Unlocking the Value of Consumer Services Careers

The consumer services industry is a vital sector that drives economic growth and provides essential support to businesses and individuals alike. As a consumer services professional, understanding the hourly wages associated with various roles can help you make informed career decisions and negotiate fair compensation. In this article, we will delve into the world of consumer services jobs and explore the factors that influence hourly pay rates.

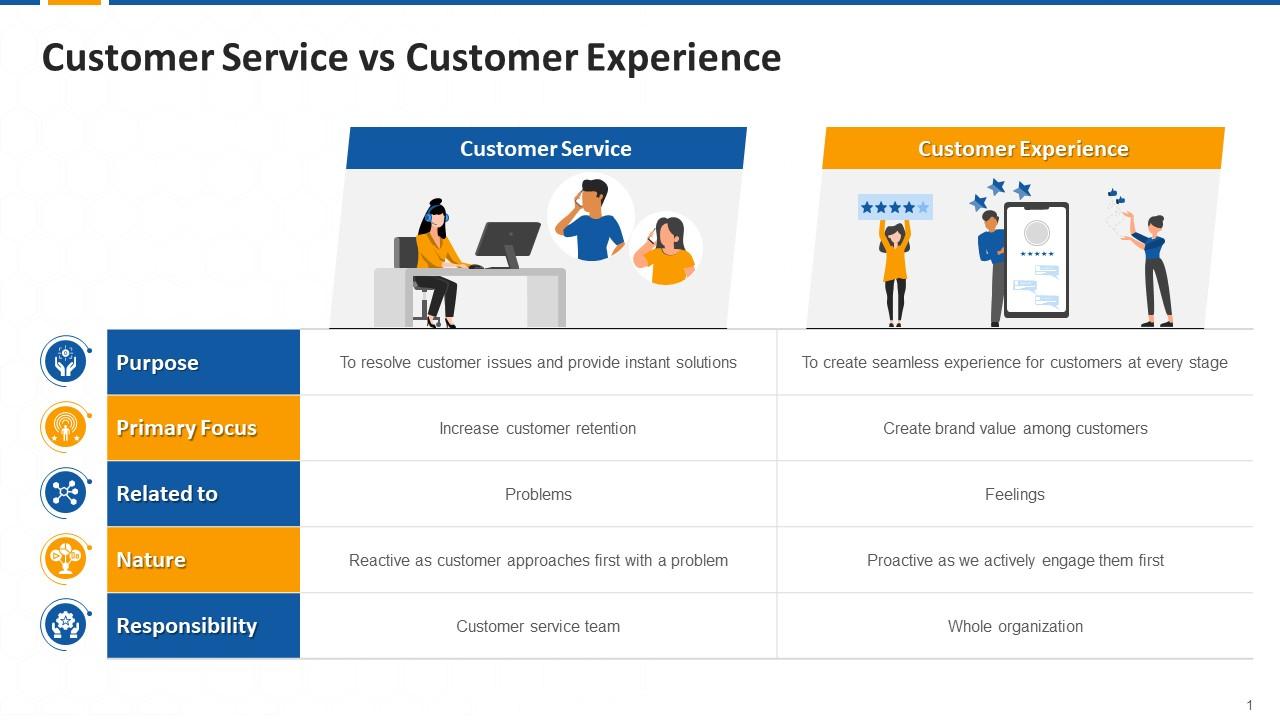

With the rise of the service-based economy, consumer services jobs have become increasingly important. These roles involve providing support, guidance, and expertise to customers, helping them navigate complex products and services. From account management to customer success management, consumer services professionals play a critical role in driving business success.

However, navigating the complex landscape of consumer services jobs can be challenging, especially when it comes to understanding hourly wages. What do consumer services jobs pay per hour? How do factors like location, experience, and skills impact hourly pay rates? In the following sections, we will provide a comprehensive guide to hourly wages in consumer services, helping you unlock the value of your career and make informed decisions about your future.

