Mastering the Art of Venture Capital Investing

Venture capital investment strategies play a crucial role in the startup ecosystem, as they enable investors to make informed decisions and maximize returns. A well-crafted strategy can lead to successful investments and substantial returns, making it essential for venture capital investors to develop a deep understanding of the startup landscape. By leveraging venture capital investment strategies, investors can navigate the complexities of the startup ecosystem and identify opportunities that align with their investment goals.

In today’s fast-paced startup environment, venture capital investors must be equipped with the knowledge and expertise to make informed investment decisions. This requires a thorough understanding of the startup ecosystem, including the latest trends, technologies, and innovations. By staying ahead of the curve, venture capital investors can identify emerging opportunities and develop effective venture capital investment strategies that drive growth and returns.

Effective venture capital investment strategies involve a combination of art and science. On one hand, investors must have a deep understanding of the startup ecosystem, including the competitive landscape, market trends, and technological advancements. On the other hand, they must also possess the analytical skills to evaluate investment opportunities, assess risk, and make informed decisions. By striking a balance between these two aspects, venture capital investors can develop venture capital investment strategies that drive success and returns.

Moreover, venture capital investment strategies must be tailored to the specific needs and goals of each investor. This requires a thorough understanding of the investor’s risk tolerance, investment horizon, and return expectations. By developing a customized venture capital investment strategy, investors can ensure that their investments align with their overall investment objectives and risk profile.

In conclusion, mastering the art of venture capital investing requires a deep understanding of the startup ecosystem, a thorough knowledge of venture capital investment strategies, and the ability to develop effective investment plans. By leveraging these skills and expertise, venture capital investors can navigate the complexities of the startup environment and achieve success in their investment endeavors.

Understanding the Venture Capital Investment Process

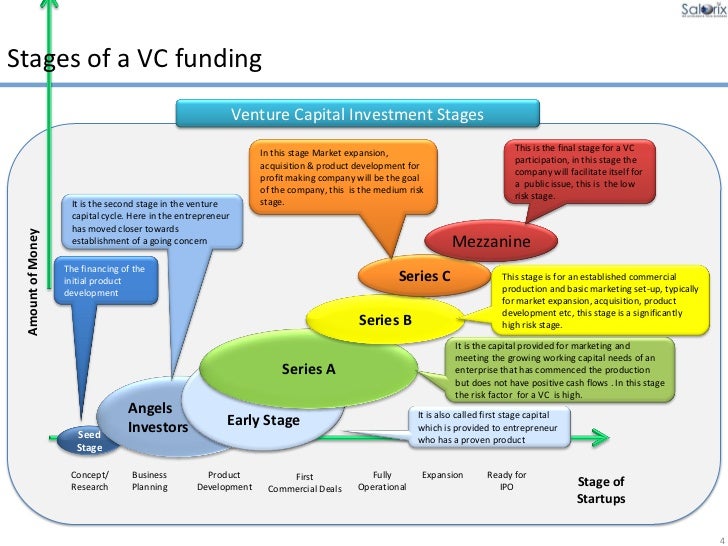

The venture capital investment process is a complex and multi-faceted journey that requires a thorough understanding of each stage to make informed investment decisions. From deal sourcing and due diligence to portfolio management and exit strategies, each stage plays a critical role in the success of a venture capital investment.

The process typically begins with deal sourcing, where venture capital firms identify potential investment opportunities through various channels, such as networking events, industry conferences, and online platforms. Once a potential investment opportunity is identified, the firm will conduct thorough due diligence to assess the startup’s market potential, competitive landscape, and financial prospects.

Due diligence is a critical stage in the venture capital investment process, as it enables investors to evaluate the startup’s strengths and weaknesses, assess the management team’s experience and expertise, and identify potential risks and challenges. A thorough due diligence process can help investors make informed decisions and avoid costly mistakes.

After completing due diligence, the venture capital firm will typically present the investment opportunity to its investment committee, which will review the proposal and make a decision on whether to invest. If the investment is approved, the firm will negotiate the terms of the investment, including the valuation, equity stake, and governance structure.

Once the investment is made, the venture capital firm will work closely with the startup to provide guidance, support, and resources to help the company grow and succeed. This may include providing strategic advice, introducing the startup to key partners and customers, and helping the company access additional funding.

As the startup grows and matures, the venture capital firm will continue to monitor its progress and adjust its investment strategy as needed. This may involve providing additional funding, introducing the startup to potential acquirers, or helping the company prepare for an initial public offering (IPO).

