What Makes a Good Investment App?

When it comes to investing, having the right tools can make all the difference. A good investment app should provide a user-friendly interface, low fees, and diverse investment options. These features can help investors make informed decisions, manage their portfolios effectively, and achieve their financial goals. Stash, a popular mobile investment app, is a great example of an app that offers these benefits. But what exactly makes an investment app like Stash a good choice for investors?

A user-friendly interface is essential for any investment app. It should be easy to navigate, even for those who are new to investing. The app should also provide clear and concise information about investment options, fees, and risks. This can help investors make informed decisions and avoid costly mistakes. Additionally, a good investment app should offer low fees, as high fees can eat into investment returns and reduce overall profitability.

Diverse investment options are also crucial for a good investment app. Investors should have access to a range of assets, including stocks, bonds, ETFs, and mutual funds. This can help them create a diversified portfolio, which can reduce risk and increase potential returns. Furthermore, a good investment app should provide educational resources and tools to help investors learn about investing and make informed decisions.

Stash, for example, offers a range of investment options, including ETFs and stocks. It also provides educational resources, such as articles and videos, to help investors learn about investing. Additionally, Stash has a user-friendly interface and low fees, making it a popular choice among investors. But is Stash a good app for everyone? In the next section, we’ll explore how to choose the right investment app for your needs.

How to Choose the Right Investment App for Your Needs

With so many investment apps available, choosing the right one can be overwhelming. To make an informed decision, it’s essential to consider your financial goals, risk tolerance, and investment preferences. Here are some tips to help you select the best investment app for your needs.

First, research the fees associated with each app. Look for apps with low or no management fees, as these can eat into your investment returns. Also, consider the types of investments offered by each app. If you’re interested in investing in stocks, look for an app that offers a wide range of stock options. If you’re interested in ETFs or mutual funds, look for an app that offers a diverse selection of these investment types.

Next, evaluate the customer support offered by each app. Look for apps with 24/7 customer support, as well as online resources and educational materials. This can help you get started with investing and answer any questions you may have along the way. Additionally, consider the app’s user interface and ease of use. If you’re new to investing, look for an app with a user-friendly interface that makes it easy to navigate and make investment decisions.

Another important factor to consider is the app’s security and safety features. Look for apps that are registered with the Securities and Exchange Commission (SEC) and use encryption technology to protect your personal and financial information. This can give you peace of mind and help you feel confident in your investment decisions.

Finally, read reviews and do your research. Look for apps with high ratings and positive reviews from other users. Also, research the app’s investment philosophy and approach to investing. This can help you determine if the app is a good fit for your investment goals and risk tolerance.

By considering these factors, you can make an informed decision and choose the right investment app for your needs. Whether you’re a seasoned investor or just starting out, the right app can help you achieve your financial goals and make investing easier and more accessible. Is Stash a good app for you? In the next section, we’ll take a closer look at the Stash app and its features.

