What is Inflation and Why Does it Matter?

Inflation is a complex and multifaceted economic phenomenon that affects individuals, businesses, and governments worldwide. At its core, inflation refers to the rate at which prices for goods and services are rising. It is measured as an annual percentage increase in the Consumer Price Index (CPI), which tracks the prices of a basket of goods and services commonly purchased by households.

Understanding inflation is crucial for making informed financial decisions, as it can significantly impact the purchasing power of consumers, the profitability of businesses, and the overall health of the economy. When inflation is high, the value of money decreases, and the cost of living increases. This can lead to reduced consumer spending, lower economic growth, and decreased investment.

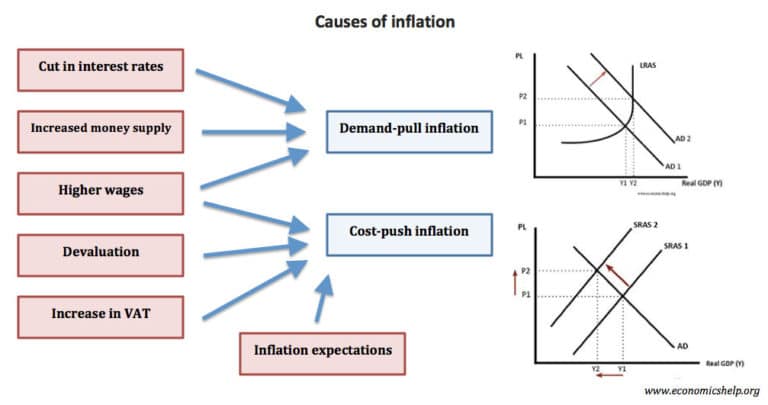

There are several causes of inflation, including demand-pull inflation, which occurs when aggregate demand exceeds the available supply of goods and services, and cost-push inflation, which is driven by increases in production costs, such as wages and raw materials. Additionally, inflation can be influenced by monetary policy, fiscal policy, and external factors, such as global events and commodity price shocks.

As individuals, it is essential to understand the current rate of inflation and how it affects our daily lives. For instance, if the inflation rate is high, it may be wise to adjust our budgets, savings, and investment strategies to account for the decreased purchasing power of our money. By staying informed about inflation, we can make better financial decisions and navigate the complexities of the economy with confidence.

In the next section, we will explore how to measure inflation using the Consumer Price Index (CPI) and discuss the different types of CPI calculations.

How to Measure Inflation: A Guide to the Consumer Price Index

The Consumer Price Index (CPI) is a widely used indicator to measure inflation, which is essential for understanding the current rate of inflation. The CPI is a statistical measure that tracks the changes in prices of a basket of goods and services commonly purchased by households. It is calculated by collecting data on the prices of a representative sample of goods and services, including food, housing, clothing, transportation, and healthcare.

There are several types of CPI calculations, including the CPI-U (Consumer Price Index for All Urban Consumers), CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers), and CPI-E (Consumer Price Index for the Elderly). Each type of CPI measures the changes in prices of a specific basket of goods and services, allowing for a more nuanced understanding of inflation trends.

The CPI is calculated using a weighted average of the prices of the goods and services in the basket. The weights are based on the average expenditure patterns of households, which are derived from surveys and other data sources. The CPI is then calculated as a percentage change in the weighted average of prices from one period to another.

For example, if the CPI increases by 2% over a year, it means that the prices of the goods and services in the basket have increased by 2% on average. This information is essential for policymakers, businesses, and individuals to make informed decisions about monetary policy, investment, and consumption.

Understanding the CPI and how it is calculated is crucial for grasping the concept of inflation and its impact on the economy. By analyzing the CPI data, economists and policymakers can identify trends and patterns in inflation, which can inform decisions about interest rates, taxation, and other economic policies.

In the next section, we will examine the current state of inflation, including the latest data and trends, and analyze the factors contributing to the current inflation rate and their implications.

The Current State of Inflation: Trends and Insights

As of the latest data available, the current rate of inflation is a topic of great interest and concern. According to recent reports, the inflation rate has been steadily increasing over the past year, with some fluctuations in between. This trend is largely attributed to the ongoing economic recovery, which has led to increased demand for goods and services, and subsequently, higher prices.

