Why You Need a Trusts and Estates Attorney

Ensuring that your estate is distributed according to your wishes is a crucial aspect of estate planning. However, without proper guidance, the process can be complex and overwhelming. This is where a wills and trusts attorney near me can provide invaluable expertise. A trusts and estates attorney specializes in helping individuals create a comprehensive estate plan that meets their unique needs and goals.

One of the primary benefits of working with a wills and trusts attorney is avoiding costly probate and family conflicts. Probate is the process by which a court validates a will and distributes the estate’s assets. However, this process can be time-consuming, expensive, and emotionally draining for loved ones. A wills and trusts attorney can help you create a plan that minimizes the risk of probate and ensures that your assets are distributed according to your wishes.

Additionally, a wills and trusts attorney can help you navigate the complexities of estate planning, including tax implications, beneficiary designations, and asset protection. They can also provide guidance on creating a living will, powers of attorney, and other essential documents that ensure your wishes are respected in the event of incapacitation.

By working with a wills and trusts attorney near me, you can ensure that your estate plan is tailored to your specific needs and goals. They can help you create a plan that protects your assets, minimizes taxes, and ensures that your loved ones are provided for. Don’t leave your estate planning to chance – seek the expertise of a wills and trusts attorney to ensure that your legacy is protected.

Understanding the Difference Between a Will and a Trust

When it comes to estate planning, two of the most common documents used are wills and trusts. While both are essential tools for distributing assets and ensuring that wishes are carried out, they serve distinct purposes and offer different benefits. A wills and trusts attorney near me can help you understand the key differences between these two documents and how they can be used together to achieve comprehensive estate planning.

A will is a document that outlines how you want your assets to be distributed after your passing. It names an executor, who is responsible for carrying out your wishes, and specifies how your assets will be divided among your beneficiaries. A will is typically used to distribute assets that are subject to probate, such as real estate, bank accounts, and personal property.

