What is Considered a Middle-Class Income in America?

The concept of middle-class income is a fundamental aspect of American society, representing a benchmark for economic stability and prosperity. In the United States, the middle class is often associated with a certain level of financial security, comfort, and access to opportunities. However, defining what constitutes a middle-class income can be challenging, as it varies significantly depending on factors such as location, family size, and occupation.

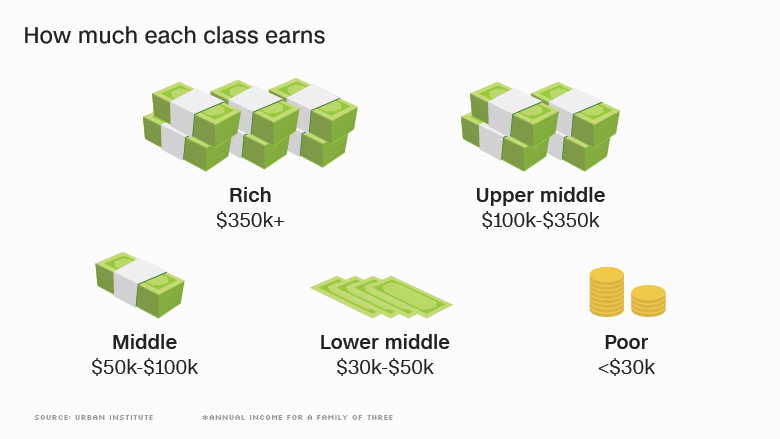

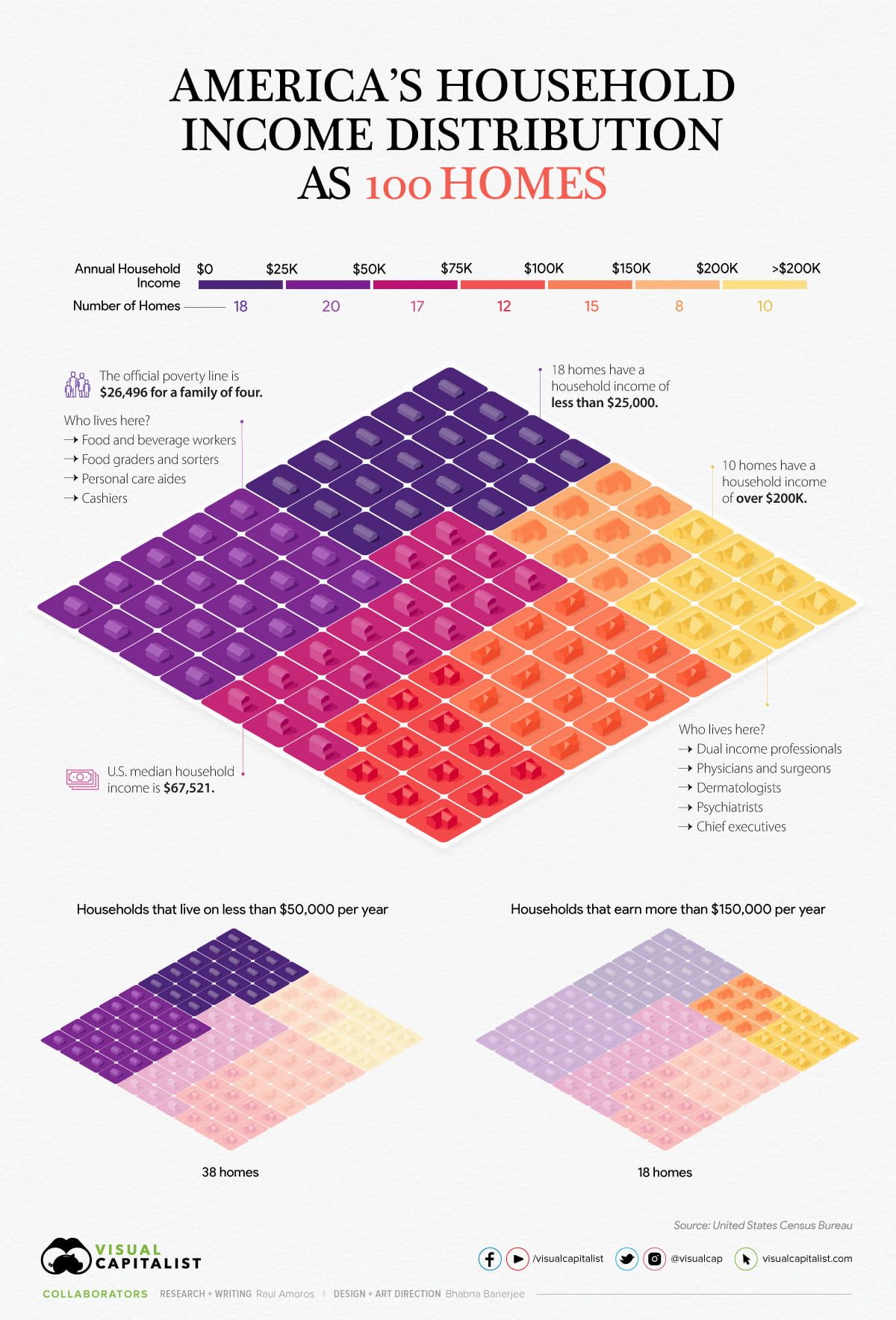

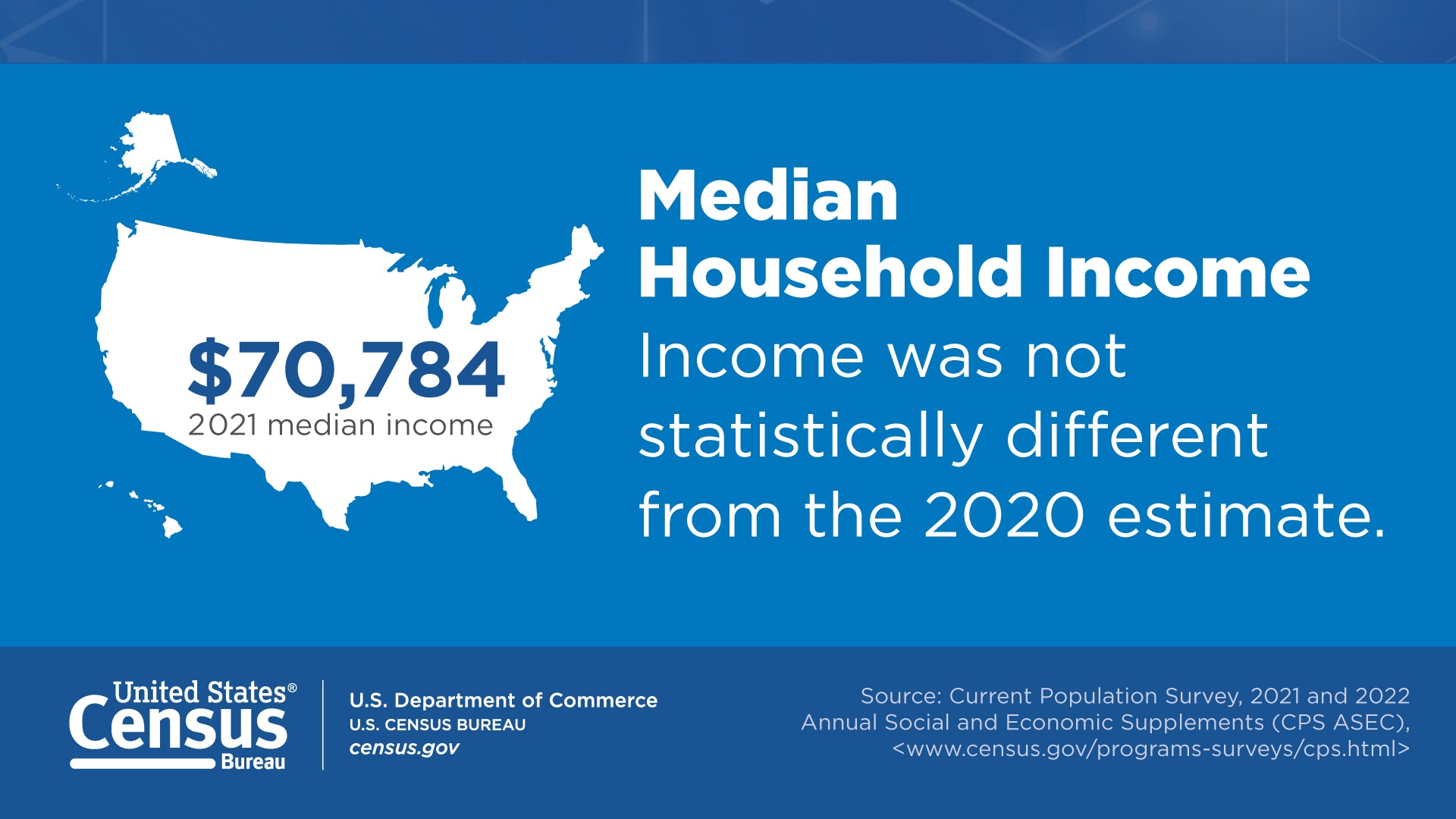

According to the Pew Research Center, the middle class is typically defined as households with incomes between 67% and 200% of the median household income. Based on this definition, the average household income in America is around $67,000 per year. However, this number can fluctuate depending on the source and methodology used. For instance, the U.S. Census Bureau reports a median household income of $67,149 for 2020.

