Understanding the Social Security Payment Cycle

The Social Security payment cycle is a critical aspect of the Social Security program, as it determines when beneficiaries receive their monthly payments. The payment cycle is based on the birthdate of the recipient, with payments typically deposited on the second, third, or fourth Wednesday of the month. To understand when Social Security checks will be deposited this month, it’s essential to know how the payment cycle works.

The Social Security Administration (SSA) uses a complex system to determine the payment date for each beneficiary. The system takes into account the recipient’s birthdate, the type of benefit they receive, and the payment schedule for their specific birthdate group. Generally, beneficiaries born between the 1st and 10th of the month receive their payments on the second Wednesday of the month, while those born between the 11th and 20th receive their payments on the third Wednesday, and those born between the 21st and 31st receive their payments on the fourth Wednesday.

However, it’s essential to note that the exact payment date may vary depending on the specific payment cycle. The SSA may adjust the payment schedule to accommodate holidays, weekends, or other factors that may impact the payment process. Additionally, some beneficiaries may receive their payments on a different date due to individual circumstances, such as a change in payment method or a delay in processing.

Despite these variations, understanding the Social Security payment cycle can help beneficiaries plan and budget for their monthly payments. By knowing when to expect their Social Security check, individuals can better manage their finances and make informed decisions about their benefits. Whether you’re trying to determine when Social Security checks will be deposited this month or simply want to understand the payment cycle, it’s crucial to stay informed about the SSA’s payment schedule and any changes that may affect your benefits.

How to Determine Your Social Security Payment Date

Determining your Social Security payment date is a straightforward process that can help you plan and budget for your monthly benefits. To find out when your Social Security check will be deposited this month, you’ll need to know your birthdate and the type of benefit you receive. Here’s a step-by-step guide to help you determine your payment date:

Step 1: Check your birthdate. Your birthdate is the key to determining your payment date. If you were born between the 1st and 10th of the month, your payment date will typically be the second Wednesday of the month. If you were born between the 11th and 20th, your payment date will typically be the third Wednesday, and if you were born between the 21st and 31st, your payment date will typically be the fourth Wednesday.

