Understanding the Basics of Business Entities

When it comes to starting a business, one of the most important decisions entrepreneurs face is choosing the right business structure. With various options available, it’s essential to understand the basics of each entity to make an informed decision. A business entity is a legally recognized organization that operates separately from its owners, providing a level of protection and benefits. The most common types of business entities include sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

Sole proprietorships are the simplest and most common type of business entity, where the owner and the business are considered one and the same. Partnerships involve two or more owners sharing ownership and decision-making responsibilities. Corporations, on the other hand, are more complex and offer liability protection, but are often subject to double taxation. LLCs, which stand for Limited Liability Companies, offer a unique combination of liability protection and tax benefits, making them a popular choice among entrepreneurs.

Understanding the different types of business entities is crucial for entrepreneurs to determine which structure best suits their business needs. Each entity has its own set of advantages and disadvantages, and choosing the right one can impact the success and growth of the business. For instance, LLCs are often preferred by small business owners and solo entrepreneurs due to their flexibility and liability protection. However, corporations may be more suitable for larger businesses or those seeking to raise capital through investors.

In the United States, the Small Business Administration (SBA) estimates that there are over 31 million small businesses, with the majority being sole proprietorships and LLCs. With the rise of entrepreneurship and small business ownership, it’s essential to understand the basics of business entities to make informed decisions and ensure the success of your venture. Whether you’re just starting out or looking to expand your business, understanding the different types of business entities can help you navigate the complex world of business ownership.

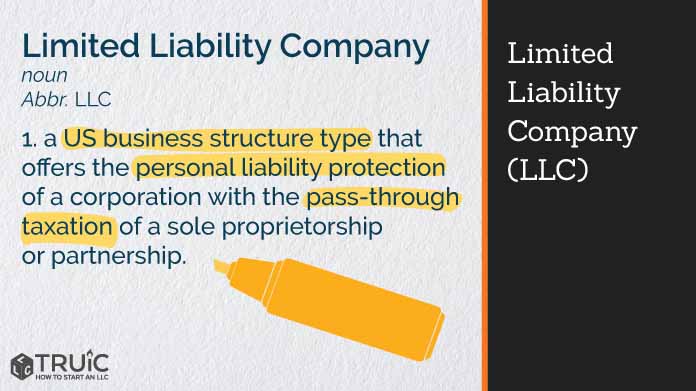

What is an LLC and How Does it Work?

A Limited Liability Company (LLC) is a type of business structure that offers liability protection and tax benefits to its owners, also known as members. LLCs are often preferred by small business owners and solo entrepreneurs due to their flexibility and ease of formation. But what does LLC stand for, and how does it work?

LLCs are hybrid entities that combine the liability protection of a corporation with the tax benefits and flexibility of a partnership. This means that LLC members are not personally liable for the debts and obligations of the business, and they can also enjoy pass-through taxation, where the business income is only taxed at the individual level.

One of the main benefits of forming an LLC is liability protection. LLCs provide a level of protection for their members’ personal assets, such as homes and savings, in case the business is sued or incurs debt. This can provide peace of mind for entrepreneurs who want to protect their personal assets while still running a business.

Another advantage of LLCs is their flexibility in terms of ownership and management. LLCs can have any number of owners, and ownership can be structured in a variety of ways. LLCs can also be managed by their members, or they can hire a manager to oversee the business.

In terms of taxation, LLCs are often referred to as “pass-through” entities, meaning that the business income is only taxed at the individual level. This can help avoid double taxation, which can occur in corporations where the business income is taxed at both the corporate and individual levels.

Overall, LLCs offer a unique combination of liability protection, tax benefits, and flexibility, making them a popular choice for many business owners. Whether you’re just starting out or looking to expand your business, understanding what an LLC is and how it works can help you make informed decisions about your business structure.