Ultimately, the goal of the venture capital investment process is to generate strong returns on investment through successful exits, such as acquisitions or IPOs. By understanding each stage of the process and making informed investment decisions, venture capital firms can increase their chances of success and deliver strong returns to their investors.

How to Identify Promising Startup Opportunities

Identifying promising startup opportunities is a critical component of successful venture capital investment strategies. To increase the chances of investing in a successful startup, venture capital investors must be able to evaluate market potential, assess the competitive landscape, and analyze the founding team’s experience and expertise.

Market potential is a key factor in evaluating a startup’s potential for success. Venture capital investors should assess the size of the market, the growth rate, and the potential for the startup to capture a significant share of the market. This can be done by analyzing industry trends, market research reports, and the startup’s business plan.

Assessing the competitive landscape is also crucial in evaluating a startup’s potential for success. Venture capital investors should analyze the competitive landscape to identify potential competitors, assess their strengths and weaknesses, and evaluate the startup’s unique value proposition. This can be done by analyzing industry reports, researching competitors, and evaluating the startup’s marketing and sales strategy.

The founding team’s experience and expertise are also critical factors in evaluating a startup’s potential for success. Venture capital investors should assess the team’s experience and expertise in the industry, their track record of success, and their ability to execute the business plan. This can be done by researching the team’s background, evaluating their skills and experience, and assessing their ability to lead the company to success.

In addition to these factors, venture capital investors should also evaluate the startup’s financials, including their revenue growth, profitability, and cash flow. This can be done by analyzing the startup’s financial statements, evaluating their business model, and assessing their ability to generate returns on investment.

By evaluating these factors, venture capital investors can increase their chances of investing in a successful startup and achieving strong returns on investment. It’s also important to note that venture capital investment strategies should be tailored to the specific needs and goals of each investor, and that a thorough evaluation of each startup opportunity is critical to making informed investment decisions.

Some of the key metrics that venture capital investors use to evaluate startup opportunities include customer acquisition costs, customer lifetime value, and retention rates. These metrics can provide valuable insights into the startup’s business model, its ability to generate revenue, and its potential for growth.

Ultimately, identifying promising startup opportunities requires a combination of art and science. Venture capital investors must be able to analyze complex data, evaluate market trends, and make informed investment decisions. By developing a well-informed investment strategy and staying up-to-date on the latest market trends, venture capital investors can increase their chances of success and achieve strong returns on investment.

Portfolio Diversification Strategies for Venture Capital Investors

Portfolio diversification is a critical component of successful venture capital investment strategies. By spreading investments across various industries, stages, and geographies, venture capital investors can reduce risk, increase potential returns, and improve overall portfolio performance.

Industry diversification is one of the most common strategies used by venture capital investors. By investing in startups across multiple industries, investors can reduce their exposure to any one particular market or sector. This can be especially important in times of economic uncertainty or when a particular industry is experiencing a downturn.

