Defining Adjusted Gross Income: The Key to Tax Savings

Adjusted Gross Income (AGI) is a crucial concept in tax calculations, serving as the foundation for determining an individual’s or business’s tax liability. AGI represents the total gross income from various sources, minus allowable deductions and exemptions. Understanding what is Adjusted Gross Income and its significance is essential for taxpayers to navigate the complexities of the tax system and make informed decisions about their financial situation.

In the United States, the Internal Revenue Service (IRS) uses AGI to determine an individual’s tax bracket and eligibility for various tax credits and deductions. A lower AGI can result in a lower tax liability, making it an attractive goal for taxpayers. By grasping the concept of AGI, individuals can better comprehend how their income affects their tax obligations and explore opportunities to minimize their tax burden.

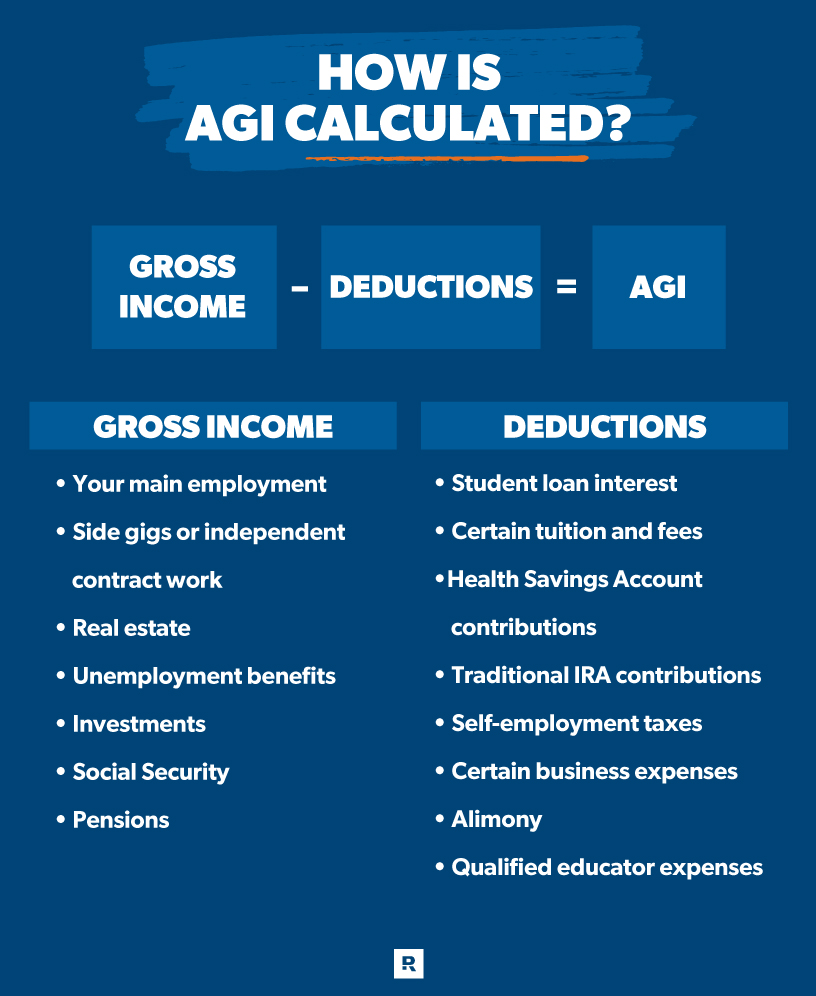

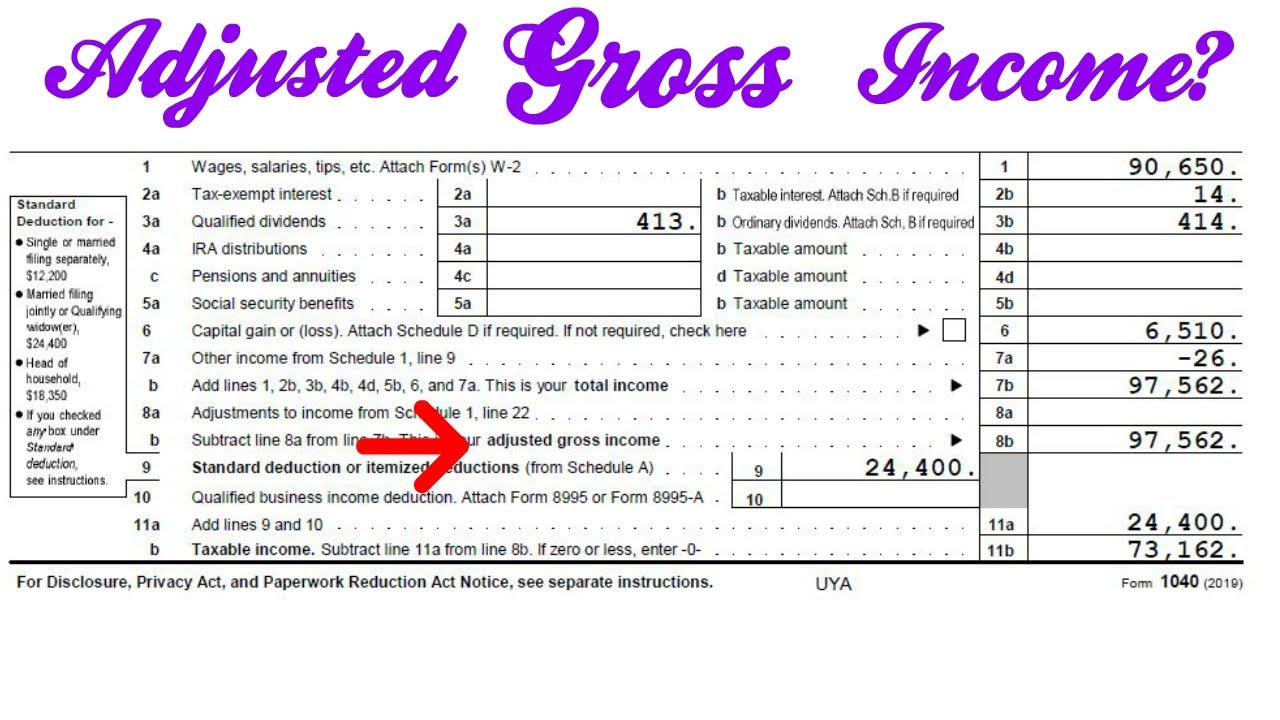

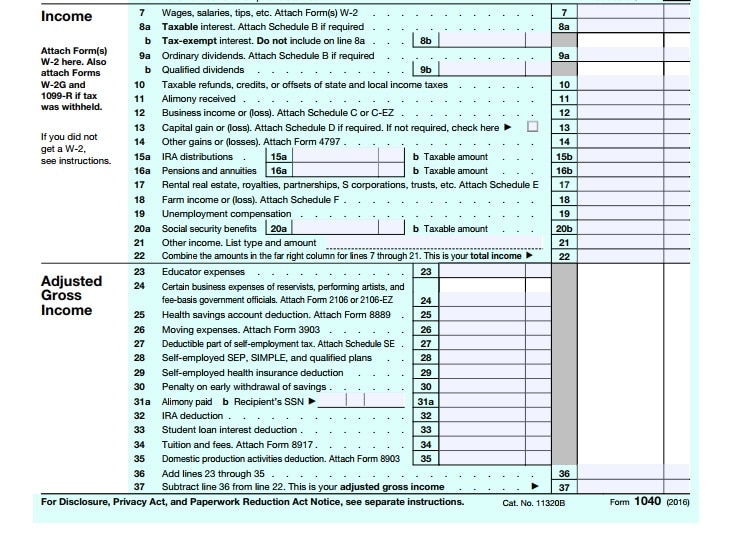

The calculation of AGI involves adding up all taxable income from various sources, including wages, salaries, tips, and self-employment income. This total is then reduced by allowable deductions, such as charitable donations, mortgage interest, and student loan interest. The resulting figure represents the individual’s AGI, which is used to determine their tax liability.

AGI plays a critical role in determining an individual’s eligibility for various tax credits and deductions. For instance, the Earned Income Tax Credit (EITC) and the Child Tax Credit are both based on AGI. By understanding how AGI affects these credits and deductions, taxpayers can make informed decisions about their tax strategy and optimize their tax savings.