How to Determine Your Worth in Consumer Services: A Guide to Hourly Pay

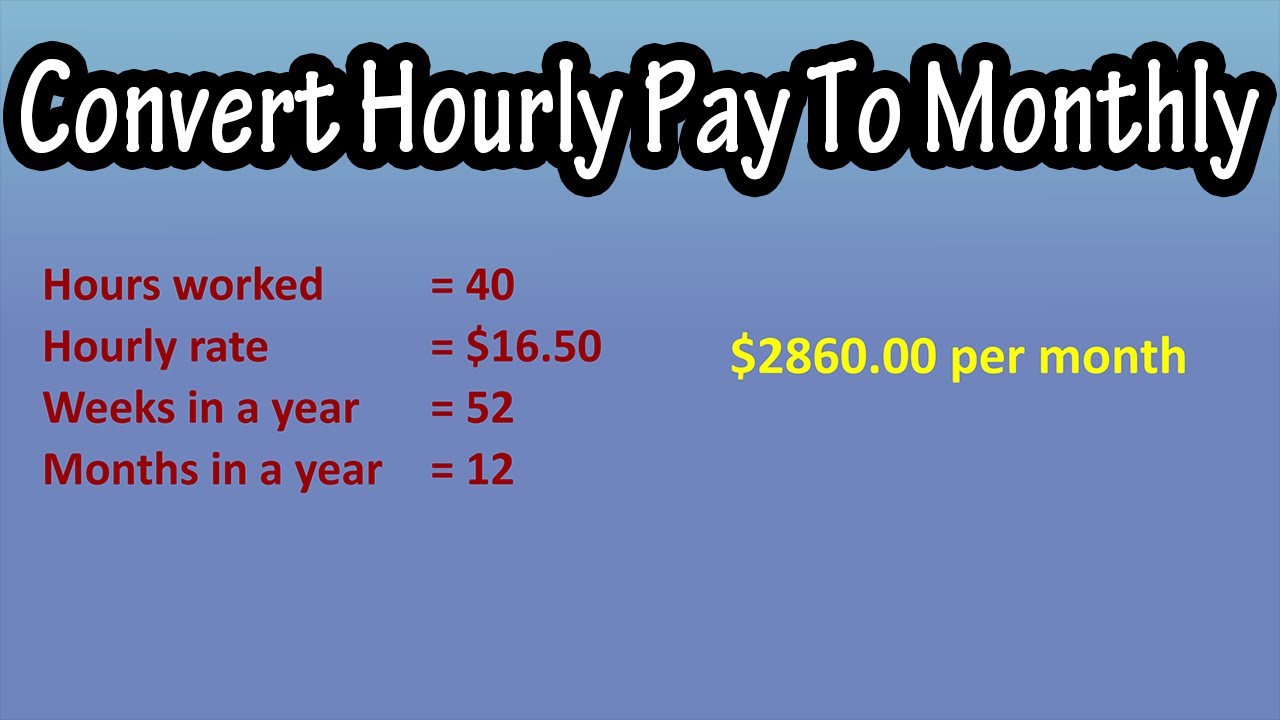

Determining your worth in consumer services requires research and understanding of the market. To find out what consumer services jobs pay per hour, start by using online resources such as job boards, salary websites, and industry reports. These sources can provide valuable insights into hourly pay rates for various consumer services roles.

Networking is also a crucial step in determining your worth. Reach out to professionals in your industry and ask about their experiences with hourly pay. Attend industry events and conferences to connect with others and learn about market trends.

Evaluating job descriptions is another important step. Look for job postings that include hourly pay rates or salary ranges. Analyze the job requirements and responsibilities to determine the level of expertise and experience required. This information can help you determine your worth and negotiate fair compensation.

Additionally, consider using online tools such as salary calculators and hourly pay rate estimators. These tools can provide a more accurate estimate of your worth based on your experience, skills, and location.

By following these steps, you can gain a better understanding of your worth in consumer services and make informed decisions about your career. Remember to stay up-to-date with market trends and adjust your expectations accordingly.

The Impact of Location on Consumer Services Hourly Wages

Location plays a significant role in determining hourly wages in consumer services. Regional variations, urban vs. rural differences, and cost of living all impact hourly pay rates. For example, cities with a high cost of living, such as San Francisco or New York, tend to have higher hourly wages to compensate for the increased cost of living.

