What is Adjusted Gross Income and Why Does it Matter?

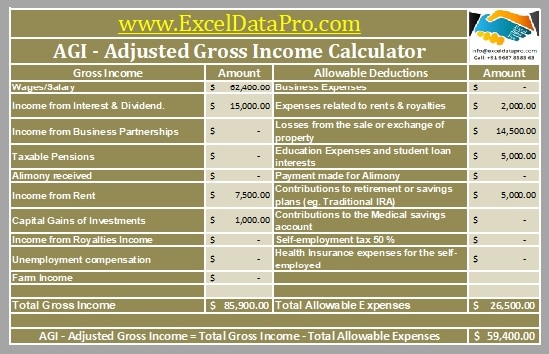

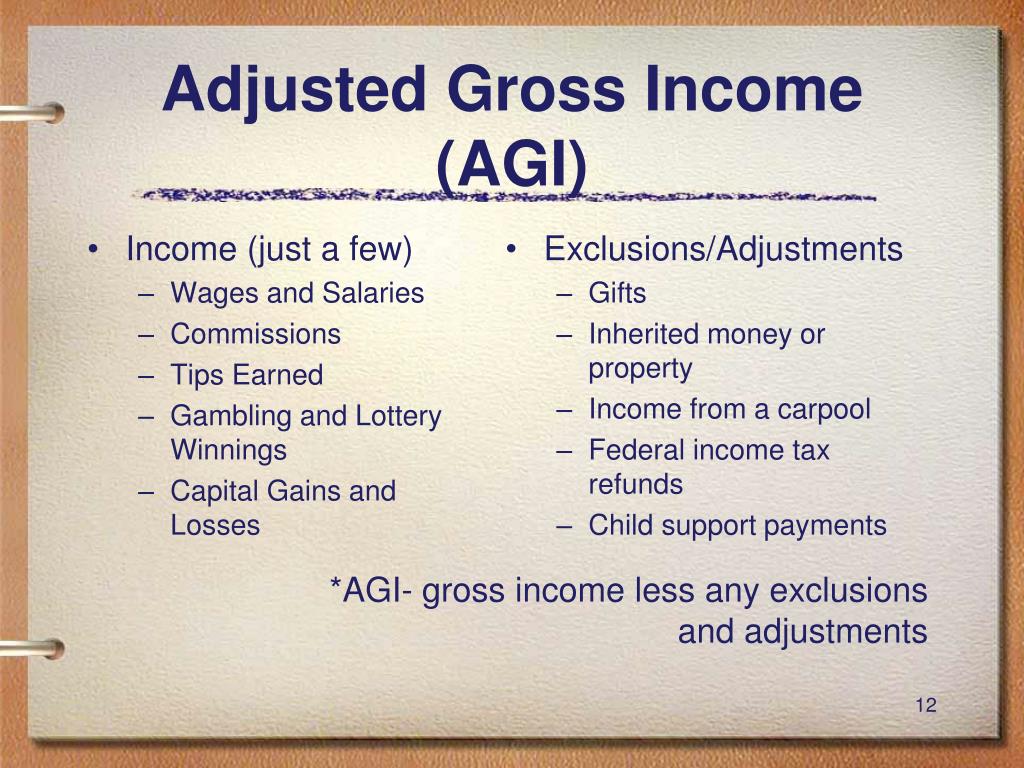

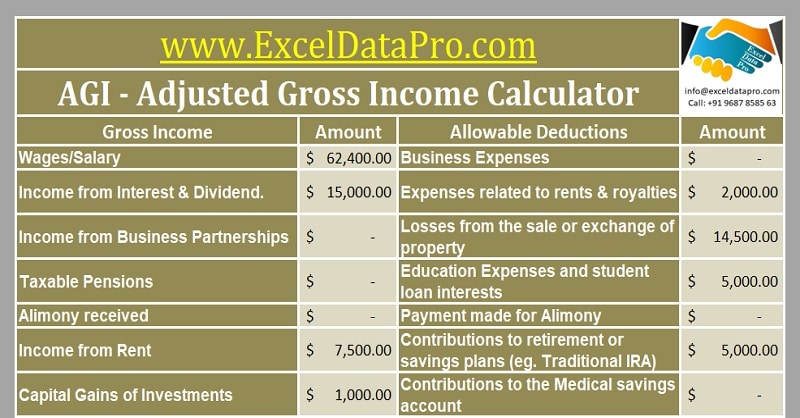

Adjusted Gross Income (AGI) is a crucial concept in the tax filing process, and understanding what it entails can make a significant difference in your tax liability. AGI is the total income earned by an individual or business, minus certain deductions and exemptions. It serves as the foundation for calculating tax brackets, deductions, and credits, ultimately determining the amount of taxes owed to the government.

In the United States, the Internal Revenue Service (IRS) requires taxpayers to report their AGI on their tax returns. This figure is calculated by adding up all sources of income, including wages, salaries, tips, and self-employment income, and then subtracting allowable deductions and exemptions. The resulting AGI is used to determine the taxpayer’s tax bracket, which in turn affects the tax rate applied to their income.

AGI plays a critical role in determining tax liability because it affects the amount of taxes owed, as well as eligibility for certain tax credits and deductions. For instance, a lower AGI may qualify a taxpayer for a higher Earned Income Tax Credit (EITC) or a larger standard deduction. Conversely, a higher AGI may result in a higher tax bracket, increasing the amount of taxes owed.

Furthermore, AGI is used to determine eligibility for various tax-related benefits, such as Roth IRA contributions, student loan interest deductions, and education credits. By understanding what constitutes AGI and how it is calculated, taxpayers can make informed decisions about their tax strategy and potentially reduce their tax liability.

In summary, AGI is a vital component of the tax filing process, and grasping its significance can help taxpayers navigate the complexities of tax law. By understanding what is adjusted gross income and how it is calculated, individuals and businesses can make informed decisions about their tax strategy and potentially reduce their tax liability.

How to Calculate Your Adjusted Gross Income: A Step-by-Step Guide

Calculating your Adjusted Gross Income (AGI) is a crucial step in the tax filing process. To ensure accuracy and avoid errors, follow this step-by-step guide to calculate your AGI.

