What’s the Code on My Debit Card?

A debit card is a ubiquitous part of modern life, allowing users to make purchases, withdraw cash, and manage their finances with ease. However, have you ever stopped to think about the mysterious code on the bottom of your debit card? This code is known as a routing number, and it plays a crucial role in facilitating transactions, direct deposits, and online banking. So, what is a routing number on a debit card, and why is it so important?

In essence, a routing number is a unique nine-digit code that identifies the financial institution associated with your debit card. This code is used by banks and other financial institutions to process transactions, ensuring that your money is routed to the correct account. Without a routing number, it would be impossible for banks to verify the authenticity of transactions, leading to delays, errors, and potential security risks.

Routing numbers are also used for direct deposits, such as payroll and social security benefits. When you provide your routing number to an employer or government agency, they can deposit funds directly into your account, eliminating the need for paper checks or other payment methods. This not only saves time but also reduces the risk of lost or stolen checks.

In addition to transactions and direct deposits, routing numbers are also used for online banking and bill payments. When you set up online banking or make a payment, you’ll typically be asked to provide your routing number and account number. This information is used to verify your identity and ensure that the payment is processed correctly.

In summary, the routing number on your debit card is a critical component of modern banking, enabling secure and efficient transactions, direct deposits, and online banking. By understanding the purpose and importance of this code, you can take control of your financial transactions and ensure that your money is always routed to the correct account.

How to Find Your Routing Number: A Step-by-Step Guide

Locating your routing number is a straightforward process that can be completed in a few simple steps. To find your routing number, follow these instructions:

Step 1: Check Your Debit Card – The routing number is typically printed on the bottom of your debit card, preceded by your account number. It is a nine-digit code that is usually separated from your account number by a space or a dash.

Step 2: Check Your Bank Statement – If you don’t have your debit card handy, you can also find your routing number on your bank statement. It is usually printed on the top right corner of the statement, along with your account number.

Step 3: Check Online Banking – Most banks offer online banking services that allow you to view your account information, including your routing number. Simply log in to your online banking account and look for the “Account Information” or “Account Details” section.

Step 4: Contact Your Bank’s Customer Support – If you are unable to find your routing number using the above methods, you can contact your bank’s customer support team for assistance. They will be able to provide you with your routing number and answer any other questions you may have.

Alternative Methods – In addition to the above methods, you can also find your routing number by:

Checking your bank’s website or mobile app

Calling your bank’s customer support number

Visiting your bank’s branch in person

It’s essential to note that routing numbers can vary depending on the bank and location. Therefore, it’s crucial to verify your routing number with your bank to ensure accuracy.

By following these steps, you can easily find your routing number and use it for various financial transactions, such as direct deposits, bill payments, and online banking.

The Anatomy of a Routing Number: Breaking Down the Code

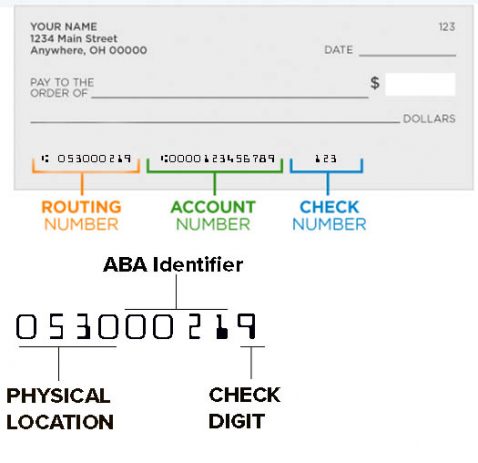

A routing number is a nine-digit code that is used to identify a financial institution and facilitate transactions. But have you ever wondered what each digit in the routing number represents? Let’s break down the anatomy of a routing number to understand its components and their significance.

The first four digits of the routing number are the Federal Reserve Bank (FRB) number. This number identifies the Federal Reserve Bank that serves the financial institution. The FRB number is used to process transactions and provide banking services to financial institutions.

The next four digits are the American Bankers Association (ABA) institution identifier. This number identifies the specific financial institution that issued the debit card. The ABA institution identifier is used to verify the authenticity of transactions and ensure that funds are transferred to the correct account.

The final digit of the routing number is the check digit. This digit is calculated using a complex algorithm that takes into account the other digits in the routing number. The check digit is used to verify the accuracy of the routing number and prevent errors during transactions.

Understanding the anatomy of a routing number can help you appreciate the complexity and security of the banking system. By knowing what each digit represents, you can better navigate the world of online banking and transactions.

It’s worth noting that routing numbers can vary depending on the bank and location. Some banks may have multiple routing numbers for different regions or types of transactions. However, the basic structure of the routing number remains the same, with the FRB number, ABA institution identifier, and check digit working together to facilitate secure and efficient transactions.

Why Is My Routing Number Important?

A routing number is a crucial component of a debit card, and its importance cannot be overstated. The routing number plays a vital role in facilitating various financial transactions, including direct deposits, bill payments, and online banking. In this section, we will explore the significance of the routing number and why it is essential to understand its importance.

Direct Deposits: A routing number is necessary for direct deposits, such as payroll, social security benefits, and tax refunds. Without a valid routing number, these deposits may be delayed or rejected, causing inconvenience and financial hardship.

Bill Payments: When making bill payments online or by phone, a routing number is required to process the transaction. An incorrect routing number can lead to delayed or rejected payments, resulting in late fees and penalties.

Online Banking: A routing number is necessary for online banking transactions, such as transferring funds between accounts or paying bills. Without a valid routing number, these transactions may be declined or delayed.

