Understanding the Risks of Credit Card Fraud

Credit card fraud is a growing concern for individuals and businesses alike. According to recent statistics, credit card fraud accounts for a significant portion of identity theft cases. When a credit card is stolen or compromised, the thief can use it to make unauthorized purchases, leading to financial losses and damage to the cardholder’s credit score. One way to help prevent credit card fraud is to sign the back of the card. But should you sign your credit card? In this article, we will explore the risks of credit card fraud and the importance of signing your credit card.

When a credit card is not signed, it can be easier for thieves to use it to make purchases. Merchants are less likely to verify the cardholder’s identity, and the thief can simply use the card to make a purchase without being detected. By signing the back of the card, the cardholder can help prevent this type of fraud. The signature serves as a form of verification, making it more difficult for thieves to use the card.

In addition to signing the back of the card, there are other ways to help prevent credit card fraud. Cardholders should regularly monitor their account activity, reporting any suspicious transactions to the bank immediately. Keeping the card information confidential and avoiding phishing scams can also help prevent credit card fraud. By taking these precautions, cardholders can help protect themselves from financial losses and damage to their credit score.

While signing the back of the credit card is an important step in preventing fraud, it is not the only solution. Cardholders should also be aware of the risks of credit card skimming and phishing scams. Credit card skimming occurs when a thief attaches a device to an ATM or credit card terminal to capture the card information. Phishing scams involve thieves sending emails or messages that appear to be from the bank, asking the cardholder to provide sensitive information. By being aware of these risks, cardholders can take steps to protect themselves and their financial information.

How to Minimize Your Risk of Credit Card Fraud

Minimizing the risk of credit card fraud requires a combination of common sense, vigilance, and proactive measures. One of the most effective ways to reduce the risk of credit card fraud is to monitor your account activity regularly. This can be done by checking your online account statements, mobile banking app, or by contacting your bank’s customer service. By regularly monitoring your account activity, you can quickly identify any suspicious transactions and report them to your bank.

Another important step in minimizing the risk of credit card fraud is to report suspicious transactions immediately. If you notice any transactions that you did not authorize, contact your bank’s customer service right away. They can help you to cancel the transaction, block your card, and prevent any further unauthorized activity. It’s also essential to keep your card information confidential and avoid sharing it with anyone, including friends and family members.

In addition to monitoring your account activity and reporting suspicious transactions, there are several other steps you can take to minimize your risk of credit card fraud. These include avoiding phishing scams, using secure online payment systems, and keeping your card information up to date. By taking these proactive measures, you can significantly reduce your risk of credit card fraud and protect your financial security.

When it comes to online transactions, it’s essential to use secure payment systems, such as those that use encryption and two-factor authentication. Avoid using public computers or public Wi-Fi to make online transactions, as these can be vulnerable to hacking and other forms of cybercrime. Instead, use a secure computer or mobile device, and make sure that your internet connection is secure.

Finally, it’s crucial to keep your card information up to date, including your address, phone number, and email address. This will help your bank to contact you quickly in the event of any suspicious activity, and prevent any unauthorized transactions from being processed. By taking these simple steps, you can minimize your risk of credit card fraud and protect your financial security.

The Importance of Signing Your Credit Card

Signing your credit card is an important step in protecting your identity and preventing credit card fraud. When you sign your credit card, you are providing a unique identifier that can be used to verify your identity and prevent unauthorized transactions. This signature serves as a form of authentication, making it more difficult for thieves to use your card.

One of the main benefits of signing your credit card is that it can help prevent unauthorized transactions. When a merchant verifies the signature on the back of the card, they can ensure that the card is being used by the authorized cardholder. This can help prevent thieves from using your card to make purchases or withdraw cash.

In addition to preventing unauthorized transactions, signing your credit card can also help protect your account from fraud. If your card is lost or stolen, a thief may try to use it to make purchases or withdraw cash. However, if the card is signed, the merchant can verify the signature and prevent the transaction from being processed.

It’s also worth noting that signing your credit card can help you avoid liability for unauthorized transactions. Under the Fair Credit Billing Act, cardholders are not liable for unauthorized transactions if they can prove that they did not authorize the transaction. By signing your credit card, you can provide evidence that you did not authorize the transaction, which can help you avoid liability.

While signing your credit card is an important step in protecting your identity and preventing credit card fraud, it’s not the only solution. Cardholders should also take other steps to protect themselves, such as monitoring their account activity, reporting suspicious transactions, and keeping their card information confidential. By taking these proactive measures, cardholders can minimize their risk of credit card fraud and protect their financial security.

What to Do If You’re a Victim of Credit Card Fraud

If you’re a victim of credit card fraud, it’s essential to act quickly to minimize the damage. The first step is to report the incident to your bank or credit card issuer immediately. You can do this by calling the phone number on the back of your card or by visiting the bank’s website. Be prepared to provide as much information as possible about the fraudulent transaction, including the date, time, and amount of the transaction.