It’s essential to note that the cost of living in different regions of the United States can significantly impact what is considered a middle-class income. For example, a household income of $100,000 may be considered middle class in some parts of the country, while it may be considered upper class in others. Additionally, factors such as education, occupation, and access to healthcare also play a crucial role in determining one’s economic stability and prosperity.

Understanding the concept of middle-class income is crucial for policymakers, researchers, and individuals seeking to improve their economic well-being. By examining the factors that influence household income, we can gain insights into the complexities of the American economy and work towards creating a more equitable society. As we explore the topic of average household income in America, it’s essential to consider the nuances and variations that exist across different regions and demographics.

How to Calculate the Average Household Income: A Breakdown of the Numbers

Calculating the average household income in America involves a complex process that takes into account various data sources and methodologies. The U.S. Census Bureau is the primary source of data for household income statistics, and it uses a combination of surveys, administrative records, and economic models to estimate the average household income.

The Census Bureau’s American Community Survey (ACS) is the primary source of data for household income statistics. The ACS is an ongoing survey that collects data from a representative sample of households across the United States. The survey asks respondents about their household income, including wages, salaries, tips, and other sources of income.

To calculate the average household income, the Census Bureau uses a weighted average formula that takes into account the number of households in each income category. The formula also adjusts for factors such as inflation, population growth, and changes in the cost of living.

Another important data source for household income statistics is the Current Population Survey (CPS). The CPS is a monthly survey that collects data from a representative sample of households across the United States. The survey asks respondents about their employment status, income, and other demographic characteristics.

In addition to these surveys, the Census Bureau also uses administrative records and economic models to estimate the average household income. For example, the Bureau uses data from the Internal Revenue Service (IRS) to estimate the number of households that file tax returns and the amount of income they report.

By combining data from these sources, the Census Bureau is able to estimate the average household income in America with a high degree of accuracy. According to the Census Bureau, the estimated average household income in America is around $67,000 per year. However, this number can vary significantly depending on factors such as location, education level, and occupation.

Understanding how the average household income is calculated can provide valuable insights into the complexities of the American economy. By examining the data sources and methodologies used to estimate the average household income, readers can gain a deeper understanding of the factors that influence household income and the overall economy.

The Impact of Location on Household Income: Regional Variations Across America

Location plays a significant role in determining household income in the United States. Regional variations in cost of living, job opportunities, and access to education and healthcare can all impact the average household income in a given area. For example, cities with a high cost of living, such as San Francisco or New York, tend to have higher average household incomes to compensate for the increased expenses.

According to data from the U.S. Census Bureau, the top five states with the highest average household incomes in 2020 were Maryland, Alaska, Hawaii, New Jersey, and Connecticut. These states tend to have strong economies, high levels of education, and access to high-paying job opportunities.

On the other hand, states with lower average household incomes tend to have weaker economies and fewer job opportunities. For example, the bottom five states with the lowest average household incomes in 2020 were Mississippi, West Virginia, Arkansas, Alabama, and Kentucky. These states often struggle with poverty, limited access to education and healthcare, and a lack of economic opportunities.

Even within states, there can be significant regional variations in household income. For example, in California, the San Francisco Bay Area tends to have much higher average household incomes than the Central Valley or other rural areas. Similarly, in New York, the New York City metropolitan area tends to have higher average household incomes than upstate New York.

Understanding the impact of location on household income can help individuals and policymakers make informed decisions about where to live, work, and invest. By examining regional variations in household income, we can gain insights into the complex factors that influence economic outcomes and develop strategies to promote economic growth and prosperity.

For instance, policymakers can use data on regional variations in household income to target economic development initiatives and investments in areas with the greatest need. Additionally, individuals can use this information to make informed decisions about where to live and work, taking into account factors such as cost of living, job opportunities, and access to education and healthcare.

