What is Stash and How Does it Work?

Stash is a mobile investment app designed to make investing accessible and affordable for everyone. The app allows users to invest small amounts of money into a variety of assets, including stocks, ETFs, and cryptocurrencies. With Stash, users can start investing with as little as $5, making it an attractive option for those who are new to investing or have limited funds.

The Stash app is available for both iOS and Android devices, and can be downloaded from the App Store or Google Play. Once downloaded, users can create an account and link a bank account to fund their investments. The app offers a range of investment options, including individual stocks, ETFs, and themed investments, such as “Clean Energy” or “Tech Giants”.

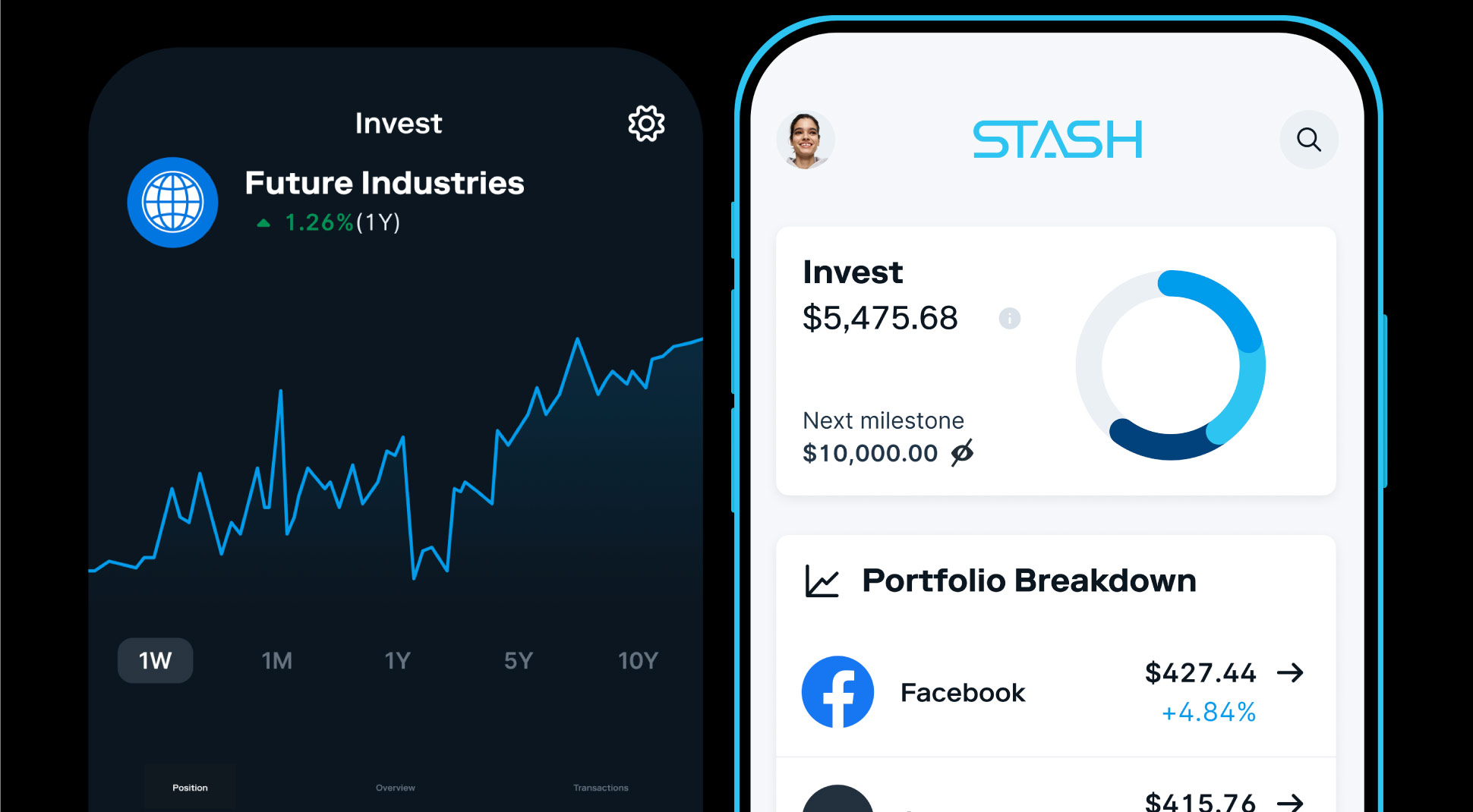

One of the key features of the Stash app is its user-friendly interface, which makes it easy for users to navigate and manage their investments. The app also provides educational resources and investment tracking tools, helping users to make informed investment decisions and stay on top of their portfolio.

For those wondering “what is the app stash“, it’s an innovative platform that aims to democratize investing by providing a simple and affordable way for people to invest in the stock market. With its low minimum investment requirements and range of investment options, Stash is an attractive option for anyone looking to start investing or diversify their portfolio.

In addition to its investment features, the Stash app also offers a range of tools and resources to help users manage their finances and achieve their long-term goals. These include budgeting tools, investment tracking, and educational resources, all designed to help users make the most of their money.

