Maximizing Returns on a Lump Sum

Receiving a $5,000 windfall can be a life-changing event, offering a unique opportunity to boost your finances and achieve long-term goals. When considering what to invest 5k in, it’s essential to approach the decision with a clear understanding of the potential benefits and risks. Investing a lump sum can be an effective way to maximize returns, as it allows you to take advantage of compound interest and potentially higher returns over time.

However, it’s crucial to make informed investment decisions to ensure your money works efficiently for you. A well-thought-out investment strategy can help you navigate the complexities of the market and make the most of your $5,000 investment. By doing so, you can set yourself up for long-term financial success and achieve your goals, whether that’s saving for a down payment on a house, retirement, or a big purchase.

When deciding what to invest 5k in, it’s essential to consider your financial goals, risk tolerance, and time horizon. Are you looking for short-term gains or long-term growth? Are you comfortable with taking on some level of risk, or do you prefer more conservative investments? By understanding your individual circumstances and priorities, you can create a tailored investment plan that aligns with your needs and objectives.

Investing a lump sum of $5,000 requires careful consideration and a strategic approach. By doing your research, understanding your options, and making informed decisions, you can unlock the full potential of your investment and set yourself up for long-term financial success. Whether you’re a seasoned investor or just starting out, the key to maximizing returns on a lump sum is to be intentional and strategic with your investment choices.

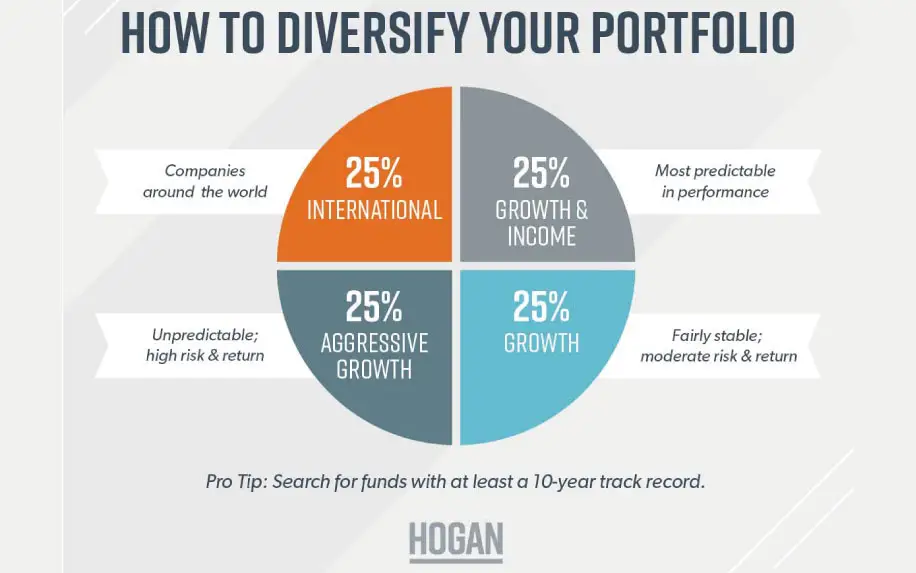

As you explore what to invest 5k in, remember that a well-diversified portfolio is key to minimizing risk and maximizing returns. By spreading your investment across different asset classes and industries, you can reduce your exposure to market volatility and increase your potential for long-term growth. With the right strategy and a bit of patience, your $5,000 investment can go a long way in helping you achieve your financial goals.

Understanding Your Risk Tolerance: A Key to Successful Investing

When considering what to invest 5k in, it’s essential to understand your risk tolerance, as it plays a crucial role in determining your investment choices. Risk tolerance refers to your ability to withstand market fluctuations and potential losses. It’s a personal and subjective measure that varies from person to person, depending on factors such as financial goals, income, expenses, and personal comfort level with risk.

To assess your risk tolerance, start by evaluating your financial goals and time horizon. Are you saving for a short-term goal, such as a down payment on a house, or a long-term goal, such as retirement? Do you have a stable income and a solid emergency fund in place? Answering these questions will help you determine your risk tolerance and create a tailored investment plan.

There are several ways to assess your risk tolerance, including online quizzes and questionnaires. These tools can provide a general idea of your risk tolerance, but it’s essential to remember that risk tolerance is not a static measure. It can change over time as your financial circumstances and goals evolve.

Once you have a clear understanding of your risk tolerance, you can begin to create a diversified investment portfolio that aligns with your goals and risk level. For conservative investors, low-risk investments such as high-yield savings accounts, certificates of deposit (CDs), and Treasury bills may be suitable. For more aggressive investors, higher-risk investments such as stocks, real estate, or peer-to-peer lending may be more appealing.