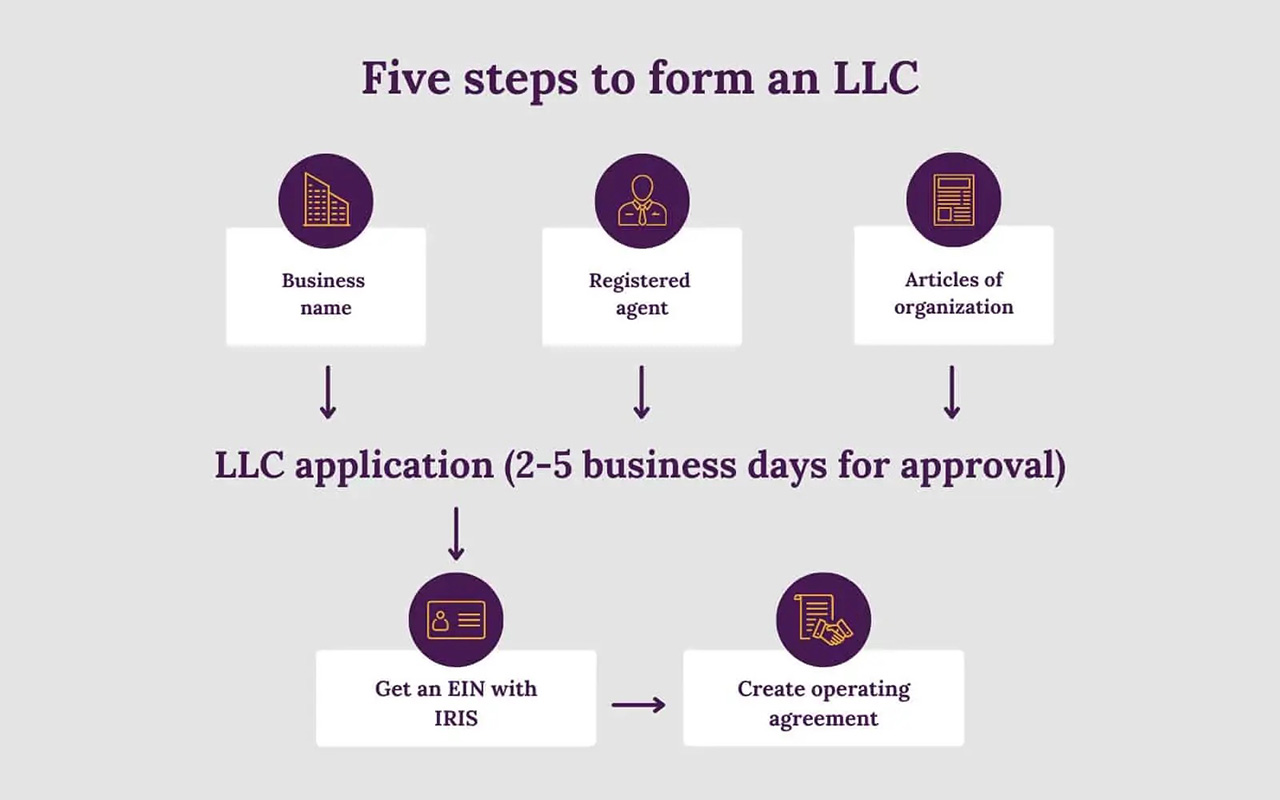

How to Form an LLC: A Step-by-Step Guide

Forming a Limited Liability Company (LLC) can be a straightforward process, but it requires careful attention to detail and compliance with state regulations. Here’s a step-by-step guide on how to form an LLC:

Step 1: Choose a Business Name

The first step in forming an LLC is to choose a unique and memorable business name. The name must comply with the state’s naming requirements, which typically include the words “Limited Liability Company” or the abbreviation “LLC.” It’s also essential to ensure that the name is not already in use by searching the state’s business database.

Step 2: File Articles of Organization

Once you’ve chosen a business name, you’ll need to file Articles of Organization with the state. This document provides basic information about the LLC, including its name, address, and purpose. The filing fee varies by state, but it’s typically around $100-$500.

Step 3: Obtain Necessary Licenses and Permits

Depending on the type of business you’re operating, you may need to obtain licenses and permits from the state or local government. These can include sales tax permits, employer identification numbers, and zoning

How to Form an LLC: A Step-by-Step Guide

Forming a Limited Liability Company (LLC) can be a straightforward process, but it requires careful attention to detail and compliance with state regulations. Here’s a step-by-step guide on how to form an LLC:

Step 1: Choose a Business Name

The first step in forming an LLC is to choose a unique and memorable business name. The name must comply with the state’s naming requirements, which typically include the words “Limited Liability Company” or the abbreviation “LLC.” It’s also essential to ensure that the name is not already in use by searching the state’s business database.