Security: A routing number is also important for security purposes. It helps to verify the authenticity of transactions and prevent unauthorized access to accounts. An incorrect routing number can compromise the security of an account, leading to financial losses.

In conclusion, a routing number is a critical component of a debit card, and its importance cannot be overstated. It plays a vital role in facilitating various financial transactions, ensuring security, and preventing errors. Understanding the importance of a routing number can help individuals take control of their financial transactions and avoid potential issues.

Can I Use My Routing Number for Online Transactions?

With the rise of online banking and transactions, it’s natural to wonder if it’s safe to use your routing number for online transactions. The answer is yes, but with some caveats. In this section, we’ll explore the security risks and potential scams associated with using your routing number online, and provide tips on how to safely use it for online banking and transactions.

Security Risks: When using your routing number online, there are some security risks to be aware of. One of the biggest risks is phishing scams, where scammers try to trick you into revealing your routing number and other sensitive information. Another risk is hacking, where cybercriminals gain unauthorized access to your account information.

Precautions: To minimize the risks associated with using your routing number online, take the following precautions:

Verify the website: Make sure the website you’re using is legitimate and secure. Look for “https” in the URL and a lock icon in the address bar.

Use strong passwords: Use strong, unique passwords for your online banking and transaction accounts.

Monitor your accounts: Regularly monitor your accounts for suspicious activity and report any discrepancies to your bank immediately.

Use two-factor authentication: Enable two-factor authentication whenever possible to add an extra layer of security to your online transactions.

Safe Online Banking Practices: To safely use your routing number for online banking and transactions, follow these best practices:

Use a secure computer: Use a secure computer and internet connection to access your online banking and transaction accounts.

Keep your software up-to-date: Keep your operating system, browser, and other software up-to-date to ensure you have the latest security patches.

Avoid public computers: Avoid using public computers or public Wi-Fi to access your online banking and transaction accounts.

By following these tips and taking the necessary precautions, you can safely use your routing number for online transactions and enjoy the convenience of online banking.

What’s the Difference Between a Routing Number and an Account Number?

When it comes to debit cards, there are two important numbers to understand: the routing number and the account number. While both numbers are essential for financial transactions, they serve different purposes and are used in different ways. In this section, we’ll clarify the distinction between the routing number and the account number on a debit card.

Routing Number: A routing number is a nine-digit code that identifies the bank or financial institution that issued the debit card. It’s used to facilitate transactions, direct deposits, and online banking. The routing number is usually printed on the bottom of the debit card, and it’s also known as the ABA number or the bank routing number.

Account Number: An account number, on the other hand, is a unique number that identifies the individual account associated with the debit card. It’s used to track transactions, balances, and other account activity. The account number is usually printed on the front of the debit card, and it’s also known as the account identifier or the account code.

Key Differences: So, what are the key differences between a routing number and an account number? Here are a few:

Routing numbers identify the bank, while account numbers identify the individual account.

Routing numbers are used for transactions, direct deposits, and online banking, while account numbers are used to track account activity and balances.

Routing numbers are usually printed on the bottom of the debit card, while account numbers are usually printed on the front.

Understanding the difference between a routing number and an account number is essential for managing your finances effectively. By knowing how to use these numbers correctly, you can avoid errors, delays, and other issues that can arise from incorrect or missing information.

Common Issues with Routing Numbers: Troubleshooting Tips

Despite the importance of routing numbers, issues can still arise. In this section, we’ll address common problems related to routing numbers and provide troubleshooting tips to help you resolve these issues.

Incorrect Routing Number: If you enter an incorrect routing number, your transaction may be delayed or rejected. To avoid this, double-check your routing number before submitting it. If you’re still having trouble, contact your bank’s customer support for assistance.

Missing Routing Number: If you’re unable to find your routing number, check your debit card, bank statement, or online banking account. If you still can’t find it, contact your bank’s customer support for help.

Routing Number Not Recognized: If your routing number is not recognized, it may be due to a technical issue or an incorrect routing number. Try re-entering the routing number or contacting your bank’s customer support for assistance.

Routing Number Expired: Routing numbers can expire, so it’s essential to check your debit card or bank statement for any updates. If your routing number has expired, contact your bank’s customer support to obtain a new one.

Troubleshooting Tips: To resolve issues related to routing numbers, follow these troubleshooting tips:

Verify your routing number: Double-check your routing number to ensure it’s correct.

Contact your bank’s customer support: Reach out to your bank’s customer support for assistance with routing number issues.

Check your debit card or bank statement: Verify your routing number on your debit card or bank statement.

Use online banking: Check your online banking account for any updates or issues related to your routing number.

By following these troubleshooting tips, you can quickly resolve common issues related to routing numbers and ensure smooth financial transactions.

Conclusion: Mastering Your Debit Card Routing Number

In conclusion, understanding the routing number on your debit card is crucial for managing your finances effectively. By familiarizing yourself with the routing number, you can ensure smooth financial transactions, avoid errors, and take control of your financial transactions.

Key Takeaways: To recap, here are the key takeaways from this article:

A routing number is a unique code that identifies the financial institution associated with your debit card.

The routing number is crucial for transactions, direct deposits, and online banking.

Understanding the structure of a routing number can help you identify errors and avoid issues.

Using your routing number for online transactions requires caution and attention to security risks.

By mastering your debit card routing number, you can take control of your financial transactions and avoid common issues.

Final Thoughts: In today’s digital age, managing your finances effectively requires a solid understanding of the tools and technologies at your disposal. By taking the time to learn about your debit card routing number, you can ensure that your financial transactions are smooth, secure, and efficient.

Remember, your debit card routing number is a powerful tool that can help you take control of your finances. By mastering it, you can unlock the secrets of your debit card and achieve financial freedom.