In addition to its impact on tax credits and deductions, AGI also influences an individual’s tax bracket. A lower AGI can result in a lower tax bracket, reducing the individual’s tax liability. Conversely, a higher AGI can push an individual into a higher tax bracket, increasing their tax liability.

By grasping the concept of AGI and its significance in tax calculations, taxpayers can take the first step towards optimizing their tax strategy and minimizing their tax liability. In the following sections, we will delve deeper into the calculation of AGI, exploring the various types of income and deductions that are included, and providing tips and strategies for reducing AGI.

How to Calculate Your Adjusted Gross Income: A Step-by-Step Guide

Calculating Adjusted Gross Income (AGI) is a straightforward process that requires attention to detail and a basic understanding of tax concepts. To calculate AGI, follow these steps:

Step 1: Gather all necessary tax documents, including W-2 forms, 1099 forms, and receipts for deductions.

Step 2: Add up all taxable income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rental income and expenses

Step 3: Calculate total income by adding up all the income sources listed above.

Step 4: Identify and calculate allowable deductions, including:

- Standard deduction or itemized deductions

- Charitable donations

- Mortgage interest and property taxes

- Student loan interest and education expenses

Step 5: Subtract total deductions from total income to arrive at AGI.

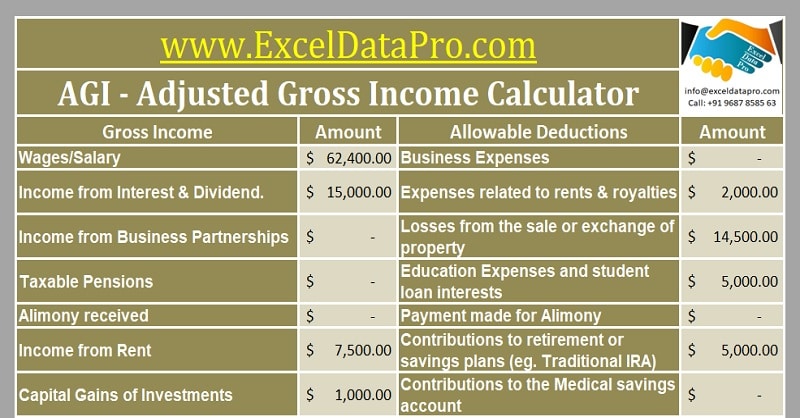

Example: John has a total income of $100,000, consisting of $80,000 in wages and $20,000 in self-employment income. He also has $10,000 in deductions, including $5,000 in mortgage interest and $5,000 in charitable donations. To calculate his AGI, John would subtract his total deductions from his total income, resulting in an AGI of $90,000.

By following these steps, taxpayers can accurately calculate their AGI and gain a better understanding of their tax situation. It’s essential to note that AGI is a critical component of tax calculations, and accurate calculations can help minimize tax liability.

In addition to these steps, taxpayers can also use tax software or consult with a tax professional to ensure accurate calculations and take advantage of all eligible deductions.

What’s Included in Adjusted Gross Income: A Breakdown of Taxable Income

Adjusted Gross Income (AGI) is a comprehensive measure of an individual’s or business’s taxable income. To understand what is Adjusted Gross Income, it’s essential to know what types of income are included in the calculation. The following income sources are typically included in AGI:

Wages, Salaries, and Tips: This includes income earned from a job, as well as tips received from customers. Employers report this income on a W-2 form, which is used to calculate AGI.

Self-Employment Income: Income earned from self-employment, such as freelancing or running a business, is also included in AGI. This income is reported on a Schedule C form, which is used to calculate business income and expenses.

Interest and Dividends: Interest earned from savings accounts, bonds, and other investments, as well as dividends received from stocks, are included in AGI.

Capital Gains and Losses: Gains and losses from the sale of assets, such as stocks, real estate, and businesses, are also included in AGI.

Rental Income and Expenses: Income earned from renting out property, as well as expenses related to the rental property, are included in AGI.

Other Income: Other types of income, such as alimony, unemployment benefits, and social security benefits, may also be included in AGI.

It’s essential to note that not all income is included in AGI. For example, tax-exempt income, such as income earned from municipal bonds, is not included in AGI.

When reporting income on a tax return, it’s crucial to accurately categorize each type of income to ensure that AGI is calculated correctly. This will help taxpayers avoid errors and ensure that they are taking advantage of all eligible deductions and credits.

