Understanding Your Investment Goals and Risk Tolerance

When considering where to invest in stocks, it’s essential to start by understanding your investment goals and risk tolerance. This foundation will help guide your investment decisions and ensure a consistent approach to investing in stocks. Your investment goals may include long-term growth, income generation, or capital preservation. Understanding these goals will help you determine the right asset allocation and risk level for your portfolio.

Risk tolerance is another critical factor to consider. It’s the degree of uncertainty you’re willing to accept when investing in stocks. If you’re risk-averse, you may prefer more conservative investments, such as dividend-paying stocks or index funds. On the other hand, if you’re willing to take on more risk, you may consider investing in individual stocks or growth-oriented sectors.

To determine your risk tolerance, consider your investment horizon, financial situation, and personal comfort level with market volatility. If you’re unsure, consider consulting with a financial advisor or conducting your own research to determine the right risk level for your portfolio.

Once you’ve established your investment goals and risk tolerance, you can begin to explore where to invest in stocks. This may involve researching individual stocks, evaluating sector trends, or considering index funds or ETFs. By understanding your investment goals and risk tolerance, you’ll be better equipped to make informed investment decisions and achieve your long-term financial objectives.

How to Evaluate Stock Market Performance and Trends

Evaluating stock market performance and trends is crucial when deciding where to invest in stocks. To make informed investment decisions, it’s essential to consider various economic indicators, sector trends, and company performance. This information will help you identify potential opportunities and risks in the market.

Start by analyzing economic indicators such as GDP growth, inflation rates, and interest rates. These indicators can provide insight into the overall health of the economy and potential impact on the stock market. For example, a growing economy with low inflation and interest rates may be conducive to stock market growth.

Next, examine sector trends to identify areas of strength and weakness. Certain sectors, such as technology and healthcare, may be experiencing rapid growth and innovation, making them attractive investment opportunities. On the other hand, sectors like energy and materials may be experiencing challenges due to changes in global demand and supply.

Company performance is also a critical factor to consider. Research the financials, management teams, and industry trends of individual companies to determine their potential for growth and profitability. Look for companies with strong revenue growth, solid balance sheets, and experienced management teams.

When evaluating stock market performance and trends, it’s also essential to consider the overall market sentiment and technical analysis. Market sentiment can provide insight into investor attitudes and potential market direction. Technical analysis can help identify trends and patterns in stock prices, providing valuable information for investment decisions.

By considering these factors, you can gain a comprehensive understanding of the stock market and make informed decisions about where to invest in stocks. Remember to stay up-to-date with market news and trends, and be prepared to adapt your investment strategy as needed.

Top Stock Market Sectors for Long-Term Growth

When considering where to invest in stocks, it’s essential to identify top-performing sectors that offer potential for long-term growth. Several sectors have consistently demonstrated strong performance and growth prospects, making them attractive investment opportunities.

Technology is one such sector, with companies like Amazon, Microsoft, and Alphabet (Google) leading the way. The technology sector has experienced rapid growth in recent years, driven by innovations in cloud computing, artificial intelligence, and cybersecurity. This trend is expected to continue, making technology a promising sector for long-term investment.

Healthcare is another sector with significant growth potential. Companies like Johnson & Johnson, Pfizer, and UnitedHealth Group are leaders in the healthcare industry, with a strong track record of innovation and growth. The aging population and increasing healthcare needs are expected to drive demand for healthcare services and products, making this sector an attractive investment opportunity.

Finance is another sector with potential for long-term growth. Companies like JPMorgan Chase, Visa, and Mastercard are leaders in the financial services industry, with a strong track record of innovation and growth. The increasing demand for digital payments and financial services is expected to drive growth in this sector.

When investing in these sectors, it’s essential to consider the potential risks and challenges. For example, the technology sector is highly competitive, and companies must continually innovate to stay ahead. The healthcare sector is subject to regulatory changes and reimbursement pressures, which can impact company performance. The finance sector is subject to economic fluctuations and regulatory changes, which can impact company performance.

Despite these risks, these sectors offer potential for long-term growth and returns. By investing in a diversified portfolio of stocks across these sectors, investors can reduce risk and increase potential returns. It’s essential to conduct thorough research and analysis before making investment decisions, and to consider seeking professional advice if needed.

