Understanding the Impact of Mortgage Rates on Your Home Loan

Mortgage rates play a crucial role in determining the overall cost of a home loan. Even a small difference in interest rates can add up to significant savings over the life of the loan. For instance, a $300,000 home loan with a 4% interest rate will result in a monthly payment of approximately $1,432. In contrast, a 4.5% interest rate will increase the monthly payment to around $1,520. This may not seem like a substantial difference, but over the 30-year term of the loan, the total interest paid will be significantly higher.

For example, assuming a $300,000 home loan with a 30-year term, a 4% interest rate will result in total interest paid of around $143,739. In contrast, a 4.5% interest rate will increase the total interest paid to approximately $164,813. This represents a difference of over $21,000 in total interest paid over the life of the loan. Therefore, it is essential to understand the impact of mortgage rates on your home loan and to explore options for securing the best possible rate.

When considering a 30-year mortgage, it is crucial to factor in the potential long-term costs. While a lower monthly payment may be appealing, it is essential to consider the total interest paid over the life of the loan. By understanding the impact of mortgage rates on your home loan, you can make informed decisions and potentially save thousands of dollars in interest payments.

So, what’s the 30-year mortgage rate that you can expect to pay? This will depend on various factors, including your credit score, loan amount, and the current market conditions. However, by doing your research and comparing rates from different lenders, you can find the best possible rate for your situation.

What Affects 30-Year Mortgage Rates?

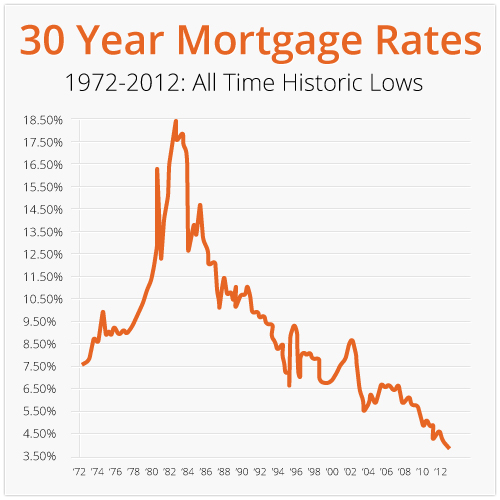

Several factors influence 30-year mortgage rates, causing them to fluctuate over time. Economic conditions, inflation, and monetary policy are some of the key drivers of mortgage rate changes. When the economy is strong, and inflation is rising, mortgage rates tend to increase. This is because lenders increase rates to keep pace with inflation and to maintain the purchasing power of their money.

Monetary policy, set by the Federal Reserve, also plays a significant role in determining 30-year mortgage rates. When the Fed lowers interest rates, mortgage rates tend to decrease, making borrowing more affordable. Conversely, when the Fed raises interest rates, mortgage rates tend to increase, making borrowing more expensive.

In addition to these macroeconomic factors, other influences can impact 30-year mortgage rates. For example, changes in the bond market, global economic trends, and government policies can all affect mortgage rates. Understanding these factors can help you make informed decisions when searching for the best 30-year mortgage rate.

For instance, if you’re wondering what’s the 30-year mortgage rate today, you’ll need to consider the current economic conditions, inflation rate, and monetary policy. By staying informed about these factors, you can better navigate the mortgage market and find the best rate for your situation.

It’s also important to note that mortgage rates can vary depending on the lender, loan amount, and other factors. Therefore, it’s essential to shop around and compare rates from different lenders to find the best deal. By doing so, you can save thousands of dollars in interest payments over the life of the loan.

How to Get the Best 30-Year Mortgage Rate for Your Situation

To secure the best 30-year mortgage rate, it’s essential to take a proactive approach. One of the most effective ways to get a better rate is to improve your credit score. A good credit score can help you qualify for lower interest rates, which can save you thousands of dollars in interest payments over the life of the loan.

Shopping around for lenders is another crucial step in finding the best 30-year mortgage rate. Different lenders offer varying rates, and some may have more competitive offers than others. By comparing rates from multiple lenders, you can find the best deal for your situation.

Considering different types of mortgage products can also help you find the best 30-year mortgage rate. For example, you may want to consider an adjustable-rate mortgage (ARM) or a fixed-rate mortgage. ARMs often offer lower initial interest rates, but the rate can increase over time. Fixed-rate mortgages, on the other hand, offer a stable interest rate for the life of the loan.

Additionally, you may want to consider working with a mortgage broker who can help you navigate the mortgage market and find the best rate for your situation. Mortgage brokers often have access to a wide range of lenders and can help you compare rates and terms.