The Role of Education and Occupation in Determining Household Income

Education and occupation are two of the most significant factors that influence household income in the United States. According to data from the U.S. Census Bureau, households with higher levels of education tend to have higher average household incomes. For example, households with a bachelor’s degree or higher have an average household income of $83,144, compared to $40,612 for households with some college or an associate’s degree.

Occupation also plays a crucial role in determining household income. Certain occupations, such as those in the fields of medicine, law, and finance, tend to have higher average salaries and benefits. For example, physicians and surgeons have an average annual salary of $208,000, while lawyers have an average annual salary of $144,530.

In addition to education and occupation, other factors such as work experience, skills, and industry also influence household income. For example, households with workers who have specialized skills, such as programming or engineering, tend to have higher average household incomes. Similarly, households with workers in industries such as technology or healthcare tend to have higher average household incomes.

According to data from the Bureau of Labor Statistics, the top five occupations with the highest average annual salaries in 2020 were:

- Physicians and surgeons: $208,000

- Lawyers: $144,530

- Air traffic controllers: $124,500

- Petroleum engineers: $138,980

- Dentists: $156,240

On the other hand, the bottom five occupations with the lowest average annual salaries in 2020 were:

- Food preparation and serving related occupations: $20,810

- Personal care and service occupations: $24,530

- Sales and related occupations: $26,110

- Office and administrative support occupations: $28,400

- Farming, fishing, and forestry occupations: $29,610

Understanding the relationship between education, occupation, and household income can help individuals make informed decisions about their career choices and education investments. By examining the data and trends, individuals can gain insights into the factors that influence household income and develop strategies to increase their earning potential.

How to Increase Your Household Income: Strategies for Success

Increasing household income is a common goal for many individuals and families in America. With the average household income in the United States being around $67,000, according to the United States Census Bureau, many people strive to earn more to improve their financial stability and quality of life. Fortunately, there are several strategies that can help individuals increase their household income and achieve their financial goals.

One effective way to boost household income is to pursue additional education or training. Acquiring new skills or certifications can lead to better job opportunities and higher salaries. For instance, workers with a bachelor’s degree typically earn around 50% more than those with only a high school diploma. Investing in education can pay off in the long run, especially in high-demand fields like technology, healthcare, and engineering.

Starting a side business or freelancing is another viable option for increasing household income. With the rise of the gig economy, it’s easier than ever to monetize skills and interests outside of a traditional 9-to-5 job. Platforms like Upwork, Fiverr, and Freelancer offer opportunities for individuals to offer services such as writing, graphic design, and social media management. Even a part-time side hustle can generate an additional $1,000 to $2,000 per month, which can make a significant difference in household income.

Investing in stocks, real estate, or other assets can also provide a potential source of passive income. While investing always carries some level of risk, it can be a lucrative way to grow wealth over time. For example, investing in a rental property can generate rental income, while investing in dividend-paying stocks can provide a regular stream of income. However, it’s essential to do thorough research and consult with a financial advisor before making any investment decisions.

Finally, negotiating a salary increase or asking for a raise at work can be a straightforward way to boost household income. Many employees are hesitant to ask for a raise, but it’s often a matter of simply asking and making a strong case for why they deserve one. According to Glassdoor, the average salary increase in the United States is around 10% to 15% per year, which can translate to an additional $5,000 to $10,000 per year for someone earning the average household income in America.

By implementing these strategies, individuals can increase their household income and improve their financial stability. Whether it’s through education, entrepreneurship, investing, or salary negotiation, there are many ways to boost earnings and achieve long-term financial success. As the average household income in America continues to evolve, it’s essential to stay adaptable and proactive in pursuing financial goals.

The Effects of Household Income on Quality of Life and Happiness

Household income plays a significant role in determining quality of life and happiness in America. Research has consistently shown that higher incomes are associated with greater financial security, better health outcomes, and increased overall satisfaction. In fact, a study by the Pew Research Center found that 64% of adults in the United States believe that a higher income would improve their overall well-being.

One of the primary ways in which household income affects quality of life is through financial security. When individuals have a stable and sufficient income, they are better able to meet their basic needs, such as housing, food, and healthcare. This, in turn, reduces stress and anxiety, allowing people to focus on other aspects of their lives. According to the American Psychological Association, financial stress is a leading cause of anxiety and depression in the United States, highlighting the importance of a stable income in maintaining mental health.

Higher household incomes are also associated with better health outcomes. Studies have shown that individuals with higher incomes tend to have better access to healthcare, healthier diets, and more opportunities for physical activity. This can lead to a range of positive health outcomes, including lower rates of obesity, diabetes, and heart disease. In fact, a study by the Centers for Disease Control and Prevention found that adults with higher incomes were more likely to report good or excellent health, compared to those with lower incomes.