Stash App Review: Pros and Cons

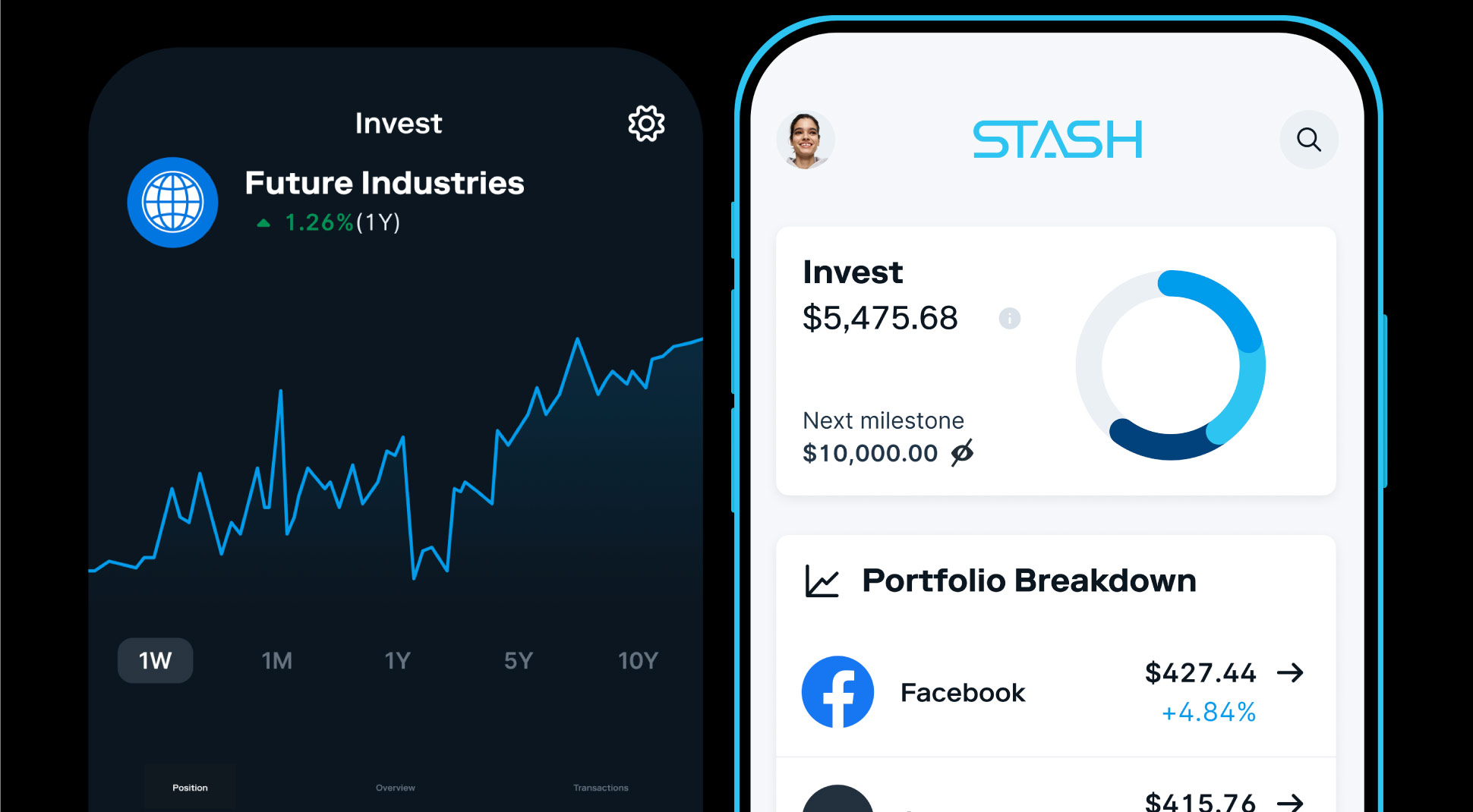

Stash is a popular mobile investment app that has gained a reputation for its ease of use and low fees. But is Stash a good app for you? In this review, we’ll take a closer look at the app’s benefits and drawbacks to help you decide.

One of the biggest advantages of Stash is its user-friendly interface. The app is easy to navigate, even for those who are new to investing. Stash also offers a range of investment options, including ETFs and stocks, which can help you diversify your portfolio. Additionally, the app has low fees, with no management fees for accounts under $1,000.

Another benefit of Stash is its educational resources. The app offers a range of articles, videos, and tutorials that can help you learn about investing and make informed decisions. Stash also has a community feature that allows you to connect with other investors and get tips and advice.

However, Stash also has some drawbacks. One of the biggest limitations of the app is its limited investment options. While Stash offers a range of ETFs and stocks, it doesn’t offer as many options as some other investment apps. Additionally, the app’s investment philosophy is focused on long-term investing, which may not be suitable for everyone.

