What are Bonds and How Do They Work?

Bonds are a type of investment instrument that represents a loan made by an investor to a borrower, typically a corporation or government entity. In the context of the stock market, bonds are often referred to as fixed-income securities because they offer a relatively stable return in the form of interest payments. When an investor buys a bond, they essentially lend money to the borrower, who promises to repay the principal amount with interest over a specified period.

There are several types of bonds, including government bonds, corporate bonds, and municipal bonds. Government bonds are issued by national governments to finance their activities, while corporate bonds are issued by companies to raise capital for various purposes. Municipal bonds, on the other hand, are issued by local governments and other public entities to finance infrastructure projects and other public works.

One of the key differences between bonds and stocks is the level of risk involved. Stocks represent ownership in a company and offer the potential for long-term growth, but they also come with a higher level of risk. Bonds, by contrast, offer a relatively stable return with lower risk, but the returns may be lower than those offered by stocks. This makes bonds an attractive option for investors who are seeking regular income and are willing to accept lower returns in exchange for lower risk.

For example, let’s say an investor buys a 10-year government bond with a face value of $1,000 and a coupon rate of 2%. The investor will receive $20 in interest payments every year for 10 years, and at the end of the 10-year period, they will receive the principal amount of $1,000. This provides a relatively stable return with lower risk, making bonds an attractive option for investors who are seeking regular income.

In the context of the stock market, bonds can be traded on various exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. Investors can buy and sell bonds through a brokerage firm or online trading platform, and the prices of bonds are determined by market forces, such as supply and demand.

Overall, bonds offer a unique combination of relatively stable returns and lower risk, making them an attractive option for investors who are seeking regular income and are willing to accept lower returns in exchange for lower risk. By understanding how bonds work and the different types of bonds available, investors can make informed decisions about adding bonds to their investment portfolio.

How to Invest in Bonds: A Step-by-Step Guide

Investing in bonds can seem daunting, but with a clear understanding of the process, it can be a straightforward and rewarding experience. Here’s a step-by-step guide on how to invest in bonds:

Step 1: Determine Your Investment Goals and Risk Tolerance

Before investing in bonds, it’s essential to determine your investment goals and risk tolerance. Are you looking for regular income or long-term growth? Are you willing to take on more risk or do you prefer a more conservative approach? Understanding your goals and risk tolerance will help you choose the right type of bond for your portfolio.

Step 2: Choose a Brokerage Firm or Online Trading Platform

Once you’ve determined your investment goals and risk tolerance, you’ll need to choose a brokerage firm or online trading platform to buy and sell bonds. Look for a reputable firm that offers a wide range of bond products, competitive pricing, and excellent customer service.

Step 3: Understand Bond Yields and Prices

Bond yields and prices are closely related. When you buy a bond, you’re essentially lending money to the borrower, who promises to repay the principal amount with interest. The yield is the return on investment you can expect to earn from the bond, while the price is the amount you pay for the bond. Understanding how bond yields and prices work will help you make informed investment decisions.

Step 4: Buy and Sell Bonds

Once you’ve chosen a brokerage firm or online trading platform, you can start buying and selling bonds. You can buy bonds directly from the issuer or through a secondary market. When buying bonds, make sure to read the prospectus carefully and understand the terms and conditions of the bond.

Step 5: Monitor and Adjust Your Bond Portfolio

After investing in bonds, it’s essential to monitor and adjust your portfolio regularly. Keep an eye on interest rate changes, credit rating downgrades, and other market conditions that may affect your bond holdings. Rebalance your portfolio as needed to ensure it remains aligned with your investment goals and risk tolerance.

Example: Let’s say you invest $10,000 in a 10-year government bond with a 2% coupon rate. You’ll receive $200 in interest payments every year for 10 years, and at the end of the 10-year period, you’ll receive the principal amount of $10,000. If interest rates rise during the 10-year period, the value of your bond may decrease, but you’ll still receive the regular interest payments and the principal amount at maturity.

By following these steps and understanding how to invest in bonds, you can create a diversified investment portfolio that generates regular income and helps you achieve your long-term financial goals.

