Navigating the World of Venture Capital

Venture capital investment strategies play a crucial role in the startup ecosystem, enabling entrepreneurs to transform innovative ideas into successful businesses. Informed decision-making is essential for venture capital investors, as it can make all the difference between a profitable investment and a costly mistake. With the rise of startups and the increasing demand for venture capital funding, it’s essential to understand the intricacies of venture capital investment strategies. This article will delve into the world of venture capital, providing insights into the key factors that contribute to successful investments. We’ll explore the different types of venture capital investment models, portfolio diversification strategies, and performance metrics, as well as common mistakes to avoid and real-world examples of successful investments.

The startup ecosystem is rapidly evolving, with new technologies and business models emerging every day. Venture capital investors must stay ahead of the curve, adapting to changing market conditions and identifying promising startup opportunities. By understanding the complexities of venture capital investment strategies, investors can make informed decisions that drive growth and returns. Whether you’re a seasoned investor or just starting out, this article will provide you with the knowledge and insights needed to navigate the world of venture capital and make successful investments.

Effective venture capital investment strategies involve a combination of art and science. Investors must balance their intuition and experience with data-driven insights and rigorous analysis. By doing so, they can identify startups with high growth potential and make informed investment decisions. In the following sections, we’ll explore the key factors that contribute to successful venture capital investments, including market demand, competitive landscape, and team dynamics.

How to Identify Promising Startup Opportunities

Identifying promising startup opportunities is a critical component of successful venture capital investment strategies. To make informed investment decisions, investors must evaluate a startup’s potential based on several key factors, including market demand, competitive landscape, and team dynamics. Market demand is a crucial consideration, as it determines the startup’s potential for growth and scalability. Investors should assess the size of the target market, the level of competition, and the startup’s unique value proposition.

The competitive landscape is another essential factor to consider when evaluating startup potential. Investors should analyze the startup’s position within the market, its competitive advantages, and its ability to differentiate itself from competitors. A thorough analysis of the competitive landscape can help investors identify potential risks and opportunities, and make more informed investment decisions.

Team dynamics are also a critical consideration when evaluating startup potential. A strong, experienced management team can make all the difference in a startup’s success. Investors should assess the team’s track record, their level of expertise, and their ability to execute on the startup’s vision. A well-rounded team with a clear vision and a strong work ethic can help drive a startup’s growth and success.

To conduct thorough research and due diligence, investors should gather as much information as possible about the startup, including its financials, product roadmap, and competitive landscape. This information can be gathered through a variety of sources, including the startup’s website, social media, and industry reports. Investors should also conduct interviews with the startup’s management team and other key stakeholders to gain a deeper understanding of the startup’s vision and potential.

