Why Effective Portfolio Management is Crucial for Venture Capital Success

Effective venture capital portfolio management is the backbone of any successful venture capital firm. It enables firms to maximize returns, mitigate risks, and achieve their investment goals. A well-managed portfolio is essential for venture capital firms to stay competitive in a rapidly changing market. By adopting a strategic approach to portfolio management, firms can optimize their investment strategy, reduce losses, and increase the potential for long-term growth.

One of the primary benefits of effective portfolio management is diversification. By spreading investments across different asset classes, sectors, and geographies, venture capital firms can minimize risk and increase the potential for returns. This approach also enables firms to capitalize on emerging trends and opportunities, while avoiding over-concentration in any one area.

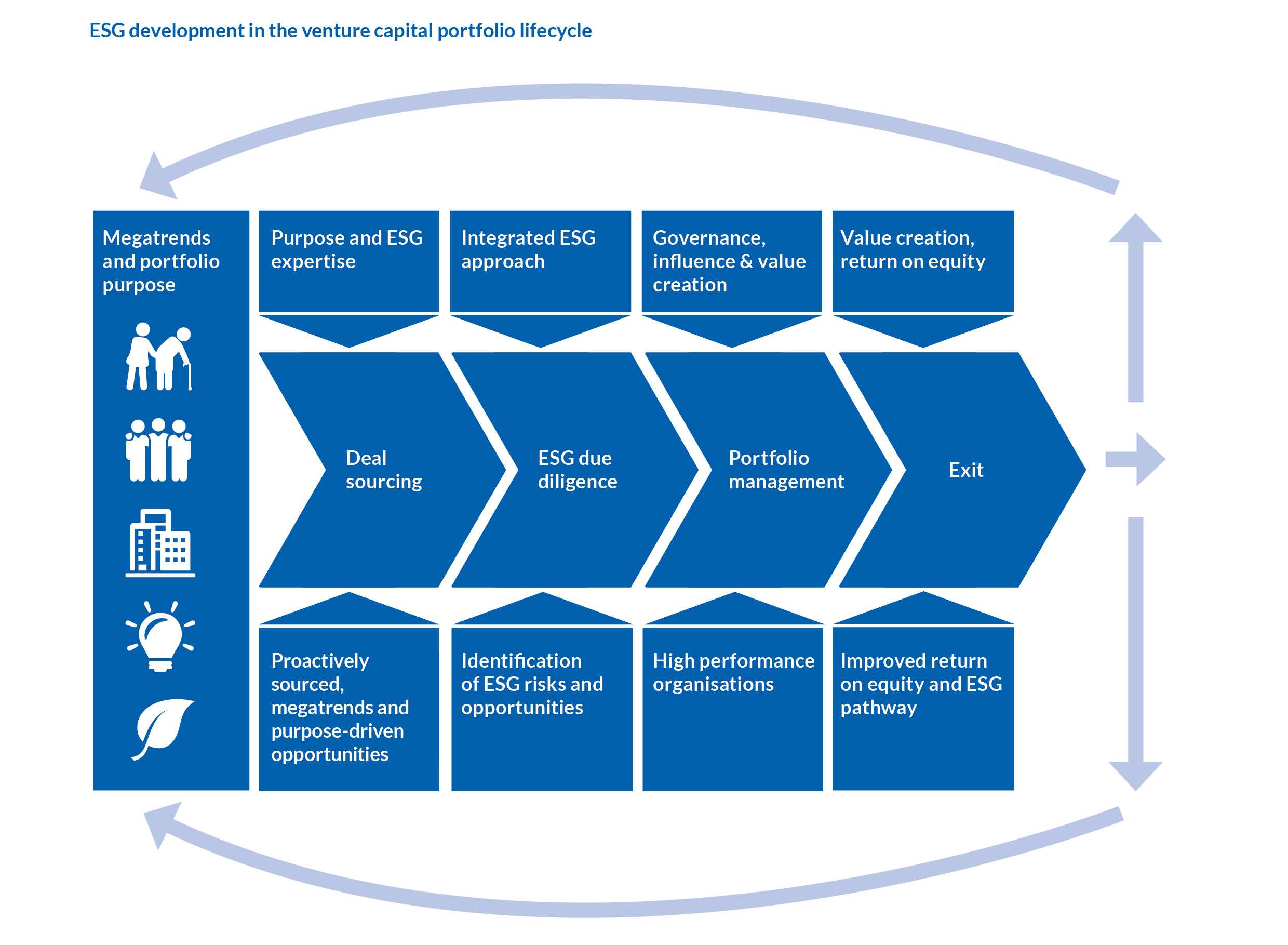

Another critical aspect of venture capital portfolio management is risk mitigation. By conducting thorough due diligence on potential investments, firms can identify potential risks and take steps to mitigate them. This includes assessing market potential, evaluating management teams, and analyzing financial projections. By taking a proactive approach to risk management, firms can reduce the likelihood of losses and ensure a more stable portfolio.