In addition to understanding what types of income are included in AGI, taxpayers should also be aware of how these income sources are reported on tax returns. This will help them navigate the tax preparation process and ensure that their AGI is calculated accurately.

Deductions and Exclusions: How to Reduce Your Adjusted Gross Income

Deductions and exclusions are essential components of the tax calculation process, as they can significantly reduce an individual’s or business’s Adjusted Gross Income (AGI). By understanding what deductions and exclusions are available, taxpayers can minimize their tax liability and maximize their tax savings.

Charitable Donations: Donations to qualified charitable organizations can be deducted from AGI, reducing tax liability. Taxpayers can deduct cash donations, as well as the fair market value of donated goods and services.

Mortgage Interest: Homeowners can deduct the interest paid on their mortgage from AGI, reducing their tax liability. This deduction can be especially beneficial for taxpayers with high mortgage payments.

Student Loan Interest: Taxpayers can deduct the interest paid on student loans from AGI, reducing their tax liability. This deduction can be especially beneficial for taxpayers with high student loan payments.

Medical Expenses: Taxpayers can deduct medical expenses that exceed 10% of their AGI from their taxable income. This deduction can be especially beneficial for taxpayers with high medical expenses.

Business Expenses: Self-employed individuals and businesses can deduct business expenses from AGI, reducing their tax liability. This can include expenses such as office supplies, travel expenses, and equipment purchases.

Exclusions: Certain types of income are excluded from AGI, such as tax-exempt interest and dividends. Taxpayers can also exclude certain types of income, such as foreign earned income, from AGI.

By taking advantage of these deductions and exclusions, taxpayers can significantly reduce their AGI and minimize their tax liability. It’s essential to keep accurate records and consult with a tax professional to ensure that all eligible deductions and exclusions are claimed.

In addition to these deductions and exclusions, taxpayers can also use tax credits to reduce their tax liability. Tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, can provide significant tax savings for eligible taxpayers.

The Impact of Adjusted Gross Income on Tax Credits and Deductions

Adjusted Gross Income (AGI) plays a crucial role in determining eligibility for various tax credits and deductions. Understanding how AGI affects these credits and deductions can help taxpayers maximize their tax savings and minimize their tax liability.

Earned Income Tax Credit (EITC): The EITC is a refundable tax credit available to low- and moderate-income working individuals and families. AGI is used to determine eligibility for the EITC, and the amount of the credit is based on the taxpayer’s AGI.

Child Tax Credit: The Child Tax Credit is a non-refundable tax credit available to taxpayers with qualifying children under the age of 17. AGI is used to determine eligibility for the credit, and the amount of the credit is based on the taxpayer’s AGI.

Education Credits: The American Opportunity Tax Credit and the Lifetime Learning Credit are two education credits available to taxpayers who pay qualified education expenses. AGI is used to determine eligibility for these credits, and the amount of the credit is based on the taxpayer’s AGI.

Retirement Savings Contributions Credit: This credit is available to taxpayers who make contributions to a retirement savings plan, such as a 401(k) or an IRA. AGI is used to determine eligibility for the credit, and the amount of the credit is based on the taxpayer’s AGI.

By understanding how AGI affects these tax credits and deductions, taxpayers can take steps to maximize their eligibility and minimize their tax liability. For example, taxpayers may be able to reduce their AGI by contributing to a retirement savings plan or by claiming deductions for education expenses.

In addition to affecting tax credits and deductions, AGI also plays a role in determining tax brackets and tax rates. Taxpayers with higher AGI may be subject to higher tax brackets and tax rates, while taxpayers with lower AGI may be eligible for lower tax brackets and tax rates.

Overall, understanding the impact of AGI on tax credits and deductions is essential for taxpayers who want to maximize their tax savings and minimize their tax liability. By taking steps to reduce AGI and maximize eligibility for tax credits and deductions, taxpayers can keep more of their hard-earned money and achieve their financial goals.

Strategies for Reducing Adjusted Gross Income: Tips for Taxpayers

Reducing Adjusted Gross Income (AGI) can have a significant impact on tax savings. By implementing the right strategies, taxpayers can minimize their tax liability and keep more of their hard-earned money. Here are some tips for reducing AGI:

Contribute to Retirement Accounts: Contributing to a 401(k) or an IRA can reduce AGI and lower tax liability. These contributions are tax-deductible, and the funds grow tax-deferred.

