What Causes a Credit Score to Plummet Overnight

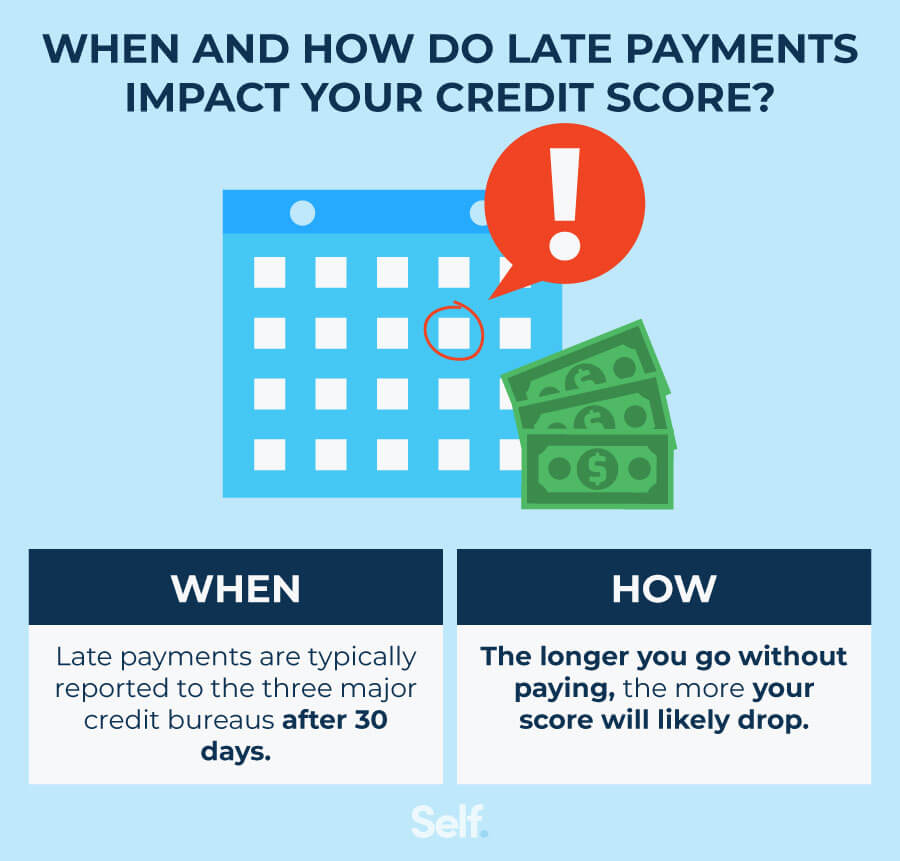

A sudden drop in credit score can be a mysterious and frustrating experience, leaving many wondering why their credit score dropped 20 points or more. The truth is, there are several factors that can contribute to a sudden decline in credit score. Late payments, high credit utilization, and credit inquiries are just a few of the common culprits behind a plummeting credit score.

