What’s Behind the Numbers: Understanding the Basics of Routing Numbers

A routing number, also known as an ABA number or routing transit number, is a nine-digit code used to identify a financial institution in the United States. The routing number plays a crucial role in facilitating bank transfers, direct deposits, and other financial transactions. But have you ever wondered what’s behind the numbers and how they work?

The history of routing numbers dates back to the early 20th century, when the American Bankers Association (ABA) developed a system to identify and route transactions between banks. Over time, the system has evolved to include the Federal Reserve Bank and other financial institutions. Today, routing numbers are used by banks, credit unions, and other financial institutions to process transactions efficiently and securely.

So, what is the routing number used for? In simple terms, it’s used to identify the bank and location where an account is held. This information is essential for processing transactions, such as direct deposits, wire transfers, and bill payments. When you provide your routing number to a merchant or financial institution, it allows them to route the transaction to the correct bank and account.

For example, when you set up direct deposit for your paycheck, you’ll need to provide your employer with your routing number and account number. This information is used to route the deposit to your bank and account, ensuring that your funds are deposited correctly and efficiently.

In addition to facilitating transactions, routing numbers also help to prevent errors and ensure the security of financial information. By using a unique nine-digit code, banks and financial institutions can verify the authenticity of transactions and prevent unauthorized access to accounts.

As you can see, understanding what is the routing number and how it works is essential for navigating the banking system. In the next section, we’ll explore how to find your routing number and provide tips on how to verify its accuracy.

How to Find Your Routing Number: A Step-by-Step Guide

Now that you understand the basics of routing numbers, it’s time to learn how to find yours. Your routing number is a unique nine-digit code that identifies your bank and location. Here’s a step-by-step guide to help you find your routing number:

