Breaking Down Your Financial Goals

When it comes to deciding what to do with $1000, it’s essential to start by setting clear financial objectives. This involves categorizing your goals into short-term and long-term, and understanding how to prioritize them. Short-term goals might include paying off high-interest debt, building an emergency fund, or covering unexpected expenses. Long-term goals, on the other hand, could involve investing in a retirement account, saving for a down payment on a house, or funding a child’s education.

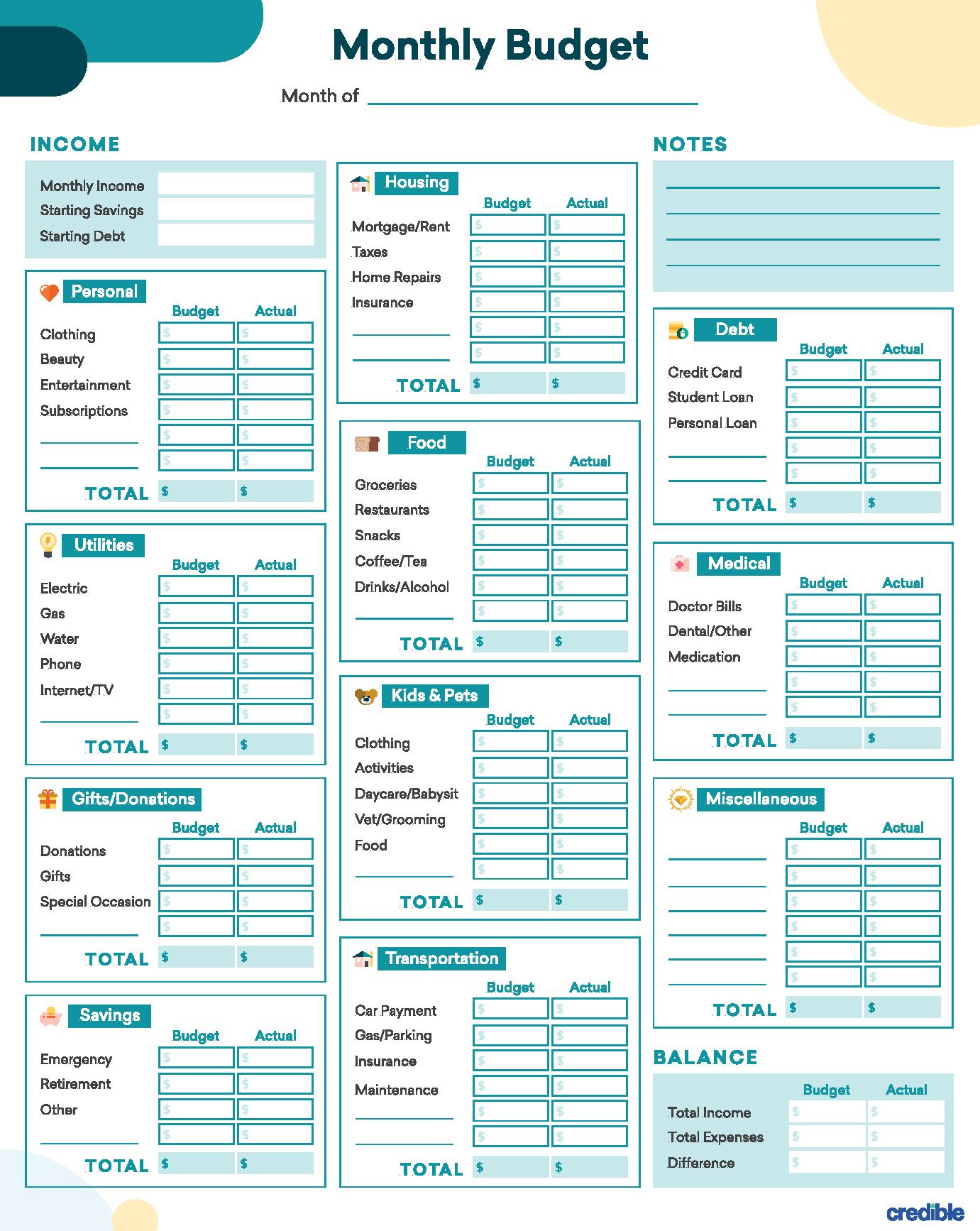

To create a comprehensive plan, consider using the 50/30/20 rule as a guideline. Allocate 50% of the $1000 towards necessary expenses, such as debt repayment or emergency fund contributions. Use 30% for discretionary spending, like investing in a retirement account or saving for a large purchase. Finally, put 20% towards long-term goals, such as building wealth or achieving financial independence.