Step 2: File Articles of Organization

Once you’ve chosen a business name, you’ll need to file Articles of Organization with the state. This document provides basic information about the LLC, including its name, address, and purpose. The filing fee varies by state, but it’s typically around $100-$500.

Step 3: Obtain Necessary Licenses and Permits

Depending on the type of business you’re operating, you may need to obtain licenses and permits from the state or local government. These can include sales tax permits, employer identification numbers, and zoning

How to Form an LLC: A Step-by-Step Guide

Forming a Limited Liability Company (LLC) can be a straightforward process, but it requires careful attention to detail and compliance with state regulations. Here’s a step-by-step guide on how to form an LLC:

Step 1: Choose a Business Name

The first step in forming an LLC is to choose a unique and memorable business name. The name must comply with the state’s naming requirements, which typically include the words “Limited Liability Company” or the abbreviation “LLC.” It’s also essential to ensure that the name is not already in use by searching the state’s business database.

Step 2: File Articles of Organization

Once you’ve chosen a business name, you’ll need to file Articles of Organization with the state. This document provides basic information about the LLC, including its name, address, and purpose. The filing fee varies by state, but it’s typically around $100-$500.

Step 3: Obtain Necessary Licenses and Permits

Depending on the type of business you’re operating, you may need to obtain licenses and permits from the state or local government. These can include sales tax permits, employer identification numbers, and zoning

How to Form an LLC: A Step-by-Step Guide

Forming a Limited Liability Company (LLC) can be a straightforward process, but it requires careful attention to detail and compliance with state regulations. Here’s a step-by-step guide on how to form an LLC:

Step 1: Choose a Business Name

The first step in forming an LLC is to choose a unique and memorable business name. The name must comply with the state’s naming requirements, which typically include the words “Limited Liability Company” or the abbreviation “LLC.” It’s also essential to ensure that the name is not already in use by searching the state’s business database.

Step 2: File Articles of Organization

Once you’ve chosen a business name, you’ll need to file Articles of Organization with the state. This document provides basic information about the LLC, including its name, address, and purpose. The filing fee varies by state, but it’s typically around $100-$500.

Step 3: Obtain Necessary Licenses and Permits

Depending on the type of business you’re operating, you may need to obtain licenses and permits from the state or local government. These can include sales tax permits, employer identification numbers, and zoning

How to Form an LLC: A Step-by-Step Guide

Forming a Limited Liability Company (LLC) can be a straightforward process, but it requires careful attention to detail and compliance with state regulations. Here’s a step-by-step guide on how to form an LLC:

Step 1: Choose a Business Name

The first step in forming an LLC is to choose a unique and memorable business name. The name must comply with the state’s naming requirements, which typically include the words “Limited Liability Company” or the abbreviation “LLC.” It’s also essential to ensure that the name is not already in use by searching the state’s business database.

Step 2: File Articles of Organization

Once you’ve chosen a business name, you’ll need to file Articles of Organization with the state. This document provides basic information about the LLC, including its name, address, and purpose. The filing fee varies by state, but it’s typically around $100-$500.

Step 3: Obtain Necessary Licenses and Permits

Depending on the type of business you’re operating, you may need to obtain licenses and permits from the state or local government. These can include sales tax permits, employer identification numbers, and zoning

How to Form an LLC: A Step-by-Step Guide

Forming a Limited Liability Company (LLC) can be a straightforward process, but it requires careful attention to detail and compliance with state regulations. Here’s a step-by-step guide on how to form an LLC:

Step 1: Choose a Business Name

The first step in forming an LLC is to choose a unique and memorable business name. The name must comply with the state’s naming requirements, which typically include the words “Limited Liability Company” or the abbreviation “LLC.” It’s also essential to ensure that the name is not already in use by searching the state’s business database.

Step 2: File Articles of Organization

Once you’ve chosen a business name, you’ll need to file Articles of Organization with the state. This document provides basic information about the LLC, including its name, address, and purpose. The filing fee varies by state, but it’s typically around $100-$500.

Step 3: Obtain Necessary Licenses and Permits

Depending on the type of business you’re operating, you may need to obtain licenses and permits from the state or local government. These can include sales tax permits, employer identification numbers, and zoning