Investing in Index Funds vs. Individual Stocks

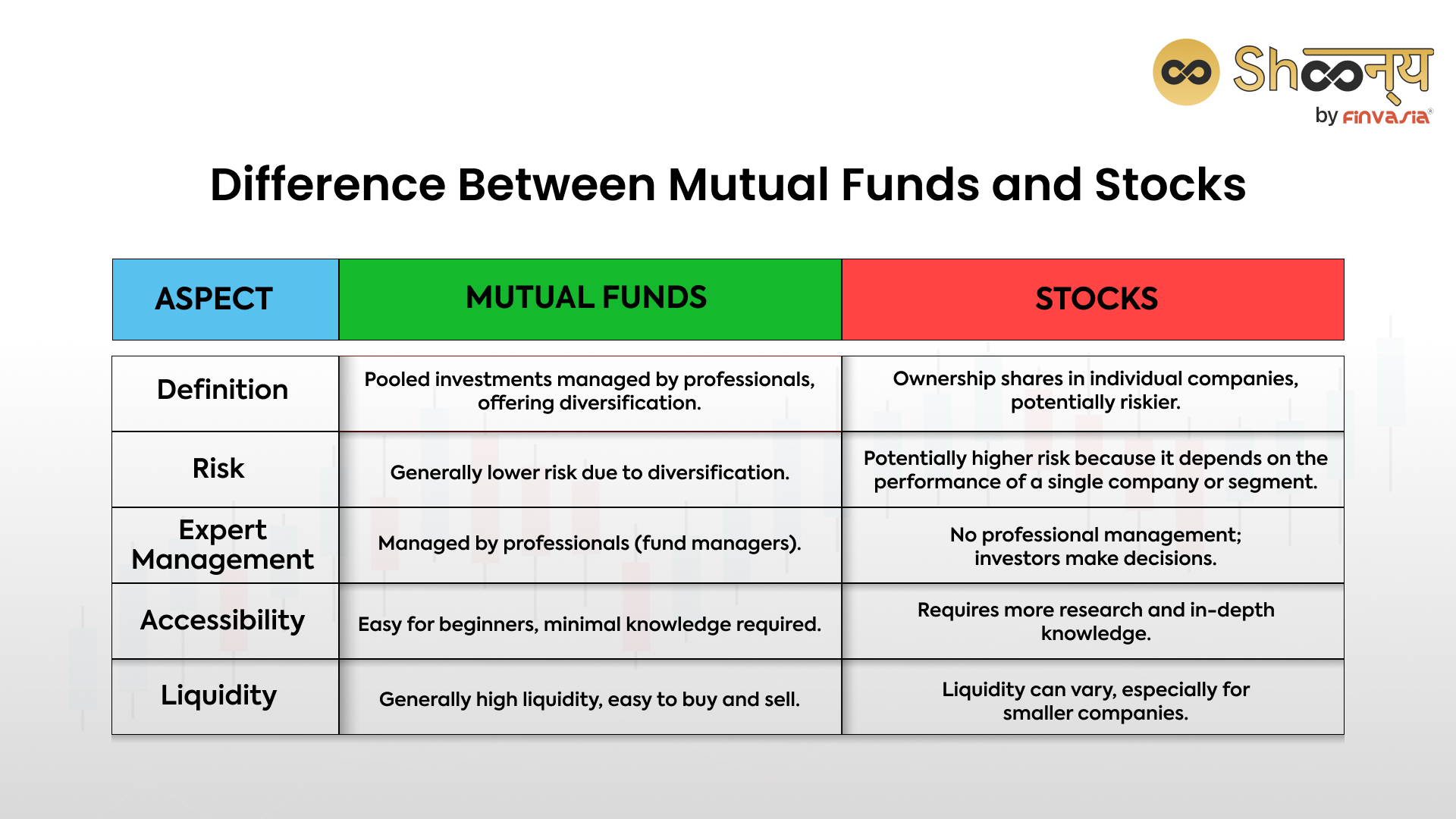

When deciding where to invest in stocks, investors often consider two popular options: index funds and individual stocks. Both options have their benefits and drawbacks, and understanding the differences between them can help investors make informed decisions.

Index funds offer a diversified portfolio of stocks that track a specific market index, such as the S&P 500. This approach provides broad market exposure and can help reduce risk. Index funds are often less expensive than actively managed funds and can provide consistent returns over the long term.