Another potential drawback of Stash is its customer support. While the app has a comprehensive FAQ section and online resources, some users have reported difficulty in getting help from the customer support team.

Overall, Stash is a solid investment app that offers a range of benefits, including ease of use, low fees, and educational resources. However, it may not be the best app for everyone, particularly those who are looking for more investment options or more comprehensive customer support. Is Stash a good app for beginners? In the next section, we’ll take a closer look at the app’s suitability for new investors.

Stash vs. Other Investment Apps: A Comparison

Stash is just one of many investment apps available in the market. To help you make an informed decision, we’ll compare Stash to other popular investment apps, including Acorns and Robinhood. In this comparison, we’ll discuss the similarities and differences between these apps in terms of fees, investment options, and features.

One of the main differences between Stash and Acorns is their investment approach. Stash allows users to invest in a range of ETFs and stocks, while Acorns focuses on micro-investing, allowing users to invest small amounts of money into a diversified portfolio. Robinhood, on the other hand, is a brokerage app that allows users to buy and sell stocks, ETFs, and options without any commission fees.

In terms of fees, Stash has a flat monthly fee of $1 for accounts under $1,000, while Acorns charges a flat monthly fee of $1 for accounts under $1,000. Robinhood, on the other hand, has no management fees or commission fees for trading stocks, ETFs, and options.

Another key difference between these apps is their investment options. Stash offers a range of ETFs and stocks, while Acorns offers a limited selection of ETFs. Robinhood, on the other hand, offers a wide range of stocks, ETFs, and options.

In terms of features, Stash has a user-friendly interface and educational resources, while Acorns has a simple and easy-to-use interface. Robinhood, on the other hand, has a more advanced trading platform with features such as real-time market data and technical analysis tools.

So, which app is right for you? If you’re looking for a user-friendly interface and educational resources, Stash may be a good choice. If you’re looking for a micro-investing app with a simple and easy-to-use interface, Acorns may be a good choice. If you’re looking for a brokerage app with advanced trading features and no commission fees, Robinhood may be a good choice.

Ultimately, the best investment app for you will depend on your individual needs and goals. Is Stash a good app for beginners? In the next section, we’ll take a closer look at the app’s suitability for new investors.

Is Stash a Good App for Beginners?

Stash is a popular investment app that is designed to be user-friendly and accessible to beginners. But is Stash a good app for those who are new to investing? In this section, we’ll take a closer look at the app’s suitability for beginners.

One of the main advantages of Stash is its user-friendly interface. The app is easy to navigate, even for those who are new to investing. Stash also offers a range of educational resources, including articles, videos, and tutorials, that can help beginners learn about investing and make informed decisions.

Another benefit of Stash is its low fees. The app has a flat monthly fee of $1 for accounts under $1,000, which makes it an affordable option for beginners. Additionally, Stash offers a range of investment options, including ETFs and stocks, which can help beginners diversify their portfolios.

However, Stash may not be the best app for beginners who are looking for a more comprehensive investment platform. The app’s investment options are limited compared to other investment apps, and it may not offer the same level of customization and control as other apps.

Despite these limitations, Stash is still a good app for beginners who are looking for a user-friendly and affordable investment platform. Here are some tips for new investors on how to get started with Stash:

First, download the Stash app and create an account. You’ll need to provide some basic information, such as your name and address, and fund your account with a minimum of $5.

Next, explore the app’s investment options and choose the ones that align with your financial goals and risk tolerance. Stash offers a range of ETFs and stocks, including index funds and sector-specific funds.

Finally, set up a regular investment schedule and start investing. Stash allows you to invest as little as $5 per month, making it easy to get started with investing.

Overall, Stash is a good app for beginners who are looking for a user-friendly and affordable investment platform. While it may not offer the same level of customization and control as other apps, it is a great option for those who are new to investing and want to get started with a simple and easy-to-use platform.

