Navigating the World of Venture Capital

Venture capital investment has become a crucial component of the startup ecosystem, providing funding for innovative businesses and promoting economic growth. Venture capital firms play a vital role in identifying and supporting promising startups, helping them to scale and achieve their full potential. With the rise of the digital age, venture capital investment has become increasingly important, as it enables entrepreneurs to turn their ideas into reality and create new industries and job opportunities.

In recent years, venture capital investment has experienced significant growth, with more and more firms entering the market. This has led to increased competition for startups seeking funding, making it essential for entrepreneurs to develop a deep understanding of venture capital investment strategies. By understanding the different types of venture capital investments, the key factors that investors consider, and the importance of due diligence, startups can increase their chances of securing funding and achieving success.

Venture capital investment is not just about providing funding; it’s also about providing guidance and support to startups. Venture capital firms often have a network of experienced professionals who can offer valuable advice and mentorship to entrepreneurs. This can be particularly beneficial for startups that are looking to scale quickly and enter new markets.

Furthermore, venture capital investment can have a significant impact on the economy. By supporting innovative businesses, venture capital firms can help to create new industries and job opportunities, which can have a positive impact on economic growth. Additionally, venture capital investment can also help to drive innovation, as startups are often at the forefront of developing new technologies and products.

As the startup ecosystem continues to evolve, it’s likely that venture capital investment will play an increasingly important role. With more and more startups emerging, the demand for venture capital funding is likely to increase, making it essential for entrepreneurs to develop a deep understanding of venture capital investment strategies. By understanding the different types of venture capital investments, the key factors that investors consider, and the importance of due diligence, startups can increase their chances of securing funding and achieving success.

How to Develop a Winning Investment Strategy

Developing a well-thought-out investment strategy is crucial for success in venture capital investing. A winning investment strategy involves identifying promising startups, assessing market trends, and mitigating risks. To achieve this, investors must conduct thorough research and analysis of the startup ecosystem, including market size, growth potential, and competitive landscape.

One key aspect of a winning investment strategy is identifying promising startups. This involves evaluating the startup’s team, product, and market potential. Investors should look for startups with a strong and experienced management team, a unique and innovative product, and a large and growing market. Additionally, investors should assess the startup’s financial projections, including revenue growth, profitability, and cash flow.

Assessing market trends is also critical for a winning investment strategy. Investors should stay up-to-date with the latest market trends and developments, including changes in consumer behavior, technological advancements, and regulatory changes. This involves reading industry publications, attending conferences, and networking with other investors and entrepreneurs.

Mitigating risks is another essential aspect of a winning investment strategy. Investors should conduct thorough due diligence on potential investments, including evaluating the startup’s financials, management team, and market potential. Additionally, investors should diversify their portfolio by investing in a range of startups across different industries and stages of development.

By developing a well-thought-out investment strategy, investors can increase their chances of success in venture capital investing. This involves identifying promising startups, assessing market trends, and mitigating risks. By following these strategies, investors can build a strong portfolio of startups and achieve long-term returns on their investments.

Furthermore, a winning investment strategy should also include a clear exit plan. Investors should consider how they will exit their investments, including through initial public offerings (IPOs), mergers and acquisitions (M&As), or sales to other investors. This involves evaluating the startup’s growth potential, market trends, and competitive landscape.

By incorporating these strategies into their investment approach, investors can develop a winning investment strategy that drives long-term returns and success in venture capital investing. By staying focused on identifying promising startups, assessing market trends, and mitigating risks, investors can build a strong portfolio of startups and achieve their investment goals.

Understanding the Different Types of Venture Capital Investments

Venture capital investments come in various forms, each with its own unique characteristics and benefits. Understanding the different types of venture capital investments is crucial for entrepreneurs and investors alike, as it can help them navigate the complex world of venture capital and make informed decisions.

Seed funding is the earliest stage of venture capital investment, typically provided to startups in the idea or prototype phase. This type of funding is usually provided by angel investors, incubators, or accelerators, and is used to support the development of a product or service. Examples of successful companies that have received seed funding include Airbnb and Uber.

