Estate Planning 101: Why You Need a Plan

Estate planning is an essential aspect of securing one’s financial future and ensuring that assets are distributed according to one’s wishes after death. A well-crafted estate plan can help individuals avoid probate, reduce taxes, and provide peace of mind for loved ones. However, many people are unclear about the differences between trusts and wills, two fundamental components of estate planning. Understanding the distinction between these two documents is crucial in creating an effective estate plan. When considering what is the difference between a trust and a will, it’s essential to recognize that both play vital roles in ensuring that assets are managed and distributed efficiently.

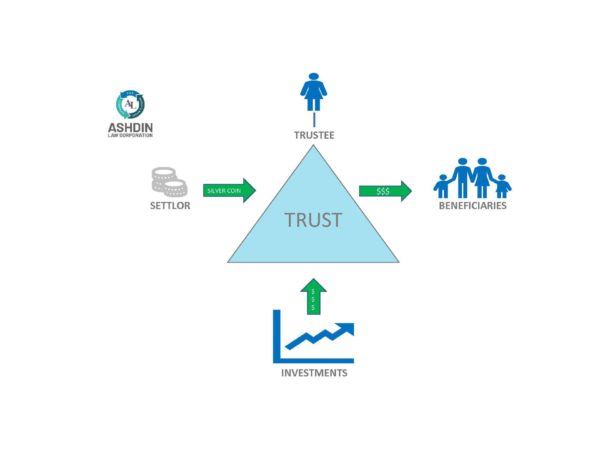

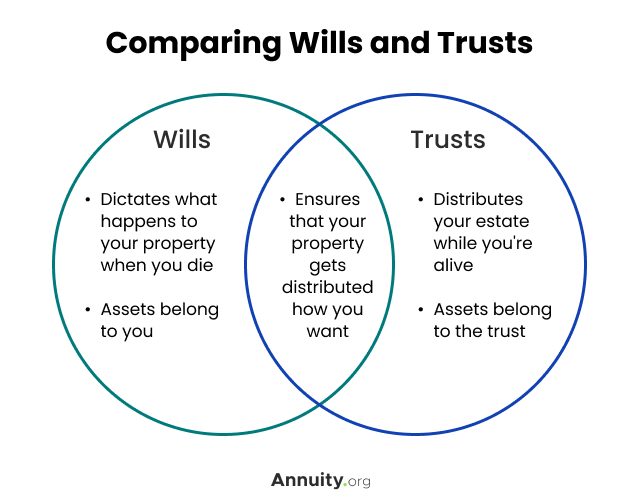

A trust is a fiduciary arrangement that allows a third party, known as the trustee, to manage assets on behalf of beneficiaries. Trusts can be used to manage assets during one’s lifetime, providing a level of control and flexibility that wills do not offer. On the other hand, a will is a legal document that outlines how assets should be distributed after death. While wills are often used to distribute assets, they can also be used to appoint guardians for minor children and name an executor to manage the estate.

Having a comprehensive estate plan in place can provide numerous benefits, including avoiding probate, reducing taxes, and ensuring that assets are distributed according to one’s wishes. Probate is a lengthy and costly process that can be avoided with a trust, allowing beneficiaries to access assets more quickly. Additionally, estate planning can help reduce taxes, ensuring that more of one’s assets are passed on to loved ones rather than being lost to taxes.

When creating an estate plan, it’s essential to consider individual circumstances and goals. For example, individuals with minor children may want to include provisions for guardianship in their will, while those with significant assets may want to consider creating a trust to manage those assets during their lifetime. By understanding the differences between trusts and wills, individuals can create an effective estate plan that meets their unique needs and ensures that their assets are managed and distributed efficiently.

Defining Trusts and Wills: What’s the Difference?

When considering what is the difference between a trust and a will, it’s essential to understand the fundamental characteristics of each. A trust is a fiduciary arrangement that allows a third party, known as the trustee, to manage assets on behalf of beneficiaries. Trusts can be used to manage assets during one’s lifetime, providing a level of control and flexibility that wills do not offer. There are several types of trusts, including revocable trusts, irrevocable trusts, and special needs trusts, each with its own unique characteristics and benefits.

