Defining Retirement Age: What You Need to Know

Retirement age is a critical concept in the United States, marking the point at which individuals can start receiving retirement benefits and transition into a new phase of life. But what is retirement age in the USA, and how does it vary across different countries? In the United States, retirement age is typically associated with the age at which individuals become eligible for full retirement benefits under the Social Security program.

However, retirement age can vary significantly across different countries, reflecting differences in social security systems, cultural norms, and economic conditions. For example, in some European countries, retirement age is lower, typically ranging from 60 to 65 years old. In contrast, some Asian countries have higher retirement ages, often above 65 years old.

In the United States, the retirement landscape is complex, with different types of retirement ages and benefits. Understanding these differences is essential for individuals planning for retirement and seeking to maximize their benefits. The concept of retirement age is also influenced by various factors, including life expectancy, healthcare costs, and economic conditions.

As the population ages and life expectancy increases, the concept of retirement age is evolving. Many experts argue that traditional retirement ages are no longer relevant, and that individuals should be encouraged to work longer and contribute to the economy. Others argue that retirement age should be lower, allowing individuals to enjoy their golden years and pursue their passions.

Regardless of the debate, one thing is clear: understanding retirement age is crucial for individuals seeking to plan for a secure future. By grasping the concept of retirement age and its implications, individuals can make informed decisions about their retirement planning, including when to retire, how to manage their benefits, and how to create a sustainable income stream.

How to Determine Your Full Retirement Age: A Step-by-Step Guide

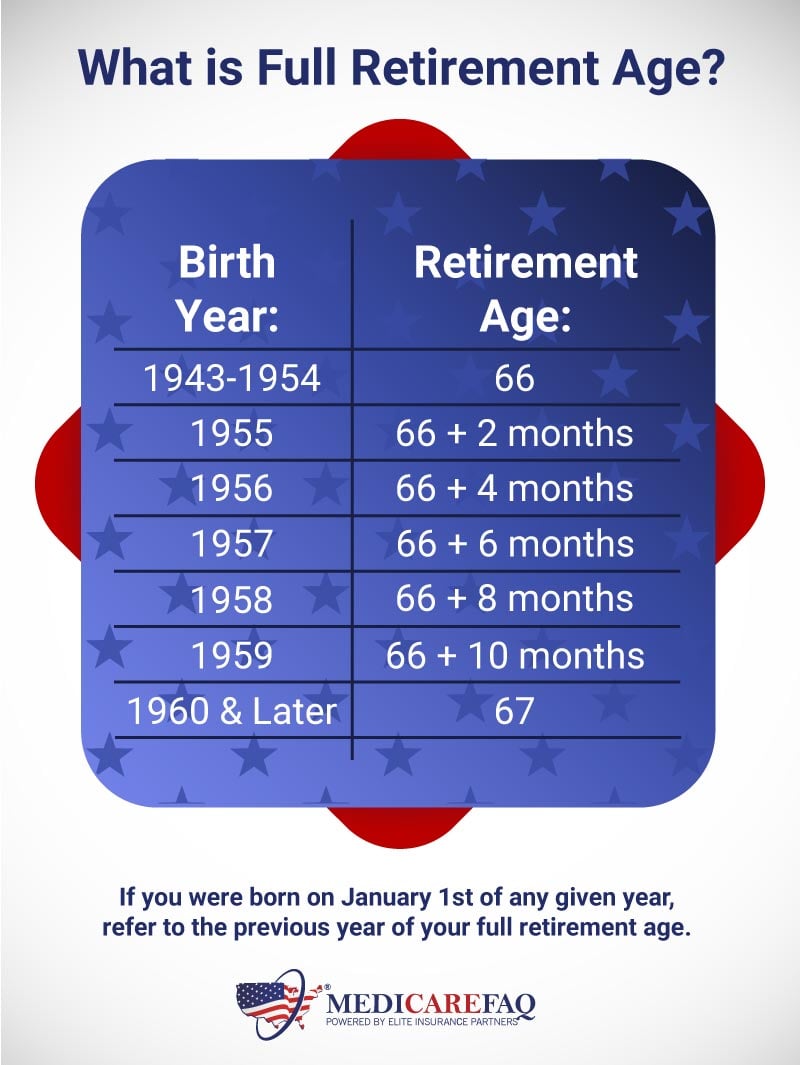

Determining your full retirement age is a crucial step in planning for a secure future. In the United States, full retirement age is the age at which individuals become eligible for full retirement benefits under the Social Security program. To calculate your full retirement age, you’ll need to consider your birth year and retirement benefits.