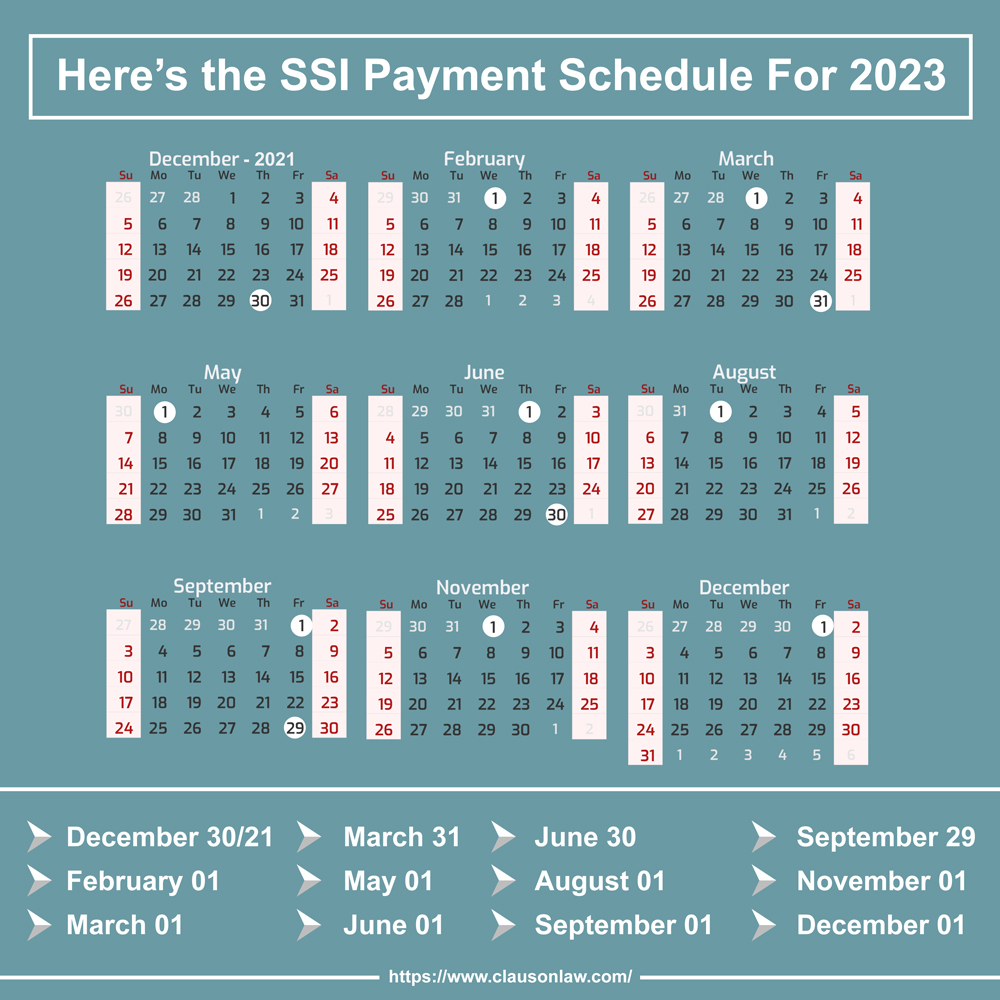

Step 2: Check your benefit type. The type of benefit you receive can also affect your payment date. For example, if you receive Supplemental Security Income (SSI) benefits, your payment date may be different from those who receive Social Security retirement benefits.

Step 3: Use the Social Security Administration’s (SSA) payment schedule. The SSA provides a payment schedule on its website that shows the payment dates for each birthdate group. You can use this schedule to determine your payment date and plan accordingly.

Step 4: Check for any changes to the payment schedule. The SSA may adjust the payment schedule from time to time, so it’s essential to check for any changes that may affect your payment date.

By following these steps, you can determine your Social Security payment date and plan for when your check will be deposited this month. Remember to check the SSA’s website for any changes to the payment schedule and to use the payment schedule to plan for your monthly benefits.

When to Expect Your Social Security Check This Month

If you’re wondering when your Social Security check will be deposited this month, you’re not alone. Many beneficiaries rely on their monthly payments to cover essential expenses, and knowing when to expect the payment can help with budgeting and planning. Here’s a general idea of when Social Security checks are typically deposited for each birthdate group:

Birthdays 1st-10th: Second Wednesday of the month

Birthdays 11th-20th: Third Wednesday of the month

Birthdays 21st-31st: Fourth Wednesday of the month

Keep in mind that these are general guidelines, and the exact date may vary depending on the specific payment cycle. Additionally, if you receive Supplemental Security Income (SSI) benefits, your payment date may be different.

It’s also important to note that the Social Security Administration (SSA) may adjust the payment schedule from time to time, so it’s always a good idea to check the SSA’s website or contact your local SSA office for the most up-to-date information.

By knowing when to expect your Social Security check, you can better plan for your monthly expenses and avoid any potential financial disruptions. Remember to check the SSA’s website for any changes to the payment schedule and to use the payment schedule to plan for your monthly benefits.

When will Social Security checks be deposited this month? The answer depends on your birthdate and the type of benefit you receive. By understanding the payment cycle and using the SSA’s payment schedule, you can stay on top of your benefits and plan for a more secure financial future.

What to Do If Your Social Security Check Is Late

If your Social Security check is late, it can be a stressful and uncertain experience. However, there are steps you can take to resolve the issue and get your payment as soon as possible. Here are some possible reasons why your Social Security check might be late and what you can do about it:

Reasons for delayed payments:

Technical issues: Sometimes, technical issues can cause delays in payment processing. This can be due to a variety of factors, such as system maintenance or software glitches.

Incorrect payment information: If your payment information is incorrect or outdated, it can cause delays in payment processing. This can include incorrect bank account information or mailing addresses.

Payment holds: In some cases, the Social Security Administration (SSA) may place a hold on your payment due to various reasons, such as a change in your eligibility status or a discrepancy in your payment information.

What to do if your payment is delayed:

Contact the SSA: If you suspect that your payment is delayed, you should contact the SSA as soon as possible. You can reach them by phone at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local SSA office.

Check your payment status: You can check the status of your payment online or by phone using the SSA’s automated system. This can help you determine if there are any issues with your payment.

Update your payment information: If you have recently changed your bank account information or mailing address, you should update your payment information with the SSA as soon as possible.

Seek assistance: If you are experiencing financial hardship due to a delayed payment, you may be eligible for assistance from the SSA or other organizations. You can contact the SSA or a local non-profit organization for more information.

Remember, if you are experiencing a delayed payment, it’s essential to stay calm and take proactive steps to resolve the issue. By contacting the SSA and checking your payment status, you can help ensure that you receive your payment as soon as possible.

How to Check the Status of Your Social Security Payment

Checking the status of your Social Security payment is a straightforward process that can be done online or by phone. The Social Security Administration (SSA) provides several options for tracking payments, including the SSA website, mobile app, and automated phone system.

Online:

You can check the status of your Social Security payment online by visiting the SSA website at www.ssa.gov. Once you log in to your account, you can view your payment history, including the date and amount of your most recent payment.

Mobile App:

The SSA also offers a mobile app that allows you to track your payments on the go. The app is available for both iOS and Android devices and can be downloaded from the App Store or Google Play.