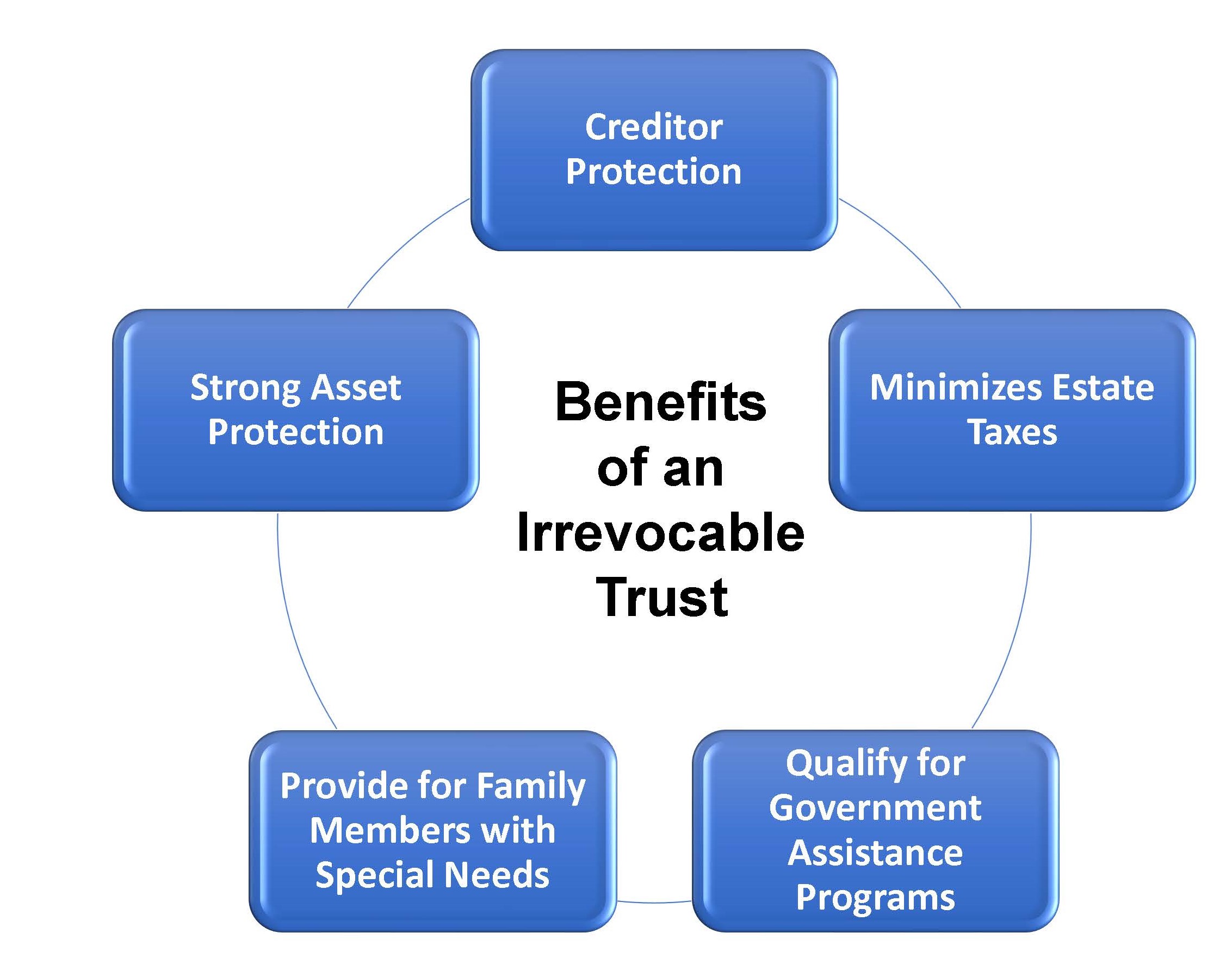

A trust, on the other hand, is a document that allows you to transfer ownership of your assets to a separate entity, which is managed by a trustee. A trust can be used to distribute assets during your lifetime or after your passing, and it can provide tax benefits and protection for your beneficiaries. There are several types of trusts, including revocable trusts, irrevocable trusts, and special needs trusts.

One of the primary benefits of using a trust is that it can help you avoid probate, which can be a time-consuming and costly process. A trust can also provide more flexibility and control over how your assets are distributed, as you can specify exactly how and when your assets will be distributed to your beneficiaries.

A wills and trusts attorney near me can help you determine whether a will, a trust, or a combination of both is right for you. They can also help you create a comprehensive estate plan that takes into account your unique needs and goals, and ensures that your wishes are carried out.

How to Choose the Right Wills and Trusts Attorney for You

Choosing the right wills and trusts attorney near me can be a daunting task, especially if you’re not familiar with the process of estate planning. However, with the right guidance, you can find an attorney who is qualified, experienced, and dedicated to helping you achieve your goals. Here are some tips to consider when selecting a wills and trusts attorney:

Experience is key when it comes to estate planning. Look for an attorney who has extensive experience in wills and trusts, as well as other areas of estate planning such as probate, guardianship, and elder law. A seasoned attorney will be able to guide you through the process and help you avoid common pitfalls.

Credentials are also important to consider. Look for an attorney who is certified by the American Board of Certification (ABC) or the National Association of Estate Planners & Councils (NAEPC). These certifications indicate that the attorney has met certain standards of education, experience, and ethics.

Communication style is also crucial. You want an attorney who is approachable, responsive, and willing to take the time to explain complex concepts in a way that’s easy to understand. Look for an attorney who is willing to listen to your concerns and answer your questions in a clear and concise manner.

Another important factor to consider is the attorney’s approach to estate planning. Look for an attorney who takes a holistic approach, considering not just your legal needs but also your financial, tax, and personal goals. A comprehensive approach will help ensure that your estate plan is tailored to your unique needs and goals.

Finally, consider the attorney’s reputation and reviews. Look for an attorney who has a strong reputation in the community and positive reviews from past clients. You can check online review sites such as Avvo or Martindale-Hubbell to get a sense of the attorney’s reputation and expertise.

By considering these factors, you can find a wills and trusts attorney near me who is qualified, experienced, and dedicated to helping you achieve your estate planning goals.

The Benefits of Working with a Local Wills and Trusts Attorney

When it comes to estate planning, working with a local wills and trusts attorney near me can provide numerous benefits. One of the primary advantages is their knowledge of state-specific laws and regulations. Estate planning laws can vary significantly from state to state, and a local attorney will be familiar with the specific laws and regulations in your area.

A local wills and trusts attorney will also be able to provide personalized service, which is essential when it comes to estate planning. They will take the time to understand your unique needs and goals, and will work with you to create a comprehensive estate plan that meets your specific requirements.

Another benefit of working with a local wills and trusts attorney is their ability to provide guidance on local resources and services. They may be familiar with local nursing homes, assisted living facilities, and other resources that can be beneficial to you or your loved ones.

In addition, a local wills and trusts attorney will be able to provide more flexible scheduling and communication options. They may be able to meet with you in person, or communicate with you via phone or email, whichever is more convenient for you.

Working with a local wills and trusts attorney near me can also provide peace of mind. You will know that your estate plan is being handled by someone who is familiar with the local laws and regulations, and who is committed to providing you with the best possible service.

Overall, working with a local wills and trusts attorney can provide numerous benefits, from their knowledge of state-specific laws and regulations to their ability to provide personalized service and guidance on local resources and services.

What to Expect During Your Initial Consultation

When you schedule an initial consultation with a wills and trusts attorney near me, you can expect a thorough and informative discussion about your estate planning needs. The attorney will typically begin by asking you a series of questions to understand your goals, concerns, and current situation.

Some common questions you may be asked during the initial consultation include: What are your goals for estate planning? Do you have any specific concerns or worries about the distribution of your assets? Have you previously created a will or trust? Do you have any dependents or beneficiaries who will be affected by your estate plan?

In addition to asking questions, the attorney will also provide you with information about the estate planning process and the various options available to you. They may explain the differences between a will and a trust, and discuss the benefits and drawbacks of each. They may also provide guidance on how to avoid common mistakes and pitfalls in estate planning.