The Benefits of Adding Bonds to Your Investment Portfolio

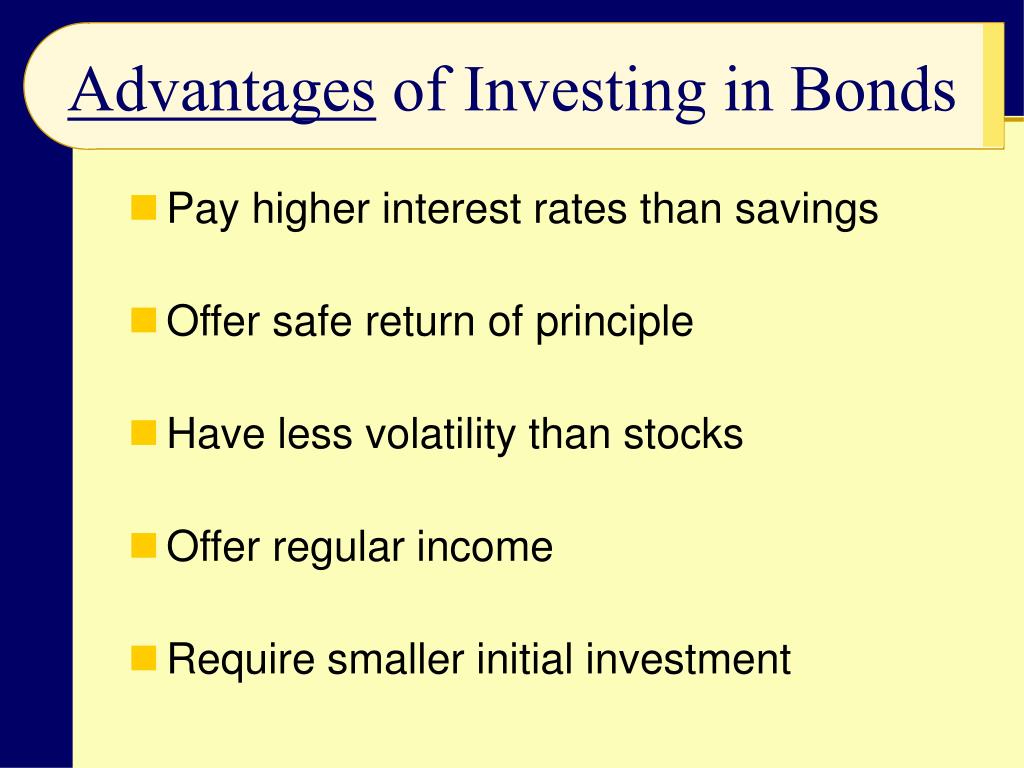

Adding bonds to an investment portfolio can provide a range of benefits, including reducing risk, generating regular income, and increasing potential returns. By understanding the advantages of bonds and how they can be used to achieve investment goals, investors can make informed decisions about their portfolio.

One of the primary benefits of bonds is their ability to reduce risk. Bonds are generally considered to be a lower-risk investment compared to stocks, as they offer a fixed return in the form of interest payments and a return of principal at maturity. This can make bonds an attractive option for investors who are seeking to reduce their exposure to market volatility.

In addition to reducing risk, bonds can also provide a regular source of income. Bonds typically offer a fixed interest rate, which can provide a predictable stream of income for investors. This can be particularly beneficial for investors who are seeking to generate income from their investments, such as retirees or those who are seeking to supplement their income.

Bonds can also increase potential returns by providing a diversification benefit. By adding bonds to a portfolio, investors can reduce their reliance on any one particular asset class and increase the potential for long-term returns. This is because bonds tend to perform differently than stocks, and can provide a hedge against market downturns.

According to a study by the Securities Industry and Financial Markets Association (SIFMA), a diversified portfolio that includes bonds can provide higher returns and lower risk compared to a portfolio that consists only of stocks. The study found that a portfolio with a 60% allocation to stocks and a 40% allocation to bonds provided a higher return and lower risk compared to a portfolio with a 100% allocation to stocks.

Another benefit of bonds is their liquidity. Bonds can be easily bought and sold on the open market, making it possible for investors to quickly access their money if needed. This can be particularly beneficial for investors who are seeking to maintain a liquid portfolio.

Example: Let’s say an investor has a portfolio that consists of 100% stocks. The investor is seeking to reduce their risk and generate regular income. By adding bonds to the portfolio, the investor can reduce their exposure to market volatility and generate a predictable stream of income. For example, the investor could allocate 40% of their portfolio to bonds and 60% to stocks. This would provide a diversified portfolio that can help to reduce risk and increase potential returns.

Overall, adding bonds to an investment portfolio can provide a range of benefits, including reducing risk, generating regular income, and increasing potential returns. By understanding the advantages of bonds and how they can be used to achieve investment goals, investors can make informed decisions about their portfolio.

Understanding Bond Ratings and Credit Risk

Bond ratings are a crucial aspect of bond investing, as they provide an assessment of the creditworthiness of the issuer. Credit risk is the risk that the issuer will default on their debt obligations, and bond ratings help investors to gauge this risk. In this section, we will explain the concept of bond ratings, including the different rating agencies and how they assess credit risk.

