What is the S&P 500 Index Fund and Why Invest in It

The S&P 500 Index Fund is a type of investment vehicle that tracks the performance of the Standard & Poor’s 500 (S&P 500) stock market index. The S&P 500 is a widely followed index of the 500 largest publicly traded companies in the US, representing a broad range of industries and sectors. By investing in an S&P 500 Index Fund, individuals can gain exposure to the entire US stock market, providing a diversified portfolio and potentially reducing risk.

One of the primary benefits of investing in the S&P 500 Index Fund is its low costs. Unlike actively managed funds, which often have higher fees due to the need for a fund manager to actively select stocks, index funds like the S&P 500 Index Fund typically have lower expense ratios. This means that more of your investment goes towards the actual stocks, rather than towards management fees.

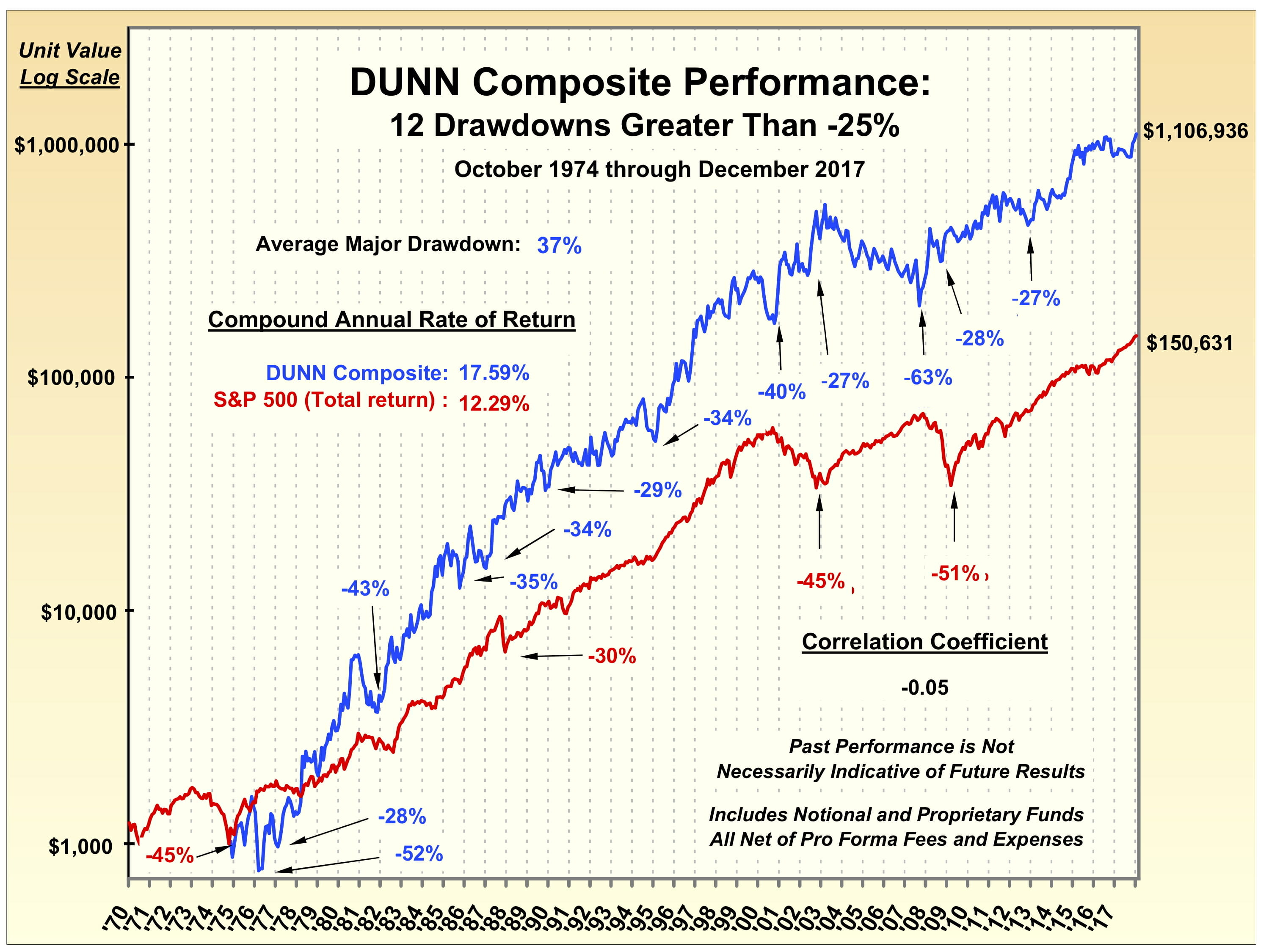

Another advantage of the S&P 500 Index Fund is its potential for long-term growth. Historically, the S&P 500 has provided strong returns over the long-term, making it a popular choice for investors seeking to grow their wealth over time. By investing in the S&P 500 Index Fund, individuals can potentially benefit from the growth of the US stock market, while also minimizing their risk through diversification.