It’s essential to remember that risk tolerance is not a one-time assessment. It’s an ongoing process that requires regular evaluation and adjustment. As your financial circumstances and goals change, your risk tolerance may also shift. By regularly assessing your risk tolerance and adjusting your investment plan accordingly, you can ensure that your investments remain aligned with your goals and risk level.

When deciding what to invest 5k in, it’s crucial to consider your risk tolerance and create a diversified investment portfolio that aligns with your goals and risk level. By doing so, you can minimize risk and maximize returns, setting yourself up for long-term financial success.

Exploring Low-Risk Investment Options for Conservative Investors

When considering what to invest 5k in, conservative investors often prioritize low-risk options that provide a stable return on investment. High-yield savings accounts, certificates of deposit (CDs), and Treasury bills are popular choices for those who want to minimize risk and preserve their capital.

High-yield savings accounts offer a low-risk investment option with easy access to your money. They typically provide a higher interest rate than traditional savings accounts, making them an attractive option for conservative investors. However, the returns may be lower than those offered by other investment options, and the interest rates may fluctuate over time.

Certificates of deposit (CDs) are another low-risk investment option that provides a fixed interest rate for a specified period. CDs tend to offer higher interest rates than traditional savings accounts, but you’ll need to keep your money locked in the CD for the specified term to avoid early withdrawal penalties.

Treasury bills (T-bills) are short-term government securities that offer a low-risk investment option with a fixed return. T-bills are backed by the full faith and credit of the US government, making them an extremely low-risk investment. However, the returns may be lower than those offered by other investment options, and the interest rates may fluctuate over time.

While these low-risk investment options may not offer the highest returns, they can provide a stable foundation for your investment portfolio. By diversifying your investments and including a mix of low-risk options, you can minimize risk and maximize returns over the long term.

When deciding what to invest 5k in, it’s essential to consider your risk tolerance and financial goals. If you’re a conservative investor, low-risk investment options like high-yield savings accounts, CDs, and T-bills may be an excellent choice. However, if you’re willing to take on more risk, you may want to consider other investment options that offer higher potential returns.

Ultimately, the key to successful investing is to find a balance between risk and return. By understanding your risk tolerance and financial goals, you can create a diversified investment portfolio that aligns with your needs and objectives.

How to Invest in the Stock Market for Long-Term Growth

When considering what to invest 5k in, the stock market can be an attractive option for long-term growth. With a $5,000 budget, you can start investing in the stock market and potentially earn higher returns over time. However, it’s essential to understand the basics of stock investing and how to get started.

Index funds and ETFs are popular investment options for beginners. They offer a diversified portfolio of stocks, which can help minimize risk and maximize returns. Index funds and ETFs track a specific market index, such as the S&P 500, and provide broad diversification and low fees.

Dividend-paying stocks are another option for long-term growth. These stocks pay out a portion of the company’s earnings to shareholders in the form of dividends. Dividend-paying stocks can provide a regular income stream and potentially lower volatility.

To get started with stock investing, you’ll need to open a brokerage account. This can be done online or through a financial advisor. Once you have an account, you can start investing in individual stocks, index funds, or ETFs.

It’s essential to remember that stock investing involves risk, and there are no guarantees of returns. However, with a long-term perspective and a diversified portfolio, you can potentially earn higher returns over time.

When deciding what to invest 5k in, it’s crucial to consider your risk tolerance and financial goals. If you’re willing to take on more risk, the stock market can be an attractive option for long-term growth. However, if you’re more conservative, you may want to consider other investment options.

Ultimately, the key to successful stock investing is to have a well-thought-out strategy and a long-term perspective. By understanding the basics of stock investing and starting with a solid foundation, you can potentially earn higher returns over time and achieve your financial goals.

Real Estate Investing: A Lucrative Option for $5,000

When considering what to invest 5k in, real estate investing can be a lucrative option. With a $5,000 budget, you can start investing in real estate and potentially earn higher returns over time. There are several options to consider, including real estate investment trusts (REITs), real estate crowdfunding, and rental properties.

REITs allow you to invest in a diversified portfolio of properties without directly managing them. They can provide a regular income stream and potentially lower volatility. Real estate crowdfunding platforms, such as Fundrise and Rich Uncles, allow you to invest in specific properties or projects with lower minimum investment requirements.

Rental properties can provide a steady income stream and potentially higher returns over time. However, they require more hands-on management and a larger upfront investment. With a $5,000 budget, you may need to consider partnering with others or exploring alternative options, such as real estate investment trusts (REITs) or real estate crowdfunding.

Real estate investing involves risk, and there are no guarantees of returns. However, with a well-thought-out strategy and a long-term perspective, you can potentially earn higher returns over time. When deciding what to invest 5k in, it’s essential to consider your risk tolerance and financial goals.