When searching for the best 30-year mortgage rate, it’s also essential to consider the loan’s terms and conditions. Look for lenders that offer flexible repayment terms, low fees, and competitive interest rates. By taking the time to research and compare different lenders and mortgage products, you can find the best 30-year mortgage rate for your needs.

So, what’s the 30-year mortgage rate that you can expect to pay? The answer will depend on various factors, including your credit score, loan amount, and the current market conditions. However, by following these tips and strategies, you can increase your chances of securing the best possible rate for your situation.

Current 30-Year Mortgage Rate Trends and Forecasts

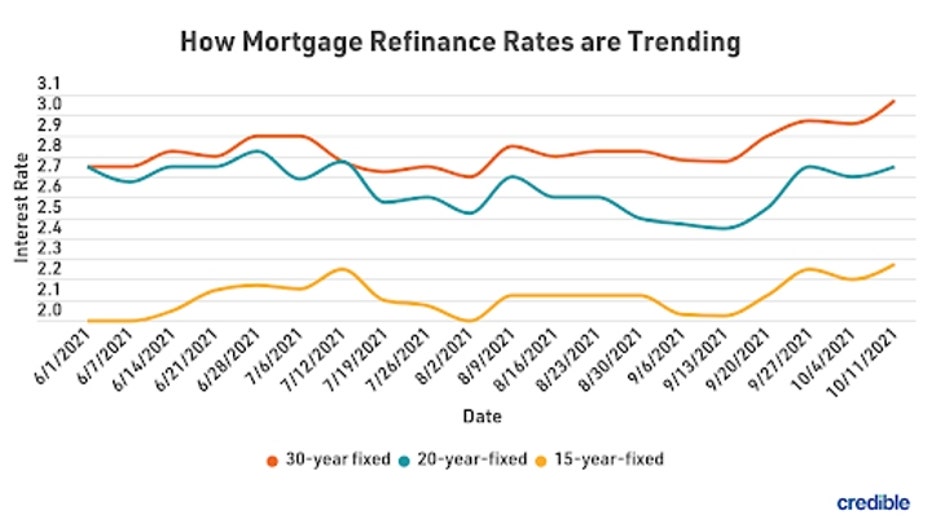

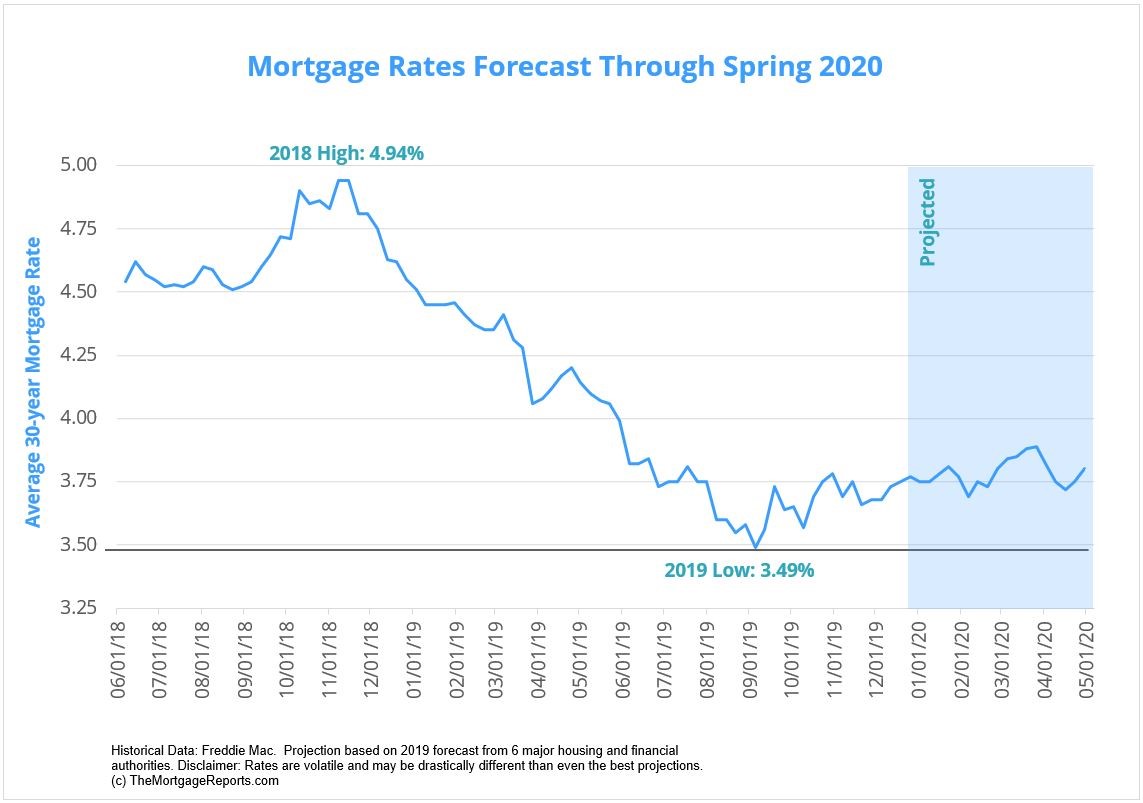

The current 30-year mortgage rate trends and forecasts indicate a stable and competitive market. According to recent data, the average 30-year mortgage rate has been hovering around 3.5% to 4.0%. This is a relatively low rate compared to historical standards, making it an excellent time for homebuyers to secure a mortgage.

Experts predict that mortgage rates will remain relatively stable in the coming months, with some forecasts suggesting a slight increase. However, it’s essential to note that mortgage rates can fluctuate rapidly in response to changes in economic conditions, inflation, and monetary policy.

