What Makes a Good Bank: Key Features to Consider

When evaluating a digital bank, there are several key features to consider. A good bank should offer a range of services that cater to your financial needs, while also providing a secure and user-friendly experience. Some essential features to look for in a digital bank include mobile banking, fee-free services, and customer support.

Mobile banking is a crucial aspect of modern banking, allowing you to manage your finances on-the-go. A good digital bank should have a mobile app that is easy to use, secure, and feature-rich. Look for an app that allows you to check your account balances, transfer funds, and pay bills with ease.

Fee-free services are another important consideration. Many traditional banks charge a range of fees, including maintenance fees, overdraft fees, and ATM fees. A good digital bank should offer fee-free services, or at least minimize the number of fees you need to pay.

Customer support is also vital. A good digital bank should offer 24/7 customer support, either through phone, email, or live chat. This ensures that you can get help whenever you need it, without having to wait for business hours.

When considering a digital bank like Chime, it’s essential to evaluate these key features. Is Chime a good bank? To answer this question, we need to examine its features, fees, and services in more detail. By doing so, we can determine whether Chime is a good fit for your financial needs.

In addition to these key features, a good digital bank should also offer a range of other services, such as direct deposit, early payment options, and budgeting tools. These services can help you manage your finances more effectively, and achieve your financial goals.

Ultimately, the best digital bank for you will depend on your individual needs and preferences. By considering the key features outlined above, you can make an informed decision about whether Chime is a good bank for you.

How to Evaluate a Digital Bank’s Reliability and Security

Evaluating a digital bank’s reliability and security is crucial before making a decision about whether to use their services. With the rise of online banking, it’s essential to ensure that your financial information is protected and that the bank is trustworthy.

One way to assess a digital bank’s reliability is to check if they have FDIC insurance. The FDIC (Federal Deposit Insurance Corporation) provides insurance coverage for deposits up to $250,000, which means that your money is protected in case the bank fails. Chime, for example, is a member of the FDIC, which provides an added layer of security for its customers.

Another way to evaluate a digital bank’s reliability is to read reviews from other customers. Look for reviews on independent websites, such as Trustpilot or Consumer Reports, to get a sense of the bank’s reputation and customer satisfaction. Pay attention to common complaints or praises, and see if the bank has responded to customer concerns.

It’s also essential to evaluate a digital bank’s website and mobile app. Look for features such as two-factor authentication, encryption, and secure login processes. A good digital bank should have a user-friendly website and mobile app that is easy to navigate and provides clear information about their services and fees.

When evaluating Chime’s reliability and security, it’s essential to consider these factors. Is Chime a good bank? By assessing their FDIC insurance, customer reviews, and website and mobile app security, you can make an informed decision about whether Chime is a reliable and secure digital bank.

In addition to these factors, it’s also important to consider the bank’s transparency and communication. A good digital bank should be transparent about their fees, services, and security measures. They should also have a clear and responsive customer support team that can address any concerns or questions you may have.

By taking the time to evaluate a digital bank’s reliability and security, you can ensure that your financial information is protected and that you’re making an informed decision about your banking needs.

Chime Bank Review: Features, Fees, and Services

Chime Bank is a digital bank that offers a range of features, fees, and services to its customers. In this review, we’ll take a closer look at what Chime has to offer and how it compares to other digital banks.

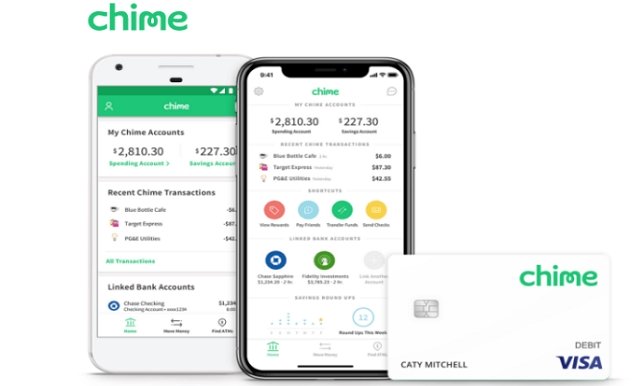

One of the standout features of Chime is its mobile banking app. The app is user-friendly and allows customers to manage their accounts, transfer funds, and pay bills on the go. Chime also offers a feature called “SpotMe,” which allows customers to overdraft up to $200 without incurring fees.