Once you’ve reported the incident, your bank or credit card issuer will likely cancel your card and issue a new one. You may also be asked to provide a statement or affidavit to confirm that you did not authorize the transaction. It’s essential to cooperate fully with the bank’s investigation to ensure that the perpetrator is caught and brought to justice.

In addition to reporting the incident to your bank, you should also monitor your credit report to ensure that no further unauthorized transactions have been made. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. Review your report carefully to ensure that all the information is accurate and up to date.

If you’re a victim of credit card fraud, you may also want to consider placing a fraud alert on your credit report. This will notify lenders and creditors that you’ve been a victim of identity theft and may help prevent further unauthorized transactions. You can place a fraud alert on your credit report by contacting one of the three major credit reporting agencies.

Finally, it’s essential to take steps to prevent future incidents of credit card fraud. This may include signing your credit card, monitoring your account activity regularly, and keeping your card information confidential. By taking these proactive measures, you can minimize your risk of credit card fraud and protect your financial security.

Alternatives to Signing Your Credit Card

While signing your credit card is an important step in protecting your identity and preventing credit card fraud, there are alternative methods that can provide similar protection. One such alternative is using a PIN (Personal Identification Number) to authenticate transactions. A PIN is a unique code that is entered by the cardholder to verify their identity and authorize transactions.

Another alternative to signing your credit card is biometric authentication, such as fingerprint or facial recognition. This method uses unique physical characteristics to verify the cardholder’s identity and authorize transactions. Biometric authentication is considered to be more secure than traditional signature-based authentication, as it is more difficult for thieves to replicate or steal.

Both PIN and biometric authentication have their pros and cons. PIN authentication is widely accepted and easy to use, but it can be vulnerable to phishing scams and other forms of cybercrime. Biometric authentication, on the other hand, is more secure, but it can be more expensive to implement and may require specialized equipment.

When considering alternative methods to signing your credit card, it’s essential to weigh the pros and cons and choose the method that best suits your needs. If you’re looking for a more secure method of authentication, biometric authentication may be the better choice. However, if you’re looking for a more convenient and widely accepted method, PIN authentication may be the better choice.

Ultimately, the decision to sign your credit card or use an alternative method of authentication depends on your individual needs and preferences. By understanding the pros and cons of each method, you can make an informed decision and choose the method that best protects your identity and prevents credit card fraud.

Best Practices for Credit Card Security

To protect your credit card and identity, it’s essential to follow best practices for credit card security. One of the most important practices is to keep your card information safe. This includes not sharing your card number, expiration date, or security code with anyone, and not storing this information in an insecure location.

Another best practice is to avoid phishing scams. Phishing scams involve scammers sending emails or messages that appear to be from your bank or credit card issuer, asking you to provide sensitive information. To avoid these scams, never provide sensitive information in response to an unsolicited email or message, and always verify the authenticity of the request before responding.

Using secure online payment systems is also crucial for credit card security. When making online purchases, look for websites that use HTTPS (Hypertext Transfer Protocol Secure) and have a lock icon in the address bar. This indicates that the website is secure and that your information will be encrypted.

In addition to these best practices, it’s also essential to regularly monitor your account activity and credit report. This can help you detect any suspicious transactions or changes to your credit report, and take action to prevent further fraud.

Finally, consider using a credit card with advanced security features, such as chip technology and zero-liability protection. These features can provide an additional layer of protection against credit card fraud and help minimize your risk of financial loss.

By following these best practices for credit card security, you can help protect your credit card and identity, and minimize your risk of credit card fraud. Remember to always be vigilant and take proactive steps to protect your financial security.