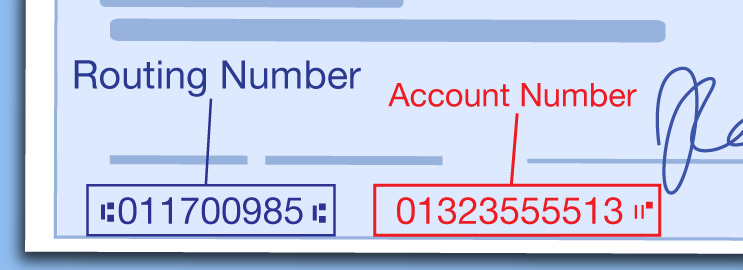

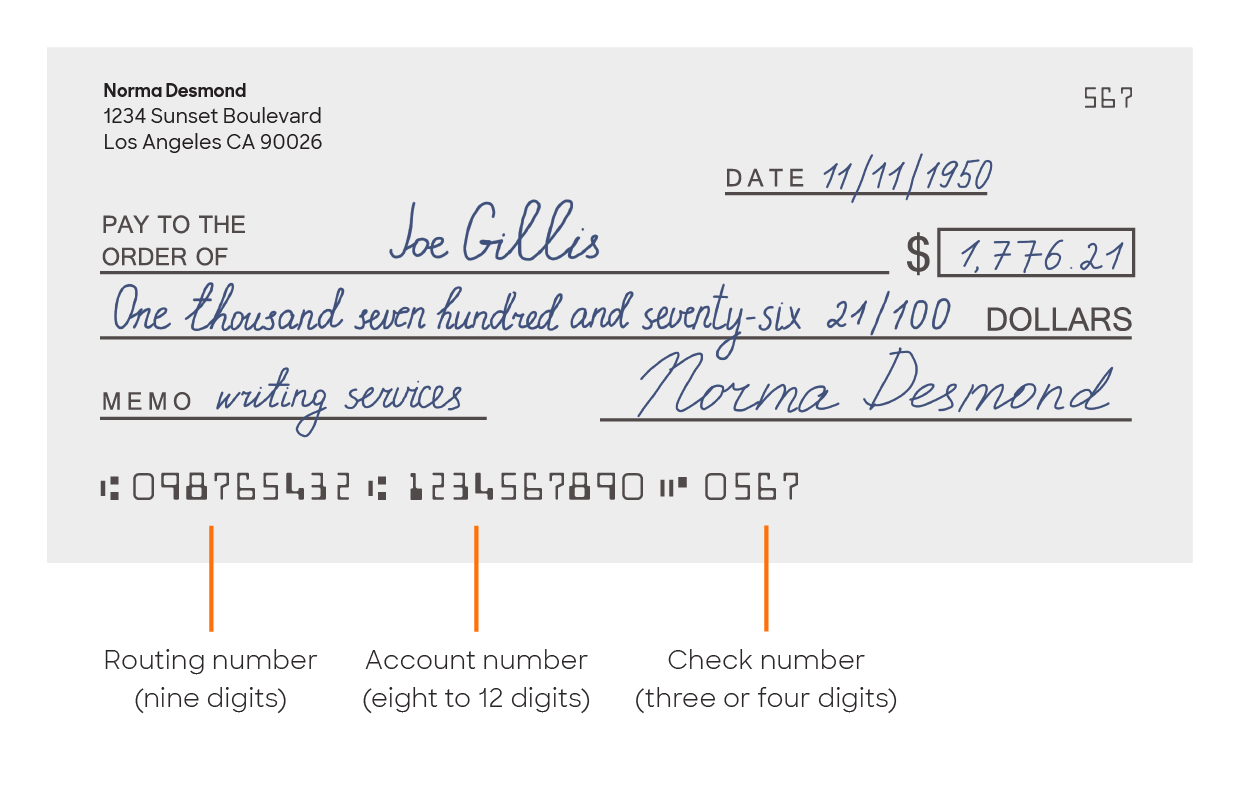

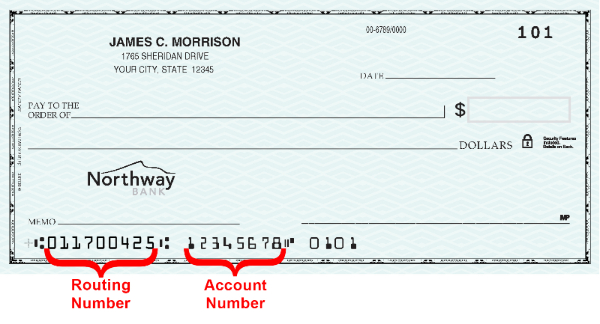

Check Your Checkbook: The easiest way to find your routing number is to check your checkbook. The routing number is usually printed on the bottom left corner of your checks, followed by your account number. Make sure to verify the accuracy of the routing number by checking it against your bank’s website or mobile app.

Review Your Bank Statements: Your bank statements also contain your routing number. Check the top right corner of your statement, where you’ll find your account information, including your routing number.

Log in to Your Online Banking Platform: Most banks offer online banking platforms that allow you to access your account information, including your routing number. Simply log in to your account, navigate to the account information section, and look for your routing number.

Mobile Banking Apps: Many banks also offer mobile banking apps that allow you to access your account information on the go. Check your app to see if it displays your routing number.

Contact Your Bank: If you’re unable to find your routing number using the above methods, you can contact your bank’s customer service department for assistance. They’ll be able to provide you with your routing number and answer any questions you may have.

Verifying the Accuracy of Your Routing Number: Once you’ve found your routing number, it’s essential to verify its accuracy. Double-check the number against your bank’s website or mobile app to ensure it’s correct. You can also use online routing number verification tools to confirm the accuracy of your routing number.

By following these steps, you’ll be able to find your routing number and ensure accurate transactions. Remember, your routing number is a critical piece of information that helps facilitate bank transfers, direct deposits, and other financial transactions.

The Anatomy of a Routing Number: Breaking Down the 9-Digit Code

A routing number is a nine-digit code that identifies a financial institution and facilitates bank transfers. But have you ever wondered what each digit represents? Let’s break down the anatomy of a routing number to understand its structure and function.

The first four digits of a routing number represent the Federal Reserve Bank (FRB) number. The FRB is responsible for processing and settling transactions between banks. The next four digits represent the American Bankers Association (ABA) institution identifier, which identifies the specific bank or financial institution. The final digit is the check digit, which is calculated using a complex algorithm to verify the accuracy of the routing number.

For example, let’s take a routing number: 123456789. The first four digits, 1234, represent the FRB number. The next four digits, 5678, represent the ABA institution identifier. The final digit, 9, is the check digit.

The check digit is calculated by multiplying each digit of the routing number by a specific weight, and then summing the results. The weight for each digit is as follows: 3, 7, 3, 7, 3, 7, 3, 7, 3. The resulting sum is then divided by 10, and the remainder is subtracted from 10 to obtain the check digit.

Understanding the anatomy of a routing number can help you appreciate the complexity and security of the banking system. By verifying the accuracy of routing numbers, banks and financial institutions can ensure that transactions are processed correctly and efficiently.

In addition to understanding the structure of a routing number, it’s also important to know how to use it correctly. In the next section, we’ll discuss the importance of accurate routing numbers in ensuring timely and secure bank transfers.

Why Routing Numbers Matter: The Impact on Your Finances

Accurate routing numbers are crucial for ensuring timely and secure bank transfers. When a routing number is incorrect, it can lead to delayed or rejected transactions, which can have significant consequences for your finances.

For example, if you’re trying to pay a bill or transfer funds to a friend, an incorrect routing number can cause the transaction to be rejected or delayed. This can result in late fees, penalties, and even damage to your credit score.

In addition to the financial consequences, incorrect routing numbers can also compromise the security of your financial information. When a routing number is incorrect, it can allow unauthorized access to your account, which can lead to identity theft and financial fraud.

Furthermore, accurate routing numbers are essential for businesses and organizations that rely on bank transfers to operate. Incorrect routing numbers can disrupt cash flow, cause delays in payment processing, and even lead to financial losses.

Therefore, it’s essential to understand the importance of accurate routing numbers and take steps to ensure that your routing number is correct. This includes verifying the accuracy of your routing number, using secure online banking platforms, and being cautious when sharing your financial information.

In the next section, we’ll explore how technology has transformed the way routing numbers are used, including the rise of online banking, mobile banking apps, and digital payment systems.