It’s also crucial to assess your current financial situation and identify areas for improvement. Take a close look at your income, expenses, debts, and savings to determine where the $1000 can have the most significant impact. By doing so, you’ll be able to make informed decisions about how to use the money and create a plan that aligns with your financial objectives.

For instance, if you have high-interest debt, such as credit card balances, it may be wise to use the $1000 to pay down the principal amount. This can help reduce the amount of interest you owe and free up more money in your budget for other expenses. On the other hand, if you have a solid emergency fund in place, you might consider using the $1000 to invest in a retirement account or save for a long-term goal.

Ultimately, the key to making the most of the $1000 is to have a clear understanding of your financial goals and priorities. By taking the time to assess your situation and create a plan, you’ll be able to use the money wisely and make progress towards achieving financial stability and success.

Assessing Your Debt Situation

When considering what to do with $1000, it’s essential to take a close look at your debt situation. High-interest debt, such as credit card balances, can be a significant burden on your finances. Using the $1000 to pay off high-interest debt can be a smart move, as it can help reduce the amount of interest you owe and free up more money in your budget for other expenses.

To prioritize debt repayment, start by making a list of all your debts, including the balance, interest rate, and minimum payment for each. Then, focus on paying off the debts with the highest interest rates first, while still making the minimum payments on the others. This approach can help you save money on interest and pay off your debts more efficiently.

Another strategy for paying off high-interest debt is to consider debt consolidation. This involves combining multiple debts into one loan with a lower interest rate and a single monthly payment. This can simplify your finances and make it easier to manage your debt. However, be cautious of debt consolidation loans with high fees or interest rates, as they can ultimately cost you more in the long run.

When negotiating with creditors, it’s essential to be proactive and communicative. Reach out to your creditors to explain your financial situation and ask if they can offer any assistance, such as a temporary reduction in payments or a lower interest rate. Be honest and transparent about your financial situation, and be willing to provide documentation to support your claims.

Some creditors may be willing to work with you to find a solution, especially if you’re experiencing financial hardship. However, be aware that creditors are not obligated to offer assistance, and it’s essential to have a plan in place in case they refuse. By being proactive and communicative, you can increase your chances of successfully negotiating with your creditors and finding a solution that works for you.

Ultimately, using the $1000 to pay off high-interest debt can be a smart move, but it’s essential to have a plan in place to avoid accumulating more debt in the future. By prioritizing debt repayment, consolidating debt, and negotiating with creditors, you can take control of your finances and make progress towards achieving financial stability and success.

Building a Safety Net

Having an emergency fund in place is crucial for covering unexpected expenses, such as car repairs, medical bills, or losing your job. When deciding what to do with $1000, consider using it to build or boost your emergency fund. This fund should be easily accessible, such as in a savings account, and should cover 3-6 months of living expenses.

To calculate the right amount for your emergency fund, consider your monthly essential expenses, such as rent/mortgage, utilities, food, and transportation. Multiply this amount by the number of months you want your emergency fund to cover. For example, if your monthly essential expenses are $3,000 and you want to cover 3 months, your emergency fund should be $9,000.

When saving the $1000 in an easily accessible savings account, consider the following tips:

Look for a savings account with a high-yield interest rate, such as a high-yield savings account or a money market account. This will help your money grow over time.

Choose a savings account with low or no fees, such as maintenance fees or overdraft fees.

Consider a savings account with a mobile banking app, making it easy to access and manage your money on the go.

Set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

By building an emergency fund, you’ll be better prepared to handle unexpected expenses and avoid going into debt. This fund will also provide peace of mind, knowing that you have a safety net in place.

Remember, an emergency fund is not a long-term investment, but rather a short-term savings plan. It’s essential to keep your emergency fund separate from your other savings and investments, and to avoid dipping into it for non-essential expenses.

Exploring Investment Options

When considering what to do with $1000, investing is a viable option to grow your wealth over time. However, it’s essential to understand the different types of investment options available and the risks associated with each. This will help you make an informed decision that aligns with your financial goals and risk tolerance.