Overall, the Stash app is a powerful tool for anyone looking to start investing or take control of their finances. With its user-friendly interface, range of investment options, and educational resources, Stash is an attractive option for both beginners and experienced investors alike.

How to Get Started with Stash: A Step-by-Step Guide

Getting started with Stash is a straightforward process that can be completed in a few easy steps. To begin, users can download the Stash app from the App Store or Google Play, depending on their device. Once the app is downloaded, users can create an account by providing some basic information, such as their name, email address, and password.

Next, users will need to link a bank account to their Stash account. This can be done by providing the routing and account numbers for the bank account, or by linking a debit card. Stash uses industry-standard security measures to protect user data and ensure that all transactions are secure.

After linking a bank account, users can set their investment goals and risk tolerance. This will help Stash to provide personalized investment recommendations and ensure that users are investing in a way that aligns with their financial goals. Users can choose from a range of investment goals, including retirement savings, wealth accumulation, and income generation.

Once the account is set up and investment goals are established, users can begin investing with Stash. The app offers a range of investment options, including individual stocks, ETFs, and themed investments. Users can browse the available investment options and select the ones that align with their investment goals and risk tolerance.

Stash also offers a range of tools and resources to help users manage their investments and achieve their financial goals. These include investment tracking, portfolio analysis, and educational resources. Users can access these tools and resources from within the app, making it easy to stay on top of their investments and make informed decisions.

For those wondering “what is the app stash” and how to get started, the process is simple and straightforward. By following these easy steps, users can begin investing with Stash and start working towards their financial goals.

It’s worth noting that Stash is a registered investment advisor with the Securities and Exchange Commission (SEC), and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). This provides an additional layer of protection for users and ensures that their investments are secure.

Key Features of the Stash App: What Sets it Apart

The Stash app offers a range of innovative features that set it apart from other investment apps. One of the key features is its user-friendly interface, which makes it easy for users to navigate and manage their investments. The app is designed to be intuitive and accessible, even for those who are new to investing.

Another key feature of the Stash app is its educational resources. The app provides a range of tools and resources to help users learn about investing and make informed decisions. This includes articles, videos, and webinars, as well as access to a community of investors who can offer support and guidance.

Stash also offers a range of investment tracking tools, which allow users to monitor their investments and stay on top of their portfolio. This includes real-time updates on stock prices, as well as alerts and notifications to help users stay informed.

In addition to its investment tracking tools, Stash also offers a range of portfolio management features. This includes the ability to set investment goals and risk tolerance, as well as the ability to rebalance portfolios and make adjustments as needed.

For those wondering “what is the app stash” and what sets it apart, the answer lies in its innovative features and user-friendly interface. The app is designed to make investing accessible and affordable for everyone, regardless of their level of experience or financial situation.

Stash also offers a range of themed investments, which allow users to invest in a specific area of interest. This includes options such as “Clean Energy” or “Tech Giants”, which allow users to invest in companies that align with their values and interests.

Overall, the Stash app offers a range of innovative features that set it apart from other investment apps. Its user-friendly interface, educational resources, and investment tracking tools make it an attractive option for beginners and experienced investors alike.

Investment Options on Stash: A Closer Look

The Stash app offers a wide range of investment options, making it easy for users to diversify their portfolios and achieve their financial goals. One of the key features of the app is its ability to allow users to invest in individual stocks, ETFs, and themed investments.

Individual stocks are a popular investment option on Stash, allowing users to invest in specific companies such as Apple, Amazon, or Google. This can be a great way to invest in companies that users believe in and want to support.

ETFs (Exchange-Traded Funds) are another popular investment option on Stash. ETFs allow users to invest in a diversified portfolio of stocks, bonds, or other assets, providing a way to spread risk and potentially increase returns.

Themed investments are a unique feature of the Stash app, allowing users to invest in specific areas of interest. For example, users can invest in a “Clean Energy” themed investment, which includes a portfolio of companies focused on renewable energy and sustainability.

Other themed investments available on Stash include “Tech Giants”, “Healthcare Innovators”, and “Real Estate Moguls”. These themed investments provide a way for users to invest in areas that align with their values and interests.

For those wondering “what is the app stash” and what investment options are available, the answer is a wide range of choices. From individual stocks to ETFs and themed investments, Stash provides a platform for users to invest in a way that aligns with their financial goals and values.

It’s worth noting that all investment options on Stash are subject to market risk, and there are no guarantees of returns. However, by providing a range of investment options and educational resources, Stash aims to empower users to make informed investment decisions and achieve their financial goals.

Overall, the investment options available on Stash provide a way for users to diversify their portfolios and achieve their financial goals. Whether users are interested in individual stocks, ETFs, or themed investments, Stash provides a platform for investing in a way that aligns with their values and interests.

Stash Fees and Pricing: What You Need to Know

When it comes to investing with Stash, it’s essential to understand the fees associated with using the app. Stash offers a transparent and competitive pricing structure, making it easy for users to manage their investments and stay on top of their costs.

Stash charges a monthly management fee of $1 for accounts with balances under $1,000. For accounts with balances over $1,000, the management fee is 0.25% of the account balance per year. This fee is waived for accounts with balances under $100.