For those looking to invest in the S&P 500 Index Fund, there are several options available. Investors can choose to buy S&P 500 Index Fund shares directly through a brokerage account or invest in a mutual fund or exchange-traded fund (ETF) that tracks the S&P 500. Some popular options include the Vanguard 500 Index Fund (VFIAX) and the Fidelity 500 Index Fund (FUSAEX).

When considering investing in the S&P 500 Index Fund, it’s essential to keep in mind that past performance is not a guarantee of future results. However, for those seeking a low-cost, diversified investment option with potential for long-term growth, the S&P 500 Index Fund is certainly worth considering.

How to Invest in the S&P 500 Index Fund for Long-Term Success

Investing in the S&P 500 Index Fund can be a straightforward process, but it requires some planning and research. To get started, follow these steps:

Step 1: Open a Brokerage Account

To buy S&P 500 Index Fund shares, you’ll need to open a brokerage account with a reputable online broker. Some popular options include Fidelity, Vanguard, and Charles Schwab. Compare fees, commissions, and services before choosing a broker.

Step 2: Choose a Fund Provider

Once you’ve opened a brokerage account, you’ll need to choose a fund provider that offers an S&P 500 Index Fund. Some popular options include Vanguard 500 Index Fund (VFIAX), Fidelity 500 Index Fund (FUSAEX), and Schwab U.S. Broad Market ETF (SCHB). Compare fees, performance, and other key features before making a decision.

Step 3: Set Up a Regular Investment Plan

To invest in the S&P 500 Index Fund, you’ll need to set up a regular investment plan. This can be done through your brokerage account, and it allows you to invest a fixed amount of money at regular intervals. This approach can help you reduce the impact of market volatility and avoid trying to time the market.

Step 4: Monitor and Adjust Your Portfolio

Once you’ve invested in the S&P 500 Index Fund, it’s essential to monitor your portfolio regularly and make adjustments as needed. This can help you stay on track with your investment goals and ensure that your portfolio remains aligned with your risk tolerance.

Additional Tips for Investing in the S&P 500 Index Fund

When investing in the S&P 500 Index Fund, it’s essential to keep a long-term perspective. Avoid trying to time the market, and instead, focus on making regular investments and monitoring your portfolio. Additionally, consider taking advantage of tax-advantaged accounts, such as 401(k) or IRA, to optimize your investment returns.

By following these steps and tips, you can invest in the S&P 500 Index Fund and potentially benefit from its long-term growth and diversification. Remember to always do your research, compare fees and performance, and consult with a financial advisor if needed.

Top S&P 500 Index Funds to Consider for Your Investment Portfolio

When it comes to investing in the S&P 500 Index Fund, there are several options available. Here are some of the top S&P 500 Index Funds to consider for your investment portfolio:

Vanguard 500 Index Fund (VFIAX)

The Vanguard 500 Index Fund is one of the most popular and widely-held S&P 500 Index Funds. It has a low expense ratio of 0.04% and has consistently tracked the performance of the S&P 500 Index. With over $500 billion in assets under management, it is one of the largest index funds in the world.

Fidelity 500 Index Fund (FUSAEX)

The Fidelity 500 Index Fund is another popular option for investors looking to track the S&P 500 Index. It has a low expense ratio of 0.015% and has a strong track record of performance. With over $200 billion in assets under management, it is one of the largest index funds offered by Fidelity.

Schwab U.S. Broad Market ETF (SCHB)

The Schwab U.S. Broad Market ETF is a popular ETF option for investors looking to track the S&P 500 Index. It has a low expense ratio of 0.03% and has a strong track record of performance. With over $10 billion in assets under management, it is one of the largest ETFs offered by Schwab.

Comparison of Fees and Performance

When comparing the fees and performance of these top S&P 500 Index Funds, it’s clear that they offer competitive options for investors. The Vanguard 500 Index Fund has a slightly higher expense ratio than the Fidelity 500 Index Fund, but it has a stronger track record of performance. The Schwab U.S. Broad Market ETF has a lower expense ratio than both the Vanguard and Fidelity funds, but its performance has been slightly lower over the long-term.

Ultimately, the choice of which S&P 500 Index Fund to invest in will depend on your individual investment goals and preferences. It’s essential to do your research, compare fees and performance, and consider your overall investment strategy before making a decision.

Understanding the Fees Associated with S&P 500 Index Funds

When considering investing in an S&P 500 Index Fund, it’s essential to understand the fees associated with these funds. While S&P 500 Index Funds are known for their low costs, there are still various fees to be aware of, which can impact investment returns over time.

The primary fee associated with S&P 500 Index Funds is the expense ratio. This is the annual fee charged by the fund provider to manage the fund, expressed as a percentage of the fund’s average net assets. For example, if an S&P 500 Index Fund has an expense ratio of 0.04%, this means that for every $1,000 invested, the fund provider will charge $4 per year.