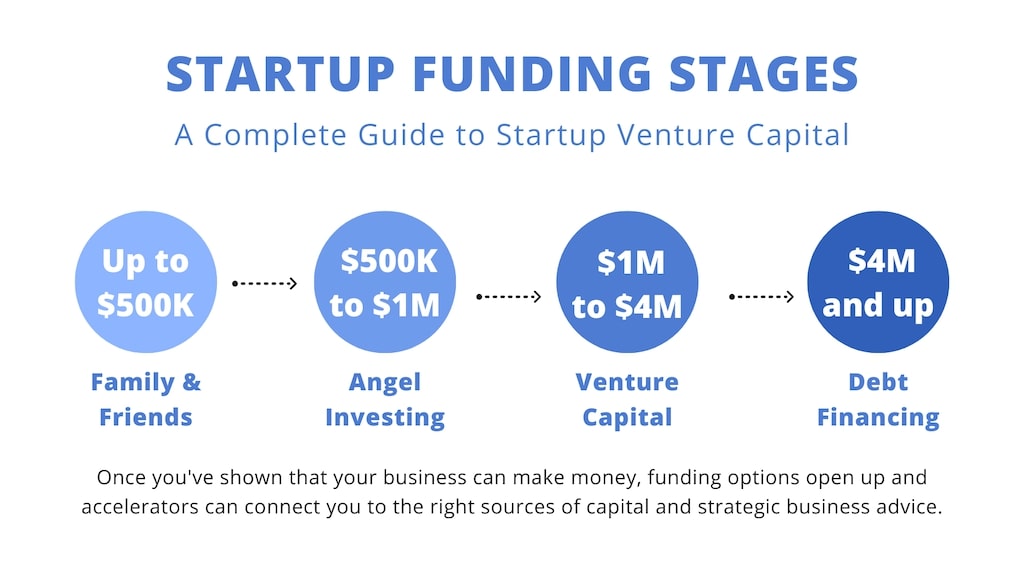

Stage diversification is another important strategy for venture capital investors. By investing in startups at different stages of development, investors can reduce their risk and increase their potential returns. For example, investing in early-stage startups can provide higher potential returns, but also comes with higher risk. Investing in later-stage startups can provide more stable returns, but may also come with lower potential for growth.

Geographic diversification is also an important strategy for venture capital investors. By investing in startups in different regions or countries, investors can reduce their exposure to any one particular market or economy. This can be especially important in times of economic uncertainty or when a particular region or country is experiencing a downturn.

Some examples of successful diversification strategies include investing in a mix of technology and life sciences startups, or investing in startups in different regions such as Silicon Valley, New York City, and London. By diversifying their portfolios, venture capital investors can increase their potential returns and reduce their risk.

It’s also important to note that diversification is not just about spreading investments across different industries, stages, and geographies. It’s also about creating a balanced portfolio that aligns with the investor’s overall investment strategy and goals. This may involve investing in a mix of high-growth and stable startups, or investing in startups with different business models or revenue streams.

Ultimately, the key to successful portfolio diversification is to create a strategy that aligns with the investor’s overall investment goals and risk tolerance. By diversifying their portfolios, venture capital investors can increase their potential returns, reduce their risk, and improve overall portfolio performance.

Some of the key metrics that venture capital investors use to evaluate portfolio diversification include the Herfindahl-Hirschman Index (HHI), which measures the concentration of a portfolio, and the Sharpe Ratio, which measures the return of a portfolio relative to its risk. By tracking these metrics, venture capital investors can ensure that their portfolios are diversified and aligned with their overall investment strategy.