Series A funding is the next stage of venture capital investment, typically provided to startups that have a proven product or service and are looking to scale. This type of funding is usually provided by venture capital firms and is used to support the growth and expansion of the business. Examples of successful companies that have received Series A funding include Facebook and Twitter.

Series B and C funding are later stages of venture capital investment, typically provided to startups that have achieved significant growth and are looking to further expand their business. This type of funding is usually provided by venture capital firms and is used to support the continued growth and development of the business. Examples of successful companies that have received Series B and C funding include LinkedIn and Pinterest.

Growth equity is a type of venture capital investment that is provided to established businesses that are looking to further accelerate their growth. This type of funding is usually provided by private equity firms and is used to support the expansion of the business through acquisitions, new product development, or other strategic initiatives. Examples of successful companies that have received growth equity include Amazon and Google.

Understanding the different types of venture capital investments is crucial for entrepreneurs and investors alike, as it can help them navigate the complex world of venture capital and make informed decisions. By understanding the characteristics and benefits of each type of investment, entrepreneurs can better position themselves to secure funding and achieve their business goals.

Moreover, understanding the different types of venture capital investments can also help investors to develop effective venture capital investment strategies. By understanding the risks and rewards associated with each type of investment, investors can make more informed decisions about where to allocate their capital and how to manage their portfolio.

Key Considerations for Venture Capital Investors

When evaluating potential investments, venture capital investors must consider several key factors to ensure that they are making informed decisions. These factors include team dynamics, market size, competitive landscape, and financial projections.

Team dynamics are a critical consideration for venture capital investors. A strong and experienced management team is essential for the success of any startup. Investors should look for teams with a proven track record of success, a clear vision for the company, and a strong work ethic.

Market size is another important consideration for venture capital investors. A large and growing market is essential for the success of any startup. Investors should look for markets with a strong potential for growth, a clear demand for the product or service, and a competitive landscape that is not too crowded.

The competitive landscape is also a key consideration for venture capital investors. A startup must be able to differentiate itself from its competitors and establish a strong market position. Investors should look for startups with a unique value proposition, a strong brand identity, and a clear plan for competing in the market.

Financial projections are also a critical consideration for venture capital investors. A startup must have a clear plan for generating revenue and achieving profitability. Investors should look for startups with a strong financial model, a clear plan for managing cash flow, and a realistic plan for achieving profitability.

By considering these key factors, venture capital investors can make informed decisions about which startups to invest in and how to structure their investments. This can help to minimize risk and maximize returns, which is essential for the success of any venture capital investment strategy.

In addition to these key factors, venture capital investors should also consider the startup’s technology, intellectual property, and regulatory environment. A startup with a strong technology platform, a clear plan for protecting its intellectual property, and a thorough understanding of the regulatory environment is more likely to succeed.

Furthermore, venture capital investors should also consider the startup’s exit strategy. A clear plan for exiting the investment, whether through an initial public offering (IPO), merger and acquisition (M&A), or other means, is essential for maximizing returns.

The Role of Due Diligence in Venture Capital Investing

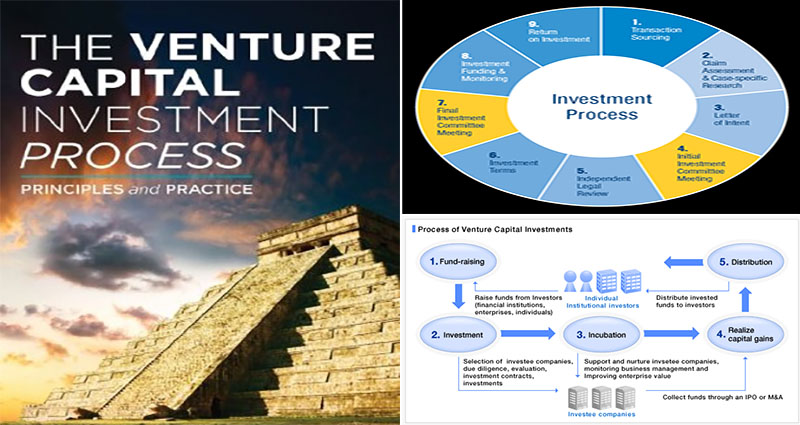

Due diligence is a critical component of venture capital investing, as it enables investors to thoroughly evaluate the potential risks and rewards of an investment. The due diligence process involves a comprehensive review of the startup’s business plan, financial projections, management team, and market potential.

