securing funding, it’s also about building a partnership that can help your startup grow and succeed. By establishing a strong relationship with venture capitalists, you can gain access to valuable resources, expertise, and networks that can help your startup achieve its goals.

Common Mistakes to Avoid When Seeking Venture Capital Funding

When seeking venture capital funding, startups often make mistakes that can harm their chances of securing investment. These mistakes can range from poor preparation to unrealistic valuations, and can ultimately lead to rejection by venture capitalists. In this article, we will highlight some of the most common mistakes to avoid when seeking venture capital funding.

One of the most common mistakes startups make is poor preparation. This can include failing to develop a solid business plan, not having a clear understanding of the market, and not being able to articulate a compelling value proposition. Venture capitalists want to see that a startup has a clear vision and a well-thought-out plan for growth and success.

Another mistake startups make is having unrealistic valuations. This can include overvaluing the company, not being transparent about financials, and not being willing to negotiate. Venture capitalists want to see that a startup has a realistic understanding of its value and is willing to work with them to find a mutually beneficial agreement.

Inadequate market research is also a common mistake startups make. This can include not understanding the target market, not having a clear understanding of the competition, and not being able to articulate a unique value proposition. Venture capitalists want to see that a startup has a deep understanding of the market and is able to differentiate itself from the competition.

Not having a strong management team is also a mistake startups make. This can include not having a clear organizational structure, not having a strong CEO, and not having a team with the necessary skills and expertise. Venture capitalists want to see that a startup has a strong and experienced management team that is able to execute on the business plan.

Finally, not being prepared for due diligence is a mistake startups make. This can include not having all the necessary financial documents, not being able to answer questions about the business, and not being transparent about the company’s operations. Venture capitalists want to see that a startup is prepared and transparent during the due diligence process.

By avoiding these common mistakes, startups can increase their chances of securing venture capital funding and achieving long-term success. Remember, securing venture capital funding is a competitive process, and startups need to be prepared and professional in order to stand out from the competition.

Alternatives to Venture Capital Funding: Exploring Other Options

While venture capital funding can be a great way to secure investment for your startup, it’s not the only option. There are several alternative funding options available, each with its own advantages and disadvantages. In this article, we will explore some of the most popular alternative funding options for startups, including angel investors, crowdfunding, and bootstrapping.

Angel investors are high net worth individuals who invest in startups in exchange for equity. They often provide valuable guidance and mentorship, in addition to funding. Angel investors are typically interested in startups with high growth potential, and they often invest in the early stages of a company’s development.

Crowdfunding is a way for startups to raise funds from a large number of people, typically through an online platform. This can be a great way to validate a product or service, and to raise funds without giving up equity. However, crowdfunding can be time-consuming and requires a lot of marketing effort to be successful.

Bootstrapping is a way for startups to fund themselves without external investment. This can be done through revenue generated by the business, or through personal savings. Bootstrapping can be a great way to maintain control and ownership of the business, but it can also limit the amount of funding available.

Other alternative funding options for startups include incubators and accelerators, which provide funding and resources in exchange for equity. There are also government programs and grants available for startups, which can provide funding and support without giving up equity.

Examples of successful startups that have used alternative funding options include Kickstarter, which was funded through crowdfunding, and Airbnb, which was funded through angel investors. These startups have gone on to achieve great success and have become household names.

When considering alternative funding options, it’s essential to weigh the pros and cons of each option carefully. Each option has its own advantages and disadvantages, and the right choice will depend on the specific needs and goals of your startup.

Ultimately, the key to securing funding for your startup is to have a solid business plan, a strong team, and a clear vision for growth and success. Whether you choose to pursue venture capital funding or alternative funding options, it’s essential to be prepared and to have a clear understanding of the funding process.

Conclusion: Securing Venture Capital Funding for Long-Term Success

Securing venture capital funding is a crucial step for startups looking to achieve long-term success. By understanding the venture capital funding process, preparing your startup for investment, and building relationships with venture capitalists, you can increase your chances of securing funding and achieving your goals.

In this article, we have discussed the importance of venture capital funding for startups, the key factors that venture capitalists look for in a startup, and the common mistakes to avoid when seeking funding. We have also explored alternative funding options, including angel investors, crowdfunding, and bootstrapping.

Remember, securing venture capital funding is a competitive process, and startups need to be prepared and professional in order to stand out from the competition. By following the tips and advice outlined in this article, you can increase your chances of securing funding and achieving long-term success.

Start preparing your startup for the funding process today. Develop a solid business plan, build a strong team, and create a prototype or minimum viable product (MVP). Network with venture capitalists, attend industry events, and leverage social media to build relationships and get your startup noticed.

With the right preparation and mindset, you can secure venture capital funding and achieve your goals. Don’t be discouraged if you face rejection or setbacks along the way. Keep working towards your vision, and with persistence and determination, you can achieve success.

Securing venture capital funding is just the first step towards achieving long-term success. By focusing on building a strong team, creating a solid business plan, and executing on your vision, you can create a successful and sustainable business that will thrive for years to come.