On the other hand, cities with a lower cost of living, such as Des Moines or Omaha, may have lower hourly wages. Additionally, rural areas tend to have lower hourly wages compared to urban areas, due to the lower cost of living and lower demand for consumer services.

Some cities with high hourly wages in consumer services include:

- San Francisco, CA: $25-$35 per hour

- New York, NY: $22-$32 per hour

- Seattle, WA: $20-$30 per hour

On the other hand, some cities with lower hourly wages in consumer services include:

- Des Moines, IA: $15-$25 per hour

- Omaha, NE: $14-$24 per hour

- Wichita, KS: $13-$23 per hour

Understanding the impact of location on hourly wages can help consumer services professionals make informed decisions about their careers and negotiate fair compensation.

Experience and Skills: Key Factors in Consumer Services Hourly Pay

Experience and skills are crucial factors in determining hourly pay in consumer services. Professionals with more experience and in-demand skills tend to earn higher hourly wages. In-demand skills in consumer services include communication, problem-solving, and customer service skills.

According to the Bureau of Labor Statistics, consumer services professionals with a bachelor’s degree and 1-2 years of experience can earn an average hourly wage of $18-$25 per hour. Those with 2-5 years of experience can earn an average hourly wage of $22-$30 per hour, while those with 5-10 years of experience can earn an average hourly wage of $25-$35 per hour.

In addition to experience, skills such as data analysis, digital marketing, and project management can also impact hourly pay. Professionals with these skills can earn higher hourly wages, even if they have less experience.

Some examples of in-demand skills and their corresponding hourly wages include:

- Data analysis: $25-$35 per hour

- Digital marketing: $22-$30 per hour

- Project management: $28-$40 per hour

Developing in-demand skills and gaining experience can help consumer services professionals increase their earning potential and advance their careers.

Top-Paying Consumer Services Jobs: An Hourly Wage Breakdown

Consumer services professionals can earn competitive hourly wages in various roles. Here are some top-paying consumer services jobs, including their hourly wages and job descriptions:

- Account Management: $30-$45 per hour

- Sales Consulting: $28-$40 per hour

- Customer Success Management: $25-$35 per hour

- Operations Management: $22-$30 per hour

- Marketing Management: $20-$28 per hour

These roles require a combination of skills, experience, and education. For example, account managers typically need a bachelor’s degree in business or a related field, as well as 2-5 years of experience in sales or customer service.

Sales consultants typically need a bachelor’s degree in business or a related field, as well as 1-3 years of experience in sales or customer service. Customer success managers typically need a bachelor’s degree in business or a related field, as well as 2-5 years of experience in customer service or sales.

Operations managers typically need a bachelor’s degree in business or a related field, as well as 2-5 years of experience in operations or management. Marketing managers typically need a bachelor’s degree in marketing or a related field, as well as 2-5 years of experience in marketing or sales.

These top-paying consumer services jobs offer competitive hourly wages and opportunities for career advancement. By understanding the hourly wages and job requirements for these roles, consumer services professionals can make informed decisions about their careers and negotiate fair compensation.

Entry-Level Consumer Services Jobs: Hourly Wages and Growth Opportunities

Entry-level consumer services jobs can provide a great starting point for professionals looking to launch their careers. These roles typically offer competitive hourly wages and opportunities for growth and advancement.

Some examples of entry-level consumer services jobs include:

- Customer Service Representative: $12-$18 per hour

- Account Coordinator: $15-$22 per hour

- Marketing Assistant: $18-$25 per hour

- Sales Associate: $15-$20 per hour

- Operations Assistant: $12-$18 per hour

These roles typically require a high school diploma or equivalent, and may require some college coursework or a degree in a related field. Entry-level consumer services jobs can provide a great foundation for career advancement, as they often involve working with customers, managing accounts, and developing marketing and sales skills.

In addition to competitive hourly wages, entry-level consumer services jobs can also provide opportunities for growth and advancement. Many companies offer training and development programs to help employees build their skills and advance in their careers.

For example, a customer service representative may have the opportunity to advance to a role such as account manager or sales consultant, while a marketing assistant may have the opportunity to advance to a role such as marketing manager or brand manager.