Chime also offers direct deposit, which allows customers to receive their paychecks up to two days earlier than traditional banks. Additionally, Chime offers early payment options, which allow customers to receive their paychecks up to two days earlier than traditional banks.

In terms of fees, Chime is generally fee-free. There are no monthly maintenance fees, no overdraft fees, and no foreign transaction fees. However, Chime does charge a fee for using out-of-network ATMs.

Chime also offers a range of services, including budgeting tools and financial education resources. The bank’s website and mobile app are also user-friendly and easy to navigate.

So, is Chime a good bank? Based on its features, fees, and services, Chime appears to be a solid option for those looking for a digital bank. However, as with any bank, it’s essential to do your research and read reviews from other customers before making a decision.

Overall, Chime’s features, fees, and services make it an attractive option for those looking for a digital bank. Its mobile banking app is user-friendly, and its fee-free structure is a significant advantage. However, as with any bank, it’s essential to weigh the pros and cons before making a decision.

Chime vs. Traditional Banks: A Comparison of Services and Fees

When considering whether Chime is a good bank, it’s essential to compare its services and fees to those of traditional banks. While Chime’s digital-only approach offers several benefits, it also has some drawbacks. In this section, we’ll delve into the key differences between Chime and traditional banks, helping you decide which option is best for your needs.

One of the primary advantages of Chime is its lack of fees. Unlike traditional banks, Chime doesn’t charge monthly maintenance fees, overdraft fees, or foreign transaction fees. This can result in significant savings, especially for those who frequently use their debit cards or travel abroad. However, traditional banks often offer more extensive branch and ATM networks, which may be a consideration for those who prefer in-person banking or need to deposit cash frequently.

In terms of services, Chime offers a range of features that are comparable to those of traditional banks. Its mobile banking app allows users to manage their accounts, pay bills, and transfer funds with ease. Chime also offers direct deposit, early payment options, and a Visa debit card. However, traditional banks often provide more comprehensive services, such as investment products, loans, and credit cards.

Another key difference between Chime and traditional banks is their approach to customer support. Chime offers 24/7 customer support through its mobile app and website, but it doesn’t have physical branches. Traditional banks, on the other hand, often have extensive branch networks and offer more personalized support. However, this comes at a cost, as traditional banks often charge higher fees to maintain their branch networks.

Ultimately, whether Chime is a good bank for you depends on your individual needs and preferences. If you’re looking for a low-fee, digital-only banking experience with a user-friendly mobile app, Chime may be an excellent choice. However, if you prefer in-person banking or need access to a broader range of services, a traditional bank may be a better fit.

When deciding between Chime and a traditional bank, consider the following factors: your financial goals, banking habits, and personal preferences. If you’re comfortable with digital banking and want to avoid fees, Chime may be an excellent option. However, if you value in-person support and a broader range of services, a traditional bank may be a better choice. By weighing the pros and cons of each option, you can make an informed decision about which bank is best for you.

Chime Customer Reviews: What Real Users Say About Their Experience

To gain a better understanding of whether Chime is a good bank, it’s essential to examine real customer reviews. By analyzing the experiences of existing customers, you can get a sense of the bank’s strengths and weaknesses. In this section, we’ll share a balanced view of Chime customer reviews, highlighting both positive and negative experiences.

Positive reviews of Chime often praise the bank’s user-friendly mobile app, fee-free services, and excellent customer support. Many customers appreciate the ability to manage their accounts, pay bills, and transfer funds with ease. Chime’s early payment options and direct deposit features are also frequently praised. Customers have reported receiving their paychecks up to two days earlier than expected, which can be a significant advantage for those living paycheck to paycheck.

