Understanding the Value of a $15 Hourly Salary

A $15 an hour salary is a significant milestone for many workers, offering a higher standard of living and improved financial stability. But what exactly does this wage mean for individuals and families? To answer this question, it’s essential to consider the benefits of a $15 an hour salary and how it compares to the current minimum wage and cost of living.

One of the primary advantages of a $15 an hour salary is increased purchasing power. With a higher wage, individuals can afford basic needs, such as housing, food, and healthcare, without having to sacrifice other essential expenses. This, in turn, can lead to improved job satisfaction, reduced stress, and a better overall quality of life.

In addition to increased purchasing power, a $15 an hour salary can also provide a sense of financial security. With a higher wage, individuals can build savings, pay off debt, and invest in their future. This can be particularly beneficial for families, who may struggle to make ends meet on a lower income.

But a $15 an hour salary is not just beneficial for individuals and families; it can also have a positive impact on the economy. By paying workers a higher wage, employers can increase productivity, reduce turnover, and improve customer satisfaction. This, in turn, can lead to increased economic growth and competitiveness.

So, what is a $15 an hour salary, and how does it compare to the current minimum wage and cost of living? In many cities and states, the minimum wage is significantly lower than $15 an hour, making it difficult for workers to afford basic needs. However, a $15 an hour salary can provide a more comfortable standard of living, allowing individuals to afford housing, food, and other essential expenses.

In conclusion, a $15 an hour salary is a significant milestone for many workers, offering a higher standard of living and improved financial stability. By understanding the benefits of a $15 an hour salary and how it compares to the current minimum wage and cost of living, individuals can make informed decisions about their career and financial future.

How to Make the Most of a $15 an Hour Job

Securing a $15 an hour job is a significant achievement, but it’s only the first step towards financial stability and success. To maximize the potential of this wage, it’s essential to develop a solid understanding of budgeting, saving, and investing. By implementing these strategies, individuals can increase their earning potential, reduce financial stress, and achieve long-term financial goals.

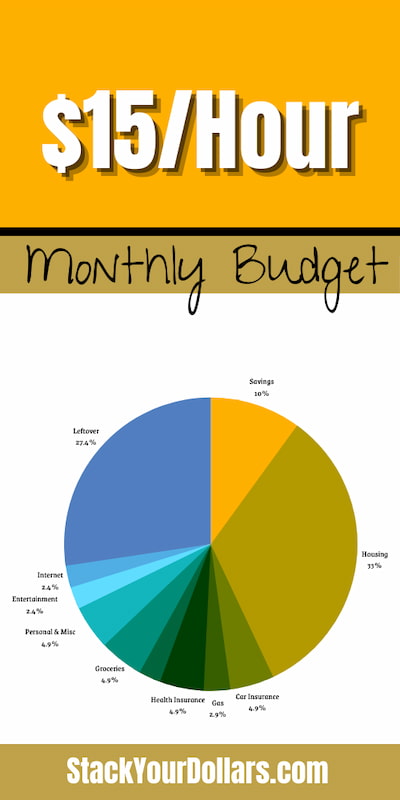

One of the most effective ways to make the most of a $15 an hour job is to create a budget that accounts for all income and expenses. This involves tracking every dollar earned and spent, identifying areas for reduction, and allocating funds towards savings and investments. By prioritizing needs over wants, individuals can ensure that they’re making the most of their hard-earned money.

In addition to budgeting, saving is another crucial aspect of maximizing the potential of a $15 an hour job. By setting aside a portion of each paycheck, individuals can build an emergency fund, pay off debt, and invest in their future. This can include taking advantage of employer-matched retirement accounts, such as 401(k) or IRA, or exploring other investment options, like stocks or real estate.

Another way to increase earning potential is to explore opportunities for overtime, promotions, or side hustles. By taking on additional responsibilities or pursuing alternative income streams, individuals can boost their income and accelerate their financial progress. This might involve developing new skills, networking with colleagues or industry leaders, or identifying emerging trends and opportunities.

For those looking to increase their earning potential, it’s essential to research the market and understand the going rate for their skills and experience. This can involve using online resources, such as Glassdoor or Payscale, to determine the average salary for their position and location. By making a strong case for a higher wage, individuals can negotiate a better salary and increase their earning potential.

Ultimately, making the most of a $15 an hour job requires a combination of financial literacy, strategic planning, and proactive effort. By developing a solid understanding of budgeting, saving, and investing, individuals can increase their earning potential, reduce financial stress, and achieve long-term financial success.

The Impact of a $15 an Hour Wage on Lifestyle and Finances

A $15 an hour wage can have a significant impact on an individual’s lifestyle and finances. With a higher wage, individuals can afford basic needs, such as housing, food, and healthcare, without having to sacrifice other essential expenses. This can lead to improved job satisfaction, reduced stress, and a better overall quality of life.

