Understanding the Benefits of a Roth IRA

A Roth Individual Retirement Account (Roth IRA) is a popular retirement savings vehicle that offers numerous benefits to individuals seeking to secure their financial future. One of the primary advantages of a Roth IRA is its tax-free growth and withdrawals, allowing individuals to keep more of their hard-earned money. This is particularly beneficial for those who expect to be in a higher tax bracket during retirement, as they can pay taxes on their contributions now and avoid higher taxes later.

In addition to tax-free growth and withdrawals, Roth IRAs also offer flexibility in retirement. Unlike traditional IRAs, Roth IRAs do not require individuals to take required minimum distributions (RMDs) during their lifetime. This means that individuals can keep their money in the account for as long as they want, without having to worry about taking mandatory withdrawals. This flexibility can be especially useful for those who do not need the money immediately or who want to leave a legacy for their heirs.

Another benefit of Roth IRAs is their potential for long-term growth. By contributing to a Roth IRA regularly and allowing the money to compound over time, individuals can build a significant nest egg for retirement. This can be especially beneficial for those who start saving early, as they can take advantage of the power of compound interest to grow their savings over time.

When considering what is the best Roth IRA for their needs, individuals should take into account their overall financial goals and circumstances. By understanding the benefits of a Roth IRA and how it can fit into their broader financial strategy, individuals can make informed decisions about their retirement savings and work towards achieving their long-term goals.

How to Choose the Best Roth IRA for Your Needs

When selecting a Roth IRA provider, it’s essential to evaluate several factors to ensure the chosen provider meets individual needs. One of the most critical considerations is fees. Look for providers that offer low or no fees for account maintenance, management, and investment options. Some providers may charge higher fees for certain investment options or services, so it’s crucial to understand the fee structure before opening an account.

Another vital factor to consider is investment options. A good Roth IRA provider should offer a range of investment options, including stocks, bonds, ETFs, and mutual funds. This allows individuals to create a diversified portfolio that aligns with their risk tolerance and financial goals. Some providers may also offer more specialized investment options, such as real estate or commodities.

Customer service is also an essential consideration when choosing a Roth IRA provider. Look for providers that offer 24/7 customer support, online chat, and phone support. This ensures that individuals can get help when they need it, whether it’s to ask questions about their account or to make changes to their investment portfolio.

Mobile access is another factor to consider. Many individuals want to be able to manage their accounts on-the-go, so look for providers that offer mobile apps or online platforms that allow for easy account management. This can include features such as mobile deposit, account transfers, and investment tracking.

When evaluating these factors, individuals should consider what is the best Roth IRA for their specific needs. By taking the time to research and compare different providers, individuals can make an informed decision and choose a provider that meets their unique needs and goals.

Top Roth IRA Providers: A Comparison of Fidelity, Vanguard, and Charles Schwab

When it comes to choosing a Roth IRA provider, there are several top options to consider. Fidelity, Vanguard, and Charles Schwab are three of the most popular providers, each with their own strengths and weaknesses. In this section, we’ll compare and contrast the features, fees, and investment options of these three providers to help readers make an informed decision.

Fidelity is one of the largest financial services companies in the world, with over $7 trillion in assets under management. Their Roth IRA offering is highly regarded, with a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Fidelity also offers low fees, with no account maintenance fees and no fees for online trades. However, their investment options may be limited compared to some other providers.