Understanding Venture Capital Investment Models

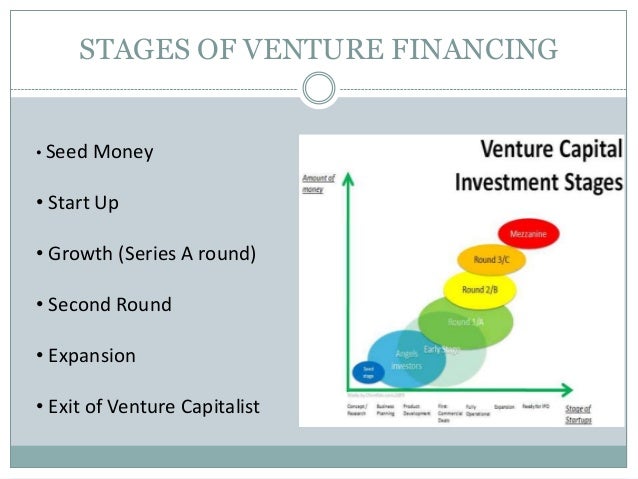

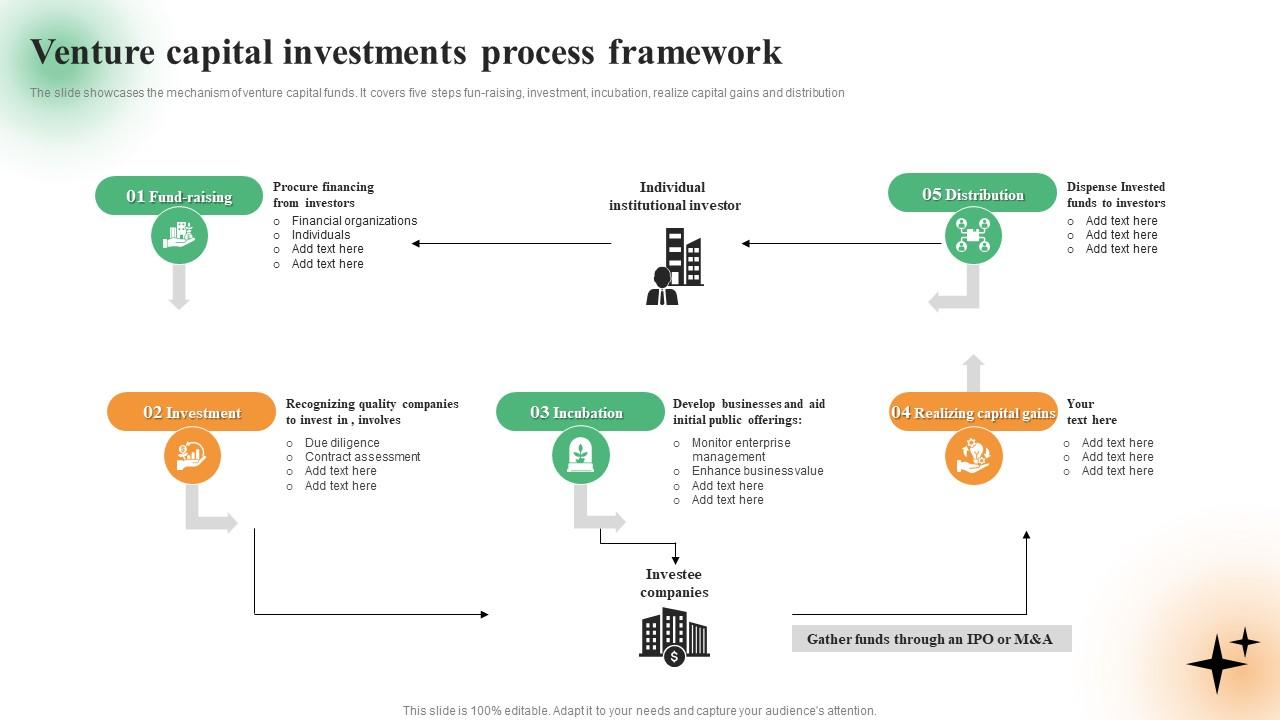

Venture capital investment models are designed to provide startups with the necessary funding to grow and scale their businesses. There are several types of venture capital investment models, each with its own advantages and disadvantages. Equity financing is one of the most common models, where investors provide funding in exchange for a percentage of ownership in the startup. This model allows startups to raise capital without taking on debt, but it also means that investors have a say in the company’s decision-making process.

Debt financing is another type of venture capital investment model, where startups borrow money from investors and repay it with interest. This model can be beneficial for startups that need to raise capital quickly, but it can also be risky if the startup is unable to repay the debt. Hybrid models, which combine elements of equity and debt financing, are also becoming increasingly popular. These models allow startups to raise capital while minimizing the amount of equity they give up.

The choice of venture capital investment model depends on the startup’s specific needs and goals. Equity financing may be suitable for startups that are looking to raise a large amount of capital and are willing to give up some ownership. Debt financing may be more suitable for startups that need to raise capital quickly and are confident in their ability to repay the debt. Hybrid models may be the best option for startups that want to raise capital while minimizing the amount of equity they give up.