One of the primary benefits of a $15 an hour wage is the ability to pay off debt and build savings. With a higher wage, individuals can allocate more funds towards debt repayment and savings, which can lead to improved financial stability and security. This can also provide a sense of financial freedom, allowing individuals to pursue their goals and aspirations without being burdened by debt.

However, a $15 an hour wage can also bring increased financial responsibility. With a higher wage, individuals may be more likely to take on additional expenses, such as a mortgage or car loan, which can increase their financial obligations. Additionally, a higher wage may also lead to increased taxes, which can reduce the individual’s take-home pay.

Despite these potential challenges, a $15 an hour wage can still have a positive impact on an individual’s lifestyle and finances. By prioritizing needs over wants and making smart financial decisions, individuals can make the most of their higher wage and achieve long-term financial success.

For example, a $15 an hour wage can provide individuals with the financial flexibility to pursue their passions and interests. With a higher wage, individuals can afford to take on hobbies or pursue additional education or training, which can lead to personal fulfillment and career advancement.

In addition, a $15 an hour wage can also have a positive impact on an individual’s mental and physical health. With a higher wage, individuals can afford to prioritize their health and well-being, which can lead to improved overall health and reduced stress.

Overall, a $15 an hour wage can have a significant impact on an individual’s lifestyle and finances. By understanding the potential benefits and challenges of a higher wage, individuals can make informed decisions about their financial future and achieve long-term financial success.

Comparing $15 an Hour to the Minimum Wage and Cost of Living

In order to understand the significance of a $15 an hour wage, it’s essential to compare it to the current minimum wage and cost of living in various cities and states. The federal minimum wage is currently $7.25 an hour, although some states and cities have implemented higher minimum wages. For example, California, Massachusetts, and New York have all implemented minimum wages of $15 an hour or higher.

However, the cost of living in these states and cities can be significantly higher than in other parts of the country. For example, the cost of living in San Francisco, California is over 60% higher than the national average, while the cost of living in New York City is over 70% higher. This means that a $15 an hour wage may not go as far in these cities as it would in other parts of the country.

Despite these challenges, a $15 an hour wage can still provide a significant improvement in standard of living for many workers. According to the Economic Policy Institute, a $15 an hour wage would increase the annual earnings of a full-time worker by over $10,000, from $15,080 to $25,200. This could make a significant difference in the lives of workers who are struggling to make ends meet.

In addition to the federal minimum wage, some cities and states have implemented their own minimum wages. For example, Seattle, Washington has implemented a minimum wage of $16 an hour, while San Francisco, California has implemented a minimum wage of $16.32 an hour. These higher minimum wages can provide a significant boost to workers in these cities, although they may also lead to higher costs for employers and consumers.

Overall, comparing a $15 an hour wage to the minimum wage and cost of living in various cities and states can provide a more nuanced understanding of the significance of this wage. While a $15 an hour wage may not be enough to support a high standard of living in all cities and states, it can still provide a significant improvement in standard of living for many workers.

It’s also worth noting that a $15 an hour wage can have a positive impact on the economy as a whole. According to a study by the Center for American Progress, increasing the minimum wage to $15 an hour could increase economic output by over $144 billion and create over 1.3 million new jobs. This could have a positive impact on workers, employers, and the economy as a whole.

The Benefits of a $15 an Hour Wage for Employers and the Economy

A $15 an hour wage can have numerous benefits for employers and the economy as a whole. One of the primary advantages is increased productivity. When employees are paid a higher wage, they are more likely to be motivated and engaged in their work, leading to increased productivity and better job performance.

Another benefit of a $15 an hour wage is reduced turnover. When employees are paid a higher wage, they are more likely to be satisfied with their job and less likely to leave, reducing turnover and the costs associated with recruiting and training new employees.

In addition to increased productivity and reduced turnover, a $15 an hour wage can also lead to improved customer satisfaction. When employees are paid a higher wage, they are more likely to be motivated and engaged in their work, leading to better customer service and improved customer satisfaction.

A $15 an hour wage can also have a positive impact on the economy as a whole. According to a study by the Economic Policy Institute, increasing the minimum wage to $15 an hour could increase economic output by over $144 billion and create over 1.3 million new jobs. This could have a positive impact on workers, employers, and the economy as a whole.

Furthermore, a $15 an hour wage can also lead to increased economic growth and competitiveness. When employees are paid a higher wage, they are more likely to have disposable income, which can lead to increased consumer spending and economic growth. Additionally, a higher minimum wage can also lead to increased competitiveness, as businesses are forced to innovate and improve their products and services in order to remain competitive.

Some employers may be concerned about the potential costs of implementing a $15 an hour wage. However, many employers have found that the benefits of a higher minimum wage far outweigh the costs. For example, Costco, a retail giant, has implemented a $15 an hour wage for its employees, and has seen significant increases in productivity and customer satisfaction as a result.

In conclusion, a $15 an hour wage can have numerous benefits for employers and the economy as a whole. From increased productivity and reduced turnover, to improved customer satisfaction and increased economic growth and competitiveness, the advantages of a higher minimum wage are clear.