In addition to financial security and better health outcomes, higher household incomes are also linked to increased overall satisfaction. When individuals have a sufficient income, they are better able to pursue their interests and hobbies, travel, and enjoy leisure activities. This can lead to a greater sense of fulfillment and happiness, as people are able to live the life they want. According to a study by the Gallup organization, adults with higher incomes tend to report higher levels of well-being and life satisfaction, compared to those with lower incomes.

It’s worth noting that the relationship between household income and quality of life is not always straightforward. While higher incomes can provide many benefits, they do not guarantee happiness or fulfillment. Other factors, such as relationships, community engagement, and personal values, also play a significant role in determining overall well-being. However, for many individuals and families in America, a higher household income can provide a foundation for a better quality of life and increased happiness.

In the context of what’s the average household income in America, it’s clear that a higher income can have a range of positive effects on quality of life and happiness. As the average household income in the United States continues to evolve, it’s essential to consider the ways in which income affects overall well-being and to prioritize policies and programs that support financial stability and security for all individuals and families.

A Historical Perspective: How Average Household Income Has Changed Over Time

The average household income in America has undergone significant changes over the past few decades. Understanding these changes can provide valuable insights into the evolution of the economy and the impact of various factors on household income. In this section, we will explore the historical context of average household income in America, highlighting trends and changes that have shaped the economy over time.

According to data from the United States Census Bureau, the average household income in America has increased steadily over the past few decades. In 1967, the average household income was around $7,300. By 1987, this number had increased to around $24,000, and by 2007, it had risen to around $50,000. However, this growth has not been uniform, and there have been periods of stagnation and decline.

One of the most significant factors that have impacted average household income in America is the decline of manufacturing jobs. In the 1960s and 1970s, manufacturing was a major driver of economic growth, and many households relied on these jobs for their income. However, with the decline of manufacturing in the 1980s and 1990s, many households saw their incomes decline. This decline was particularly pronounced in the Rust Belt states, where manufacturing had been a major industry.

