What is the Current Minimum Wage in Maryland?

As of January 2022, the minimum wage in Maryland is $12.80 per hour for employers with 15 or more employees. This rate applies to most employees in Maryland, including those who work in the private sector, state government, and local governments. It’s worth noting that this rate is higher than the federal minimum wage of $7.25 per hour, which has been in place since 2009. Maryland’s minimum wage has been increasing steadily over the years, with the goal of reaching $15 per hour by 2025.

It’s essential to understand that Maryland’s minimum wage laws apply to most employees, but there are some exceptions. For example, employees who are under the age of 20 may be paid a lower minimum wage of $4.25 per hour for the first 90 consecutive calendar days of employment. Additionally, some employees, such as those who work in agriculture or as tipped employees, may be subject to different minimum wage rates.

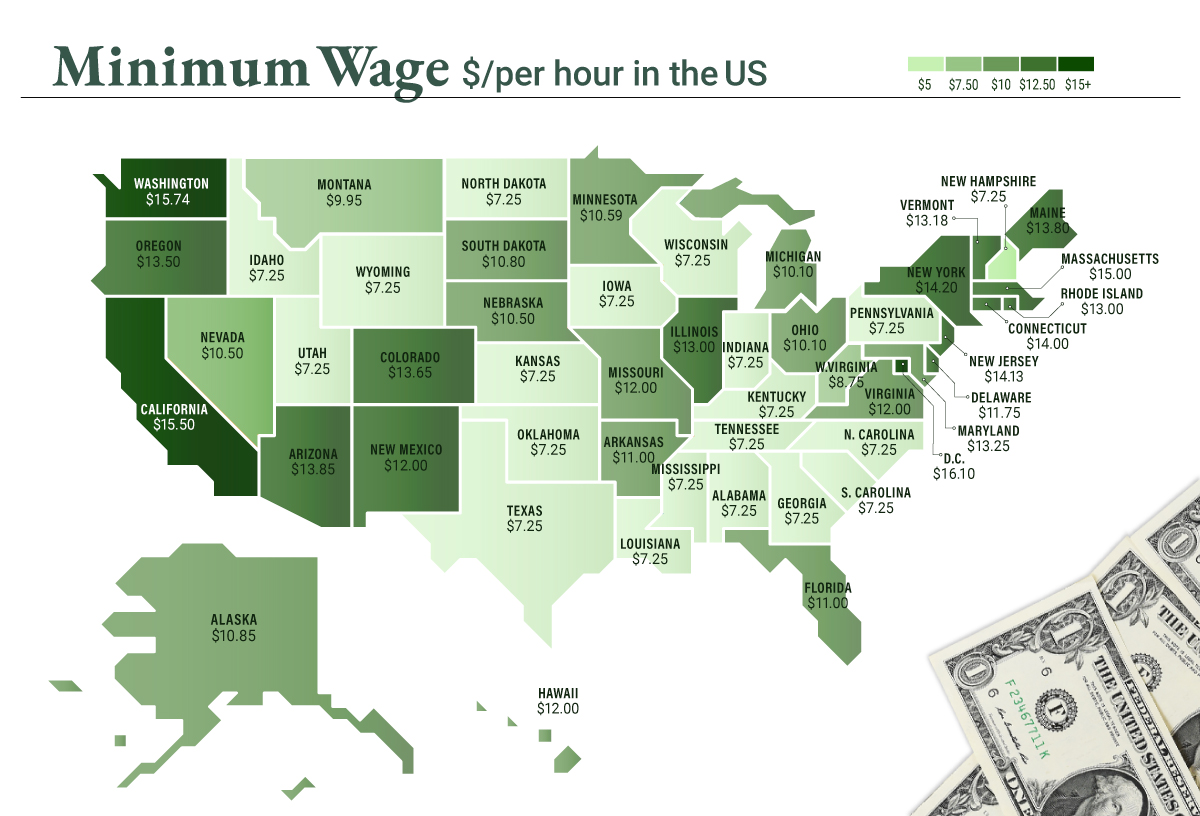

Compared to other states in the region, Maryland’s minimum wage is higher than some, but lower than others. For example, the minimum wage in Washington D.C. is $15.20 per hour, while in Virginia, it is $7.25 per hour. Understanding the minimum wage rates in different states is crucial for employers who operate in multiple states, as they must comply with the laws of each state in which they do business.