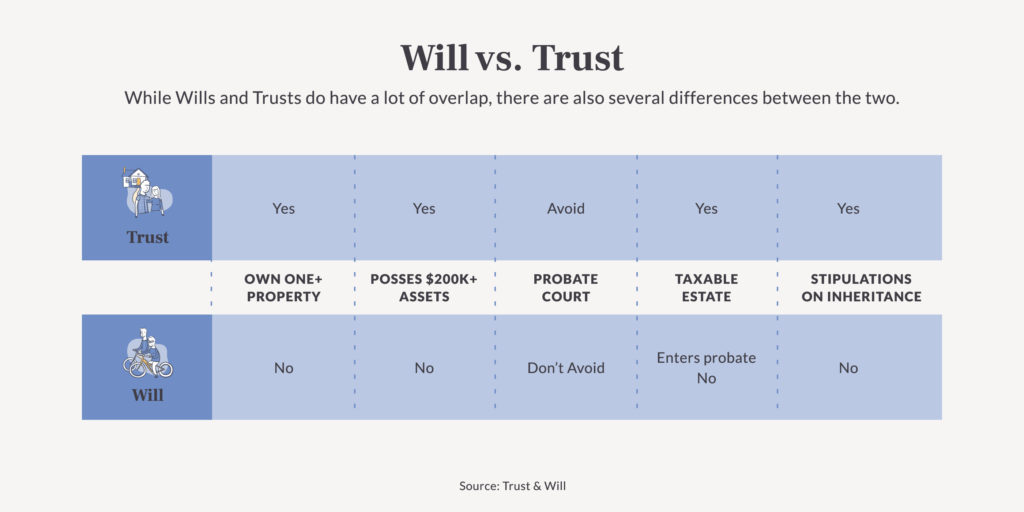

A will, on the other hand, is a legal document that outlines how assets should be distributed after death. Wills are often used to distribute assets, appoint guardians for minor children, and name an executor to manage the estate. Unlike trusts, wills do not take effect until after death, and the assets are subject to probate, a lengthy and costly process. When creating a will, it’s essential to consider the tax implications and ensure that the document is valid and enforceable.

One of the primary differences between trusts and wills is the level of control and flexibility they offer. Trusts can be used to manage assets during one’s lifetime, allowing for changes to be made as needed. Wills, on the other hand, are often more rigid and can be difficult to update. Additionally, trusts can provide a level of anonymity and asset protection that wills do not offer.

Understanding the differences between trusts and wills is crucial in creating an effective estate plan. By considering individual circumstances and goals, individuals can determine which option is best for their unique situation. Whether creating a trust or will, it’s essential to seek professional help to ensure that the documents are valid and enforceable.

In summary, trusts and wills are two distinct estate planning tools that serve different purposes. Trusts offer a level of control and flexibility during one’s lifetime, while wills take effect after death and are subject to probate. By understanding the differences between these two documents, individuals can create an effective estate plan that meets their unique needs and ensures that their assets are managed and distributed efficiently.

How to Create a Trust: A Step-by-Step Guide

Creating a trust can be a complex process, but with a clear understanding of the steps involved, individuals can ensure that their assets are managed and distributed according to their wishes. When considering what is the difference between a trust and a will, it’s essential to understand the process of creating a trust. Here is a step-by-step guide on how to create a trust:

Step 1: Choose a Trustee – The trustee is responsible for managing the trust assets and making decisions on behalf of the beneficiaries. It’s essential to choose a trustee who is trustworthy, reliable, and has the necessary expertise to manage the trust assets.

Step 2: Select Beneficiaries – The beneficiaries are the individuals or organizations that will receive the trust assets. It’s essential to clearly define the beneficiaries and their interests in the trust assets.

Step 3: Fund the Trust – The trust must be funded with assets, which can include real estate, investments, or other property. It’s essential to ensure that the trust is properly funded to achieve the desired goals.

Step 4: Create the Trust Document – The trust document outlines the terms and conditions of the trust, including the powers and duties of the trustee, the rights and interests of the beneficiaries, and the distribution of the trust assets. It’s essential to work with an attorney to create a trust document that meets the individual’s needs and goals.

Step 5: Sign and Notarize the Trust Document – Once the trust document is created, it must be signed and notarized by the individual creating the trust. This ensures that the trust is valid and enforceable.

Step 6: Fund the Trust with Assets – Once the trust is created, it must be funded with assets. This can involve transferring ownership of assets to the trust or using the trust to purchase new assets.

By following these steps, individuals can create a trust that meets their unique needs and goals. It’s essential to work with an attorney to ensure that the trust is properly created and funded to achieve the desired results.

The Role of a Will in Estate Planning

A will is a crucial component of a comprehensive estate plan, providing a clear outline of how assets should be distributed after death. When considering what is the difference between a trust and a will, it’s essential to understand the role of a will in estate planning. A will allows individuals to specify how their assets should be distributed, appoint guardians for minor children, and name an executor to manage the estate.

One of the primary benefits of having a will is that it allows individuals to control the distribution of their assets after death. Without a will, the distribution of assets is determined by state law, which may not align with the individual’s wishes. A will also provides an opportunity to appoint guardians for minor children, ensuring that they are cared for and protected after the individual’s death.