The initial screening stage of due diligence involves a preliminary review of the startup’s business plan and financial projections. This stage helps investors to identify potential red flags and determine whether the startup is a good fit for their investment strategy.

The financial analysis stage of due diligence involves a detailed review of the startup’s financial statements, including its income statement, balance sheet, and cash flow statement. This stage helps investors to evaluate the startup’s financial health and identify potential areas for improvement.

The legal review stage of due diligence involves a review of the startup’s legal documents, including its articles of incorporation, bylaws, and contracts. This stage helps investors to identify potential legal risks and ensure that the startup is in compliance with all relevant laws and regulations.

Due diligence is an essential part of venture capital investing, as it enables investors to make informed decisions about which startups to invest in. By thoroughly evaluating the potential risks and rewards of an investment, investors can minimize their risk and maximize their returns.

In addition to the stages of due diligence mentioned above, investors should also consider other factors, such as the startup’s management team, market potential, and competitive landscape. A strong management team, a large and growing market, and a competitive landscape that is not too crowded are all essential components of a successful startup.

Furthermore, due diligence is not a one-time process, but rather an ongoing process that continues throughout the investment cycle. Investors should regularly monitor the startup’s progress and adjust their investment strategy as needed.

By incorporating due diligence into their investment strategy, venture capital investors can minimize their risk and maximize their returns. This is essential for achieving success in the competitive world of venture capital investing.

Managing Risk and Maximizing Returns in Venture Capital

Effective management of risk and return is crucial for venture capital investors seeking to generate substantial returns on their investments. A well-structured venture capital investment strategy can help mitigate potential risks and maximize returns. In this context, diversification plays a vital role in spreading risk across various asset classes, industries, and geographies. By investing in a diverse portfolio of startups, venture capital firms can reduce their exposure to any one particular company or market, thereby minimizing potential losses.

Portfolio management is another critical aspect of venture capital investing. It involves actively monitoring and adjusting the portfolio to ensure that it remains aligned with the investor’s overall strategy and risk tolerance. This may involve rebalancing the portfolio by adjusting the allocation of funds to different asset classes or industries, or by exiting underperforming investments. By regularly reviewing and adjusting their portfolios, venture capital investors can optimize their returns and minimize losses.

Exit planning is also essential for venture capital investors seeking to maximize returns. This involves developing a clear strategy for exiting investments, whether through an initial public offering (IPO), merger and acquisition (M&A), or other means. By having a well-defined exit strategy in place, venture capital investors can ensure that they are able to realize the full value of their investments and generate substantial returns.

In addition to these strategies, venture capital investors can also employ various risk management techniques to mitigate potential risks. These may include conducting thorough due diligence on potential investments, negotiating favorable deal terms, and monitoring portfolio companies closely. By employing these risk management techniques, venture capital investors can minimize potential losses and maximize returns.

Furthermore, venture capital investors can also leverage data analytics and machine learning algorithms to gain insights into market trends and identify potential investment opportunities. By analyzing large datasets and identifying patterns and correlations, venture capital investors can make more informed investment decisions and optimize their portfolios.

In conclusion, managing risk and maximizing returns is critical for venture capital investors seeking to generate substantial returns on their investments. By employing a well-structured venture capital investment strategy, diversifying their portfolios, and leveraging data analytics and machine learning algorithms, venture capital investors can optimize their returns and minimize losses. By following these strategies, venture capital investors can stay ahead of the curve and achieve success in the competitive world of venture capital investing.