When evaluating venture capital investment models, investors should consider the startup’s financial situation, its growth potential, and its competitive landscape. They should also assess the startup’s management team and its ability to execute on its business plan. By carefully evaluating these factors, investors can make informed decisions about which venture capital investment model is best for the startup.

In addition to the type of investment model, investors should also consider the terms of the investment, including the valuation, the amount of capital raised, and the ownership percentage. They should also evaluate the startup’s exit strategy and its potential for returns on investment. By carefully evaluating these factors, investors can make informed decisions about which venture capital investment model is best for the startup and which will provide the best returns on investment.

Portfolio Diversification Strategies for Venture Capital Investors

Portfolio diversification is a crucial aspect of venture capital investment strategies, as it helps to minimize risk and maximize returns. By spreading investments across different sectors, geographies, and stages of development, venture capital investors can reduce their exposure to any one particular investment and increase their potential for returns. In this section, we will discuss the importance of portfolio diversification and provide examples of successful diversification strategies.

Sector-specific investments are one way to diversify a venture capital portfolio. By investing in companies across different sectors, such as technology, healthcare, and finance, investors can reduce their reliance on any one particular sector and increase their potential for returns. For example, a venture capital firm may invest in a portfolio of companies that includes a software company, a biotech company, and a fintech company.

Geographic diversification is another way to diversify a venture capital portfolio. By investing in companies across different regions, such as the United States, Europe, and Asia, investors can reduce their exposure to any one particular market and increase their potential for returns. For example, a venture capital firm may invest in a portfolio of companies that includes a US-based software company, a European-based biotech company, and an Asian-based fintech company.

Stage-specific investments are also a way to diversify a venture capital portfolio. By investing in companies at different stages of development, such as seed, early-stage, and growth-stage, investors can reduce their exposure to any one particular stage and increase their potential for returns. For example, a venture capital firm may invest in a portfolio of companies that includes a seed-stage software company, an early-stage biotech company, and a growth-stage fintech company.

In addition to sector-specific, geographic, and stage-specific investments, venture capital investors can also diversify their portfolios by investing in different types of companies, such as business-to-business (B2B) and business-to-consumer (B2C) companies. By investing in a mix of B2B and B2C companies, investors can reduce their exposure to any one particular type of company and increase their potential for returns.

By diversifying their portfolios, venture capital investors can reduce their risk and increase their potential for returns. However, diversification is not a one-time event, but rather an ongoing process that requires continuous monitoring and rebalancing of the portfolio. By regularly reviewing and adjusting their portfolios, venture capital investors can ensure that they are well-positioned to take advantage of new opportunities and minimize their exposure to risk.

Measuring Venture Capital Investment Performance

Evaluating the success of venture capital investments is crucial for investors to refine their strategies, optimize portfolio performance, and make informed decisions. To accurately measure venture capital investment performance, investors rely on several key metrics that provide insights into the financial health and growth potential of their portfolio companies.

One of the primary metrics used to evaluate venture capital investment performance is the internal rate of return (IRR). IRR measures the annual return on investment, taking into account the timing and magnitude of cash inflows and outflows. A higher IRR indicates better performance, but it’s essential to consider the investment’s risk profile and liquidity when interpreting this metric.

Cash-on-cash return is another important metric, which calculates the total return on investment by dividing the total cash distributed by the initial investment amount. This metric provides a clear picture of the investment’s profitability, but it may not account for the time value of money.

Multiples of invested capital (MOIC) is a metric that measures the return on investment by dividing the total value of the investment by the initial investment amount. MOIC provides a simple and intuitive way to evaluate investment performance, but it may not capture the nuances of the investment’s cash flow profile.

Regular portfolio monitoring and rebalancing are critical to optimizing venture capital investment performance. Investors should regularly review their portfolio companies’ financials, assess market trends, and adjust their investment strategies as needed. This proactive approach enables investors to identify potential issues early, capitalize on new opportunities, and maximize returns.