Stash App Security and Safety Features

When it comes to investing, security and safety are top priorities. Stash takes the security of its users’ accounts and investments very seriously, and has implemented a range of measures to protect them. In this section, we’ll take a closer look at the security and safety features of the Stash app.

First and foremost, Stash is registered with the Securities and Exchange Commission (SEC), which means that it is subject to regular audits and inspections to ensure that it is operating in compliance with securities laws and regulations. This provides an added layer of protection for users, as it ensures that Stash is being held to high standards of accountability and transparency.

In addition to its registration with the SEC, Stash also uses encryption technology to protect users’ personal and financial information. This means that all data transmitted between the user’s device and the Stash servers is encrypted, making it virtually impossible for hackers to intercept and access.

Stash also has a range of other security measures in place, including two-factor authentication, which requires users to enter a code sent to their phone or email in addition to their password. This adds an extra layer of security to the login process, making it much harder for hackers to gain unauthorized access to users’ accounts.

Furthermore, Stash has a team of experienced security professionals who monitor the app and its systems 24/7, looking for any potential security threats or vulnerabilities. This means that users can have confidence that their accounts and investments are being protected by a team of experts who are dedicated to keeping them safe.

Overall, Stash has a strong track record when it comes to security and safety. The app’s registration with the SEC, use of encryption technology, and range of other security measures all contribute to a safe and secure investing experience for users. Is Stash a good app for you? In the next section, we’ll evaluate the quality of Stash’s customer support and community features.

Stash Customer Support and Community

When it comes to investing, having access to quality customer support and a supportive community can make all the difference. Stash understands this, and has put in place a range of resources to help users get the most out of the app. In this section, we’ll take a closer look at the quality of Stash’s customer support and community features.

Stash offers a comprehensive online resource center, which includes a range of articles, videos, and tutorials that cover everything from investing basics to advanced strategies. This is a great resource for users who are new to investing, or who want to learn more about specific investment options.

In addition to its online resources, Stash also has a customer service team that is available to answer questions and provide support via phone, email, or live chat. This team is available 24/7, which means that users can get help whenever they need it.

Stash also has a strong social media presence, with active accounts on Twitter, Facebook, and Instagram. This is a great way for users to connect with the Stash community, ask questions, and get updates on new features and investment options.

Furthermore, Stash has a community forum where users can connect with each other, ask questions, and share their experiences. This is a great way for users to learn from each other, and to get support and guidance from more experienced investors.

Overall, Stash has a strong commitment to customer support and community engagement. The app’s online resources, customer service team, and social media presence all contribute to a supportive and inclusive community that helps users achieve their investment goals. Is Stash a good investment app for you? In the next section, we’ll summarize the key points discussed in the article and provide a final verdict.

Conclusion: Is Stash a Good Investment App for You?

In conclusion, Stash is a solid investment app that offers a range of benefits, including a user-friendly interface, low fees, and diverse investment options. While it may not be the best app for everyone, particularly those who are looking for more advanced investment features, it is a great option for beginners and those who want to start investing with a simple and easy-to-use platform.

Throughout this article, we have discussed the key features of a good investment app, including user-friendly interface, low fees, and diverse investment options. We have also reviewed the Stash app, highlighting its benefits and drawbacks, and compared it to other popular investment apps.

Ultimately, whether or not Stash is a good investment app for you will depend on your individual needs and goals. If you are looking for a simple and easy-to-use platform that offers a range of investment options and low fees, then Stash may be a good choice. However, if you are looking for more advanced investment features or a wider range of investment options, then you may want to consider other apps.

We encourage readers to try out the Stash app and start investing today. With its user-friendly interface and low fees, it is a great way to get started with investing and start building your wealth. Remember, investing is a long-term game, and it’s never too early or too late to start.

So, is Stash a good app? We believe that it is a solid option for those who are looking for a simple and easy-to-use investment platform. However, it’s always important to do your own research and consider your own needs and goals before making any investment decisions.