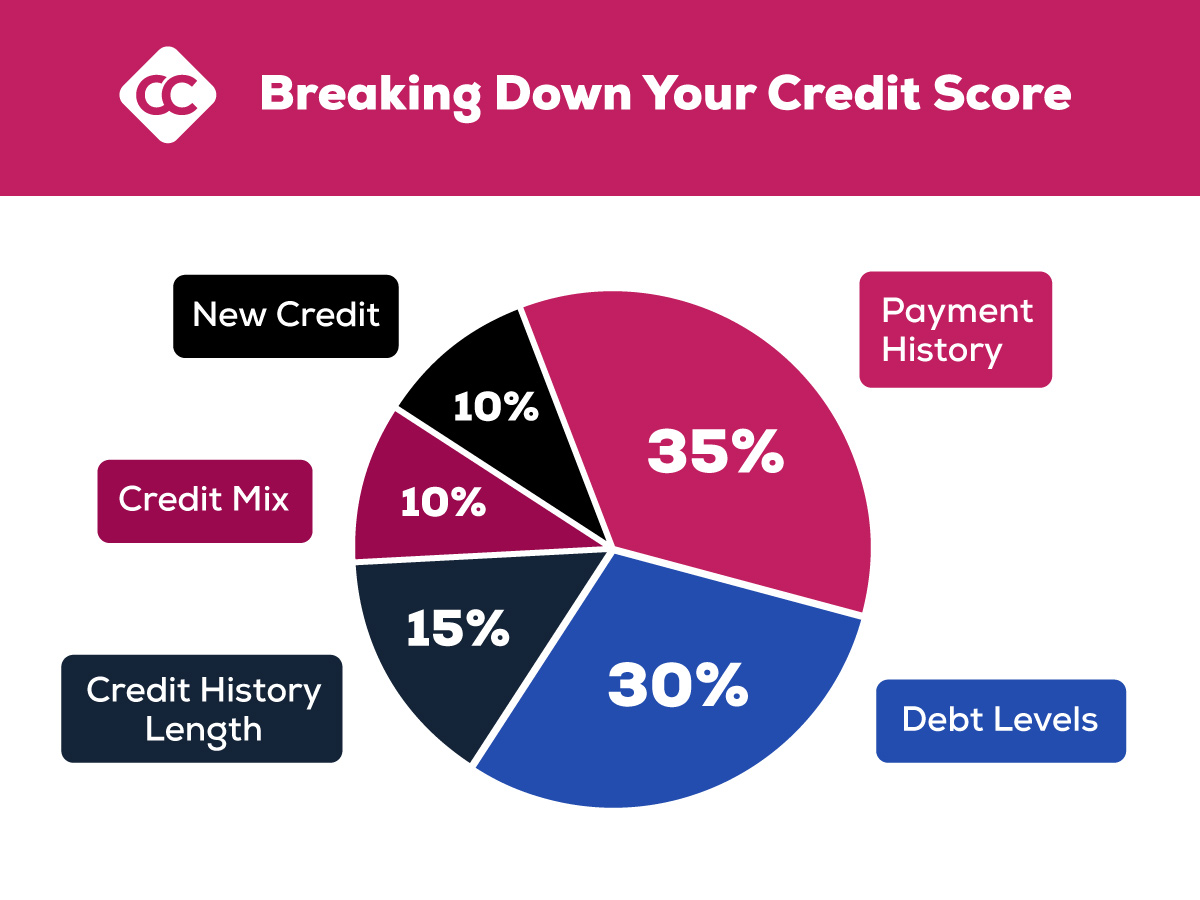

When a payment is missed or late, it can significantly lower credit scores. This is because payment history accounts for 35% of the total credit score, making it the most important factor in determining creditworthiness. High credit utilization, on the other hand, can also negatively impact credit scores. When credit utilization exceeds 30%, it can signal to lenders that the borrower is taking on too much debt and may struggle to make payments.

Credit inquiries can also contribute to a sudden drop in credit score. When a lender or creditor checks an individual’s credit report, it can result in a small decrease in credit score. This is because credit inquiries can indicate to lenders that the individual is taking on new debt or applying for multiple credit products.

Other factors, such as credit account closures, credit limit reductions, and public records like bankruptcies or foreclosures, can also impact credit scores. Understanding the specific reason behind a credit score drop is crucial in taking corrective action to improve credit scores over time.

For instance, if a credit score drop is due to high credit utilization, reducing debt and keeping credit utilization below 30% can help improve credit scores. Similarly, making on-time payments and avoiding late payments can also help to improve credit scores.

By understanding the factors that contribute to a sudden drop in credit score, individuals can take proactive steps to improve their credit scores and maintain good credit health. Whether it’s reducing debt, avoiding late payments, or monitoring credit reports, taking control of credit scores is essential in achieving long-term financial stability.

How to Identify the Reason Behind Your Credit Score Drop

When a credit score drops unexpectedly, it can be challenging to determine the cause. However, identifying the reason behind the drop is crucial in taking corrective action to improve credit scores. One of the most effective ways to identify the reason behind a credit score drop is to review credit reports.

Credit reports contain a wealth of information about an individual’s credit history, including payment history, credit utilization, and credit inquiries. By reviewing credit reports, individuals can identify errors or inaccuracies that may be contributing to a credit score drop. For instance, if a credit report shows a late payment that was not actually late, it can be disputed and corrected.