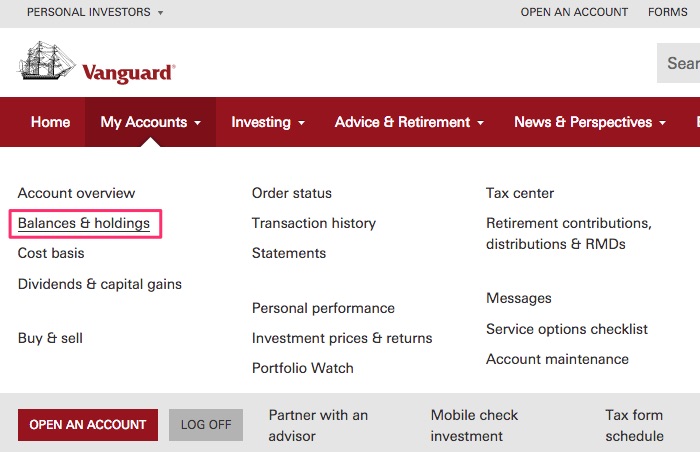

Vanguard is another highly respected provider, known for their low-cost index funds and ETFs. Their Roth IRA offering is highly customizable, with a wide range of investment options and low fees. Vanguard also offers a unique feature called “Vanguard Personal Advisor Services,” which provides personalized investment advice and portfolio management. However, their fees may be higher than some other providers, and their investment options may be limited to Vanguard funds.

Charles Schwab is a well-established provider with a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Their Roth IRA offering is highly regarded, with low fees and no account maintenance fees. Schwab also offers a unique feature called “Schwab Intelligent Portfolios,” which provides automated investment management and portfolio rebalancing. However, their fees may be higher than some other providers, and their investment options may be limited compared to some other providers.

When evaluating these providers, individuals should consider what is the best Roth IRA for their specific needs. By comparing and contrasting the features, fees, and investment options of these three providers, individuals can make an informed decision and choose a provider that meets their unique needs and goals.

Investment Options for Your Roth IRA: A Guide to Stocks, Bonds, and ETFs

When it comes to investing in a Roth IRA, there are several options to consider. Stocks, bonds, ETFs, and mutual funds are all popular choices, each with their own unique characteristics and potential benefits. In this section, we’ll explore the various investment options available for a Roth IRA, including the risks and potential returns associated with each option.

Stocks are a popular investment option for Roth IRAs, offering the potential for long-term growth and higher returns. However, stocks can also be volatile, and their value may fluctuate over time. To mitigate this risk, it’s essential to diversify your portfolio by investing in a range of stocks across different industries and sectors.

Bonds are another investment option for Roth IRAs, offering a relatively stable source of income and lower risk. However, bonds typically offer lower returns than stocks, and their value may be affected by changes in interest rates. To maximize returns, it’s essential to choose bonds with a high credit rating and a competitive interest rate.

ETFs (Exchange-Traded Funds) are a type of investment fund that tracks a particular index, sector, or asset class. They offer a diversified portfolio and can be traded on an exchange like stocks. ETFs are a popular choice for Roth IRAs, offering flexibility and diversification.

Mutual funds are another type of investment fund that pools money from multiple investors to invest in a variety of assets. They offer a diversified portfolio and professional management, making them a popular choice for Roth IRAs.

When creating a diversified portfolio for your Roth IRA, it’s essential to consider your risk tolerance, investment goals, and time horizon. A well-diversified portfolio can help you achieve your long-term financial goals and maximize your returns.

Ultimately, the best investment options for your Roth IRA will depend on your individual circumstances and goals. By understanding the risks and potential returns associated with each option, you can make informed decisions and create a diversified portfolio that meets your needs.

Managing Your Roth IRA: Tips for Contributions, Conversions, and Withdrawals

Managing a Roth IRA requires careful planning and attention to detail. To maximize the benefits of a Roth IRA, it’s essential to understand the rules and regulations surrounding contributions, conversions, and withdrawals. In this section, we’ll provide tips and strategies for managing your Roth IRA, including how to make the most of your contributions, conversions, and withdrawals.