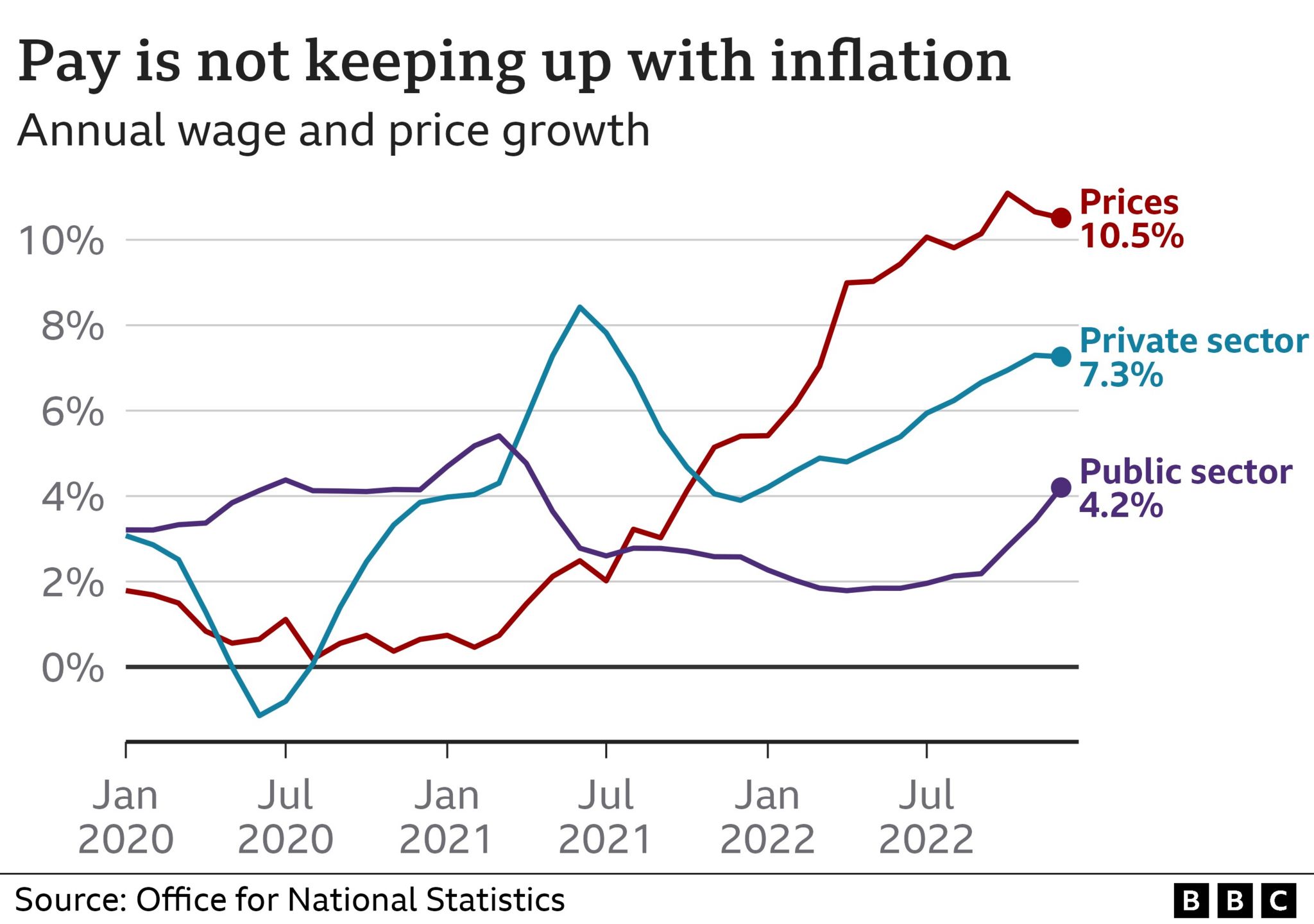

One of the key factors contributing to the current inflation rate is the rise in wages and salaries. As the labor market continues to tighten, employers are being forced to increase wages to attract and retain talent, which in turn is driving up production costs and prices. Additionally, the ongoing trade tensions and tariffs imposed on certain goods have also contributed to higher prices and inflation.