To review credit reports, individuals can request a free copy from each of the three major credit reporting agencies – Experian, TransUnion, and Equifax. Credit reports can be requested online, by phone, or by mail. Once the report is received, it’s essential to review it carefully, looking for any errors or inaccuracies.

Some common errors to look for on credit reports include incorrect payment history, incorrect credit utilization, and incorrect credit inquiries. If any errors are found, they can be disputed with the credit reporting agency. The agency will then investigate the dispute and correct any errors found.

In addition to reviewing credit reports, individuals can also use online tools to monitor their credit scores and identify potential issues. Many credit card companies and banks offer free credit score monitoring services that can help individuals track their credit scores over time.

By regularly monitoring credit scores and reviewing credit reports, individuals can identify potential issues and take corrective action to improve their credit scores. Whether it’s disputing errors on a credit report or reducing debt, taking control of credit scores is essential in achieving long-term financial stability.

For example, if a credit score drop is due to high credit utilization, reducing debt and keeping credit utilization below 30% can help improve credit scores. Similarly, making on-time payments and avoiding late payments can also help to improve credit scores.

By understanding how to identify the reason behind a credit score drop, individuals can take proactive steps to improve their credit scores and maintain good credit health. Whether it’s reviewing credit reports or monitoring credit scores, taking control of credit scores is essential in achieving long-term financial stability.

The Impact of Credit Utilization on Your Credit Score

Credit utilization is a critical factor in determining credit scores. It refers to the percentage of available credit being used by an individual. High credit utilization can negatively impact credit scores, while low credit utilization can have a positive effect.

When credit utilization exceeds 30%, it can signal to lenders that an individual is taking on too much debt and may struggle to make payments. This can lead to a decrease in credit scores. On the other hand, keeping credit utilization below 30% can help improve credit scores

The Impact of Credit Utilization on Your Credit Score

Credit utilization is a critical factor in determining credit scores. It refers to the percentage of available credit being used by an individual. High credit utilization can negatively impact credit scores, while low credit utilization can have a positive effect.

When credit utilization exceeds 30%, it can signal to lenders that an individual is taking on too much debt and may struggle to make payments. This can lead to a decrease in credit scores. On the other hand, keeping credit utilization below 30% can help improve credit scores over time.

For example, if an individual has a credit limit of $1,000 and a balance of $300, their credit utilization is 30%. This is considered a good credit utilization ratio. However, if the balance increases to $500, the credit utilization ratio jumps to 50%, which can negatively impact credit scores.

There are several strategies for reducing credit utilization and improving credit scores. One approach is to pay down debt and reduce the balance on credit accounts. This can help lower credit utilization and improve credit scores over time.

Another approach is to increase the credit limit on existing accounts. This can help reduce credit utilization and improve credit scores. However, it’s essential to avoid applying for multiple credit accounts, as this can lead to a decrease in credit scores.

Additionally, individuals can consider consolidating debt into a single loan with a lower interest rate. This can help reduce credit utilization and improve credit scores. However, it’s essential to carefully review the terms and conditions of the loan before consolidating

The Impact of Credit Utilization on Your Credit Score

Credit utilization is a critical factor in determining credit scores. It refers to the percentage of available credit being used by an individual. High credit utilization can negatively impact credit scores, while low credit utilization can have a positive effect.

When credit utilization exceeds 30%, it can signal to lenders that an individual is taking on too much debt and may struggle to make payments. This can lead to a decrease in credit scores. On the other hand, keeping credit utilization below 30% can help improve credit scores over time.

For example, if an individual has a credit limit of $1,000 and a balance of $300, their credit utilization is 30%. This is considered a good credit utilization ratio. However, if the balance increases to $500, the credit utilization ratio jumps to 50%, which can negatively impact credit scores.

There are several strategies for reducing credit utilization and improving credit scores. One approach is to pay down debt and reduce the balance on credit accounts. This can help lower credit utilization and improve credit scores over time.