However, not all Chime customer reviews are positive. Some customers have reported issues with the bank’s customer support, citing long wait times and unhelpful representatives. Others have experienced problems with the mobile app, including glitches and errors. A few customers have also reported difficulties with the bank’s overdraft protection, which can result in unexpected fees.

Common praises about Chime include its ease of use, low fees, and excellent mobile app. Many customers appreciate the bank’s transparent fee structure and lack of surprise charges. Chime’s customer support is also frequently praised, with many customers reporting helpful and responsive representatives.

Common complaints about Chime include issues with customer support, problems with the mobile app, and difficulties with overdraft protection. Some customers have also reported frustration with the bank’s limited branch and ATM network, which can make it difficult to deposit cash or access funds in person.

Overall, Chime customer reviews suggest that the bank is a good option for those who value convenience, low fees, and excellent customer support. However, the bank may not be the best choice for those who require in-person banking or have complex financial needs. By weighing the pros and cons of Chime, you can make an informed decision about whether it’s the right bank for you.

When evaluating Chime customer reviews, it’s essential to consider the source and credibility of the reviews. Look for reviews from reputable sources, such as Trustpilot or Consumer Reports, and pay attention to the overall rating and number of reviews. By doing your research and reading a balanced view of customer reviews, you can gain a better understanding of whether Chime is a good bank for your needs.

Chime’s Mobile Banking App: A Review of Its Features and User Experience

Chime’s mobile banking app is a crucial component of its overall banking experience. In this section, we’ll review the app’s features, user interface, and overall user experience. By examining the app’s strengths and weaknesses, you can gain a better understanding of whether Chime is a good bank for your needs.

The Chime mobile banking app is available for both iOS and Android devices and offers a range of features that make it easy to manage your accounts on the go. The app allows you to check your account balances, view transaction history, and transfer funds between accounts. You can also use the app to pay bills, deposit checks, and send money to friends and family.

One of the standout features of the Chime app is its user-friendly interface. The app is easy to navigate, with clear and concise menus that make it simple to find the features you need. The app also offers a range of customization options, allowing you to personalize your experience and make the app your own.

In terms of user experience, the Chime app is generally well-regarded by customers. The app is fast and responsive, with quick loading times and minimal lag. The app also offers a range of security features, including two-factor authentication and encryption, to help protect your accounts and personal data.

However, some customers have reported issues with the app’s functionality, including glitches and errors. Some users have also reported difficulty with the app’s navigation, citing confusing menus and unclear instructions. Despite these issues, the Chime app remains one of the top-rated mobile banking apps on the market.

Overall, the Chime mobile banking app is a solid choice for anyone looking for a user-friendly and feature-rich banking experience. While the app may have some minor issues, its strengths far outweigh its weaknesses. By offering a range of features and a user-friendly interface, the Chime app makes it easy to manage your accounts on the go.

When evaluating the Chime app, it’s essential to consider your individual needs and preferences. If you’re looking for a mobile banking app that offers a range of features and a user-friendly interface, the Chime app may be an excellent choice. However, if you’re looking for an app with more advanced features or a more comprehensive banking experience, you may want to consider other options.

Ultimately, the Chime mobile banking app is a key component of the bank’s overall banking experience. By offering a range of features and a user-friendly interface, the app makes it easy to manage your accounts on the go. Whether you’re looking for a simple and straightforward banking experience or a more comprehensive and feature-rich experience, the Chime app is definitely worth considering.

Is Chime a Good Bank for You? A Decision-Making Guide

When considering whether Chime is a good bank for your needs, there are several factors to consider. In this section, we’ll provide a decision-making guide to help you determine if Chime is the right bank for you. By evaluating your financial goals, banking habits, and personal preferences, you can make an informed decision about whether Chime is a good fit.