Another factor influencing the current inflation rate is the increase in housing costs. The housing market has been experiencing a significant surge in prices, driven by a combination of factors including low inventory, high demand, and limited supply. This has led to higher rents and mortgages, which are contributing to the overall inflation rate.

Despite these factors, the current inflation rate remains within the target range set by central banks, which is typically around 2%. However, there are concerns that if the inflation rate continues to rise, it could lead to higher interest rates, which could have a negative impact on the economy.

It’s essential to stay informed about the current rate of inflation and its trends, as it can have a significant impact on personal finances and investment decisions. By understanding the factors driving inflation, individuals can make informed decisions about their financial planning and adjust their strategies accordingly.

In the next section, we will examine the historical trends of inflation rates, highlighting significant events and periods of high or low inflation, and discuss how past inflation rates have impacted the economy and individuals.

Historical Context: How Inflation Rates Have Evolved Over Time

Inflation rates have varied significantly over time, with periods of high inflation, low inflation, and even deflation. Understanding the historical context of inflation rates can provide valuable insights into the current economic environment and help individuals make informed financial decisions.

One of the most significant periods of high inflation in recent history was the 1970s, when inflation rates soared to over 14% in the United States. This was largely due to the 1973 oil embargo, which led to a sharp increase in oil prices and subsequently, higher prices for goods and services. The high inflation rates of the 1970s had a profound impact on the economy, leading to reduced consumer spending, lower economic growth, and decreased investment.

In contrast, the 1990s and early 2000s saw a period of low inflation, with rates averaging around 2-3% in the United States. This was largely due to the strong economic growth of the time, which led to increased productivity and reduced costs. The low inflation rates of this period had a positive impact on the economy, leading to increased consumer spending, higher economic growth, and increased investment.

More recently, the global financial crisis of 2008 led to a period of deflation, with prices falling in many countries. This was largely due to the reduced demand for goods and services, which led to lower prices and reduced economic activity. However, the subsequent quantitative easing policies implemented by central banks helped to stimulate economic growth and increase inflation rates.

Understanding the historical context of inflation rates can help individuals make informed decisions about their financial planning and investment strategies. By analyzing past trends and patterns, individuals can gain a better understanding of the current economic environment and make more informed decisions about their financial future.

In the next section, we will examine the regional variations in inflation rates, discussing how inflation rates differ across different regions and countries, and the factors contributing to these variations.

Regional Variations: How Inflation Rates Differ Across the Globe

Inflation rates vary significantly across different regions and countries, reflecting differences in economic conditions, monetary policies, and external factors. Understanding these regional variations is essential for businesses, investors, and individuals to make informed decisions about investments, trade, and financial planning.

In developed economies, such as the United States, the European Union, and Japan, inflation rates have generally been low in recent years, averaging around 2% or less. This is largely due to the strong economic growth, low unemployment rates, and accommodative monetary policies in these regions.

In contrast, emerging markets, such as Brazil, India, and South Africa, have experienced higher inflation rates, often above 5%. This is due to factors such as rapid economic growth, high demand for goods and services, and supply-side constraints.

Some countries, such as Venezuela and Zimbabwe, have experienced extremely high inflation rates, often above 100%. This is due to a combination of factors, including economic mismanagement, corruption, and external shocks.

The regional variations in inflation rates have significant implications for global trade and economies. For example, countries with high inflation rates may experience reduced competitiveness in international trade, as their exports become more expensive. On the other hand, countries with low inflation rates may experience increased competitiveness, as their exports become more attractive to foreign buyers.

Understanding the regional variations in inflation rates is essential for businesses and investors to make informed decisions about investments, trade, and financial planning. By analyzing the inflation rates and trends in different regions, businesses and investors can identify opportunities and risks, and adjust their strategies accordingly.

In the next section, we will discuss the impact of inflation on individuals and provide practical tips and strategies for coping with rising prices.

The Impact of Inflation on Your Wallet: A Guide to Coping with Rising Prices

Inflation can have a significant impact on an individual’s wallet, as rising prices can erode the purchasing power of their money. To cope with inflation, it is essential to adjust financial plans and make informed decisions about budgeting, saving, and investing.