Individual stocks, on the other hand, offer the potential for higher returns, but also come with higher risk. Investing in individual stocks requires a thorough understanding of the company’s financials, management team, and industry trends. This approach can be more time-consuming and requires a higher level of investment knowledge.

One of the main benefits of index funds is diversification. By investing in a broad range of stocks, investors can reduce their exposure to individual company risk. Index funds also offer a low-cost way to invest in the stock market, with many funds having expense ratios of less than 0.1%.

Individual stocks, however, offer the potential for higher returns. By investing in a specific company, investors can benefit from the company’s growth and success. This approach also allows investors to have more control over their investments and make more targeted investment decisions.

Ultimately, the decision between index funds and individual stocks depends on an investor’s goals, risk tolerance, and investment knowledge. A combination of both approaches can also be a viable option, allowing investors to benefit from the diversification of index funds while also taking advantage of the potential for higher returns with individual stocks.

When deciding where to invest in stocks, it’s essential to consider your investment goals and risk tolerance. By understanding the benefits and drawbacks of index funds and individual stocks, investors can make informed decisions and create a diversified portfolio that meets their needs.

How to Research and Select Individual Stocks for Investment

When deciding where to invest in stocks, researching and selecting individual stocks can be a daunting task. However, with a solid understanding of the key factors to consider, investors can make informed decisions and increase their chances of success.

One of the most important factors to consider when researching individual stocks is the company’s financial health. This includes evaluating the company’s revenue growth, profit margins, and debt levels. Investors should also review the company’s financial statements, including the income statement, balance sheet, and cash flow statement.

Another key factor to consider is the company’s management team. A strong management team can make all the difference in a company’s success. Investors should research the management team’s experience, track record, and leadership style.

Industry trends are also an essential factor to consider. Investors should research the company’s position within its industry, including its market share, competitive landscape, and growth prospects.

In addition to these factors, investors should also consider the company’s valuation. This includes evaluating the company’s price-to-earnings ratio, price-to-book ratio, and dividend yield.

Once investors have researched and selected individual stocks, they should also consider their investment goals and risk tolerance. This includes determining the right asset allocation and diversification strategy for their portfolio.

By following these steps, investors can make informed decisions and increase their chances of success when deciding where to invest in stocks. Remember to always do your own research, stay up-to-date with market news, and adapt your investment strategy as needed.

Some popular tools and resources for researching individual stocks include financial websites such as Yahoo Finance and Google Finance, as well as stock screeners and research reports from reputable sources.

Understanding Dividend Investing and Income-Generating Stocks

Dividend investing is a popular strategy for income-seeking investors, and for good reason. By investing in dividend-paying stocks, investors can generate a regular stream of income, which can help to offset market volatility and provide a relatively stable source of returns.

But what exactly is dividend investing, and how can investors get started? Dividend investing involves buying shares in companies that pay out a portion of their earnings to shareholders in the form of dividends. These dividends can be paid out quarterly or annually, and can provide a regular source of income for investors.

When evaluating dividend-paying stocks, investors should consider several key factors, including the dividend yield, payout history, and sustainability of the dividend payments. The dividend yield is the ratio of the annual dividend payment to the stock’s current price, and can provide a useful indicator of the stock’s income-generating potential.

The payout history is also an important consideration, as it can provide insight into the company’s ability to maintain its dividend payments over time. Investors should look for companies with a long history of paying consistent dividends, as this can indicate a stable and sustainable business model.

Finally, investors should consider the sustainability of the dividend payments, including the company’s earnings growth prospects, debt levels, and cash flow generation. By evaluating these factors, investors can gain a better understanding of the company’s ability to maintain its dividend payments over time.

Some popular dividend-paying stocks to consider include real estate investment trusts (REITs), master limited partnerships (MLPs), and established companies with a long history of paying consistent dividends. By incorporating these stocks into a diversified portfolio, investors can generate a regular stream of income and potentially reduce their exposure to market volatility.

When deciding where to invest in stocks, dividend investing can be a valuable strategy to consider. By evaluating the dividend yield, payout history, and sustainability of dividend payments, investors can make informed decisions and potentially generate a regular stream of income.