By understanding the hourly wages and growth opportunities for entry-level consumer services jobs, professionals can make informed decisions about their careers and take the first step towards a successful and rewarding career in consumer services.

Negotiating Hourly Pay in Consumer Services: Tips and Strategies

Negotiating hourly pay in consumer services can be a daunting task, but it’s essential to ensure fair compensation for one’s skills and experience. To effectively negotiate hourly pay, it’s crucial to be prepared and knowledgeable about the market. Researching what consumer services jobs pay per hour can provide valuable insights into the going rate for specific roles.

Before entering into salary discussions, it’s essential to have a clear understanding of the job requirements, responsibilities, and expectations. Reviewing the job description and requirements can help identify areas where skills and experience align, providing a solid foundation for negotiation. Additionally, researching the company’s compensation structure and industry standards can provide a basis for determining a fair hourly wage.

Highlighting relevant skills and experience is critical in negotiating hourly pay. Emphasizing achievements and qualifications can demonstrate value to the employer, justifying higher compensation. It’s also essential to be confident and assertive when discussing salary, avoiding apologetic or hesitant tone. Instead, focus on the value brought to the organization and the expected outcomes.

Knowing when to walk away is also crucial in negotiation. If the offered hourly wage is not commensurate with skills and experience, it may be necessary to explore other opportunities. Having a clear understanding of the minimum acceptable hourly wage can help make this decision. Remember, negotiation is a conversation, not a confrontation. Approaching the discussion with a collaborative mindset can lead to a mutually beneficial agreement.

Some additional tips for negotiating hourly pay in consumer services include:

- Being flexible and open to creative compensation packages

- Using online resources, such as salary calculators and job boards, to determine fair market rates

- Networking with professionals in the industry to gain insights into compensation standards

- Emphasizing soft skills, such as communication and problem-solving, which are valuable in consumer services

By being prepared, confident, and informed, consumer services professionals can effectively negotiate hourly pay that reflects their worth. Remember, understanding what consumer services jobs pay per hour is essential in determining fair compensation. By taking control of the negotiation process, professionals can maximize their earning potential and achieve a fulfilling career in consumer services.

Maximizing Your Earning Potential in Consumer Services

Understanding hourly wages is crucial for consumer services professionals to make informed career decisions and maximize their earning potential. By researching what consumer services jobs pay per hour, professionals can determine fair compensation for their skills and experience. Developing in-demand skills, such as communication, problem-solving, and customer service, can also lead to higher earning potential.

Negotiating salary is a critical aspect of maximizing earning potential in consumer services. By being prepared, confident, and informed, professionals can effectively negotiate hourly pay that reflects their worth. Remember, understanding what consumer services jobs pay per hour is essential in determining fair compensation. By taking control of the negotiation process, professionals can achieve a fulfilling career in consumer services.

In addition to negotiating salary, professionals can also maximize their earning potential by seeking out top-paying consumer services jobs. Roles such as account management, sales consulting, and customer success management often offer higher hourly wages and opportunities for career advancement. Entry-level consumer services jobs can also serve as a stepping stone for career advancement, providing valuable experience and skills that can lead to higher earning potential.

Location is also a critical factor in maximizing earning potential in consumer services. Cities with high hourly wages, such as New York and San Francisco, may offer more lucrative career opportunities. However, regional variations and urban vs. rural differences can also impact hourly wages. Professionals should research the local job market and cost of living to determine the best location for their career goals.

In conclusion, maximizing earning potential in consumer services requires a combination of understanding hourly wages, developing in-demand skills, and negotiating salary. By taking control of their career and seeking out top-paying job opportunities, professionals can achieve a fulfilling and lucrative career in consumer services.

Key takeaways for consumer services professionals include:

- Researching what consumer services jobs pay per hour to determine fair compensation

- Developing in-demand skills, such as communication and problem-solving

- Negotiating salary to reflect worth and experience

- Seeking out top-paying consumer services jobs and locations

- Continuously developing skills and experience to maximize earning potential

By following these tips and staying informed about the consumer services industry, professionals can maximize their earning potential and achieve a successful and fulfilling career.