Real-World Examples of Successful Venture Capital Investments

Several successful companies have received venture capital investments, which have played a crucial role in their growth and success. One such example is Uber, which received its first venture capital investment in 2010 from First Round Capital. This investment helped Uber expand its operations and improve its services, ultimately leading to its current status as a global leader in the ride-hailing industry.

Another example is Airbnb, which received its first venture capital investment in 2009 from Sequoia Capital. This investment helped Airbnb expand its user base and improve its platform, ultimately leading to its current status as a global leader in the online marketplace for short-term vacation rentals.

Facebook is another example of a successful company that received venture capital investments. In 2005, Facebook received its first venture capital investment from Accel Partners, which helped the company expand its user base and improve its platform. This investment ultimately led to Facebook’s current status as a global leader in social media.

These examples demonstrate the importance of venture capital investments in helping startups grow and succeed. By providing the necessary funding and support, venture capital firms can help startups overcome the challenges they face and achieve their full potential.

In addition to these examples, there are many other successful companies that have received venture capital investments. These companies include LinkedIn, which received its first venture capital investment in 2003 from Sequoia Capital, and Twitter, which received its first venture capital investment in 2007 from Union Square Ventures.

These examples demonstrate the effectiveness of venture capital investment strategies in helping startups grow and succeed. By identifying promising startups and providing them with the necessary funding and support, venture capital firms can help these companies achieve their full potential and generate substantial returns on investment.

Furthermore, these examples also highlight the importance of venture capital firms in promoting innovation and economic growth. By providing funding and support to startups, venture capital firms can help these companies develop new products and services, create jobs, and stimulate economic growth.

In conclusion, the examples of Uber, Airbnb, Facebook, LinkedIn, and Twitter demonstrate the importance of venture capital investments in helping startups grow and succeed. By providing the necessary funding and support, venture capital firms can help these companies achieve their full potential and generate substantial returns on investment.

Staying Ahead of the Curve in Venture Capital Investing

The venture capital landscape is constantly evolving, with new trends, technologies, and innovations emerging every year. To stay ahead of the curve, venture capital investors must be proactive in staying informed and adapting to these changes. One way to do this is by attending industry conferences and events, where investors can network with other professionals, learn about the latest trends and developments, and gain insights from industry experts.

Reading industry publications and online resources is another way to stay informed about the latest developments in venture capital investing. This can include publications such as Venture Capital Journal, Private Equity International, and Forbes, as well as online resources such as VentureBeat, TechCrunch, and PitchBook. By staying up-to-date with the latest news and trends, venture capital investors can gain a competitive edge and make more informed investment decisions.

Networking with other investors and industry professionals is also essential for staying ahead of the curve in venture capital investing. This can include joining industry associations, attending networking events, and participating in online forums and discussion groups. By building relationships with other investors and industry professionals, venture capital investors can gain access to valuable insights, advice, and deal flow.

In addition to these strategies, venture capital investors can also leverage technology to stay ahead of the curve. This can include using data analytics and machine learning algorithms to identify trends and patterns in the market, as well as utilizing online platforms and tools to streamline the investment process and improve portfolio management.

Finally, venture capital investors must be willing to adapt and evolve their investment strategies in response to changing market conditions. This can include shifting focus to new industries or sectors, adjusting investment thesis, and exploring new investment opportunities. By being agile and responsive to changing market conditions, venture capital investors can stay ahead of the curve and achieve long-term success.

By following these strategies, venture capital investors can stay informed, adapt to changing market conditions, and achieve long-term success in the competitive world of venture capital investing. Whether through attending industry conferences, reading industry publications, networking with other investors, leveraging technology, or adapting investment strategies, there are many ways for venture capital investors to stay ahead of the curve and achieve their investment goals.

Ultimately, the key to success in venture capital investing is to stay informed, be proactive, and be willing to adapt and evolve. By following these principles, venture capital investors can navigate the complex and ever-changing landscape of venture capital investing and achieve long-term success.