Managing Risk and Diversifying Your Stock Portfolio

Effective risk management and diversification are crucial components of a successful long-term investment strategy in the stock market. By understanding how to manage risk and diversify a portfolio, investors can minimize potential losses and maximize returns. This section will discuss the importance of risk management and diversification, as well as provide tips on how to implement these strategies in a stock portfolio.

One of the primary ways to manage risk in a stock portfolio is through asset allocation. This involves dividing a portfolio among different asset classes, such as stocks, bonds, and cash, to reduce exposure to any one particular market. By allocating assets effectively, investors can reduce the overall risk of their portfolio and increase potential returns. For example, if an investor has a portfolio that is heavily weighted in stocks, they may consider allocating a portion of their portfolio to bonds or cash to reduce risk.

Sector rotation is another strategy that can be used to manage risk and diversify a portfolio. This involves rotating investments between different sectors or industries to take advantage of trends and reduce exposure to underperforming sectors. For example, if an investor has a portfolio that is heavily weighted in technology stocks, they may consider rotating a portion of their portfolio to healthcare or finance stocks to reduce risk and increase potential returns.

Stop-loss orders are another tool that can be used to manage risk in a stock portfolio. A stop-loss order is an instruction to sell a stock when it falls to a certain price, which can help limit losses if a stock declines in value. By setting stop-loss orders, investors can reduce the risk of significant losses and protect their portfolio from market downturns.

In addition to these strategies, diversification is also critical to managing risk and maximizing returns in a stock portfolio. Diversification involves spreading investments across a range of different stocks, sectors, and asset classes to reduce exposure to any one particular market. By diversifying a portfolio, investors can reduce risk and increase potential returns over the long-term. For example, if an investor has a portfolio that is heavily weighted in individual stocks, they may consider diversifying their portfolio by investing in index funds or ETFs, which track a particular market index, such as the S&P 500.

When deciding where to invest in stocks, it’s essential to consider risk management and diversification strategies. By understanding how to manage risk and diversify a portfolio, investors can make informed decisions about where to invest in stocks and maximize their potential returns over the long-term. Whether investing in individual stocks or index funds, a well-diversified portfolio that is managed effectively can help investors achieve their long-term financial goals.

Staying Informed and Adapting to Market Changes

Staying informed about market trends and changes is crucial for long-term success in the stock market. By staying up-to-date with market news and adapting investment strategies as needed, investors can make informed decisions about where to invest in stocks and maximize their potential returns. In this section, we will discuss the importance of staying informed and provide tips on how to stay ahead of the curve.

One of the most effective ways to stay informed about market trends and changes is to follow reputable financial news sources. Websites such as Bloomberg, CNBC, and The Wall Street Journal provide up-to-date news and analysis on the stock market, helping investors stay informed about market trends and changes. Additionally, investors can follow financial experts and analysts on social media to stay informed about market news and trends.

Another way to stay informed is to set up a news alert system. Many financial news websites and apps offer news alert systems that send notifications when a specific stock or market trend is mentioned in the news. This can help investors stay informed about market changes and trends in real-time, allowing them to make informed decisions about where to invest in stocks.

In addition to staying informed, it’s also important to adapt investment strategies as needed. This may involve rebalancing a portfolio to reflect changes in market trends or adjusting investment goals and risk tolerance. By staying flexible and adapting to market changes, investors can maximize their potential returns and achieve their long-term financial goals.

When deciding where to invest in stocks, it’s essential to consider the current market trends and changes. By staying informed and adapting investment strategies as needed, investors can make informed decisions about where to invest in stocks and maximize their potential returns. Whether investing in individual stocks or index funds, a well-informed and adaptable investment strategy can help investors achieve their long-term financial goals.

Some popular tools and resources for staying informed about market trends and changes include financial news websites, stock screeners, and portfolio tracking software. These tools can help investors stay informed about market news and trends, track their portfolio’s performance, and make informed decisions about where to invest in stocks.

In conclusion, staying informed about market trends and changes is crucial for long-term success in the stock market. By following reputable financial news sources, setting up a news alert system, and adapting investment strategies as needed, investors can make informed decisions about where to invest in stocks and maximize their potential returns. Whether investing in individual stocks or index funds, a well-informed and adaptable investment strategy can help investors achieve their long-term financial goals.