Real estate investing can provide a hedge against inflation and market volatility. It can also provide a regular income stream and potentially higher returns over time. However, it’s essential to understand the risks and rewards of real estate investing and to develop a well-thought-out strategy.

Ultimately, the key to successful real estate investing is to have a solid understanding of the market and a well-thought-out strategy. By considering your options and developing a plan, you can potentially earn higher returns over time and achieve your financial goals.

Peer-to-Peer Lending: A High-Yield Alternative to Traditional Investing

When considering what to invest 5k in, peer-to-peer lending can be a high-yield alternative to traditional investing. Platforms like Lending Club and Prosper allow you to lend money to individuals or small businesses, earning interest on your investment.

Peer-to-peer lending offers several benefits, including higher returns than traditional savings accounts or CDs, and a low minimum investment requirement. However, it’s essential to understand the risks involved, including the potential for borrower default and the impact of economic downturns on lending demand.

To get started with peer-to-peer lending, you’ll need to create an account with a reputable platform and deposit your funds. You can then browse loan listings and select the loans you want to invest in, based on factors such as creditworthiness, loan term, and interest rate.

It’s essential to diversify your peer-to-peer lending portfolio by investing in multiple loans, to minimize the risk of borrower default. You can also consider investing in a diversified portfolio of loans through a platform’s automated investment feature.

Peer-to-peer lending can be a high-yield alternative to traditional investing, but it’s essential to understand the risks and rewards involved. By doing your research and creating a diversified portfolio, you can potentially earn higher returns over time and achieve your financial goals.

When deciding what to invest 5k in, it’s crucial to consider your risk tolerance and financial goals. Peer-to-peer lending can be a high-risk, high-reward option, but it may not be suitable for all investors. By understanding the benefits and risks of peer-to-peer lending, you can make an informed decision about whether it’s right for you.

Robo-Advisors: A Convenient and Affordable Investing Solution

When considering what to invest 5k in, robo-advisors can be a convenient and affordable investing solution. Robo-advisors are online platforms that use algorithms to manage investment portfolios, providing a low-cost and efficient way to invest in the stock market.

Robo-advisors offer several benefits, including low fees, diversification, and ease of use. They typically charge lower fees than traditional financial advisors, and they offer a range of investment options, including index funds, ETFs, and individual stocks.

Some popular robo-advisors include Betterment and Wealthfront. These platforms offer a range of investment options, including tax-loss harvesting and socially responsible investing. They also provide tools and resources to help investors make informed decisions about their investments.

To get started with a robo-advisor, you’ll need to create an account and deposit your funds. You’ll then be asked to complete a questionnaire to determine your investment goals and risk tolerance. Based on your answers, the robo-advisor will create a diversified investment portfolio for you.

Robo-advisors can be a convenient and affordable way to invest in the stock market, but it’s essential to understand the risks and benefits involved. By doing your research and choosing a reputable robo-advisor, you can potentially earn higher returns over time and achieve your financial goals.

When deciding what to invest 5k in, it’s crucial to consider your risk tolerance and financial goals. Robo-advisors can be a good option for investors who want a low-cost and efficient way to invest in the stock market. By understanding the benefits and risks of robo-advisors, you can make an informed decision about whether they are right for you.

Creating a Diversified Investment Portfolio with $5,000

When considering what to invest 5k in, creating a diversified investment portfolio is crucial to minimizing risk and maximizing returns. A diversified portfolio can help you achieve your financial goals, whether you’re saving for a short-term goal or a long-term objective.

To create a diversified investment portfolio with a $5,000 budget, you’ll need to consider asset allocation, diversification, and regular portfolio rebalancing. Asset allocation involves dividing your investment portfolio among different asset classes, such as stocks, bonds, and real estate.

Diversification involves spreading your investments across different industries, sectors, and geographic regions. This can help you minimize risk and maximize returns, as different investments will perform differently in different market conditions.

Regular portfolio rebalancing involves periodically reviewing your investment portfolio and adjusting your asset allocation and diversification to ensure that your investments remain aligned with your financial goals and risk tolerance.

To create a diversified investment portfolio with a $5,000 budget, you can consider investing in a mix of low-risk and high-risk investments. Low-risk investments, such as high-yield savings accounts and Treasury bills, can provide a stable foundation for your portfolio, while high-risk investments, such as stocks and real estate, can potentially provide higher returns over time.

When deciding what to invest 5k in, it’s essential to consider your risk tolerance and financial goals. By creating a diversified investment portfolio and regularly rebalancing your investments, you can potentially earn higher returns over time and achieve your financial goals.

Ultimately, the key to creating a diversified investment portfolio is to have a well-thought-out strategy and a long-term perspective. By understanding the benefits and risks of different investments and creating a diversified portfolio, you can potentially earn higher returns over time and achieve your financial goals.