Another approach is to increase the credit limit on existing accounts. This can help reduce credit utilization and improve credit scores. However, it’s essential to avoid applying for multiple credit accounts, as this can lead to a decrease in credit scores.

Additionally, individuals can consider consolidating debt into a single loan with a lower interest rate. This can help reduce credit utilization and improve credit scores. However, it’s essential to carefully review the terms and conditions of the loan before consolidating

The Impact of Credit Utilization on Your Credit Score

Credit utilization is a critical factor in determining credit scores. It refers to the percentage of available credit being used by an individual. High credit utilization can negatively impact credit scores, while low credit utilization can have a positive effect.

When credit utilization exceeds 30%, it can signal to lenders that an individual is taking on too much debt and may struggle to make payments. This can lead to a decrease in credit scores. On the other hand, keeping credit utilization below 30% can help improve credit scores over time.

For example, if an individual has a credit limit of $1,000 and a balance of $300, their credit utilization is 30%. This is considered a good credit utilization ratio. However, if the balance increases to $500, the credit utilization ratio jumps to 50%, which can negatively impact credit scores.

There are several strategies for reducing credit utilization and improving credit scores. One approach is to pay down debt and reduce the balance on credit accounts. This can help lower credit utilization and improve credit scores over time.

Another approach is to increase the credit limit on existing accounts. This can help reduce credit utilization and improve credit scores. However, it’s essential to avoid applying for multiple credit accounts, as this can lead to a decrease in credit scores.

Additionally, individuals can consider consolidating debt into a single loan with a lower interest rate. This can help reduce credit utilization and improve credit scores. However, it’s essential to carefully review the terms and conditions of the loan before consolidating

The Impact of Credit Utilization on Your Credit Score

Credit utilization is a critical factor in determining credit scores. It refers to the percentage of available credit being used by an individual. High credit utilization can negatively impact credit scores, while low credit utilization can have a positive effect.

When credit utilization exceeds 30%, it can signal to lenders that an individual is taking on too much debt and may struggle to make payments. This can lead to a decrease in credit scores. On the other hand, keeping credit utilization below 30% can help improve credit scores over time.

For example, if an individual has a credit limit of $1,000 and a balance of $300, their credit utilization is 30%. This is considered a good credit utilization ratio. However, if the balance increases to $500, the credit utilization ratio jumps to 50%, which can negatively impact credit scores.

There are several strategies for reducing credit utilization and improving credit scores. One approach is to pay down debt and reduce the balance on credit accounts. This can help lower credit utilization and improve credit scores over time.

Another approach is to increase the credit limit on existing accounts. This can help reduce credit utilization and improve credit scores. However, it’s essential to avoid applying for multiple credit accounts, as this can lead to a decrease in credit scores.

Additionally, individuals can consider consolidating debt into a single loan with a lower interest rate. This can help reduce credit utilization and improve credit scores. However, it’s essential to carefully review the terms and conditions of the loan before consolidating

The Impact of Credit Utilization on Your Credit Score

Credit utilization is a critical factor in determining credit scores. It refers to the percentage of available credit being used by an individual. High credit utilization can negatively impact credit scores, while low credit utilization can have a positive effect.

When credit utilization exceeds 30%, it can signal to lenders that an individual is taking on too much debt and may struggle to make payments. This can lead to a decrease in credit scores. On the other hand, keeping credit utilization below 30% can help improve credit scores over time.

For example, if an individual has a credit limit of $1,000 and a balance of $300, their credit utilization is 30%. This is considered a good credit utilization ratio. However, if the balance increases to $500, the credit utilization ratio jumps to 50%, which can negatively impact credit scores.

There are several strategies for reducing credit utilization and improving credit scores. One approach is to pay down debt and reduce the balance on credit accounts. This can help lower credit utilization and improve credit scores over time.

Another approach is to increase the credit limit on existing accounts. This can help reduce credit utilization and improve credit scores. However, it’s essential to avoid applying for multiple credit accounts, as this can lead to a decrease in credit scores.

Additionally, individuals can consider consolidating debt into a single loan with a lower interest rate. This can help reduce credit utilization and improve credit scores. However, it’s essential to carefully review the terms and conditions of the loan before consolidating