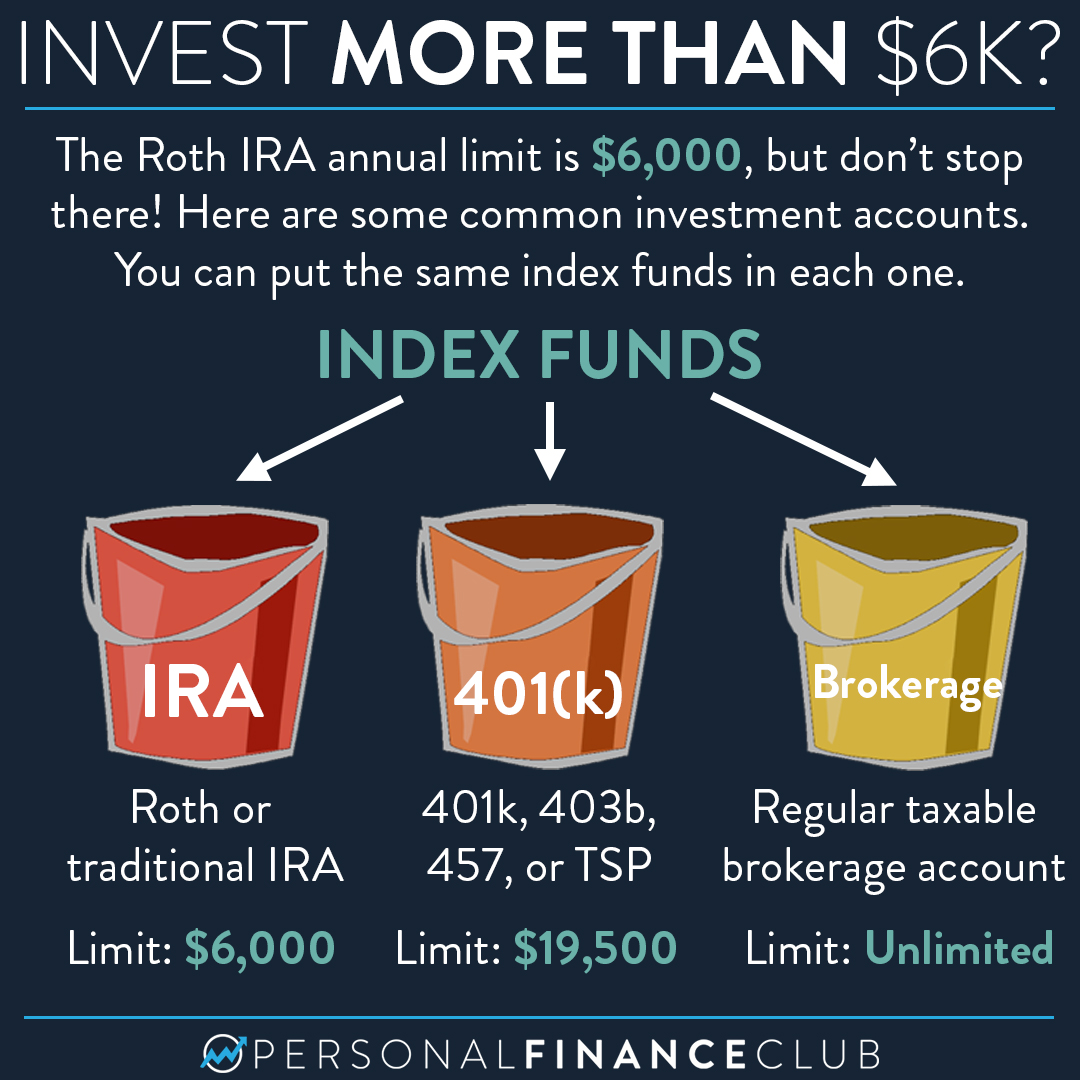

Contributions: The key to maximizing your Roth IRA is to contribute as much as possible, as early as possible. The annual contribution limit for Roth IRAs is $6,000 in 2022, or $7,000 if you are 50 or older. It’s essential to contribute at least enough to take full advantage of any employer match, if available. Additionally, consider setting up automatic contributions to make saving easier and less prone to being neglected.

Conversions: If you have a traditional IRA or 401(k), you may be able to convert it to a Roth IRA. This can be a great way to take advantage of the tax-free growth and withdrawals offered by a Roth IRA. However, it’s essential to understand the rules and regulations surrounding conversions, including the potential tax implications.