One of the key factors influencing current mortgage rate trends is the Federal Reserve’s monetary policy. The Fed has been maintaining a dovish stance, keeping interest rates low to support economic growth. This has contributed to the current low mortgage rate environment.

Another factor affecting mortgage rates is the bond market. The yield on the 10-year Treasury bond has been trending downward, which has put downward pressure on mortgage rates. This trend is expected to continue, which could lead to even lower mortgage rates in the future.

So, what’s the 30-year mortgage rate that you can expect to pay? Based on current trends and forecasts, it’s likely that rates will remain competitive, with some lenders offering rates as low as 3.25%. However, it’s essential to shop around and compare rates from different lenders to find the best deal for your situation.

It’s also worth noting that some lenders are offering special promotions and discounts, which can help you secure an even better rate. For example, some lenders may offer a 0.25% discount for borrowers who make a 20% down payment. By taking advantage of these promotions, you can save even more money on your mortgage.

Comparing 30-Year Mortgage Rates from Top Lenders

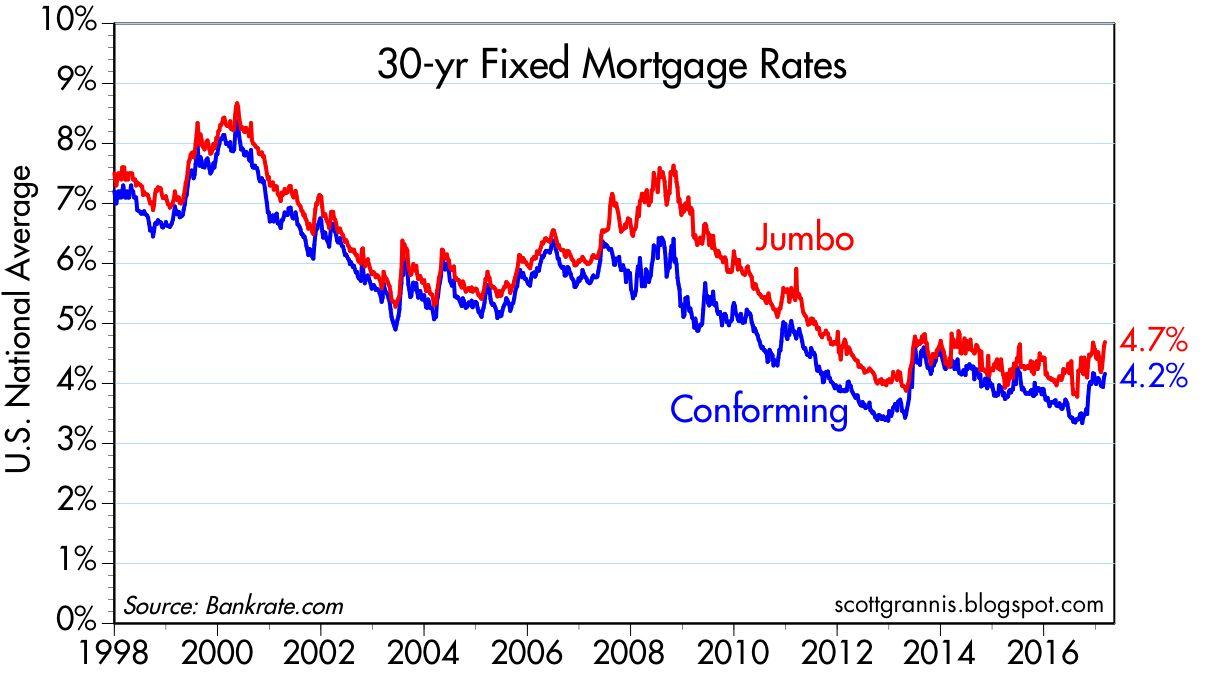

When searching for the best 30-year mortgage rate, it’s essential to compare rates from top lenders. This includes banks, credit unions, and online mortgage providers. By comparing rates, you can find the best deal for your situation and save thousands of dollars in interest payments over the life of the loan.