In addition to diversification and risk mitigation, effective portfolio management also involves ongoing monitoring and adjustment. This includes regular review of portfolio performance, identification of areas for improvement, and making adjustments as needed. By staying up-to-date with market trends and changes, venture capital firms can ensure that their portfolio remains aligned with their investment goals and objectives.

Ultimately, effective venture capital portfolio management is critical for achieving success in the venture capital industry. By adopting a strategic approach to portfolio management, firms can optimize their investment strategy, reduce risks, and increase the potential for long-term growth. As the venture capital landscape continues to evolve, firms that prioritize effective portfolio management will be best positioned to thrive in a rapidly changing market.

Key Principles of Venture Capital Portfolio Management

Effective venture capital portfolio management is built on a foundation of key principles that guide investment decisions and portfolio construction. At its core, venture capital portfolio management involves the strategic allocation of assets across different investments to achieve optimal returns while minimizing risk. Three fundamental principles underpin successful venture capital portfolio management: portfolio construction, asset allocation, and risk management.

Portfolio construction is the process of selecting and combining individual investments to create a cohesive portfolio that aligns with the venture capital firm’s investment goals and objectives. This involves evaluating potential investments based on their growth potential, market size, competitive landscape, and management team. By constructing a portfolio that balances risk and potential returns, venture capital firms can create a solid foundation for long-term success.

Asset allocation is another critical principle of venture capital portfolio management. This involves allocating assets across different investment classes, sectors, and geographies to optimize returns and minimize risk. By diversifying their portfolio, venture capital firms can reduce their exposure to any one particular market or sector, while increasing their potential for returns. For example, a venture capital firm may allocate 60% of its portfolio to technology investments, 20% to healthcare investments, and 20% to consumer goods investments.

Risk management is the third key principle of venture capital portfolio management. This involves identifying and mitigating potential risks associated with individual investments and the overall portfolio. By conducting thorough due diligence on potential investments, venture capital firms can identify potential risks and take steps to mitigate them. This includes assessing market potential, evaluating management teams, and analyzing financial projections.

Successful venture capital firms that have implemented these principles include Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins. These firms have demonstrated a deep understanding of the key principles of venture capital portfolio management, and have used this knowledge to drive long-term success and returns for their investors.

By understanding and applying these key principles, venture capital firms can create a solid foundation for successful portfolio management. By constructing a diversified portfolio, allocating assets effectively, and managing risk, venture capital firms can optimize their investment strategy and achieve their investment goals.

How to Conduct Thorough Due Diligence on Potential Investments

Conducting thorough due diligence on potential investments is a critical step in venture capital portfolio management. Due diligence involves a comprehensive evaluation of a potential investment, including its market potential, management team, financial projections, and competitive landscape. By conducting thorough due diligence, venture capital firms can identify potential risks and opportunities, and make informed investment decisions.

One of the key components of due diligence is evaluating market potential. This involves assessing the size and growth potential of the market, as well as the competitive landscape. Venture capital firms should also evaluate the management team, including their experience, skills, and track record. This can help identify potential risks and opportunities, and ensure that the management team has the necessary expertise to execute the business plan.

Financial projections are also a critical component of due diligence. Venture capital firms should carefully evaluate the financial projections of the potential investment, including revenue growth, profitability, and cash flow. This can help identify potential risks and opportunities, and ensure that the investment has a clear path to profitability.

In addition to evaluating market potential, management team, and financial projections, venture capital firms should also conduct a thorough review of the competitive landscape. This involves assessing the competitive position of the potential investment, including its market share, pricing power, and competitive advantages. By conducting a thorough review of the competitive landscape, venture capital firms can identify potential risks and opportunities, and ensure that the investment has a clear competitive advantage.

Some common red flags to watch out for during due diligence include unrealistic financial projections, inadequate management teams, and unclear competitive advantages. Venture capital firms should also be wary of investments with high levels of debt, poor cash flow, or unclear exit strategies.

By conducting thorough due diligence, venture capital firms can make informed investment decisions and avoid potential pitfalls. Due diligence is a critical component of venture capital portfolio management, and can help firms achieve their investment goals and objectives.

Some successful venture capital firms that have implemented thorough due diligence processes include Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins. These firms have demonstrated a commitment to thorough due diligence, and have used this process to drive long-term success and returns for their investors.

Building a Balanced Portfolio: Strategies for Diversification

Building a balanced portfolio is a critical component of venture capital portfolio management. A balanced portfolio is one that is diversified across different asset classes, sectors, and geographies, and is designed to minimize risk and maximize returns. By spreading risk across different investments, venture capital firms can reduce their exposure to any one particular market or sector, and increase their potential for returns.