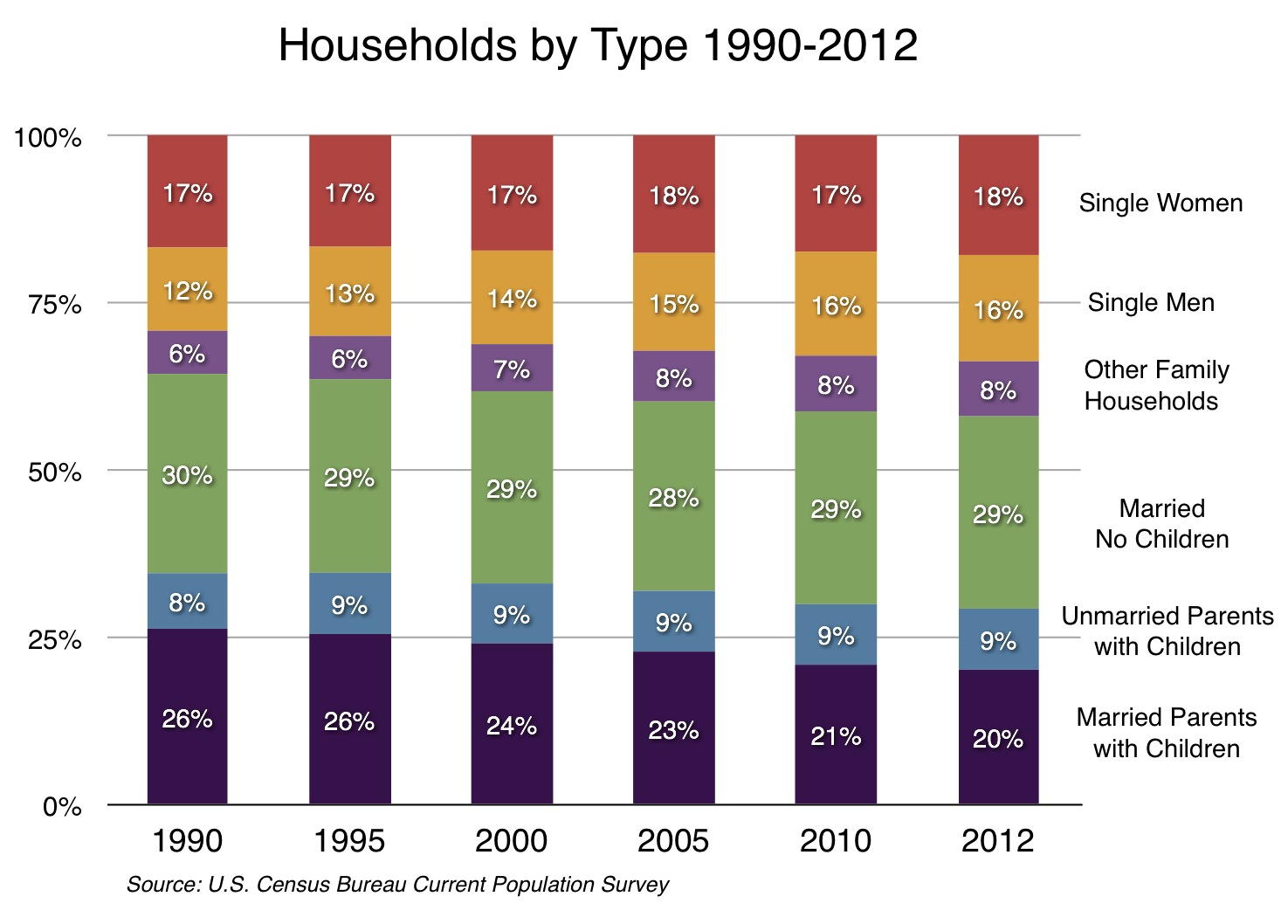

Another factor that has impacted average household income in America is the rise of the service sector. As the economy has shifted towards services, many households have seen their incomes increase. However, this growth has been uneven, and many service sector jobs are low-wage and lack benefits. This has led to a widening income gap between high- and low-income households.

The Great Recession of 2007-2009 also had a significant impact on average household income in America. During this period, many households saw their incomes decline, and the poverty rate increased. However, since the recession, the economy has recovered, and average household income has increased. According to data from the United States Census Bureau, the average household income in America was around $67,000 in 2020.

Understanding the historical context of average household income in America can provide valuable insights into the evolution of the economy. By examining the trends and changes that have shaped the economy over time, we can better understand the factors that have impacted household income and make predictions about what the future may hold. As we look to the future, it’s clear that the average household income in America will continue to evolve, and it’s essential to stay informed about the trends and changes that are shaping the economy.

In the context of what’s the average household income in America, it’s clear that the economy has undergone significant changes over the past few decades. By understanding these changes, we can better navigate the complexities of the economy and make informed decisions about our financial futures.

What the Future Holds: Predictions for Average Household Income in America

As we look to the future, it’s essential to consider the trends and forecasts that will shape the average household income in America. Based on current economic indicators and forecasts, here are some predictions for the future of average household income in America.

One of the most significant factors that will impact average household income in the future is the growth of the gig economy. As more people turn to freelance and contract work, the traditional notion of a steady paycheck will continue to evolve. According to a report by Intuit, the gig economy is expected to grow to 43% of the workforce by 2025, which could lead to a shift in the way households earn and manage their income.

Another factor that will impact average household income is the increasing cost of living. As the cost of housing, healthcare, and education continues to rise, households will need to adapt to these changes by finding ways to increase their income or reduce their expenses. According to a report by the Economic Policy Institute, the cost of living in the United States is expected to continue to rise, with the average household needing to earn an additional $10,000 to $20,000 per year to maintain their standard of living.

Technology will also play a significant role in shaping the future of average household income. As automation and artificial intelligence continue to advance, some jobs will become obsolete, while new ones will be created. According to a report by the McKinsey Global Institute, up to 800 million jobs could be lost worldwide due to automation by 2030. However, this could also lead to the creation of new jobs and industries that we cannot yet imagine.

Finally, demographic changes will also impact average household income in the future. As the population ages and becomes more diverse, households will need to adapt to these changes by finding ways to increase their income or reduce their expenses. According to a report by the Pew Research Center, the population of the United States is expected to become more diverse, with the Hispanic population growing from 18% to 28% by 2060.

In the context of what’s the average household income in America, it’s clear that the future will be shaped by a complex array of factors. By understanding these trends and forecasts, households can prepare for the challenges and opportunities that lie ahead. Whether it’s through education, entrepreneurship, or innovation, households will need to be adaptable and resilient in order to thrive in the years to come.

As we look to the future, it’s essential to remember that the average household income in America is not just a number, but a reflection of the hopes and dreams of millions of people. By working together to create a more equitable and prosperous society, we can ensure that the future is bright for all households, regardless of their income level.