Routing Numbers in the Digital Age: How Technology Has Changed the Game

The rise of online banking, mobile banking apps, and digital payment systems has transformed the way routing numbers are used. With the ability to access and manage financial information online, routing numbers have become an essential part of the digital banking experience.

One of the key benefits of technology is the increased speed and efficiency of bank transfers. With online banking, you can initiate transactions and verify routing numbers in real-time, reducing the risk of errors and delays.

Mobile banking apps have also made it easier to access and manage routing numbers on-the-go. Many apps allow you to view your account information, including your routing number, and initiate transactions with just a few taps.

Digital payment systems, such as PayPal and Venmo, have also changed the way routing numbers are used. These systems allow you to send and receive money electronically, using your routing number to facilitate the transaction.

However, the increased use of technology has also introduced new challenges and risks. Cybersecurity threats, such as hacking and identity theft, have become a major concern for banks and financial institutions.

To mitigate these risks, banks and financial institutions have implemented various security measures, such as encryption, secure servers, and two-factor authentication. These measures help to protect routing numbers and prevent unauthorized access to financial information.

In the next section, we’ll explore common mistakes people make when using routing numbers, and provide tips on how to avoid these mistakes and ensure accurate transactions.

Common Routing Number Mistakes to Avoid

When using routing numbers, it’s essential to avoid common mistakes that can lead to delayed or rejected transactions. Here are some common mistakes to watch out for:

Transposing digits: One of the most common mistakes is transposing digits in the routing number. This can happen when you’re typing in the number or when you’re reading it from a check or bank statement. To avoid this mistake, double-check the routing number to ensure that the digits are in the correct order.

Using outdated numbers: Routing numbers can change over time, so it’s essential to use the most up-to-date number. Check your bank’s website or contact their customer service to ensure that you have the correct routing number.

Entering incorrect account information: When using a routing number, you’ll also need to enter your account information, such as your account number and name. Make sure to enter this information correctly to avoid any errors.

Not verifying the routing number: Before using a routing number, verify its accuracy by checking it against your bank’s website or mobile app. This will help ensure that the number is correct and that your transaction is processed smoothly.

To avoid these mistakes, it’s essential to be careful and meticulous when using routing numbers. Take your time to double-check the number and your account information, and verify the routing number before using it.

By avoiding these common mistakes, you can ensure that your transactions are processed quickly and securely. In the next section, we’ll discuss the security measures in place to protect routing numbers and prevent unauthorized access to financial information.

Routing Numbers and Security: Protecting Your Financial Information

Routing numbers are a critical component of the banking system, and as such, they require robust security measures to protect against unauthorized access and financial fraud. In this section, we’ll explore the security measures in place to safeguard routing numbers and prevent financial information from falling into the wrong hands.

Encryption: One of the most effective ways to protect routing numbers is through encryption. Encryption involves converting the routing number into a code that can only be deciphered by authorized parties. This ensures that even if a routing number is intercepted or stolen, it cannot be used without the decryption key.

Secure Servers: Banks and financial institutions store routing numbers on secure servers that are protected by firewalls, intrusion detection systems, and other security measures. These servers are designed to prevent unauthorized access and ensure that routing numbers are only accessible to authorized personnel.

Two-Factor Authentication: Two-factor authentication is a security process that requires users to provide two forms of identification before accessing their account information, including their routing number. This adds an additional layer of security to prevent unauthorized access and financial fraud.

Regular Security Audits: Banks and financial institutions regularly conduct security audits to ensure that their systems and processes are secure and up-to-date. This includes testing for vulnerabilities and implementing new security measures to stay ahead of potential threats.

Education and Awareness: Finally, education and awareness are critical components of routing number security. By educating customers on the importance of routing number security and providing them with the tools and resources they need to protect their financial information, banks and financial institutions can help prevent financial fraud and unauthorized access.

By implementing these security measures, banks and financial institutions can help protect routing numbers and prevent financial information from falling into the wrong hands. In the next section, we’ll summarize the key takeaways from this article and provide final thoughts on the importance of understanding routing numbers.

Conclusion: Mastering the World of Routing Numbers

In conclusion, understanding routing numbers is crucial for navigating the banking system and ensuring accurate transactions. By knowing what a routing number is, how to find it, and how to use it correctly, you can take control of your financial information and avoid common mistakes.

As we’ve seen, routing numbers play a critical role in facilitating bank transfers, direct deposits, and other financial transactions. They are a unique identifier for banks and financial institutions, and are used to route transactions to the correct account.

By following the tips and guidelines outlined in this article, you can master the world of routing numbers and ensure that your financial transactions are processed smoothly and securely. Remember to always verify the accuracy of your routing number, use secure online banking platforms, and be cautious when sharing your financial information.

By taking control of your financial information and understanding routing numbers, you can avoid common mistakes and ensure that your transactions are processed correctly. Whether you’re a business owner, individual, or financial institution, mastering the world of routing numbers is essential for navigating the banking system with confidence.

With this comprehensive guide, you now have the knowledge and tools to unlock the mystery of bank transfers and take control of your financial information. Remember to stay informed, stay vigilant, and always prioritize the security of your financial information.