One strategy for building a balanced portfolio is to diversify across different asset classes. This can include investing in a mix of early-stage, growth-stage, and late-stage companies, as well as investing in different types of assets, such as equity, debt, and real assets. By diversifying across different asset classes, venture capital firms can reduce their risk and increase their potential for returns.

Another strategy for building a balanced portfolio is to diversify across different sectors. This can include investing in a mix of technology, healthcare, financial services, and consumer goods companies, among others. By diversifying across different sectors, venture capital firms can reduce their risk and increase their potential for returns.

Geographic diversification is also an important strategy for building a balanced portfolio. This can include investing in companies based in different regions, such as the United States, Europe, Asia, and Latin America. By diversifying across different geographies, venture capital firms can reduce their risk and increase their potential for returns.

Some successful venture capital firms that have implemented diversified portfolio strategies include Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins. These firms have demonstrated a commitment to diversification, and have used this strategy to drive long-term success and returns for their investors.

For example, Sequoia Capital has invested in a mix of early-stage, growth-stage, and late-stage companies across different sectors, including technology, healthcare, and financial services. The firm has also invested in companies based in different regions, including the United States, Europe, and Asia. By diversifying its portfolio, Sequoia Capital has been able to reduce its risk and increase its potential for returns.

Andreessen Horowitz has also implemented a diversified portfolio strategy, investing in a mix of early-stage, growth-stage, and late-stage companies across different sectors, including technology, healthcare, and financial services. The firm has also invested in companies based in different regions, including the United States, Europe, and Asia. By diversifying its portfolio, Andreessen Horowitz has been able to reduce its risk and increase its potential for returns.

Monitoring and Adjusting Your Portfolio: The Importance of Ongoing Management

Monitoring and adjusting your portfolio is a critical component of venture capital portfolio management. Ongoing management involves regularly reviewing portfolio performance, identifying areas for improvement, and making adjustments as needed. By staying on top of market trends and changes, venture capital firms can ensure that their portfolio remains aligned with their investment goals and objectives.

One key aspect of ongoing management is regular portfolio review. This involves regularly reviewing the performance of individual investments, as well as the overall portfolio. By doing so, venture capital firms can identify areas for improvement, such as underperforming investments or sectors that are no longer aligned with their investment goals.

Another important aspect of ongoing management is identifying areas for improvement. This can involve analyzing market trends and changes, as well as assessing the competitive landscape. By identifying areas for improvement, venture capital firms can make adjustments to their portfolio, such as rebalancing their asset allocation or adjusting their investment strategy.

Adjusting the portfolio is also a critical component of ongoing management. This can involve making changes to the portfolio’s asset allocation, such as increasing or decreasing exposure to certain sectors or asset classes. By making adjustments to the portfolio, venture capital firms can ensure that their portfolio remains aligned with their investment goals and objectives.

Some successful venture capital firms that have implemented ongoing management strategies include Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins. These firms have demonstrated a commitment to ongoing management, and have used this strategy to drive long-term success and returns for their investors.

For example, Sequoia Capital has implemented a regular portfolio review process, which involves regularly reviewing the performance of individual investments and the overall portfolio. The firm has also established a process for identifying areas for improvement, such as analyzing market trends and changes, and assessing the competitive landscape. By making adjustments to the portfolio, Sequoia Capital has been able to ensure that its portfolio remains aligned with its investment goals and objectives.

Andreessen Horowitz has also implemented an ongoing management strategy, which involves regularly reviewing portfolio performance and identifying areas for improvement. The firm has also established a process for making adjustments to the portfolio, such as rebalancing its asset allocation or adjusting its investment strategy. By doing so, Andreessen Horowitz has been able to drive long-term success and returns for its investors.

Using Data and Analytics to Inform Portfolio Decisions

Data and analytics play a critical role in venture capital portfolio management. By leveraging data and analytics, venture capital firms can inform investment decisions, track portfolio performance, and identify areas for improvement. This can help firms make more informed decisions, reduce risk, and increase returns.

One way that data and analytics can be used in venture capital portfolio management is to inform investment decisions. By analyzing data on market trends, company performance, and industry trends, venture capital firms can identify potential investment opportunities and make more informed decisions. For example, a firm may use data analytics to identify companies that are likely to experience rapid growth, and then use that information to inform their investment decisions.

Data and analytics can also be used to track portfolio performance. By analyzing data on portfolio companies, venture capital firms can identify areas for improvement and make adjustments to their investment strategy. For example, a firm may use data analytics to track the performance of their portfolio companies, and then use that information to identify areas where they can improve their investment strategy.