Step 1: Gather necessary forms and schedules. You will need your W-2 forms, 1099 forms, and any other relevant tax documents. You may also need to complete Schedule 1 (Form 1040) and Schedule 2 (Form 1040) to report certain types of income and deductions.

Step 2: Report all income. Start by reporting all your income from various sources, including:

- Wages, salaries, and tips (reported on W-2 forms)

- Self-employment income (reported on Schedule C, Form 1040)

- Interest and dividends (reported on Schedule 1, Form 1040)

- Capital gains and losses (reported on Schedule D, Form 1040)

Step 3: Calculate total income. Add up all the income reported in Step 2 to calculate your total income.

Step 4: Subtract deductions and exemptions. You can subtract certain deductions and exemptions from your total income to calculate your AGI. These may include:

- Standard deduction or itemized deductions (reported on Schedule A, Form 1040)

- Personal exemptions (reported on Form 1040)

- Business expenses (reported on Schedule C, Form 1040)

Step 5: Calculate AGI. Subtract the total deductions and exemptions from your total income to calculate your AGI.

Example: Let’s say your total income is $50,000, and you have $10,000 in deductions and exemptions. Your AGI would be $40,000 ($50,000 – $10,000).

By following these steps, you can accurately calculate your AGI and ensure a smoother tax filing experience. Remember to consult the IRS website or a tax professional if you have any questions or concerns.

What’s Included in Adjusted Gross Income: A Breakdown of Income Sources

Adjusted Gross Income (AGI) is the total income earned by an individual or business, minus certain deductions and exemptions. To calculate AGI, it’s essential to understand what types of income are included and how to report them on tax returns.

Wages, Salaries, and Tips: These types of income are reported on Form W-2 and are included in AGI. This includes income from full-time and part-time jobs, as well as tips received from customers.

Self-Employment Income: Self-employment income is reported on Schedule C (Form 1040) and is included in AGI. This includes income from freelance work, consulting, and other business ventures.