Use Tax-Loss Harvesting: Tax-loss harvesting involves selling securities that have declined in value to offset gains from other investments. This strategy can reduce AGI and minimize tax liability.

Take Advantage of Tax-Deferred Savings Options: Tax-deferred savings options, such as 529 plans and health savings accounts, can reduce AGI and lower tax liability.

Maximize Charitable Donations: Charitable donations can reduce AGI and lower tax liability. Taxpayers can donate cash, securities, or other assets to qualified charitable organizations.

Claim Business Expenses: Self-employed individuals and businesses can claim business expenses on their tax return, reducing AGI and lower tax liability.

Utilize the Home Office Deduction: The home office deduction allows taxpayers to deduct a portion of their rent or mortgage interest and utilities as a business expense, reducing AGI and lower tax liability.

By implementing these strategies, taxpayers can reduce their AGI and minimize their tax liability. It’s essential to consult with a tax professional to determine the best strategies for your specific situation.

In addition to these strategies, taxpayers can also reduce their AGI by taking advantage of tax credits and deductions. For example, the Earned Income Tax Credit (EITC) and the Child Tax Credit can provide significant tax savings for eligible taxpayers.

By combining these strategies with accurate calculations and strategic planning, taxpayers can maximize their tax savings and minimize their tax liability.

Common Mistakes to Avoid When Calculating Adjusted Gross Income

Calculating Adjusted Gross Income (AGI) can be a complex process, and mistakes can lead to errors on tax returns and potential penalties. Here are some common mistakes to avoid when calculating AGI:

Forgetting to Include Income: One of the most common mistakes taxpayers make is forgetting to include all sources of income when calculating AGI. This can include wages, salaries, tips, and self-employment income.

Claiming Incorrect Deductions: Taxpayers may claim deductions that are not eligible or exceed the allowed limits. This can lead to errors on tax returns and potential penalties.

Not Accounting for Business Expenses: Self-employed individuals and businesses may not account for all business expenses, leading to an incorrect AGI calculation.

Not Considering Tax Credits: Taxpayers may not consider tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, which can impact AGI.

Not Keeping Accurate Records: Taxpayers may not keep accurate records of income and expenses, leading to errors on tax returns and potential penalties.

To avoid these mistakes, taxpayers should:

- Keep accurate records of income and expenses

- Consult with a tax professional to ensure accurate calculations

- Review tax returns carefully before submission

- Take advantage of tax credits and deductions

By avoiding these common mistakes, taxpayers can ensure accurate calculations and minimize potential penalties.

In addition to avoiding mistakes, taxpayers should also stay informed about changes to tax laws and regulations that may impact AGI calculations.

Maximizing Your Tax Savings: How Adjusted Gross Income Impacts Your Bottom Line

Understanding Adjusted Gross Income (AGI) is crucial for maximizing tax savings and minimizing tax liability. By accurately calculating AGI, taxpayers can take advantage of tax credits and deductions, reduce their tax bracket, and keep more of their hard-earned money.

Accurate AGI calculations are essential for tax planning and strategy. By understanding how AGI affects tax credits and deductions, taxpayers can make informed decisions about their financial situation and minimize their tax liability.

In addition to accurate calculations, strategic planning is also essential for maximizing tax savings. Taxpayers should consider contributing to retirement accounts, using tax-loss harvesting, and taking advantage of tax-deferred savings options to reduce their AGI and minimize their tax liability.

By combining accurate calculations with strategic planning, taxpayers can maximize their tax savings and achieve their financial goals. It’s essential to stay informed about changes to tax laws and regulations that may impact AGI calculations and to consult with a tax professional to ensure accurate calculations and strategic planning.

In conclusion, understanding AGI and its impact on tax savings is crucial for taxpayers who want to maximize their tax savings and minimize their tax liability. By accurately calculating AGI, taking advantage of tax credits and deductions, and engaging in strategic planning, taxpayers can keep more of their hard-earned money and achieve their financial goals.

By following the tips and strategies outlined in this article, taxpayers can ensure accurate AGI calculations and maximize their tax savings. Remember, understanding AGI is the key to unlocking your tax potential and achieving your financial goals.