Real-Life Examples of Jobs that Pay $15 an Hour or More

While a $15 an hour wage may seem like a lofty goal, there are many jobs that already offer this level of compensation. Here are some real-life examples of jobs that pay $15 an hour or more, including job titles, industries, and companies:

1. Retail Manager: Many retail companies, such as Costco and Trader Joe’s, pay their managers a salary of $15 an hour or more. These managers are responsible for overseeing store operations, managing employees, and ensuring customer satisfaction.

2. Software Engineer: Software engineers are in high demand, and many companies are willing to pay top dollar for their skills. Companies like Google, Amazon, and Microsoft pay their software engineers a salary of $15 an hour or more.

3. Registered Nurse: Registered nurses are essential to the healthcare industry, and many hospitals and medical facilities pay them a salary of $15 an hour or more. These nurses are responsible for providing patient care, administering medications, and working with doctors and other medical professionals.

4. Data Analyst: Data analysts are responsible for analyzing and interpreting data to help companies make informed business decisions. Many companies, such as IBM and Accenture, pay their data analysts a salary of $15 an hour or more.

5. Marketing Manager: Marketing managers are responsible for developing and implementing marketing campaigns to promote products and services. Many companies, such as Procter & Gamble and Coca-Cola, pay their marketing managers a salary of $15 an hour or more.

6. Web Developer: Web developers are responsible for designing and building websites, as well as maintaining and updating existing sites. Many companies, such as Amazon and Facebook, pay their web developers a salary of $15 an hour or more.

7. Sales Representative: Sales representatives are responsible for selling products and services to customers. Many companies, such as pharmaceutical companies and software companies, pay their sales representatives a salary of $15 an hour or more.

8. Human Resources Manager: Human resources managers are responsible for overseeing employee relations, benefits, and training. Many companies, such as Google and Microsoft, pay their human resources managers a salary of $15 an hour or more.

These are just a few examples of jobs that pay $15 an hour or more. While these jobs may require specialized skills and education, they demonstrate that a $15 an hour wage is achievable in many industries and companies.

Negotiating a $15 an Hour Salary: Tips and Strategies

Negotiating a $15 an hour salary can be a challenging but rewarding experience. Here are some tips and strategies to help you prepare and make a strong case for a higher wage:

1. Research the market: Before entering into negotiations, research the market to determine the average salary for your position and industry. This will give you a basis for your negotiation and help you make a strong case for a higher wage.

2. Prepare your case: Make a list of your skills, qualifications, and achievements, and be prepared to explain how they align with the job requirements and company goals. This will help you demonstrate your value to the employer and make a strong case for a higher wage.

3. Know your worth: Be confident in your worth and the value you bring to the company. Avoid apologetic or hesitant language, and instead focus on your strengths and achievements.

4. Be flexible: Be open to negotiation and willing to consider alternative compensation packages. This may include additional benefits, such as health insurance or retirement plans, or a performance-based raise.

5. Practice your negotiation skills: Practice your negotiation skills with a friend or family member to build your confidence and prepare for the negotiation.

6. Be prepared to explain why you deserve a $15 an hour salary: Be prepared to explain why you deserve a $15 an hour salary, based on your research and preparation. This may include highlighting your skills, qualifications, and achievements, as well as the value you bring to the company.

7. Be confident but respectful: Be confident and assertive in your negotiation, but also respectful and professional. Avoid aggressive or confrontational language, and instead focus on building a positive and collaborative relationship with the employer.

8. Be willing to walk away: If the negotiation is not successful, be willing to walk away from the job offer. This will show the employer that you are confident in your worth and willing to stand up for yourself.

By following these tips and strategies, you can effectively negotiate a $15 an hour salary and achieve your career goals.

Conclusion: The Future of the $15 an Hour Wage

In conclusion, a $15 an hour wage has the potential to significantly improve the lives of workers, employers, and the economy as a whole. By understanding the value of a $15 an hour salary, maximizing the potential of a $15 an hour job, and negotiating a $15 an hour salary, workers can achieve financial stability and security.

As the economy continues to evolve, it is likely that the demand for a $15 an hour wage will only continue to grow. With the rise of the gig economy and the increasing cost of living, workers are seeking fair compensation for their labor. Employers who offer a $15 an hour wage can expect to see increased productivity, reduced turnover, and improved customer satisfaction.

However, there are also potential challenges and opportunities associated with a $15 an hour wage. For example, some employers may struggle to absorb the increased costs of a higher minimum wage, while others may see it as an opportunity to invest in their employees and improve their competitiveness.

Ultimately, the future of the $15 an hour wage will depend on a variety of factors, including the state of the economy, the actions of policymakers, and the decisions of employers. However, one thing is clear: a $15 an hour wage has the potential to make a significant difference in the lives of workers and the economy as a whole.

As we look to the future, it is essential that we continue to prioritize the needs of workers and the economy. By working together, we can create a more equitable and sustainable economy that benefits everyone.