Interest and Dividends: Interest and dividends are reported on Schedule 1 (Form 1040) and are included in AGI. This includes interest from savings accounts, bonds, and other investments, as well as dividends from stocks and mutual funds.

Capital Gains and Losses: Capital gains and losses are reported on Schedule D (Form 1040) and are included in AGI. This includes gains and losses from the sale of stocks, bonds, and other investments.

Rental Income: Rental income is reported on Schedule E (Form 1040) and is included in AGI. This includes income from renting out properties, such as apartments or houses.

Other Income: Other income, such as alimony, prizes, and awards, is reported on Schedule 1 (Form 1040) and is included in AGI.

It’s essential to accurately report all income sources on tax returns to ensure an accurate AGI calculation. Failure to report income can result in penalties and fines, so it’s crucial to keep accurate records and seek professional help if needed.

In addition to understanding what types of income are included in AGI, it’s also important to know how to report them on tax returns. The IRS provides various forms and schedules to report different types of income, and it’s essential to use the correct forms to avoid errors and penalties.

Deductions and Credits: How to Reduce Your Adjusted Gross Income

Adjusted Gross Income (AGI) is the total income earned by an individual or business, minus certain deductions and exemptions. To reduce AGI, taxpayers can claim various deductions and credits, which can help lower their tax liability.

Standard Deduction: The standard deduction is a fixed amount that taxpayers can deduct from their AGI, without needing to itemize their deductions. For the 2022 tax year, the standard deduction is $12,950 for single filers and $25,900 for joint filers.

Itemized Deductions: Itemized deductions allow taxpayers to deduct specific expenses, such as mortgage interest, property taxes, and charitable donations. To itemize deductions, taxpayers must complete Schedule A (Form 1040) and attach it to their tax return.

Tax Credits: Tax credits are dollar-for-dollar reductions in tax liability, and can be more valuable than deductions. Common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the Education Credits.

Business Expenses: Self-employed individuals and business owners can deduct business expenses on Schedule C (Form 1040). This includes expenses such as rent, utilities, and supplies.

Medical Expenses: Taxpayers can deduct medical expenses on Schedule A (Form 1040), but only if they exceed 10% of their AGI.

Charitable Donations: Taxpayers can deduct charitable donations on Schedule A (Form 1040), but only if they itemize their deductions.

Education Expenses: Taxpayers can deduct education expenses on Schedule A (Form 1040), but only if they itemize their deductions.

By claiming these deductions and credits, taxpayers can reduce their AGI and lower their tax liability. However, it’s essential to keep accurate records and follow the IRS guidelines to avoid errors and penalties.

The Impact of Adjusted Gross Income on Tax Brackets and Rates

Adjusted Gross Income (AGI) plays a crucial role in determining tax brackets and rates. The IRS uses a progressive tax system, which means that different levels of income are taxed at different rates. Understanding how AGI affects tax brackets and rates can help taxpayers minimize their tax liability.

Tax Brackets: The IRS divides income into seven tax brackets, ranging from 10% to 37%. The tax bracket is determined by the taxpayer’s AGI, and the tax rate applies to the amount of income within that bracket.

Tax Rates: The tax rate is the percentage of income that is taxed. The tax rate increases as the taxpayer’s AGI increases. For example, a single taxpayer with an AGI of $40,000 may be in the 24% tax bracket, while a single taxpayer with an AGI of $100,000 may be in the 32% tax bracket.

Using Tax Tables and Schedules: Taxpayers can use tax tables and schedules to determine their tax liability. The IRS provides tax tables and schedules that show the tax rates and brackets for different levels of income. Taxpayers can use these tables and schedules to estimate their tax liability and plan their tax strategy.

Example: Let’s say a single taxpayer has an AGI of $60,000. Using the tax tables and schedules, we can determine that the taxpayer is in the 24% tax bracket. The tax rate applies to the amount of income within that bracket, so the taxpayer would pay 24% of $60,000, or $14,400, in taxes.

By understanding how AGI affects tax brackets and rates, taxpayers can make informed decisions about their tax strategy and minimize their tax liability. It’s essential to consult the IRS website or a tax professional to ensure accurate calculations and to take advantage of available tax credits and deductions.