There are several bond rating agencies, including Moody’s, Standard & Poor’s, and Fitch. These agencies assign a credit rating to the issuer based on their assessment of the issuer’s creditworthiness. The credit rating is usually expressed as a letter grade, with AAA being the highest rating and D being the lowest.

The bond rating agencies assess credit risk by evaluating the issuer’s financial health, management team, industry trends, and other factors. They also consider the issuer’s history of debt repayment and their ability to meet their financial obligations. Based on this assessment, the rating agency assigns a credit rating that reflects the issuer’s creditworthiness.

For example, a bond with a AAA rating is considered to be of high credit quality, with a low risk of default. On the other hand, a bond with a D rating is considered to be of low credit quality, with a high risk of default. Investors can use bond ratings to make informed decisions about their investments, as they provide a snapshot of the issuer’s creditworthiness.

It’s worth noting that bond ratings are not a guarantee of the issuer’s creditworthiness, and investors should always conduct their own research before making an investment decision. Additionally, bond ratings can change over time, so it’s essential to monitor the rating agencies’ updates and adjust your investment strategy accordingly.

Understanding bond ratings and credit risk is essential for bond investors, as it helps them to make informed decisions about their investments. By considering the credit rating of a bond, investors can gauge the risk of default and make a more informed decision about whether to invest in the bond.

For instance, let’s say an investor is considering investing in a bond with a BBB rating. The investor should understand that this rating indicates a moderate credit risk, and the issuer may be more likely to default on their debt obligations compared to an issuer with a AAA rating. Based on this information, the investor can decide whether to invest in the bond or explore other investment options.

In conclusion, bond ratings and credit risk are critical aspects of bond investing. By understanding how bond ratings work and how to assess credit risk, investors can make more informed decisions about their investments and achieve their financial goals.

How to Read a Bond Table: Deciphering the Data

When it comes to investing in bonds, understanding how to read a bond table is crucial. A bond table is a summary of the key characteristics of a bond, including its coupon rate, maturity date, yield to maturity, and credit rating. In this section, we will explain how to read a bond table and provide examples to illustrate the process.

A bond table typically includes the following columns:

Coupon Rate: This is the interest rate that the bond pays periodically, usually semi-annually or annually.

Maturity Date: This is the date when the bond expires and the principal amount is repaid to the investor.

Yield to Maturity: This is the total return that an investor can expect to earn from the bond, including the coupon payments and the return of principal.

Credit Rating: This is the rating assigned to the bond by a credit rating agency, such as Moody’s or Standard & Poor’s.

Face Value: This is the principal amount of the bond, which is repaid to the investor at maturity.

Market Price: This is the current price of the bond in the market.

Example: Let’s say we are looking at a bond table for a 10-year corporate bond with a coupon rate of 4% and a maturity date of 2030. The yield to maturity is 5%, and the credit rating is BBB. The face value is $1,000, and the market price is $950.

By understanding how to read a bond table, investors can quickly and easily compare different bonds and make informed investment decisions. For instance, an investor may compare the yield to maturity of different bonds to determine which one offers the highest return. Alternatively, an investor may compare the credit ratings of different bonds to determine which one is less risky.

In addition to understanding the columns in a bond table, it’s also important to understand the different types of bond tables. There are two main types of bond tables: the bond summary table and the bond detail table. The bond summary table provides a summary of the key characteristics of a bond, while the bond detail table provides more detailed information about the bond, including its coupon payments and credit rating.

By understanding how to read a bond table and the different types of bond tables, investors can make more informed investment decisions and achieve their financial goals.

Bond Investing Strategies for Different Market Conditions

When it comes to investing in bonds, it’s essential to consider the current market conditions and adjust your investment strategy accordingly. Different market conditions require different bond investing strategies, and understanding these strategies can help you make informed investment decisions.

Rising Interest Rates:

When interest rates are rising, it’s essential to focus on short-term bonds with lower durations. This is because short-term bonds are less sensitive to interest rate changes, and their prices are less likely to decline when interest rates rise. Additionally, consider investing in bonds with floating interest rates, which can help you keep pace with rising interest rates.

Economic Downturns:

During economic downturns, it’s crucial to focus on high-quality bonds with strong credit ratings. This is because high-quality bonds are less likely to default, and their prices are less likely to decline during economic downturns. Additionally, consider investing in bonds with a shorter duration, as they are less sensitive to economic downturns.