Another way that data and analytics can be used in venture capital portfolio management is to identify areas for improvement. By analyzing data on market trends, company performance, and industry trends, venture capital firms can identify areas where they can improve their investment strategy. For example, a firm may use data analytics to identify areas where they can improve their due diligence process, and then use that information to make adjustments to their investment strategy.

Some successful venture capital firms that have implemented data-driven portfolio management strategies include Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins. These firms have demonstrated a commitment to using data and analytics to inform their investment decisions, and have used this strategy to drive long-term success and returns for their investors.

For example, Sequoia Capital has implemented a data-driven approach to portfolio management, which involves using data analytics to inform investment decisions and track portfolio performance. The firm has also established a data analytics team, which is responsible for analyzing data on market trends, company performance, and industry trends. By leveraging data and analytics, Sequoia Capital has been able to make more informed investment decisions and drive long-term success and returns for their investors.

Andreessen Horowitz has also implemented a data-driven approach to portfolio management, which involves using data analytics to inform investment decisions and track portfolio performance. The firm has also established a data analytics team, which is responsible for analyzing data on market trends, company performance, and industry trends. By leveraging data and analytics, Andreessen Horowitz has been able to make more informed investment decisions and drive long-term success and returns for their investors.

Common Mistakes to Avoid in Venture Capital Portfolio Management

While venture capital portfolio management can be a complex and challenging task, there are several common mistakes that can be avoided to ensure a well-managed portfolio. By being aware of these mistakes, venture capital firms can take steps to mitigate risks and maximize returns.

One common mistake to avoid is over-concentration. This occurs when a venture capital firm invests too much of its portfolio in a single company or industry. By diversifying their portfolio, venture capital firms can reduce their risk and increase their potential for returns.

Another common mistake to avoid is poor due diligence. This occurs when a venture capital firm fails to conduct thorough research and analysis on a potential investment. By conducting thorough due diligence, venture capital firms can identify potential risks and opportunities, and make more informed investment decisions.

Inadequate risk management is also a common mistake to avoid. This occurs when a venture capital firm fails to properly assess and manage the risks associated with its investments. By implementing a robust risk management strategy, venture capital firms can reduce their risk and increase their potential for returns.

Some successful venture capital firms that have avoided these common mistakes include Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins. These firms have demonstrated a commitment to diversification, thorough due diligence, and robust risk management, and have used these strategies to drive long-term success and returns for their investors.

For example, Sequoia Capital has implemented a diversified investment strategy, which involves investing in a range of companies and industries. The firm has also established a thorough due diligence process, which involves conducting extensive research and analysis on potential investments. By avoiding common mistakes and implementing a robust risk management strategy, Sequoia Capital has been able to drive long-term success and returns for its investors.

Andreessen Horowitz has also implemented a diversified investment strategy, which involves investing in a range of companies and industries. The firm has also established a thorough due diligence process, which involves conducting extensive research and analysis on potential investments. By avoiding common mistakes and implementing a robust risk management strategy, Andreessen Horowitz has been able to drive long-term success and returns for its investors.

Best Practices for Venture Capital Portfolio Management: Lessons from the Experts

Effective venture capital portfolio management is crucial for achieving success in the venture capital industry. By following best practices and lessons from experienced venture capital firms and investors, firms can optimize their investment strategy and achieve their investment goals.

One best practice for venture capital portfolio management is to maintain a diversified portfolio. This involves spreading risk across different asset classes, sectors, and geographies to minimize risk and maximize returns. By diversifying their portfolio, venture capital firms can reduce their exposure to any one particular market or sector, and increase their potential for returns.

Another best practice for venture capital portfolio management is to conduct thorough due diligence on potential investments. This involves evaluating market potential, assessing management teams, and analyzing financial projections to identify potential risks and opportunities. By conducting thorough due diligence, venture capital firms can make more informed investment decisions and reduce their risk.

Robust risk management is also a critical best practice for venture capital portfolio management. This involves identifying and mitigating potential risks, such as market risk, credit risk, and operational risk. By implementing a robust risk management strategy, venture capital firms can reduce their risk and increase their potential for returns.

Some successful venture capital firms that have implemented these best practices include Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins. These firms have demonstrated a commitment to diversification, thorough due diligence, and robust risk management, and have used these strategies to drive long-term success and returns for their investors.

For example, Sequoia Capital has implemented a diversified investment strategy, which involves investing in a range of companies and industries. The firm has also established a thorough due diligence process, which involves conducting extensive research and analysis on potential investments. By implementing a robust risk management strategy, Sequoia Capital has been able to reduce its risk and increase its potential for returns.

Andreessen Horowitz has also implemented a diversified investment strategy, which involves investing in a range of companies and industries. The firm has also established a thorough due diligence process, which involves conducting extensive research and analysis on potential investments. By implementing a robust risk management strategy, Andreessen Horowitz has been able to reduce its risk and increase its potential for returns.