Managing Risk in Venture Capital Investments

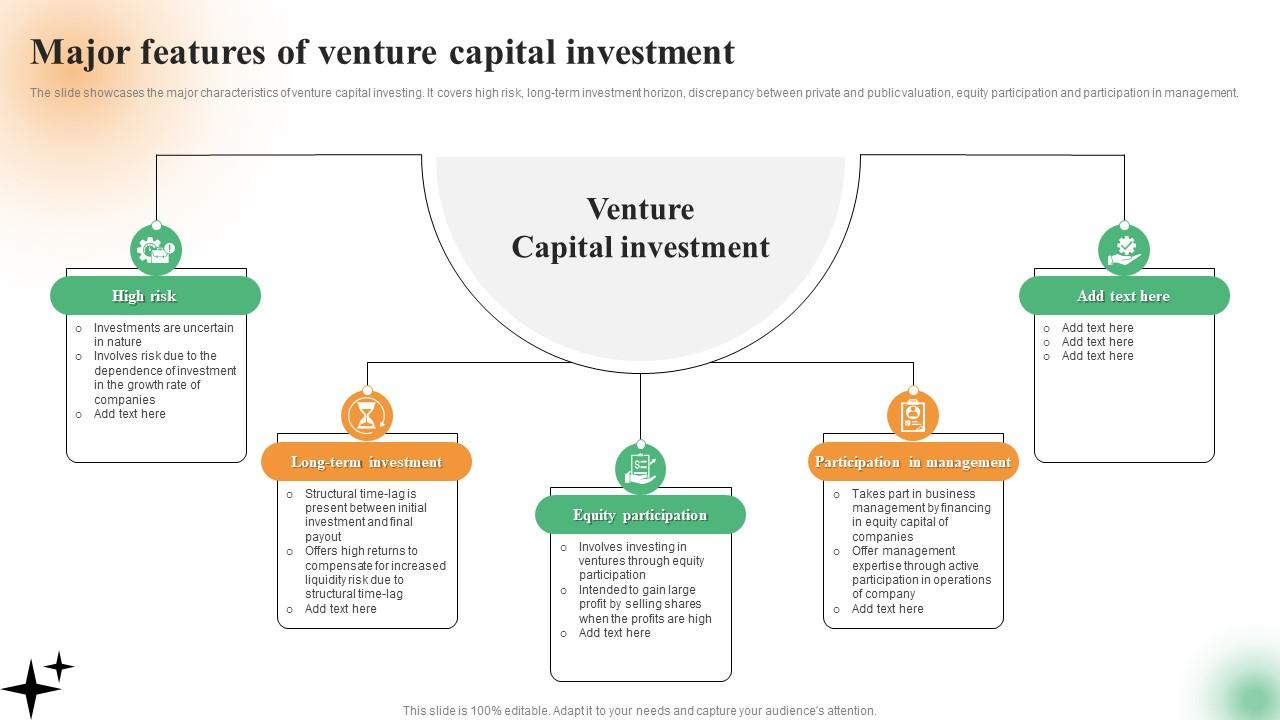

Risk management is a critical component of successful venture capital investment strategies. Venture capital investments are inherently high-risk, high-reward, and investors must be able to mitigate potential risks to achieve successful outcomes.

Market risks are one of the most significant risks associated with venture capital investments. Market risks refer to the potential for market fluctuations, changes in consumer demand, and shifts in competitive landscapes to impact the performance of a portfolio company. To mitigate market risks, venture capital investors can diversify their portfolios across multiple industries and geographies, and invest in companies with strong market positions and competitive advantages.

Liquidity risks are another significant risk associated with venture capital investments. Liquidity risks refer to the potential for investors to be unable to exit their investments quickly or at a favorable price. To mitigate liquidity risks, venture capital investors can invest in companies with strong growth prospects and high demand for their products or services, and can also consider investing in companies with multiple exit options, such as IPOs or acquisitions.

Operational risks are also a significant concern for venture capital investors. Operational risks refer to the potential for companies to experience operational difficulties, such as management turnover, supply chain disruptions, or regulatory issues. To mitigate operational risks, venture capital investors can conduct thorough due diligence on potential investments, and can also consider investing in companies with strong management teams and operational track records.

Thorough due diligence is a critical component of risk management in venture capital investing. Due diligence involves a comprehensive review of a company’s financials, management team, market position, and competitive landscape. By conducting thorough due diligence, venture capital investors can identify potential risks and opportunities, and can make informed investment decisions.

Regular portfolio monitoring is also essential for managing risk in venture capital investments. Portfolio monitoring involves regular review of a company’s financials, management team, and market position, as well as ongoing assessment of the company’s progress towards its business plan. By regularly monitoring their portfolios, venture capital investors can identify potential risks and opportunities, and can make adjustments to their investment strategies as needed.

Adaptive investment strategies are also important for managing risk in venture capital investments. Adaptive investment strategies involve adjusting investment approaches in response to changes in market conditions, company performance, or other factors. By adopting adaptive investment strategies, venture capital investors can respond quickly to changing circumstances, and can optimize their investment outcomes.

Ultimately, managing risk in venture capital investments requires a combination of thorough due diligence, regular portfolio monitoring, and adaptive investment strategies. By employing these risk management techniques, venture capital investors can mitigate potential risks, and can achieve successful outcomes in their investments.

Measuring Success in Venture Capital Investing

Measuring success in venture capital investing is crucial for investors to evaluate the performance of their investments and make informed decisions. Key performance indicators (KPIs) play a vital role in assessing the success of venture capital investments, and investors must track and analyze these metrics to optimize their investment strategies.

Internal rate of return (IRR) is one of the most widely used KPIs in venture capital investing. IRR measures the rate of return on investment, taking into account the time value of money. It provides a comprehensive view of the investment’s performance, allowing investors to compare the returns of different investments.

Cash-on-cash return is another important KPI in venture capital investing. It measures the return on investment in terms of cash, excluding any non-cash items such as depreciation and amortization. This metric provides a clear picture of the investment’s cash flow and helps investors evaluate the investment’s liquidity.

Multiples on invested capital (MOIC) is a KPI that measures the return on investment as a multiple of the initial investment. It provides a simple and intuitive way to evaluate the investment’s performance, allowing investors to compare the returns of different investments.

Tracking and analyzing these KPIs is essential for venture capital investors to optimize their investment strategies. By monitoring these metrics, investors can identify areas of improvement, adjust their investment approaches, and make informed decisions to maximize returns.

In addition to these KPIs, venture capital investors should also track other metrics such as portfolio company performance, market trends, and industry developments. This comprehensive approach to performance measurement enables investors to gain a deeper understanding of their investments and make data-driven decisions.