In addition to distributing assets and appointing guardians, a will also allows individuals to name an executor to manage the estate. The executor is responsible for carrying out the instructions outlined in the will, including paying debts, taxes, and other expenses. By naming an executor, individuals can ensure that their estate is managed efficiently and effectively.

It’s essential to note that a will only takes effect after death, whereas a trust can be used to manage assets during one’s lifetime. However, a will is still a vital component of estate planning, providing a clear outline of how assets should be distributed after death. By including a will in a comprehensive estate plan, individuals can ensure that their assets are distributed according to their wishes and that their loved ones are protected.

When creating a will, it’s essential to work with an attorney to ensure that the document is valid and enforceable. An attorney can provide guidance on the best way to distribute assets, appoint guardians, and name an executor. By seeking professional help, individuals can ensure that their will is comprehensive and effective, providing peace of mind for themselves and their loved ones.

Trusts vs Wills: Which is Right for You?

When it comes to estate planning, two of the most common tools used to manage and distribute assets are trusts and wills. While both serve the same ultimate purpose, they differ significantly in terms of their characteristics, benefits, and drawbacks. Understanding the differences between trusts and wills is crucial in determining which option is best suited for individual circumstances.

One of the primary differences between trusts and wills lies in their purpose. A trust is a fiduciary arrangement that allows a third party, known as the trustee, to manage assets on behalf of the grantor (the person creating the trust) during their lifetime. In contrast, a will is a legal document that takes effect after the testator’s (the person creating the will) death, outlining how their assets should be distributed.

Another key difference is the level of control and flexibility offered by each. Trusts provide more control over asset distribution, as the grantor can specify exactly how and when assets are to be distributed. Wills, on the other hand, are more rigid and may be subject to probate, which can lead to delays and increased costs.

In terms of tax implications, trusts can offer significant benefits. By transferring assets into a trust, individuals can reduce their taxable estate, minimizing the amount of taxes owed. Wills, however, do not offer the same level of tax protection.

Despite these differences, both trusts and wills have their advantages and disadvantages. Trusts can be more complex and expensive to establish, while wills are generally simpler and less costly. However, wills may not provide the same level of protection and control as trusts.

So, what is the difference between a trust and a will? Ultimately, the choice between the two depends on individual circumstances and goals. If you’re looking for more control over asset distribution, tax benefits, and flexibility, a trust may be the better option. However, if you’re seeking a simpler, more cost-effective solution, a will may be sufficient.

To determine which option is right for you, consider the following factors:

- Asset value and complexity

- Tax implications

- Level of control desired

- Family dynamics and beneficiary needs

By carefully evaluating these factors and understanding the differences between trusts and wills, individuals can make informed decisions about their estate planning needs and ensure that their assets are distributed according to their wishes.

Common Mistakes to Avoid When Creating a Trust or Will

Creating a trust or will is a crucial step in estate planning, but it’s not uncommon for individuals to make mistakes that can have significant consequences. Avoiding these common errors can help ensure that your wishes are carried out and your loved ones are protected.

One of the most common mistakes is failing to update documents. As circumstances change, such as the birth of a child or the acquisition of new assets, it’s essential to review and update your trust or will to reflect these changes. Failing to do so can lead to confusion and disputes among beneficiaries.

Another mistake is not considering tax implications. Trusts and wills can have significant tax implications, and failing to consider these can result in unnecessary taxes and penalties. For example, if you create a trust without considering the tax implications, you may inadvertently trigger a tax liability that could have been avoided.

Neglecting to name beneficiaries is another common mistake. Failing to name beneficiaries or not clearly defining their roles can lead to confusion and disputes among family members. It’s essential to clearly define the roles and responsibilities of beneficiaries to avoid any potential conflicts.

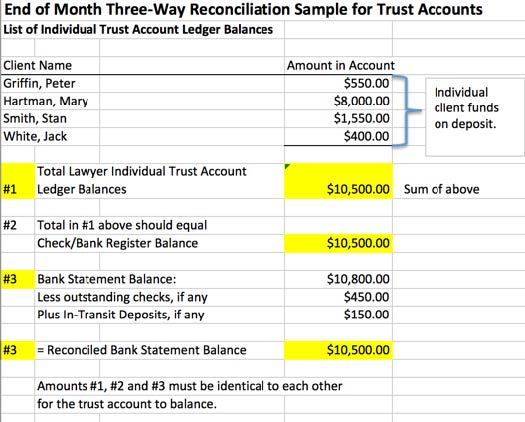

Not funding a trust is another mistake that can have significant consequences. A trust is only as effective as the assets that are transferred into it. Failing to fund a trust can result in the trust being deemed invalid, which can lead to probate and other costly consequences.