It’s also a good idea to come prepared with questions of your own to ask the attorney. Some examples might include: What experience do you have with estate planning? How will you help me create a comprehensive estate plan? What are the costs associated with your services? How will you communicate with me throughout the estate planning process?

During the initial consultation, the attorney will also provide you with an overview of the estate planning process and what you can expect from their services. They may explain the steps involved in creating a will or trust, and discuss the timeline for completion. They may also provide you with information about their fees and payment structures.

Overall, the initial consultation with a wills and trusts attorney near me is an opportunity for you to learn more about the estate planning process and to determine whether the attorney is a good fit for your needs. By coming prepared with questions and being open and honest about your goals and concerns, you can get the most out of the consultation and take the first step towards creating a comprehensive estate plan.

Common Mistakes to Avoid in Estate Planning

Estate planning can be a complex and nuanced process, and it’s easy to make mistakes that can have serious consequences. A wills and trusts attorney near me can help you avoid common mistakes and ensure that your estate plan is comprehensive and effective.

One common mistake is failing to update your estate plan after a major life change, such as a marriage, divorce, or the birth of a child. This can lead to outdated and ineffective estate planning documents that do not reflect your current wishes or circumstances.

Another mistake is not considering the tax implications of your estate plan. A wills and trusts attorney can help you minimize taxes and ensure that your estate plan is tax-efficient.

Not having a clear plan for the distribution of your assets is another common mistake. A wills and trusts attorney can help you create a clear and comprehensive plan for the distribution of your assets, including real estate, investments, and personal property.

Not considering the needs of loved ones with special needs is also a common mistake. A wills and trusts attorney can help you create a special needs plan that ensures the well-being and protection of loved ones with special needs.

Finally, not reviewing and updating your estate plan regularly is a common mistake. A wills and trusts attorney can help you review and update your estate plan regularly to ensure that it remains comprehensive and effective.

By avoiding these common mistakes, you can ensure that your estate plan is comprehensive and effective, and that your wishes are carried out after your passing. A wills and trusts attorney near me can help you create a comprehensive estate plan that meets your unique needs and goals.

How a Wills and Trusts Attorney Can Help with Special Needs Planning

Special needs planning is a critical aspect of estate planning, particularly for families with loved ones who have special needs. A wills and trusts attorney near me can help ensure that these individuals are protected and provided for, both now and in the future.

One of the primary concerns for families with special needs is ensuring that their loved one is eligible for government benefits, such as Medicaid and Supplemental Security Income (SSI). A wills and trusts attorney can help create a special needs trust that allows the individual to receive these benefits while still receiving financial support from family members.

A special needs trust is a type of trust that is specifically designed to hold assets for the benefit of an individual with special needs. The trust is typically funded with assets from family members or other sources, and is managed by a trustee who is responsible for making decisions about how the assets are used.

A wills and trusts attorney can help create a special needs trust that is tailored to the specific needs of the individual. They can also help ensure that the trust is properly funded and managed, and that the individual’s needs are being met.

In addition to creating a special needs trust, a wills and trusts attorney can also help with other aspects of special needs planning, such as creating a letter of intent and developing a care plan. A letter of intent is a document that outlines the individual’s needs and preferences, and provides guidance for caregivers and other decision-makers. A care plan is a document that outlines the individual’s medical and personal needs, and provides guidance for caregivers and other decision-makers.

Overall, a wills and trusts attorney near me can play a critical role in helping families with special needs plan for the future. By creating a special needs trust and developing a comprehensive care plan, families can ensure that their loved one is protected and provided for, both now and in the future.

Protecting Your Legacy with a Comprehensive Estate Plan

A comprehensive estate plan is essential for protecting your legacy and ensuring that your wishes are carried out after your passing. A wills and trusts attorney near me can help you create a comprehensive estate plan that meets your unique needs and goals.

A comprehensive estate plan should include a will, a trust, and other documents that outline your wishes for the distribution of your assets, the care of your loved ones, and the management of your estate. A wills and trusts attorney can help you create these documents and ensure that they are properly executed and funded.

In addition to creating a comprehensive estate plan, a wills and trusts attorney can also help you with other aspects of estate planning, such as probate, guardianship, and elder law. They can also provide guidance on how to avoid common mistakes and pitfalls in estate planning, and how to ensure that your estate plan is up-to-date and effective.

By working with a wills and trusts attorney near me, you can ensure that your legacy is protected and that your wishes are carried out after your passing. A comprehensive estate plan can provide peace of mind and ensure that your loved ones are taken care of, even after you’re gone.

A wills and trusts attorney can also help you with special needs planning, which is an important aspect of estate planning for families with loved ones who have special needs. They can help you create a special needs trust and develop a care plan that ensures the well-being and protection of your loved one.

Overall, a comprehensive estate plan is essential for protecting your legacy and ensuring that your wishes are carried out after your passing. A wills and trusts attorney near me can help you create a comprehensive estate plan that meets your unique needs and goals, and provides peace of mind for you and your loved ones.