Effective performance measurement is essential for venture capital investors to refine their investment strategies, optimize portfolio performance, and drive long-term success. By leveraging metrics such as IRR, cash-on-cash return, and MOIC, investors can gain valuable insights into their portfolio companies’ financial health and growth potential, ultimately informing data-driven investment decisions that drive superior returns.

By incorporating these metrics into their investment approach, venture capital investors can develop a comprehensive understanding of their portfolio’s performance, identify areas for improvement, and make informed decisions that drive long-term success. As the venture capital landscape continues to evolve, investors who prioritize performance measurement and adapt to changing market conditions will be best positioned to thrive.

Common Mistakes to Avoid in Venture Capital Investing

Venture capital investing can be a lucrative and rewarding experience, but it also comes with its fair share of risks and challenges. To maximize returns and minimize losses, it’s essential to be aware of common pitfalls that can derail even the most well-intentioned investment strategies. By understanding these mistakes and taking steps to mitigate them, venture capital investors can make more informed decisions and achieve greater success.

One of the most significant mistakes venture capital investors make is inadequate due diligence. This involves failing to thoroughly research and vet potential investments, which can lead to costly surprises down the line. To avoid this mistake, investors should conduct exhaustive research on the company, its management team, and the market it operates in. This includes reviewing financial statements, assessing the competitive landscape, and evaluating the company’s growth potential.

Poor investment timing is another common mistake venture capital investors make. This involves investing too early or too late in a company’s life cycle, which can result in suboptimal returns. To avoid this mistake, investors should carefully consider the company’s stage of development, its growth prospects, and the overall market conditions before making an investment.

Insufficient portfolio diversification is also a common mistake venture capital investors make. This involves over-investing in a single company or sector, which can lead to excessive risk and reduced returns. To avoid this mistake, investors should strive to maintain a diversified portfolio that includes a mix of companies across different sectors and stages of development.

Failure to monitor and adjust investment strategies is another mistake venture capital investors make. This involves failing to regularly review and rebalance the portfolio, which can result in missed opportunities and suboptimal returns. To avoid this mistake, investors should regularly review their portfolio companies’ financials, assess market trends, and adjust their investment strategies as needed.

Finally, venture capital investors should be aware of the risks associated with investing in companies with weak governance structures or inadequate management teams. This can include companies with poor financial reporting, inadequate risk management, or weak corporate governance. To avoid this mistake, investors should carefully evaluate the company’s governance structure and management team before making an investment.

By being aware of these common mistakes and taking steps to mitigate them, venture capital investors can make more informed decisions and achieve greater success. By incorporating best practices into their investment approach, investors can minimize risk, maximize returns, and drive long-term success in the venture capital ecosystem.

Effective venture capital investment strategies require a combination of thorough research, careful planning, and ongoing monitoring. By avoiding common mistakes and staying focused on long-term goals, investors can navigate the complex world of venture capital and achieve superior returns. As the venture capital landscape continues to evolve, investors who prioritize informed decision-making and adapt to changing market conditions will be best positioned to thrive.

Real-World Examples of Successful Venture Capital Investments

Venture capital investments have played a crucial role in the success of many high-growth companies. By analyzing real-world examples of successful venture capital investments, investors can gain valuable insights into the key factors that contribute to a company’s success. In this section, we’ll explore the stories of Uber, Airbnb, and Facebook, and examine the lessons that can be applied to future investments.

Uber, the ride-hailing giant, is a prime example of a successful venture capital investment. In 2010, Uber raised $1.25 million in seed funding from investors such as First Round Capital and Benchmark Capital. Over the next several years, Uber continued to raise additional funding, eventually reaching a valuation of over $80 billion. The key to Uber’s success was its ability to identify a significant market opportunity and execute a scalable business model.