High-yield savings accounts are a low-risk investment option that provides easy access to your money. They typically offer higher interest rates than traditional savings accounts, making them an attractive option for those who want to earn a higher return on their investment.

Certificates of deposit (CDs) are another type of investment that offers a fixed interest rate for a specific period. They tend to be low-risk and provide a higher return than traditional savings accounts. However, you’ll need to keep your money locked in the CD for the specified term to avoid early withdrawal penalties.

Stocks, on the other hand, are a higher-risk investment option that can provide higher returns over the long-term. They represent ownership in companies, and their value can fluctuate based on market conditions. Investing in stocks requires a solid understanding of the market and a willingness to take on more risk.

Other investment options, such as bonds, mutual funds, and exchange-traded funds (ETFs), also exist. Each has its unique characteristics, risks, and potential returns. It’s essential to research and understand each option before making a decision.

When investing, it’s crucial to consider your financial goals, risk tolerance, and time horizon. This will help you determine the right investment strategy for your situation. Additionally, it’s essential to diversify your investments to minimize risk and maximize returns.

For example, if you’re looking for a low-risk investment option, a high-yield savings account or a CD might be a good choice. However, if you’re willing to take on more risk and have a longer time horizon, investing in stocks or other higher-risk investments might be more suitable.

Ultimately, investing is a personal decision that requires careful consideration and research. By understanding the different investment options available and their associated risks, you can make an informed decision that aligns with your financial goals and helps you achieve long-term financial success.

Maximizing Returns with High-Yield Savings Accounts

High-yield savings accounts are a popular option for those looking to maximize returns on their savings. When considering what to do with $1000, a high-yield savings account can be a great way to earn a higher interest rate than a traditional savings account.

One of the benefits of high-yield savings accounts is their liquidity. You can access your money at any time, making it a great option for emergency funds or short-term savings goals. Additionally, high-yield savings accounts are typically low-risk, meaning you won’t have to worry about losing your principal investment.

Some popular high-yield savings accounts include Ally and Marcus. These accounts offer competitive interest rates and have low or no fees. For example, Ally’s high-yield savings account offers a 2.20% APY, while Marcus offers a 2.15% APY.

To open a high-yield savings account, you’ll typically need to provide some personal and financial information, such as your name, address, and social security number. You may also need to fund the account with an initial deposit, which can be done via transfer from another bank account or by mailing a check.

Once you’ve opened a high-yield savings account, you can start earning interest on your deposit. The interest rate will be applied to your balance, and you can withdraw your money at any time. Keep in mind that some high-yield savings accounts may have certain restrictions or requirements to avoid fees or penalties.

For example, some accounts may require you to maintain a minimum balance to avoid a monthly maintenance fee. Others may have restrictions on withdrawals or transfers. Be sure to review the terms and conditions of the account before opening it to ensure it meets your needs.

Overall, high-yield savings accounts can be a great way to maximize returns on your savings. By choosing a reputable bank and understanding the terms and conditions of the account, you can earn a higher interest rate than a traditional savings account and reach your savings goals faster.

Using the $1000 to Boost Your Career

When considering what to do with $1000, investing in career development can be a great way to boost your earning potential and achieve long-term financial success. Whether you’re looking to switch careers, advance in your current field, or simply improve your skills, there are many ways to use $1000 to invest in your career.

One way to use $1000 for career development is to take courses or attend conferences related to your field. This can help you gain new skills, stay up-to-date on industry trends, and network with other professionals. You can find courses and conferences through online platforms like Coursera, Udemy, or LinkedIn Learning, or through professional associations and organizations in your industry.

Another way to use $1000 for career development is to invest in a certification or license that can help you advance in your career. For example, if you’re a software developer, you might use $1000 to obtain a certification in a specific programming language or technology. If you’re a healthcare professional, you might use $1000 to obtain a certification in a specialized area like pediatrics or gerontology.

When choosing a career development opportunity, it’s essential to consider your goals and priorities. What are you trying to achieve in your career? What skills or knowledge do you need to acquire to get there? By focusing on your goals and priorities, you can ensure that you’re using your $1000 wisely and making progress towards your career objectives.