Using online templates or DIY kits is another mistake that can have serious consequences. While these may seem like a cost-effective solution, they often lack the necessary complexity and nuance to address individual circumstances. Using a DIY kit or online template can result in a trust or will that is invalid or unenforceable.

Not seeking professional help is perhaps the most significant mistake. Creating a trust or will requires a deep understanding of estate planning laws and regulations. Failing to seek the advice of an attorney can result in a trust or will that is invalid, unenforceable, or fails to achieve the desired outcome.

Other common mistakes to avoid include:

- Not considering the role of guardians for minor children

- Not naming an executor or trustee

- Not clearly defining asset distribution

- Not considering the impact of divorce or remarriage on estate planning

By avoiding these common mistakes, individuals can ensure that their trust or will is effective, valid, and achieves the desired outcome. It’s essential to seek the advice of an attorney to ensure that your estate planning documents are comprehensive, accurate, and enforceable.

How to Update Your Trust or Will: A Guide

As circumstances change, it’s essential to update your trust or will to reflect these changes. Failing to do so can lead to confusion, disputes, and unintended consequences. Updating your trust or will can be a straightforward process, but it requires careful consideration and attention to detail.

When to Update Your Trust or Will

There are several situations that may require updating your trust or will, including:

- Marriage or divorce

- Birth or adoption of a child

- Death of a beneficiary or trustee

- Changes in asset ownership or value

- Changes in tax laws or regulations

How to Update Your Trust

Updating a trust requires careful consideration of the trust’s terms and the impact of any changes. Here are the steps to follow:

- Review the trust agreement: Carefully review the trust agreement to understand its terms and any restrictions on making changes.

- Identify the changes: Determine what changes need to be made and why.

- Consult with an attorney: Consult with an attorney to ensure that the changes are valid and enforceable.

- Amend the trust: Make the necessary changes to the trust agreement, including updating beneficiaries, trustees, or asset distribution.

- Sign and notarize: Sign and notarize the updated trust agreement to ensure its validity.

How to Update Your Will

Updating a will is a more straightforward process than updating a trust, but it still requires careful consideration. Here are the steps to follow:

- Review the will: Carefully review the will to understand its terms and any restrictions on making changes.

- Identify the changes: Determine what changes need to be made and why.

- Consult with an attorney: Consult with an attorney to ensure that the changes are valid and enforceable.

- Make the changes: Make the necessary changes to the will, including updating beneficiaries, executors, or asset distribution.

- Sign and witness: Sign and witness the updated will to ensure its validity.

Best Practices for Updating Your Trust or Will

When updating your trust or will, it’s essential to follow best practices to ensure that the changes are valid and enforceable. Here are some tips:

- Consult with an attorney to ensure that the changes are valid and enforceable.

- Keep a record of all changes, including the date and reason for the change.

- Ensure that all changes are signed and notarized (for trusts) or witnessed (for wills).

- Store the updated trust or will in a safe and secure location.

By following these steps and best practices, you can ensure that your trust or will is up-to-date and reflects your current wishes and circumstances.

Seeking Professional Help: When to Consult an Attorney

Creating a trust or will can be a complex and nuanced process, and seeking professional help from an attorney can be invaluable in ensuring that your documents are valid and enforceable. An attorney can provide guidance on the best options for your individual circumstances and help you avoid common mistakes that can have significant consequences.

Why Consult an Attorney?

There are several reasons why consulting an attorney is essential when creating or updating a trust or will:

- Expertise: Attorneys have extensive knowledge of estate planning laws and regulations, ensuring that your documents are valid and enforceable.

- Customization: An attorney can help you create a customized trust or will that meets your specific needs and goals.

- Tax implications: An attorney can help you understand the tax implications of your trust or will and ensure that you are taking advantage of available tax savings.

- Complexity: An attorney can help you navigate complex family dynamics, asset distribution, and other issues that may arise during the estate planning process.

When to Consult an Attorney

It’s essential to consult an attorney in the following situations:

- Creating a trust or will for the first time

- Updating a trust or will due to changes in circumstances, such as marriage, divorce, or the birth of a child

- Managing complex assets, such as real estate or business interests

- Dealing with complex family dynamics, such as blended families or special needs beneficiaries

- Ensuring that your trust or will is valid and enforceable in multiple jurisdictions

What to Expect from an Attorney

When consulting an attorney, you can expect the following:

- A thorough review of your individual circumstances and goals

- Expert guidance on the best options for your trust or will

- Customized documents that meet your specific needs and goals

- Explanation of the tax implications of your trust or will

- Guidance on how to update and maintain your trust or will over time

By seeking professional help from an attorney, you can ensure that your trust or will is valid, enforceable, and meets your individual needs and goals.