First, consider your financial goals. Are you looking for a bank that can help you save money, pay off debt, or build credit? Chime offers a range of features that can help you achieve these goals, including a savings account with no fees or minimums, a credit builder loan, and a secured credit card. If you’re looking for a bank that can help you manage your finances and achieve your financial goals, Chime may be a good choice.

Next, consider your banking habits. Do you prefer to bank online or in person? Chime is a digital-only bank, which means that you’ll need to be comfortable with online banking and mobile banking apps. If you prefer to bank in person, you may want to consider a traditional bank with physical branches. However, if you’re comfortable with online banking, Chime’s mobile banking app is highly rated and offers a range of features that make it easy to manage your accounts on the go.

Finally, consider your personal preferences. Are you looking for a bank with a strong customer support team? Chime offers 24/7 customer support, which means that you can get help whenever you need it. If you’re looking for a bank with a user-friendly interface, Chime’s mobile banking app is highly rated and offers a range of features that make it easy to navigate.

By evaluating your financial goals, banking habits, and personal preferences, you can determine if Chime is a good bank for your needs. If you’re looking for a bank that can help you manage your finances, achieve your financial goals, and offer a range of features that make it easy to bank online, Chime may be a good choice. However, if you prefer to bank in person or have complex financial needs, you may want to consider a traditional bank.

Ultimately, the decision of whether Chime is a good bank for you depends on your individual needs and preferences. By considering your financial goals, banking habits, and personal preferences, you can make an informed decision about whether Chime is a good fit. If you’re looking for a bank that can help you manage your finances and achieve your financial goals, Chime is definitely worth considering.

When evaluating Chime, it’s also important to consider the pros and cons of the bank. Some of the pros of Chime include its fee-free services, user-friendly interface, and excellent customer support. However, some of the cons of Chime include its limited branch and ATM network, which can make it difficult to deposit cash or access funds in person.

By weighing the pros and cons of Chime, you can make an informed decision about whether it’s a good bank for your needs. If you’re looking for a bank that can help you manage your finances and achieve your financial goals, Chime is definitely worth considering. However, if you prefer to bank in person or have complex financial needs, you may want to consider a traditional bank.

Conclusion: Weighing the Pros and Cons of Chime Bank

After conducting a comprehensive review of Chime Bank, it’s clear that the bank offers a range of benefits and drawbacks. On the one hand, Chime’s fee-free services, user-friendly mobile banking app, and excellent customer support make it an attractive option for those looking for a hassle-free banking experience. Additionally, Chime’s digital-only approach allows it to offer lower fees and higher interest rates than traditional banks.

On the other hand, Chime’s limited branch and ATM network may be a drawback for those who prefer to bank in person or need to deposit cash frequently. Additionally, some customers have reported issues with Chime’s customer support and mobile banking app, which can be frustrating for those who rely on these services.

So, is Chime a good bank? The answer depends on your individual needs and preferences. If you’re looking for a bank that offers fee-free services, a user-friendly mobile banking app, and excellent customer support, Chime may be a good choice. However, if you prefer to bank in person or need to deposit cash frequently, you may want to consider a traditional bank.

Ultimately, the decision of whether Chime is a good bank for you depends on your financial goals, banking habits, and personal preferences. By weighing the pros and cons of Chime and considering your individual needs, you can make an informed decision about whether Chime is the right bank for you.

In conclusion, Chime Bank is a solid option for those looking for a hassle-free banking experience. While it may not be the best choice for everyone, its fee-free services, user-friendly mobile banking app, and excellent customer support make it an attractive option for many. By considering the pros and cons of Chime and weighing your individual needs, you can make an informed decision about whether Chime is a good bank for you.

As you consider whether Chime is a good bank for your needs, remember to evaluate your financial goals, banking habits, and personal preferences. By doing so, you can make an informed decision about whether Chime is the right bank for you. With its fee-free services, user-friendly mobile banking app, and excellent customer support, Chime is definitely worth considering.