Phone:

You can also check the status of your Social Security payment by phone by calling the SSA’s automated system at 1-800-772-1213 (TTY 1-800-325-0778). The system is available 24/7 and can provide information on your payment status, including the date and amount of your most recent payment.

Additional Tips:

When checking the status of your Social Security payment, make sure to have your Social Security number and payment information readily available. This will help ensure that you can access your payment information quickly and easily.

Additionally, if you are experiencing any issues with your payment, such as a delayed or missing payment, you can contact the SSA directly for assistance. The SSA is available to help with any questions or concerns you may have about your Social Security benefits.

By checking the status of your Social Security payment regularly, you can stay on top of your benefits and ensure that you receive your payments on time. Remember to check your payment status online, by mobile app, or by phone to stay informed about your Social Security benefits.

Common Questions About Social Security Payments

As a Social Security beneficiary, you may have questions or concerns about your payments. Here are some common questions and answers to help you better understand your Social Security benefits:

Q: What if my payment is lost or stolen?

A: If your payment is lost or stolen, you should contact the Social Security Administration (SSA) immediately. You can report the issue online or by phone, and the SSA will help you resolve the problem and reissue your payment.

Q: How do I change my direct deposit information?

A: To change your direct deposit information, you can log in to your SSA account online or contact the SSA by phone. You will need to provide your new bank account information and confirm the changes.

Q: Can I receive my payment by mail instead of direct deposit?

A: Yes, you can receive your payment by mail instead of direct deposit. However, this option is not recommended, as it may take longer to receive your payment and may be more prone to errors or loss.

Q: How do I report a change in my income or marital status?

A: If you experience a change in your income or marital status, you should report it to the SSA as soon as possible. This will help ensure that your benefits are adjusted correctly and that you receive the correct amount of payment.

Q: Can I receive my payment earlier or later than my scheduled payment date?

A: In some cases, you may be able to receive your payment earlier or later than your scheduled payment date. However, this is subject to SSA approval and may depend on your individual circumstances.

By understanding the answers to these common questions, you can better manage your Social Security benefits and ensure that you receive your payments on time. Remember to always contact the SSA if you have any questions or concerns about your benefits.

Changes to the Social Security Payment Schedule

The Social Security Administration (SSA) periodically reviews and updates the Social Security payment schedule to ensure that beneficiaries receive their payments in a timely and efficient manner. Here are some recent and upcoming changes to the Social Security payment schedule:

Recent Changes:

In 2022, the SSA introduced a new payment schedule that allows beneficiaries to receive their payments on a more frequent basis. This change was made to help beneficiaries better manage their finances and reduce the need for loans or other forms of credit.

Upcoming Changes:

In 2023, the SSA plans to introduce a new online payment portal that will allow beneficiaries to view and manage their payment information online. This portal will provide beneficiaries with more control over their payments and make it easier for them to track their payment history.

New Payment Options:

The SSA is also exploring new payment options, such as mobile payments and digital wallets, to make it easier for beneficiaries to receive their payments. These new payment options will provide beneficiaries with more flexibility and convenience when it comes to receiving their payments.

Impact on Beneficiaries:

These changes to the Social Security payment schedule may impact beneficiaries in different ways. For example, some beneficiaries may need to update their payment information or adjust their budget to accommodate the new payment schedule. However, the SSA is committed to ensuring that beneficiaries receive their payments in a timely and efficient manner, and these changes are designed to improve the overall payment experience.

By staying informed about changes to the Social Security payment schedule, beneficiaries can better manage their finances and plan for the future. Remember to check the SSA website or contact your local SSA office for more information about these changes and how they may impact your benefits.

Additional Tips for Managing Your Social Security Benefits

Managing your Social Security benefits effectively requires careful planning and attention to detail. Here are some additional tips to help you make the most of your benefits:

Budgeting for Payments:

It’s essential to budget for your Social Security payments to ensure that you can cover your living expenses. Consider setting up a separate bank account specifically for your Social Security payments to help you keep track of your funds.

Planning for the Future:

Think about your long-term financial goals and how your Social Security benefits fit into your overall plan. Consider consulting with a financial advisor to get personalized advice on managing your benefits and achieving your financial goals.

Staying Informed:

Stay up-to-date with changes to the Social Security program and payment schedule by regularly checking the Social Security Administration’s website or contacting your local SSA office.

Maximizing Your Benefits:

Consider strategies to maximize your Social Security benefits, such as delaying your retirement or using the “file and suspend” strategy. However, be sure to consult with a financial advisor before making any decisions.

By following these tips and staying informed about your Social Security benefits, you can ensure that you’re making the most of your payments and achieving your financial goals.