Common Mistakes to Avoid When Calculating Adjusted Gross Income

Calculating Adjusted Gross Income (AGI) can be a complex process, and taxpayers often make mistakes that can lead to errors and penalties. To avoid these mistakes, it’s essential to understand the common errors that taxpayers make when calculating AGI.

Forgetting to Include Income: One of the most common mistakes taxpayers make is forgetting to include all sources of income when calculating AGI. This includes income from wages, salaries, tips, and self-employment income.

Claiming Incorrect Deductions: Taxpayers often claim incorrect deductions, such as claiming a standard deduction when they should be itemizing deductions. This can lead to an incorrect AGI calculation and potential penalties.

Not Accounting for Business Expenses: Self-employed individuals and business owners often fail to account for business expenses when calculating AGI. This can lead to an incorrect AGI calculation and potential penalties.

Not Reporting Capital Gains and Losses: Taxpayers often fail to report capital gains and losses when calculating AGI. This can lead to an incorrect AGI calculation and potential penalties.

Not Keeping Accurate Records: Taxpayers often fail to keep accurate records of their income and expenses, which can lead to errors and penalties when calculating AGI.

Tips to Avoid These Mistakes:

- Keep accurate records of all income and expenses.

- Consult the IRS website or a tax professional to ensure accurate calculations.

- Double-check all calculations and ensure that all income and expenses are included.

- Use tax software or a tax professional to help with AGI calculations.

By avoiding these common mistakes, taxpayers can ensure accurate AGI calculations and avoid potential penalties. It’s essential to take the time to understand the AGI calculation process and seek professional help if needed.

How Adjusted Gross Income Affects Other Tax-Related Benefits

Adjusted Gross Income (AGI) not only affects tax brackets and rates, but also impacts other tax-related benefits. Understanding how AGI affects these benefits can help taxpayers make informed decisions about their tax strategy.

Eligibility for Roth IRA Contributions: AGI affects eligibility for Roth IRA contributions. For the 2022 tax year, single taxpayers with an AGI below $137,500 and joint taxpayers with an AGI below $208,500 are eligible to contribute to a Roth IRA.

Student Loan Interest Deductions: AGI affects the amount of student loan interest that can be deducted. For the 2022 tax year, single taxpayers with an AGI below $85,000 and joint taxpayers with an AGI below $170,000 can deduct up to $2,500 in student loan interest.

Education Credits: AGI affects eligibility for education credits, such as the American Opportunity Tax Credit and the Lifetime Learning Credit. For the 2022 tax year, single taxpayers with an AGI below $90,000 and joint taxpayers with an AGI below $180,000 are eligible for these credits.

Other Tax-Related Benefits: AGI also affects other tax-related benefits, such as the Earned Income Tax Credit (EITC), the Child Tax Credit, and the Premium Tax Credit. Understanding how AGI affects these benefits can help taxpayers maximize their tax savings.

By understanding how AGI affects other tax-related benefits, taxpayers can make informed decisions about their tax strategy and maximize their tax savings. It’s essential to consult the IRS website or a tax professional to ensure accurate calculations and to take advantage of available tax credits and deductions.

Conclusion: Mastering Adjusted Gross Income for a Smoother Tax Filing Experience

Understanding Adjusted Gross Income (AGI) is crucial for a smoother tax filing experience. By grasping the concept of AGI and its significance in the tax filing process, taxpayers can make informed decisions about their tax strategy and minimize their tax liability.

In this article, we have discussed the concept of AGI, how to calculate it, and its impact on tax brackets, deductions, and credits. We have also explored common mistakes to avoid when calculating AGI and how AGI affects other tax-related benefits.

By mastering AGI, taxpayers can:

- Accurately calculate their tax liability

- Maximize their tax savings

- Avoid common mistakes and penalties

- Make informed decisions about their tax strategy

To further enhance their understanding of AGI, taxpayers can consult tax professionals or the IRS website for more information. Additionally, taxpayers can use tax software or online resources to help with AGI calculations and tax planning.

By taking the time to understand AGI, taxpayers can ensure a smoother tax filing experience and minimize their tax liability. Remember, understanding AGI is key to unlocking the secrets of your tax return.