Here’s a step-by-step guide to help you determine your full retirement age:

Step 1: Determine your birth year. Your birth year plays a significant role in determining your full retirement age. If you were born in 1937 or earlier, your full retirement age is 65. If you were born between 1938 and 1942, your full retirement age increases gradually to 65 and 2-10 months. If you were born between 1943 and 1954, your full retirement age is 66. If you were born between 1955 and 1959, your full retirement age increases gradually to 66 and 2-10 months. If you were born in 1960 or later, your full retirement age is 67.

Step 2: Consider your retirement benefits. Your retirement benefits are based on your earnings history and the age at which you retire. If you retire before your full retirement age, your benefits will be reduced. If you retire after your full retirement age, your benefits will increase.

Step 3: Use the Social Security Administration’s (SSA) Retirement Age Calculator. The SSA provides a retirement age calculator that can help you determine your full retirement age based on your birth year and retirement benefits. Simply enter your birth year and retirement benefits, and the calculator will provide your full retirement age.

For example, if you were born in 1960 and plan to retire at 67, your full retirement age would be 67. However, if you plan to retire at 62, your benefits would be reduced by 30%. On the other hand, if you plan to retire at 70, your benefits would increase by 24%.

By following these steps, you can determine your full retirement age and plan for a secure future. Remember to consider your birth year and retirement benefits when calculating your full retirement age, and use the SSA’s Retirement Age Calculator to ensure accuracy.

Retirement Age in the USA: A Historical Perspective

The concept of retirement age in the United States has undergone significant changes over the years. To understand the current retirement landscape, it’s essential to delve into the history of retirement age in the USA.

In the early 20th century, retirement was not a common practice in the United States. Many people worked until they were no longer able to do so, and retirement was often seen as a luxury only the wealthy could afford. However, with the passage of the Social Security Act in 1935, the concept of retirement age began to take shape.

The Social Security Act established a retirement age of 65, which was considered old age at the time. The act provided a safety net for workers, ensuring they would receive a steady income in their golden years. However, the retirement age was not uniform, and it varied depending on the state and employer.

In the 1950s and 1960s, the concept of retirement age began to evolve. The Social Security Administration (SSA) introduced the concept of early retirement, allowing workers to retire at 62 with reduced benefits. This move was aimed at encouraging older workers to retire, making way for younger workers in the workforce.

The 1980s saw significant changes to the retirement age landscape. The SSA introduced the concept of delayed retirement, allowing workers to retire after 65 with increased benefits. This move was aimed at encouraging workers to continue working beyond 65, thereby increasing their retirement benefits.

Today, the retirement age in the USA is 67, although workers can retire earlier or later depending on their birth year and retirement benefits. Understanding the history of retirement age in the USA is essential for planning a secure future. By knowing how retirement age has evolved over time, individuals can make informed decisions about their retirement planning.

The history of retirement age in the USA is a testament to the country’s commitment to providing a safety net for its citizens. From the Social Security Act to the present day, the concept of retirement age has undergone significant changes, reflecting the country’s evolving demographics and economic landscape.

Understanding the Different Types of Retirement Ages

When it comes to retirement age in the USA, there are several types of retirement ages to consider. Understanding these different types of retirement ages can help individuals make informed decisions about their retirement planning.

Full Retirement Age (FRA) is the age at which individuals become eligible for full retirement benefits under the Social Security program. FRA varies depending on birth year, but for most people, it is between 65 and 67 years old. Retiring at FRA ensures that individuals receive their full retirement benefits without any reduction.

Early Retirement Age is the age at which individuals can retire with reduced benefits. In the USA, early retirement age is typically 62 years old. Retiring early can provide individuals with a steady income stream, but it also means that their benefits will be reduced. The reduction in benefits can range from 20% to 30% depending on the individual’s birth year and retirement age.

Delayed Retirement Age is the age at which individuals can retire with increased benefits. In the USA, delayed retirement age is typically 70 years old. Retiring later can provide individuals with a higher income stream, but it also means that they will have to work longer. The increase in benefits can range from 8% to 16% depending on the individual’s birth year and retirement age.

Understanding the different types of retirement ages can help individuals make informed decisions about their retirement planning. It’s essential to consider factors such as life expectancy, health, and financial situation when deciding which retirement age is best. By choosing the right retirement age, individuals can ensure a secure and comfortable retirement.

In addition to understanding the different types of retirement ages, it’s also essential to consider the impact of retirement age on Social Security benefits. Retiring early or late can affect the amount of benefits received, and it’s crucial to understand these implications when making retirement decisions.

How Retirement Age Affects Social Security Benefits

Retirement age plays a significant role in determining Social Security benefits. The age at which individuals retire can affect the amount of benefits they receive, and it’s essential to understand these implications when making retirement decisions.