Some of the top lenders offering competitive 30-year mortgage rates include Wells Fargo, Bank of America, and Quicken Loans. These lenders often offer a range of mortgage products, including fixed-rate and adjustable-rate loans. By comparing rates from these lenders, you can find the best option for your needs.

For example, Wells Fargo is currently offering a 30-year fixed-rate mortgage with an interest rate of 3.5%. Bank of America is offering a similar loan with an interest rate of 3.625%. Quicken Loans, on the other hand, is offering a 30-year fixed-rate mortgage with an interest rate of 3.375%.

Online mortgage providers, such as SoFi and LendingTree, are also offering competitive 30-year mortgage rates. SoFi is currently offering a 30-year fixed-rate mortgage with an interest rate of 3.25%, while LendingTree is offering a similar loan with an interest rate of 3.5%.

When comparing 30-year mortgage rates from top lenders, it’s essential to consider the loan’s terms and conditions. Look for lenders that offer flexible repayment terms, low fees, and competitive interest rates. By taking the time to research and compare different lenders and mortgage products, you can find the best 30-year mortgage rate for your situation.

So, what’s the 30-year mortgage rate that you can expect to pay? Based on current market conditions, it’s likely that you’ll be able to find a rate between 3.25% and 4.0%. However, the best rate for you will depend on your individual circumstances, including your credit score, loan amount, and other factors.

Calculating Your Monthly Mortgage Payment with a 30-Year Loan

Calculating your monthly mortgage payment with a 30-year loan is a straightforward process that involves considering several factors, including the loan amount, interest rate, and loan term. To calculate your monthly payment, you can use a mortgage calculator or create a formula using a spreadsheet.

The formula for calculating monthly mortgage payments is: M = P [ i (1 + i)^n ] / [ (1 + i)^n – 1], where M is the monthly payment, P is the loan amount, i is the monthly interest rate, and n is the number of payments.

For example, let’s say you have a $300,000 loan with a 30-year term and an interest rate of 3.5%. Using the formula above, your monthly payment would be approximately $1,347. However, if the interest rate increases to 4.0%, your monthly payment would increase to approximately $1,432.

As you can see, even a small difference in interest rates can result in a significant increase in monthly payments. Therefore, it’s essential to shop around for the best 30-year mortgage rate and consider working with a lender that offers competitive rates and flexible repayment terms.

In addition to the loan amount and interest rate, other factors can affect your monthly mortgage payment, including property taxes and insurance. These costs can vary depending on the location and value of the property, as well as the type of insurance coverage you choose.

By understanding how to calculate your monthly mortgage payment and considering the various factors that can affect it, you can make informed decisions about your home loan and ensure that you’re getting the best deal possible.

So, what’s the 30-year mortgage rate that you can expect to pay? Based on current market conditions, it’s likely that you’ll be able to find a rate between 3.25% and 4.0%. However, the best rate for you will depend on your individual circumstances, including your credit score, loan amount, and other factors.

Is a 30-Year Mortgage Right for You?