Withdrawals: Withdrawals from a Roth IRA are tax-free and penalty-free if you are 59 1/2 or older and have had a Roth IRA for at least five years. However, if you withdraw earnings before age 59 1/2 or within the first five years of opening a Roth IRA, you may be subject to taxes and penalties. To avoid these penalties, it’s essential to understand the rules and regulations surrounding withdrawals and to plan carefully.

By following these tips and strategies, you can maximize the benefits of your Roth IRA and achieve your long-term financial goals. Remember to always consult with a financial advisor or tax professional to ensure you are making the most of your Roth IRA and avoiding any potential penalties or taxes.

Avoiding Common Mistakes with Your Roth IRA

While a Roth IRA can be a powerful tool for retirement savings, there are several common mistakes that individuals can make when managing their account. In this section, we’ll identify some of the most common mistakes and provide guidance on how to avoid them.

Inadequate Contributions: One of the most common mistakes individuals make with their Roth IRA is not contributing enough. To maximize the benefits of a Roth IRA, it’s essential to contribute as much as possible, as early as possible. Consider setting up automatic contributions to make saving easier and less prone to being neglected.

Poor Investment Choices: Another common mistake individuals make with their Roth IRA is making poor investment choices. To avoid this mistake, it’s essential to understand the risks and potential returns associated with each investment option and to create a diversified portfolio. Consider consulting with a financial advisor or conducting your own research to make informed investment decisions.

Untimely Withdrawals: Withdrawing from a Roth IRA too early can result in penalties and taxes. To avoid this mistake, it’s essential to understand the rules and regulations surrounding withdrawals and to plan carefully. Consider waiting until age 59 1/2 or later to withdraw from your

Avoiding Common Mistakes with Your Roth IRA

While a Roth IRA can be a powerful tool for retirement savings, there are several common mistakes that individuals can make when managing their account. In this section, we’ll identify some of the most common mistakes and provide guidance on how to avoid them.

Inadequate Contributions: One of the most common mistakes individuals make with their Roth IRA is not contributing enough. To maximize the benefits of a Roth IRA, it’s essential to contribute as much as possible, as early as possible. Consider setting up automatic contributions to make saving easier and less prone to being neglected.

Poor Investment Choices: Another common mistake individuals make with their Roth IRA is making poor investment choices. To avoid this mistake, it’s essential to understand the risks and potential returns associated with each investment option and to create a diversified portfolio. Consider consulting with a financial advisor or conducting your own research to make informed investment decisions.

Untimely Withdrawals: Withdrawing from a Roth IRA too early can result in penalties and taxes. To avoid this mistake, it’s essential to understand the rules and regulations surrounding withdrawals and to plan carefully. Consider waiting until age 59 1/2 or later to withdraw from your

Avoiding Common Mistakes with Your Roth IRA

While a Roth IRA can be a powerful tool for retirement savings, there are several common mistakes that individuals can make when managing their account. In this section, we’ll identify some of the most common mistakes and provide guidance on how to avoid them.

Inadequate Contributions: One of the most common mistakes individuals make with their Roth IRA is not contributing enough. To maximize the benefits of a Roth IRA, it’s essential to contribute as much as possible, as early as possible. Consider setting up automatic contributions to make saving easier and less prone to being neglected.

Poor Investment Choices: Another common mistake individuals make with their Roth IRA is making poor investment choices. To avoid this mistake, it’s essential to understand the risks and potential returns associated with each investment option and to create a diversified portfolio. Consider consulting with a financial advisor or conducting your own research to make informed investment decisions.

Untimely Withdrawals: Withdrawing from a Roth IRA too early can result in penalties and taxes. To avoid this mistake, it’s essential to understand the rules and regulations surrounding withdrawals and to plan carefully. Consider waiting until age 59 1/2 or later to withdraw from your