Employers in Maryland must also be aware of the requirements for paying overtime. Under Maryland law, employees who work more than 40 hours in a workweek must be paid at a rate of 1.5 times their regular rate of pay for all hours worked over 40. This applies to most employees, but there are some exceptions, such as those who work in executive, administrative, or professional capacities.

In summary, the current minimum wage in Maryland is $12.80 per hour for employers with 15 or more employees. Employers must comply with Maryland’s minimum wage laws, which apply to most employees, and be aware of the requirements for paying overtime. Understanding these laws is crucial for employers who want to avoid penalties and ensure that they are treating their employees fairly.

How to Determine if You’re Eligible for Minimum Wage in Maryland

To determine if you’re eligible for minimum wage in Maryland, you’ll need to consider several factors, including your age, employment status, and industry-specific requirements. In general, most employees in Maryland are entitled to receive the state’s minimum wage, which is currently $12.80 per hour for employers with 15 or more employees.

Age is an important factor in determining eligibility for minimum wage in Maryland. Employees who are under the age of 20 may be paid a lower minimum wage of $4.25 per hour for the first 90 consecutive calendar days of employment. This is known as the “youth minimum wage” and is intended to provide employers with an incentive to hire younger workers.

Employment status is also a key factor in determining eligibility for minimum wage in Maryland. Employees who work in the private sector, state government, and local governments are generally entitled to receive the state’s minimum wage. However, some employees may be exempt from minimum wage laws, including those who work in executive, administrative, or professional capacities.

Industry-specific requirements can also impact eligibility for minimum wage in Maryland. For example, employees who work in agriculture or as tipped employees may be subject to different minimum wage rates. In agriculture, employees may be paid a lower minimum wage of $7.25 per hour, while tipped employees may be paid a lower minimum wage of $3.63 per hour, provided that their tips bring their total hourly wage up to the state’s minimum wage.

To determine if you’re exempt from minimum wage laws in Maryland, you’ll need to review the state’s exemption criteria. Exemptions may apply to employees who work in certain industries, such as agriculture or retail, or to employees who work in certain capacities, such as executive or administrative roles.

If you’re unsure about your eligibility for minimum wage in Maryland, you can contact the state’s labor department for guidance. The labor department can provide information on the state’s minimum wage laws and help you determine whether you’re entitled to receive the state’s minimum wage.

A Brief History of Minimum Wage in Maryland

Maryland’s minimum wage laws have a long and complex history, with numerous changes and updates over the years. The state’s first minimum wage law was enacted in 1969, setting the minimum wage at $1.00 per hour. Since then, the minimum wage has been increased numerous times, with significant changes in 2007, 2014, and 2020.

In 2007, Maryland’s minimum wage was increased to $6.15 per hour, with a provision to adjust the wage annually for inflation. This change was intended to help low-income workers keep pace with the rising cost of living in the state.

In 2014, Maryland’s minimum wage was increased again, this time to $7.25 per hour, with a provision to increase the wage to $8.00 per hour in 2015 and $8.75 per hour in 2016. This change was part of a broader effort to raise the minimum wage across the country.

In 2020, Maryland’s minimum wage was increased to $11.00 per hour, with a provision to increase the wage to $12.80 per hour in 2022 and $15.00 per hour in 2025. This change was part of a broader effort to raise the minimum wage to a living wage, which is the wage necessary to afford a basic standard of living in the state.

Throughout its history, Maryland’s minimum wage law has been shaped by a variety of factors, including economic conditions, social attitudes, and political pressures. The law has been influenced by national trends and policies, as well as by the state’s own unique economic and demographic characteristics.