How to Choose a Secure Credit Card

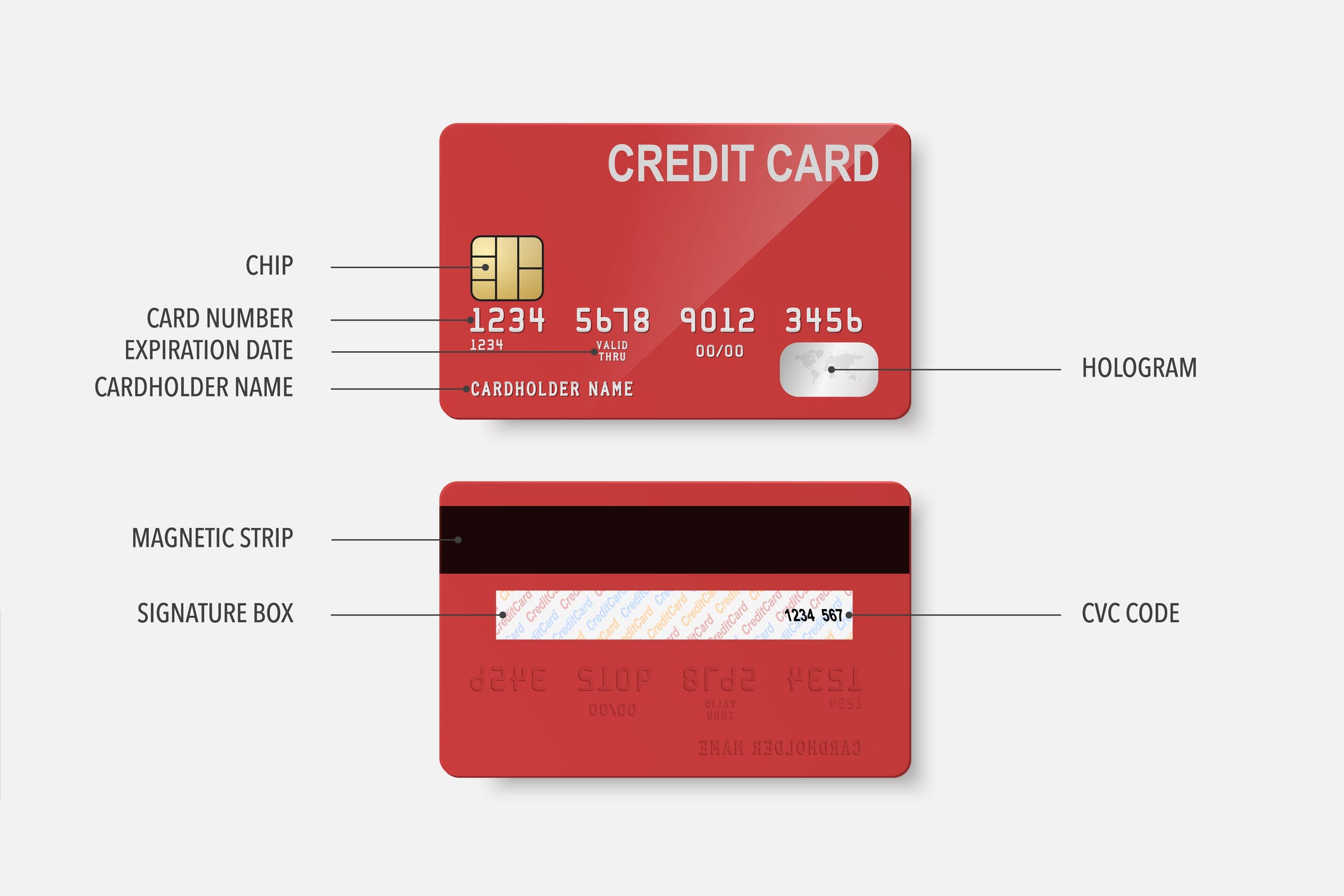

When choosing a credit card, it’s essential to consider the security features that are included. One of the most important features to look for is chip technology. Chip technology uses a small microchip to store and process data, making it more difficult for thieves to access your information.

Another important feature to look for is zero-liability protection. This means that if your card is lost or stolen, you will not be held liable for any unauthorized transactions. This can provide peace of mind and help minimize your risk of financial loss.

Credit monitoring is also an important feature to consider. This allows you to keep track of your credit report and detect any suspicious activity. Many credit cards offer free credit monitoring, so be sure to look for this feature when choosing a card.

In addition to these features, it’s also essential to consider the credit card issuer’s reputation and security record. Look for issuers that have a strong reputation for security and have implemented robust security measures to protect their customers’ information.

Finally, be sure to read the terms and conditions of the credit card agreement carefully. This will help you understand the security features that are included and any potential risks or liabilities associated with the card.

By considering these factors and choosing a secure credit card, you can help minimize your risk of credit card fraud and protect your financial security. Remember to always be vigilant and take proactive steps to protect your identity and credit card information.

Conclusion: Protecting Your Credit Card and Identity

In conclusion, protecting your credit card and identity is crucial in today’s digital age. By understanding the risks of credit card fraud and taking proactive steps to minimize your risk, you can help protect your financial security and prevent identity theft.

Signing your credit card is an important step in protecting your identity and preventing credit card fraud. However, it’s not the only solution. By following best practices for credit card security, such as monitoring your account activity, reporting suspicious transactions, and keeping your card information confidential, you can help minimize your risk of credit card fraud.

Additionally, considering alternative methods to signing your credit card, such as using a PIN or biometric authentication, can provide an additional layer of security. Choosing a secure credit card with features such as chip technology, zero-liability protection, and credit monitoring can also help protect your financial security.

Remember, protecting your credit card and identity requires ongoing vigilance and attention to detail. By staying informed and taking proactive steps to protect your financial security, you can help minimize your risk of credit card fraud and prevent identity theft.

So, should you sign your credit card? The answer is yes, but it’s not the only solution. By following best practices for credit card security and considering alternative methods to signing your credit card, you can help protect your financial security and prevent identity theft.