In addition to taking courses or obtaining certifications, you can also use $1000 to invest in other career development opportunities, such as:

Coaching or mentoring: Working with a career coach or mentor can help you gain new insights and perspectives on your career, and develop a plan to achieve your goals.

Networking: Attending industry events, joining professional associations, or connecting with other professionals on LinkedIn can help you build relationships and opportunities that can advance your career.

Personal branding: Investing in a professional website, business cards, or other personal branding materials can help you establish yourself as an expert in your field and attract new opportunities.

By using $1000 to invest in your career, you can take control of your professional development and achieve long-term financial success. Remember to focus on your goals and priorities, and choose opportunities that align with your career objectives.

Creating a Budget-Friendly Plan for Large Purchases

When considering what to do with $1000, making a large purchase can be a great way to use the funds. However, it’s essential to create a budget-friendly plan to ensure that you’re getting the best value for your money. Whether you’re looking to buy a new laptop, repair your car, or make another large purchase, here are some tips to help you make the most of your $1000.

First, research and compare prices to find the best deal. Look for discounts, promotions, and sales that can help you save money. You can also use online tools, such as price comparison websites or apps, to find the best prices.

Next, consider negotiating the price. If you’re buying from a physical store, ask the salesperson if they can offer any discounts or promotions. If you’re buying online, look for coupons or promo codes that can help you save money.

Another way to save money is to consider buying a refurbished or used item. Refurbished items are often significantly cheaper than brand new items, and they can still offer great quality and performance. Used items can also be a great option, especially if you’re looking for a rare or hard-to-find item.

When making a large purchase, it’s also essential to consider the costs of ownership. For example, if you’re buying a new laptop, consider the cost of maintenance, repairs, and upgrades. If you’re buying a car, consider the cost of fuel, insurance, and maintenance.

Finally, make sure to read reviews and do your research before making a purchase. Look for reviews from other customers, and check the seller’s ratings and reputation. This can help you avoid buying a lemon or a low-quality item.

By following these tips, you can create a budget-friendly plan for large purchases and make the most of your $1000. Remember to always prioritize your financial goals and make smart financial decisions.

Some popular large purchases that you can make with $1000 include:

A new laptop or tablet

A car repair or maintenance

A home appliance or furniture

A vacation or travel package

A course or training program

By being smart and strategic with your $1000, you can make a large purchase that meets your needs and fits your budget.

Avoiding Lifestyle Creep and Staying on Track

Receiving a $1000 windfall can be a great opportunity to make progress towards financial goals, but it can also lead to lifestyle inflation if not managed carefully. Lifestyle creep occurs when increased income or wealth leads to increased spending, rather than saving or investing. To avoid this pitfall, it’s essential to create a budget and track expenses to ensure that the $1000 is used wisely.

Start by reviewing current expenses and categorizing them into needs, wants, and debt repayment. Be honest about what is essential and what can be cut back. Consider using the 50/30/20 rule as a guideline: 50% of income should go towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Next, identify areas where expenses can be reduced or optimized. Consider ways to save on everyday expenses, such as cooking at home instead of eating out, canceling subscription services, or finding ways to lower household bills. Use the $1000 to make a dent in high-interest debt or to build an emergency fund.

It’s also crucial to prioritize needs over wants. Be mindful of the difference between essential expenses and discretionary spending. For example, using the $1000 to pay for a vacation might be tempting, but it’s essential to prioritize more critical financial goals, such as paying off debt or building an emergency fund.

To stay on track, consider implementing a “reverse budgeting” approach. Start by setting aside the $1000 for a specific financial goal, and then work backwards to determine how much can be spent on discretionary items. This approach can help ensure that financial goals are prioritized and that progress is made towards achieving them.

Finally, regularly review and adjust the budget to ensure that progress is being made towards financial goals. Consider setting up regular check-ins to review expenses, income, and progress towards goals. By staying focused and avoiding lifestyle creep, it’s possible to make the most of the $1000 windfall and achieve long-term financial success.

When deciding what to do with 1000 dollars, it’s essential to prioritize financial goals and avoid lifestyle inflation. By creating a budget, tracking expenses, and prioritizing needs over wants, it’s possible to make progress towards financial goals and achieve long-term success. Remember to stay focused, avoid lifestyle creep, and make the most of the $1000 windfall.