Furthermore, venture capital investors should consider using data analytics and visualization tools to track and analyze their KPIs. These tools provide a clear and intuitive way to visualize data, enabling investors to quickly identify trends and patterns in their investments.

Ultimately, measuring success in venture capital investing requires a combination of KPIs, data analytics, and a comprehensive approach to performance measurement. By tracking and analyzing these metrics, venture capital investors can optimize their investment strategies, maximize returns, and achieve success in the startup ecosystem.

Some of the key benefits of using KPIs in venture capital investing include improved investment decision-making, enhanced portfolio performance, and increased transparency. By leveraging KPIs, venture capital investors can gain a deeper understanding of their investments and make data-driven decisions to drive success.

Staying Ahead of the Curve in Venture Capital Investing

Staying informed about market trends, technological advancements, and regulatory changes is crucial for venture capital investors to make informed investment decisions and stay ahead of the curve. The venture capital ecosystem is constantly evolving, and investors must be able to adapt to these changes to remain competitive.

Attending industry events is an excellent way for venture capital investors to stay informed about the latest trends and developments in the startup ecosystem. Industry events provide a platform for investors to network with peers, learn from industry experts, and gain insights into the latest market trends and technological advancements.

Networking with peers is also essential for venture capital investors to stay informed about the latest developments in the startup ecosystem. By building relationships with other investors, entrepreneurs, and industry experts, investors can gain valuable insights into the market and stay ahead of the curve.

Leveraging online resources is another effective way for venture capital investors to stay informed about the latest trends and developments in the startup ecosystem. Online resources such as industry reports, research studies, and news articles provide a wealth of information on the latest market trends, technological advancements, and regulatory changes.

Staying informed about regulatory changes is also crucial for venture capital investors to ensure compliance with relevant laws and regulations. Regulatory changes can have a significant impact on the startup ecosystem, and investors must be able to adapt to these changes to remain competitive.

Furthermore, venture capital investors should also stay informed about the latest technological advancements in the startup ecosystem. Technological advancements can have a significant impact on the market, and investors must be able to adapt to these changes to remain competitive.

Some of the key benefits of staying informed about market trends, technological advancements, and regulatory changes include improved investment decision-making, enhanced portfolio performance, and increased competitiveness. By staying ahead of the curve, venture capital investors can make informed investment decisions, optimize their investment strategies, and achieve success in the startup ecosystem.

Ultimately, staying informed about market trends, technological advancements, and regulatory changes is essential for venture capital investors to remain competitive and achieve success in the startup ecosystem. By leveraging industry events, networking with peers, and leveraging online resources, investors can stay ahead of the curve and make informed investment decisions.

Best Practices for Venture Capital Investors

Developing a well-informed investment strategy is crucial for venture capital investors to achieve success in the startup ecosystem. A well-crafted strategy can help investors make informed decisions, diversify their portfolios, manage risk, and continuously monitor and adapt to changes in the market.

Diversifying portfolios is another key best practice for venture capital investors. By spreading investments across various industries, stages, and geographies, investors can reduce risk, increase potential returns, and improve overall portfolio performance.

Managing risk is also essential for venture capital investors. By conducting thorough due diligence, regularly monitoring portfolios, and adapting investment strategies, investors can mitigate potential risks and optimize their investment outcomes.

Continuously monitoring and adapting to changes in the startup ecosystem is also critical for venture capital investors. By staying informed about market trends, technological advancements, and regulatory changes, investors can make informed decisions and stay ahead of the curve.

Some of the key benefits of following these best practices include improved investment decision-making, enhanced portfolio performance, and increased competitiveness. By developing a well-informed investment strategy, diversifying portfolios, managing risk, and continuously monitoring and adapting to changes in the market, venture capital investors can achieve success in the startup ecosystem.

Ultimately, venture capital investing requires a combination of art and science. By leveraging best practices, staying informed about market trends, and continuously adapting to changes in the market, investors can make informed decisions and achieve success in the startup ecosystem.

By following these best practices, venture capital investors can optimize their investment strategies, reduce risk, and increase potential returns. By staying informed about market trends, technological advancements, and regulatory changes, investors can make informed decisions and stay ahead of the curve.

In conclusion, developing a well-informed investment strategy, diversifying portfolios, managing risk, and continuously monitoring and adapting to changes in the market are essential best practices for venture capital investors. By following these best practices, investors can achieve success in the startup ecosystem and optimize their investment outcomes.