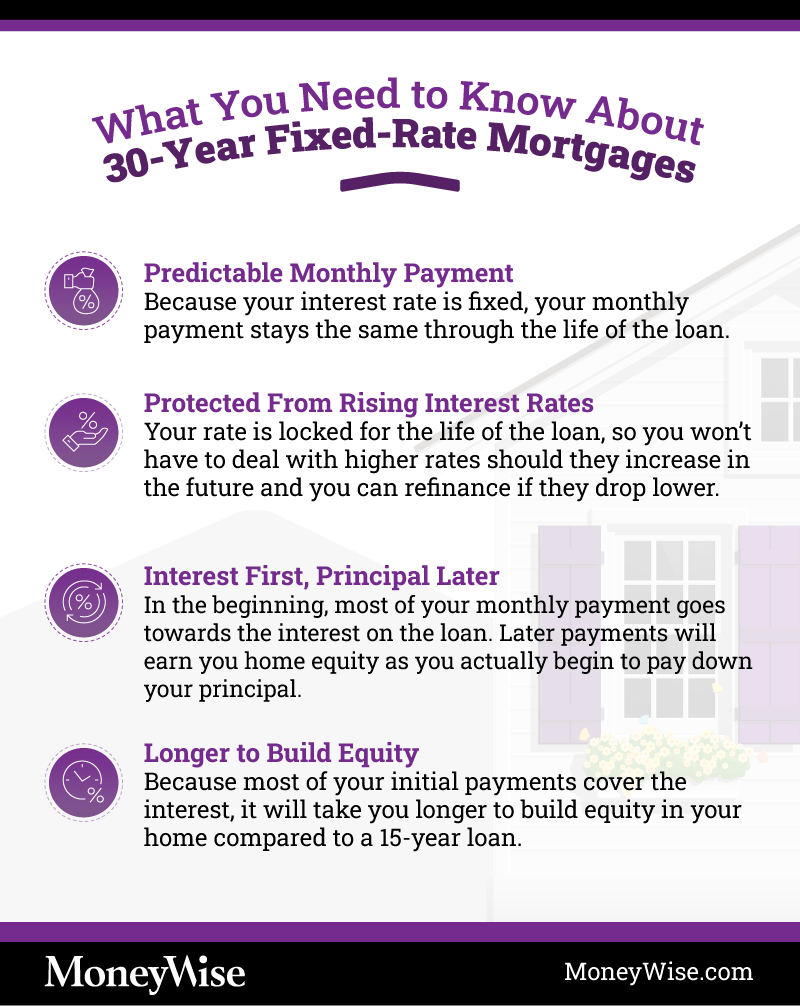

A 30-year mortgage can be a great option for many homebuyers, but it’s essential to consider the pros and cons before making a decision. One of the primary benefits of a 30-year mortgage is the lower monthly payment. With a longer loan term, the monthly payment is spread out over a more extended period, making it more manageable for many borrowers.

However, there are also potential drawbacks to consider. One of the main concerns is that you’ll pay more in interest over the life of the loan. Since the loan term is longer, you’ll be paying interest for a more extended period, which can add up to a significant amount over time.

For example, let’s say you have a $300,000 loan with a 30-year term and an interest rate of 3.5%. Over the life of the loan, you’ll pay approximately $143,739 in interest. In contrast, a 15-year loan with the same interest rate would result in approximately $63,819 in interest.

Another consideration is that a 30-year mortgage may not be the best option if you plan to sell your home or refinance your loan in the near future. With a longer loan term, you’ll be locked into the loan for a more extended period, which may limit your flexibility.

Ultimately, whether a 30-year mortgage is right for you depends on your individual circumstances and financial goals. If you’re looking for a lower monthly payment and are willing to pay more in interest over the life of the loan, a 30-year mortgage may be a good option. However, if you’re looking to pay off your loan quickly and minimize interest payments, a shorter loan term may be a better choice.

So, what’s the 30-year mortgage rate that you can expect to pay? Based on current market conditions, it’s likely that you’ll be able to find a rate between 3.25% and 4.0%. However, the best rate for you will depend on your individual circumstances, including your credit score, loan amount, and other factors.

Next Steps: Finding the Best 30-Year Mortgage Rate for Your Needs

After understanding the impact of mortgage rates on your home loan, the factors that influence 30-year mortgage rates, and the strategies for securing the best rate, it’s time to take the next steps in finding the best 30-year mortgage rate for your needs. To get started, consider the following key takeaways:

Firstly, it’s essential to monitor current 30-year mortgage rate trends and forecasts to make informed decisions. Keep an eye on economic conditions, inflation, and monetary policy, as these factors can cause mortgage rates to fluctuate over time. By staying up-to-date with the latest developments, you can make the most of your mortgage application.

Secondly, don’t underestimate the power of comparison shopping. Research and compare 30-year mortgage rates from top lenders, including banks, credit unions, and online mortgage providers. Look for any notable differences or promotions that can help you save on interest. Remember, even a small difference in interest rates can add up to significant savings over the life of the loan.

Thirdly, take control of your credit score. Improving your credit score can help you qualify for better mortgage rates, which can save you thousands of dollars in interest over the life of the loan. Make sure to check your credit report regularly and work on improving your credit score before applying for a mortgage.

Lastly, consider seeking professional advice from a mortgage broker or financial advisor. They can help you navigate the complex mortgage market and find the best 30-year mortgage rate for your situation. With their expertise, you can make informed decisions and avoid costly mistakes.

By following these next steps, you can find the best 30-year mortgage rate for your needs and achieve your dream of owning a home. Remember to stay informed, compare rates, improve your credit score, and seek professional advice to make the most of your mortgage application. With the right strategy and knowledge, you can unlock the best mortgage rates and start building equity in your home.