In addition to the management fee, Stash also charges trading fees for certain investment options. For example, trading fees for individual stocks and ETFs are $0.02 per share, with a minimum fee of $1 per trade. Trading fees for cryptocurrencies are 1.5% of the transaction amount.

It’s worth noting that Stash does not charge any fees for account maintenance, inactivity, or withdrawals. This makes it an attractive option for users who want to invest without incurring unnecessary costs.

For those wondering “what is the app stash” and how it compares to other investment apps, Stash’s fees are competitive with other popular investment apps. For example, Robinhood charges a flat fee of $5 per month for accounts with balances under $1,000, while Acorns charges a management fee of 0.25% of the account balance per year.

Overall, Stash’s fees and pricing structure are designed to be transparent and competitive, making it an attractive option for users who want to invest without breaking the bank.

It’s essential to note that fees and pricing are subject to change, and users should always review the terms and conditions before investing. However, Stash’s commitment to transparency and competitiveness makes it an excellent choice for users who want to invest with confidence.

Stash Security and Regulation: Protecting Your Investments

When it comes to investing with Stash, security and regulation are top priorities. Stash takes the protection of user data and investments very seriously, and has implemented a range of measures to ensure that users’ assets are safe and secure.

Stash is a registered investment advisor with the Securities and Exchange Commission (SEC), and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). This means that Stash is subject to regular audits and inspections, and is required to maintain high standards of security and compliance.

In terms of data security, Stash uses industry-standard encryption and secure socket layer (SSL) technology to protect user data. This ensures that all data transmitted between the user’s device and the Stash servers is encrypted and secure.

Stash also has a range of measures in place to prevent unauthorized access to user accounts. This includes two-factor authentication, which requires users to enter a verification code sent to their mobile device in addition to their password.

For those wondering “what is the app stash” and how it protects user investments, the answer is that Stash takes security and regulation very seriously. By registering with the SEC and FINRA, and implementing robust security measures, Stash provides a safe and secure environment for users to invest and manage their assets.

It’s worth noting that Stash is not a bank, and is not insured by the Federal Deposit Insurance Corporation (FDIC). However, Stash does offer protection for user investments through the SIPC, which provides coverage up to $500,000 per account.

Overall, Stash’s commitment to security and regulation makes it an attractive option for users who want to invest with confidence. By prioritizing the protection of user data and investments, Stash provides a safe and secure environment for users to achieve their investment goals.

Stash Reviews and Ratings: What Users Are Saying

To get a better understanding of the Stash app and its performance, it’s essential to look at what users are saying about it. Stash has received overwhelmingly positive reviews from users across various platforms, including the App Store, Google Play, and Trustpilot.

On the App Store, Stash has an average rating of 4.8 out of 5 stars, based on over 10,000 reviews. Users have praised the app’s user-friendly interface, ease of use, and variety of investment options.

On Google Play, Stash has an average rating of 4.5 out of 5 stars, based on over 5,000 reviews. Users have praised the app’s simplicity, flexibility, and customer support.

On Trustpilot, Stash has an average rating of 4.5 out of 5 stars, based on over 1,000 reviews. Users have praised the app’s ease of use, investment options, and customer support.

Common praises about Stash include its user-friendly interface, variety of investment options, and excellent customer support. Some users have also praised the app’s educational resources and investment tracking tools.

However, some users have complained about the app’s fees, particularly the management fee. Some users have also reported issues with customer support and the app’s user interface.

For those wondering “what is the app stash” and what users are saying about it, the answer is that Stash has received overwhelmingly positive reviews from users across various platforms. While some users have reported issues with fees and customer support, the majority of users have praised the app’s user-friendly interface, investment options, and educational resources.

Overall, Stash’s positive reviews and ratings demonstrate its commitment to providing a high-quality investment app that meets the needs of its users.

Conclusion: Is Stash the Right Investment App for You?

In conclusion, Stash is a powerful investment app that offers a range of features and benefits for users. From its user-friendly interface to its educational resources and investment tracking tools, Stash provides a comprehensive platform for investors of all levels.

Whether you’re a beginner looking to start investing or an experienced investor looking to diversify your portfolio, Stash is an excellent choice. With its low fees, variety of investment options, and excellent customer support, Stash is an attractive option for anyone looking to achieve their investment goals.

For those wondering “what is the app stash” and whether it’s the right investment app for them, the answer is that Stash is a valuable tool for anyone looking to invest in the stock market. With its ease of use, flexibility, and range of investment options, Stash is an excellent choice for anyone looking to achieve their investment goals.

Ultimately, the decision to use Stash or any other investment app depends on your individual needs and goals. However, with its comprehensive platform, low fees, and excellent customer support, Stash is an excellent choice for anyone looking to invest in the stock market.

In summary, Stash is a powerful investment app that offers a range of features and benefits for users. With its user-friendly interface, educational resources, and investment tracking tools, Stash provides a comprehensive platform for investors of all levels. Whether you’re a beginner or an experienced investor, Stash is an excellent choice for anyone looking to achieve their investment goals.