Despite the many changes to Maryland’s minimum wage law, the state’s minimum wage remains lower than that of some neighboring states, such as Washington D.C. and New York. However, the state’s minimum wage is higher than that of many other states, including Virginia and West Virginia.

Understanding the history of Maryland’s minimum wage law is essential for understanding the current state of the law and the ongoing debates about the minimum wage. By examining the key milestones and changes to the law, we can gain a deeper understanding of the complex factors that shape the minimum wage and its impact on workers and employers in the state.

How Maryland’s Minimum Wage Compares to Other States

Maryland’s minimum wage is one of the highest in the country, but it still lags behind some neighboring states. For example, Washington D.C. has a minimum wage of $15.00 per hour, while New York has a minimum wage of $14.20 per hour. However, Maryland’s minimum wage is higher than that of many other states, including Virginia and West Virginia.

In the Mid-Atlantic region, Maryland’s minimum wage is higher than that of Delaware, New Jersey, and Pennsylvania. However, it is lower than that of Connecticut and Massachusetts. These differences in minimum wage rates can have significant impacts on workers and employers who operate in multiple states.

For workers, the differences in minimum wage rates can affect their ability to afford basic necessities like housing, food, and healthcare. For example, a worker who earns the minimum wage in Maryland may not be able to afford the same standard of living as a worker who earns the minimum wage in Washington D.C. or New York.

For employers, the differences in minimum wage rates can affect their ability to compete with businesses in other states. For example, an employer who operates in Maryland may need to pay higher wages to attract and retain workers, which can increase their labor costs and affect their bottom line.

Despite these challenges, many employers in Maryland are committed to paying their workers a living wage, which is the wage necessary to afford a basic standard of living in the state. Some employers have even implemented their own minimum wage rates, which are higher than the state’s minimum wage.

Overall, Maryland’s minimum wage is an important issue that affects workers and employers across the state. By understanding how Maryland’s minimum wage compares to other states, we can better appreciate the complexities of this issue and the need for ongoing advocacy and reform.

Tips for Employers: How to Ensure Compliance with Maryland’s Minimum Wage Laws

As an employer in Maryland, it is essential to ensure compliance with the state’s minimum wage laws to avoid penalties and fines. Here are some tips to help you comply with Maryland’s minimum wage laws:

1. Know the current minimum wage rate: The current minimum wage rate in Maryland is $12.80 per hour for employers with 15 or more employees. Make sure to check the Maryland Department of Labor, Licensing and Regulation (DLLR) website for any updates or changes to the minimum wage rate.

2. Keep accurate records: Keep accurate records of all employee wages, including hours worked, wages paid, and any deductions made. This will help you demonstrate compliance with Maryland’s minimum wage laws in case of an audit or investigation.

3. Post minimum wage notices: Post minimum wage notices in a conspicuous location where employees can easily see them. This will help ensure that employees are aware of their rights under Maryland’s minimum wage laws.

4. Pay overtime correctly: Pay overtime correctly to employees who work more than 40 hours in a workweek. Maryland’s overtime laws require employers to pay employees at a rate of 1.5 times their regular rate of pay for all hours worked over 40.

5. Comply with industry-specific requirements: Comply with industry-specific requirements, such as those for tipped employees or employees in the agricultural industry. These requirements may differ from the general minimum wage requirements.

6. Train supervisors and managers: Train supervisors and managers on Maryland’s minimum wage laws and ensure that they understand their responsibilities in enforcing these laws.

7. Conduct regular audits: Conduct regular audits to ensure compliance with Maryland’s minimum wage laws. This will help you identify any potential issues or discrepancies and take corrective action.

By following these tips, you can ensure compliance with Maryland’s minimum wage laws and avoid penalties and fines. Remember to always check the DLLR website for any updates or changes to the minimum wage laws.