Airbnb, the online marketplace for short-term rentals, is another example of a successful venture capital investment. In 2009, Airbnb raised $7.2 million in seed funding from investors such as Sequoia Capital and Greylock Partners. Today, Airbnb is valued at over $50 billion and has become one of the largest online marketplaces in the world. The key to Airbnb’s success was its ability to create a unique and scalable business model that disrupted the traditional hospitality industry.

Facebook, the social media giant, is a classic example of a successful venture capital investment. In 2005, Facebook raised $500,000 in seed funding from investors such as Peter Thiel and Reid Hoffman. Over the next several years, Facebook continued to raise additional funding, eventually reaching a valuation of over $500 billion. The key to Facebook’s success was its ability to identify a significant market opportunity and execute a scalable business model.

So what can we learn from these examples? First, it’s clear that identifying a significant market opportunity is critical to success. Each of these companies identified a unique need in the market and created a scalable business model to address it. Second, execution is key. Each of these companies was able to execute its business model effectively, which enabled it to achieve rapid growth and scale. Finally, the right venture capital investment strategies can make all the difference. By providing critical funding and support, venture capital investors can help companies achieve their full potential.

By analyzing these real-world examples of successful venture capital investments, investors can gain valuable insights into the key factors that contribute to a company’s success. By applying these lessons to future investments, investors can increase their chances of success and achieve superior returns in the venture capital ecosystem.

These examples demonstrate the importance of venture capital investment strategies in driving growth and innovation. By providing critical funding and support, venture capital investors can help companies achieve their full potential and create significant value for investors. As the venture capital ecosystem continues to evolve, investors who prioritize informed decision-making and adapt to changing market conditions will be best positioned to thrive.

Staying Ahead of the Curve in Venture Capital Investing

The venture capital ecosystem is constantly evolving, with new trends, technologies, and regulatory changes emerging all the time. To stay ahead of the curve and achieve success in venture capital investing, it’s essential to stay informed and adapt to changing market conditions. In this section, we’ll explore the importance of staying informed and offer tips on how to stay ahead of the curve.

Market trends are a key factor to consider in venture capital investing. Staying on top of the latest trends and developments can help investors identify new opportunities and avoid potential pitfalls. For example, the rise of artificial intelligence and machine learning has created new opportunities for investment in companies that specialize in these areas.

Technological advancements are also crucial to consider in venture capital investing. New technologies can create new opportunities for investment and disrupt existing industries. For example, the rise of blockchain technology has created new opportunities for investment in companies that specialize in this area.

Regulatory changes are also important to consider in venture capital investing. Changes in regulations can impact the viability of certain investments and create new opportunities for others. For example, changes in tax laws can impact the attractiveness of certain investments and create new opportunities for others.

So how can investors stay ahead of the curve in venture capital investing? First, it’s essential to stay informed about market trends, technological advancements, and regulatory changes. This can be achieved by reading industry publications, attending conferences, and networking with other investors and entrepreneurs.

Second, it’s essential to be adaptable and willing to pivot when necessary. Venture capital investing is a dynamic and rapidly changing field, and investors must be able to adapt quickly to changing market conditions.

Third, it’s essential to have a strong network of contacts and connections in the venture capital ecosystem. This can include other investors, entrepreneurs, and industry experts. By leveraging these connections, investors can gain valuable insights and stay ahead of the curve.

Finally, it’s essential to have a clear and well-defined investment strategy. This can help investors stay focused and avoid getting caught up in the latest trends and fads. By having a clear strategy, investors can make informed decisions and achieve their investment goals.

By staying informed, being adaptable, and having a strong network of contacts and connections, investors can stay ahead of the curve in venture capital investing and achieve success. By incorporating these strategies into their investment approach, investors can maximize their returns and achieve their investment goals.

Staying ahead of the curve in venture capital investing requires a combination of knowledge, adaptability, and strategy. By staying informed about market trends, technological advancements, and regulatory changes, investors can identify new opportunities and avoid potential pitfalls. By being adaptable and willing to pivot when necessary, investors can stay ahead of the curve and achieve success.