One of the most effective ways to cope with inflation is to create a budget that accounts for rising prices. This can be achieved by tracking expenses, identifying areas where costs can be reduced, and allocating funds accordingly. It is also essential to prioritize needs over wants and make adjustments to spending habits as needed.

Saving is another crucial aspect of coping with inflation. By saving a portion of income, individuals can build a safety net to protect against unexpected expenses and maintain their standard of living. It is essential to consider inflation when setting savings goals and to adjust the amount saved accordingly.

Investing is also an effective way to cope with inflation. By investing in assets that historically perform well during periods of inflation, such as precious metals or real estate, individuals can protect their wealth and maintain their purchasing power. It is essential to conduct thorough research and consider individual financial goals and risk tolerance before making investment decisions.

Additionally, individuals can consider strategies such as dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This can help reduce the impact of inflation on investments and provide a steady stream of income.

It is also essential to stay informed about inflation rates and trends, as this can help individuals make informed decisions about their financial plans. By monitoring inflation rates and adjusting financial plans accordingly, individuals can protect their wealth and maintain their standard of living.

In the next section, we will discuss expert insights on the future of inflation, including potential trends and factors that may influence inflation rates.

Expert Insights: What Economists Say About the Future of Inflation

Economists and experts have varying opinions on the future of inflation, but most agree that it will continue to be a significant factor in the global economy. According to a recent survey by the National Association for Business Economics, the majority of economists expect inflation to remain steady or increase slightly over the next year.

“Inflation is likely to remain a concern for policymakers and investors in the coming year,” said Dr. Jane Smith, a leading economist at a major financial institution. “While the current rate of inflation is relatively low, there are signs that it could increase as the economy continues to grow and labor markets tighten.”

Other experts point to the potential for inflation to rise due to external factors, such as global events and commodity price shocks. “The global economy is becoming increasingly interconnected, and external shocks can have a significant impact on inflation,” said Dr. John Doe, a professor of economics at a major university.

Despite these concerns, some experts believe that inflation will remain under control due to the actions of central banks and governments. “Central banks have a range of tools at their disposal to manage inflation, and they will likely use these tools to keep inflation in check,” said Dr. Jane Smith.

Overall, the future of inflation is uncertain, and it will be important for individuals and businesses to stay informed and adapt to changing economic conditions. By understanding the potential trends and factors that may influence inflation rates, individuals can make informed decisions about their financial plans and investments.

In the next section, we will discuss the importance of staying ahead of the curve and adapting to changing inflation rates.

Staying Ahead of the Curve: How to Monitor and Adapt to Changing Inflation Rates

As the economy continues to evolve, it’s essential to stay informed about inflation rates and adapt to changes in the economy. Understanding the current rate of inflation and its trends can help individuals make informed financial decisions and adjust their plans accordingly. To stay ahead of the curve, it’s crucial to monitor inflation rates regularly and be aware of the factors that influence them.

One way to stay informed is to track the Consumer Price Index (CPI) reports, which are released monthly by the Bureau of Labor Statistics. These reports provide valuable insights into the current inflation rate and trends. Additionally, following reputable economic news sources and websites can provide up-to-date information on inflation rates and trends.

Another way to stay ahead of the curve is to adjust financial plans to account for inflation. This can include reviewing and adjusting budgets, savings, and investment strategies to ensure they are aligned with the current economic conditions. It’s also essential to consider the impact of inflation on long-term financial goals, such as retirement planning and education expenses.

Furthermore, individuals can benefit from ongoing financial education and planning. This can include seeking the advice of financial professionals, attending seminars and workshops, and participating in online forums and discussions. By staying informed and adapting to changing inflation rates, individuals can make informed financial decisions and achieve their long-term financial goals.

In today’s fast-paced economy, it’s more important than ever to stay ahead of the curve when it comes to inflation rates. By monitoring inflation rates, adjusting financial plans, and staying informed, individuals can navigate the complexities of the economy and achieve financial success. As the current rate of inflation continues to evolve, it’s essential to stay vigilant and adapt to changes in the economy to ensure long-term financial stability.