Retiring early, typically at 62 years old, can result in reduced Social Security benefits. The reduction in benefits can range from 20% to 30% depending on the individual’s birth year and retirement age. For example, if an individual’s full retirement benefit is $1,000 per month, retiring at 62 may result in a reduced benefit of $700 to $800 per month.

On the other hand, delaying retirement can result in increased Social Security benefits. For every year an individual delays retirement beyond their full retirement age, their benefits increase by 8% to 16%. For example, if an individual’s full retirement benefit is $1,000 per month, delaying retirement to 70 years old may result in an increased benefit of $1,200 to $1,400 per month.

It’s essential to consider the impact of retirement age on Social Security benefits when making retirement decisions. Individuals should weigh the pros and cons of retiring early or delaying retirement, taking into account their financial situation, life expectancy, and health.

In addition to understanding the impact of retirement age on Social Security benefits, it’s also essential to consider the relationship between retirement age and Medicare eligibility. Medicare is a critical component of retirement planning, and understanding how retirement age affects Medicare eligibility can help individuals make informed decisions about their healthcare.

Retirement Age and Medicare: What You Need to Know

Retirement age and Medicare eligibility are closely linked in the USA. Understanding the relationship between these two concepts is essential for planning a secure retirement.

Medicare is a federal health insurance program that provides coverage to individuals 65 and older, as well as certain younger people with disabilities. In the USA, Medicare eligibility is typically tied to retirement age. Individuals who retire before 65 may not be eligible for Medicare, while those who retire after 65 may be eligible for Medicare benefits.

There are several implications of retiring before or after Medicare eligibility age. Retiring before 65 may mean that individuals will need to purchase private health insurance or rely on employer-sponsored coverage until they become eligible for Medicare. On the other hand, retiring after 65 may mean that individuals will be eligible for Medicare benefits, but may also face higher premiums or reduced benefits if they delay retirement.

It’s essential to consider the relationship between retirement age and Medicare eligibility when making retirement decisions. Individuals should weigh the pros and cons of retiring before or after Medicare eligibility age, taking into account their health, financial situation, and life expectancy.

In addition to understanding the relationship between retirement age and Medicare eligibility, it’s also essential to plan for retirement income. Creating a retirement plan, saving for retirement, and managing retirement income are critical components of a secure retirement.

Planning for Retirement: Tips and Strategies

Planning for retirement is a critical step in securing a comfortable and enjoyable post-work life. Understanding retirement age and its implications is just the first step. Here are some practical tips and strategies to help you plan for retirement:

Create a retirement plan: Start by defining your retirement goals and objectives. Consider your desired lifestyle, expenses, and income needs. Create a comprehensive plan that outlines your retirement goals, income sources, and expenses.

Save for retirement: Saving for retirement is essential to securing a comfortable post-work life. Consider contributing to a 401(k) or IRA, and take advantage of employer matching contributions. Aim to save at least 10% to 15% of your income towards retirement.

Manage retirement income: Managing retirement income is critical to ensuring a sustainable post-work life. Consider creating a retirement income plan that outlines your income sources, expenses, and tax implications. Aim to create a diversified income stream that includes a combination of guaranteed income sources, such as pensions or annuities, and non-guaranteed income sources, such as investments or part-time work.

Start early: Starting early is critical to securing a comfortable retirement. The power of compound interest can help your retirement savings grow significantly over time. Consider starting to save for retirement in your 20s or 30s, and aim to contribute consistently over time.

Stay informed: Staying informed about retirement planning and retirement age is essential to making informed decisions. Consider staying up-to-date on changes to Social Security, Medicare, and other retirement-related programs. Aim to educate yourself on retirement planning strategies and best practices.

Conclusion: Taking Control of Your Retirement Future

In conclusion, understanding retirement age in the USA is crucial for planning a secure and comfortable post-work life. By understanding the concept of retirement age, its significance, and how it varies across different countries, individuals can make informed decisions about their retirement planning.

It’s essential to take control of your retirement planning by creating a retirement plan, saving for retirement, and managing retirement income. Starting early and staying informed about retirement planning and retirement age can help individuals make the most of their retirement savings and ensure a sustainable post-work life.

Remember, retirement age is not just a number; it’s a critical component of your overall retirement plan. By understanding the different types of retirement ages, including full retirement age, early retirement age, and delayed retirement age, individuals can make informed decisions about their retirement planning and ensure a comfortable and enjoyable post-work life.

Take control of your retirement future today by understanding retirement age in the USA and making informed decisions about your retirement planning. With the right knowledge and planning, you can ensure a secure and comfortable post-work life and enjoy the retirement you deserve.