What to Do if You’re Not Being Paid Minimum Wage in Maryland

If you’re not being paid minimum wage in Maryland, there are several steps you can take to address the issue. First, review your pay stubs and employment contract to ensure that you’re being paid the correct amount. If you’re still unsure, you can contact your employer to discuss the issue.

If your employer is unwilling to pay you the minimum wage, you can file a complaint with the Maryland Department of Labor, Licensing and Regulation (DLLR). The DLLR will investigate your complaint and take action if necessary.

To file a complaint, you’ll need to provide documentation, including your pay stubs, employment contract, and any other relevant information. You can submit your complaint online or by mail.

In addition to filing a complaint with the DLLR, you may also want to consider seeking legal action. You can contact a lawyer who specializes in employment law to discuss your options.

It’s also important to note that you have the right to file a lawsuit against your employer if you’re not being paid minimum wage. A lawsuit can help you recover back wages and other damages.

Remember, you have the right to be paid minimum wage in Maryland. Don’t be afraid to speak up and take action if you’re not being paid fairly.

Here are some additional resources that may be helpful:

* Maryland Department of Labor, Licensing and Regulation (DLLR): [www.dllr.state.md.us](http://www.dllr.state.md.us)

* Maryland Employment Law Attorney: [www.marylandemploymentlaw.com](http://www.marylandemploymentlaw.com)

By taking action and seeking help, you can ensure that you’re being paid fairly and that your rights are protected.

Future of Minimum Wage in Maryland: Potential Changes and Updates

Maryland’s minimum wage laws are subject to change, and there are several potential updates and changes on the horizon. One of the most significant changes is the proposed increase to $15 per hour, which is currently being considered by the Maryland General Assembly.

If passed, this increase would bring Maryland’s minimum wage in line with several other states, including California, Massachusetts, and New York. This change would have a significant impact on workers and employers in the state, particularly in industries that rely heavily on low-wage labor.

In addition to the proposed increase, there are also efforts underway to index Maryland’s minimum wage to inflation. This would ensure that the minimum wage keeps pace with the rising cost of living in the state, and would help to prevent the erosion of the minimum wage over time.

Another potential change on the horizon is the expansion of Maryland’s minimum wage laws to include more workers. Currently, certain workers, such as those in the agricultural industry, are exempt from the minimum wage. However, there are efforts underway to extend the minimum wage to these workers, which would provide them with greater protections and benefits.

It’s also worth noting that there are several advocacy groups and organizations that are working to raise the minimum wage in Maryland. These groups, such as the Maryland Working Families Party and the Service Employees International Union (SEIU), are pushing for a higher minimum wage and greater protections for workers in the state.

Overall, the future of minimum wage in Maryland is likely to be shaped by a combination of legislative changes, advocacy efforts, and economic trends. As the state continues to grow and evolve, it’s likely that the minimum wage will play an increasingly important role in ensuring that workers are paid a fair and living wage.

Conclusion: Understanding and Navigating Maryland’s Minimum Wage Requirements

In conclusion, understanding and complying with Maryland’s minimum wage laws is crucial for both workers and employers in the state. By knowing the current minimum wage rate, eligibility criteria, and potential changes on the horizon, individuals can ensure that they are receiving fair compensation for their work and that they are in compliance with state laws.

It is essential to note that Maryland’s minimum wage laws are subject to change, and it is crucial to stay informed about any updates or changes to the law. By doing so, workers and employers can avoid potential penalties and fines, and ensure that they are in compliance with state regulations.

For workers, understanding Maryland’s minimum wage laws can help them to identify potential wage theft and take action to recover lost wages. For employers, complying with Maryland’s minimum wage laws can help to maintain a positive reputation, avoid costly lawsuits, and ensure that they are providing fair compensation to their employees.

Ultimately, understanding and complying with Maryland’s minimum wage laws is essential for promoting fair labor practices, protecting workers’ rights, and maintaining a healthy and productive workforce in the state.

By following the guidelines and recommendations outlined in this article, workers and employers can navigate Maryland’s minimum wage requirements with confidence and ensure that they are in compliance with state laws.