Inflationary Environments:

When inflation is rising, it’s essential to focus on bonds with inflation-indexed interest rates. This is because inflation-indexed bonds can help you keep pace with inflation, and their purchasing power is less likely to decline. Additionally, consider investing in bonds with a longer duration, as they can provide a higher return to compensate for the effects of inflation.

Example: Let’s say you’re investing in a bond portfolio during a period of rising interest rates. You may consider investing in a short-term bond with a floating interest rate, such as a 2-year Treasury bond with a floating interest rate. This can help you keep pace with rising interest rates and minimize the impact of interest rate changes on your bond portfolio.

By understanding the different bond investing strategies for various market conditions, you can make informed investment decisions and adjust your bond portfolio to changing market conditions. This can help you achieve your investment goals and minimize the risks associated with bond investing.

It’s also essential to consider the concept of “bond ladders” when investing in bonds. A bond ladder is a strategy that involves investing in a series of bonds with different maturities, such as 2-year, 5-year, and 10-year bonds. This can help you spread out the risk of interest rate changes and create a steady stream of income.

By incorporating bond ladders into your investment strategy, you can create a diversified bond portfolio that can help you achieve your investment goals and minimize the risks associated with bond investing.

Common Mistakes to Avoid When Investing in Bonds

When investing in bonds, it’s essential to avoid common mistakes that can lead to losses or reduced returns. In this section, we will highlight some of the most common mistakes investors make when investing in bonds and provide advice on how to avoid these pitfalls.

Neglecting Credit Risk:

One of the most common mistakes investors make when investing in bonds is neglecting credit risk. Credit risk is the risk that the issuer will default on their debt obligations, and it’s essential to assess the creditworthiness of the issuer before investing in their bonds.

Failing to Diversify:

Another common mistake investors make when investing in bonds is failing to diversify their portfolio. Diversification is essential to minimize risk and maximize returns, and it’s crucial to invest in a variety of bonds with different credit ratings, maturities, and interest rates.

Not Monitoring Interest Rate Changes:

Interest rate changes can have a significant impact on bond prices, and it’s essential to monitor interest rate changes to adjust your bond portfolio accordingly. When interest rates rise, bond prices tend to fall, and when interest rates fall, bond prices tend to rise.

Example: Let’s say you invested in a 10-year corporate bond with a 5% coupon rate. If interest rates rise to 6%, the price of your bond may decline, and you may incur a loss if you sell your bond before maturity. To avoid this, you can consider investing in a bond with a floating interest rate or a shorter maturity date.

By avoiding these common mistakes, you can make informed investment decisions and achieve your investment goals. It’s essential to remember that bond investing requires a long-term perspective, and it’s crucial to be patient and disciplined when investing in bonds.

Additionally, it’s essential to keep in mind that bond investing is not a one-time event, but rather an ongoing process. It’s crucial to regularly review and adjust your bond portfolio to ensure that it remains aligned with your investment goals and risk tolerance.

By following these tips and avoiding common mistakes, you can create a successful bond investment strategy that helps you achieve your financial goals.

Conclusion: Why Bonds Deserve a Place in Your Investment Portfolio

In conclusion, bonds are a valuable addition to any investment portfolio, offering a unique combination of regular income, relatively low risk, and diversification benefits. By understanding the basics of bonds, including the different types of bonds, how to invest in bonds, and how to read a bond table, investors can make informed decisions about their investment strategy.

As we have discussed throughout this article, bonds offer a range of benefits, including reducing risk, generating regular income, and increasing potential returns. By including bonds in a diversified investment portfolio, investors can minimize their exposure to market volatility and maximize their returns over the long term.

Additionally, bonds can provide a hedge against inflation, as the interest payments and return of principal can help to keep pace with rising prices. This makes bonds an attractive option for investors who are seeking to protect their purchasing power over time.

While bonds may not offer the same level of potential returns as stocks, they can provide a relatively stable source of income and a lower-risk investment option. By understanding the different types of bonds, including government, corporate, and municipal bonds, investors can make informed decisions about their investment strategy and achieve their financial goals.

In summary, bonds are a valuable addition to any investment portfolio, offering a unique combination of regular income, relatively low risk, and diversification benefits. By including bonds in a diversified investment portfolio, investors can minimize their exposure to market volatility and maximize their returns over the long term.

As you consider adding bonds to your investment portfolio, remember to keep in mind the key points discussed in this article, including the importance of understanding the different types of bonds, how to invest in bonds, and how to read a bond table. By following these tips and avoiding common mistakes, you can create a successful bond investment strategy that helps you achieve your financial goals.

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)