Other fees to consider when investing in an S&P 500 Index Fund include management fees, administrative fees, and trading fees. Management fees are paid to the fund manager for their services, while administrative fees cover the costs of running the fund. Trading fees, on the other hand, are incurred when buying or selling securities within the fund.

To minimize fees when investing in an S&P 500 Index Fund, consider the following strategies:

- Choose a fund with a low expense ratio. Vanguard’s S&P 500 Index Fund (VFIAX), for instance, has an expense ratio of just 0.04%.

- Avoid funds with high management fees or administrative fees.

- Consider investing in an ETF (Exchange-Traded Fund) version of the S&P 500 Index Fund, which often has lower fees than mutual fund versions.

- Take advantage of tax-loss harvesting, which can help offset capital gains taxes and reduce the impact of fees.

When evaluating the fees associated with an S&P 500 Index Fund, it’s essential to consider the overall cost of ownership. This includes not only the expense ratio but also any other fees that may be incurred. By choosing a fund with low fees and implementing strategies to minimize costs, investors can help maximize their returns and achieve long-term success.

For those looking to buy S&P 500 Index Fund, it’s crucial to carefully review the fees associated with the fund and consider the potential impact on investment returns. By doing so, investors can make informed decisions and create a portfolio that aligns with their long-term goals and objectives.

Managing Risk and Volatility in Your S&P 500 Index Fund Investment

Investing in the S&P 500 Index Fund can be a great way to build long-term wealth, but it’s essential to understand the risks and volatility associated with this investment. Market downturns, economic uncertainty, and other factors can impact the performance of the S&P 500 Index Fund, making it crucial to have a strategy in place to manage risk.

One of the most effective ways to manage risk when investing in the S&P 500 Index Fund is through diversification. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to any one particular market or sector. This can help to minimize losses during market downturns and capture growth opportunities during upswings.

Dollar-cost averaging is another strategy that can help to manage risk when investing in the S&P 500 Index Fund. This involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. By doing so, investors can reduce the impact of market volatility and avoid trying to time the market.

Regular portfolio rebalancing is also essential for managing risk when investing in the S&P 500 Index Fund. This involves periodically reviewing the portfolio to ensure that it remains aligned with the investor’s goals and risk tolerance. By rebalancing the portfolio, investors can help to maintain an optimal asset allocation and reduce the risk of significant losses.

In addition to these strategies, investors can also consider other risk management techniques, such as:

- Stop-loss orders: These can help to limit losses by automatically selling a security when it falls below a certain price.

- Position sizing: This involves allocating a specific amount of capital to each investment, based on the investor’s risk tolerance and goals.

- Risk parity: This involves allocating capital to different asset classes based on their risk profile, rather than their expected return.

When considering how to buy S&P 500 Index Fund, it’s essential to think about risk management and how to mitigate potential losses. By incorporating these strategies into an investment plan, investors can help to ensure long-term success and achieve their financial goals.

Investing in the S&P 500 Index Fund can be a great way to build wealth over the long-term, but it’s crucial to be aware of the risks and volatility associated with this investment. By understanding these risks and implementing effective risk management strategies, investors can help to minimize losses and maximize returns.

Ultimately, managing risk and volatility is an essential part of investing in the S&P 500 Index Fund. By being aware of the potential risks and taking steps to mitigate them, investors can help to ensure long-term success and achieve their financial goals.

Long-Term Performance of the S&P 500 Index Fund: Historical Data and Trends

The S&P 500 Index Fund has a long history of providing investors with strong returns over the long-term. Since its inception in 1957, the S&P 500 Index has returned an average of around 10% per year, making it one of the most successful investments of the past century.

Historical data shows that the S&P 500 Index Fund has consistently outperformed other asset classes over the long-term. For example, over the past 20 years, the S&P 500 Index Fund has returned an average of around 8% per year, compared to around 5% per year for bonds and around 3% per year for cash.

One of the key trends in the data is the long-term upward trajectory of the S&P 500 Index Fund. Despite experiencing several significant downturns over the years, including the 2008 financial crisis, the S&P 500 Index Fund has consistently recovered and gone on to reach new highs.

Another trend in the data is the increasing importance of the S&P 500 Index Fund in the global economy. As the US economy has grown and become more interconnected with the rest of the world, the S&P 500 Index Fund has become a key benchmark for investors around the globe.

When considering how to buy S&P 500 Index Fund, it’s essential to look at the historical data and trends. By understanding the long-term performance of the S&P 500 Index Fund, investors can make informed decisions about their investment strategy and achieve their long-term goals.

In addition to its strong long-term performance, the S&P 500 Index Fund also offers several other benefits to investors. These include:

- Diversification: By investing in the S&P 500 Index Fund, investors can gain exposure to a broad range of stocks and sectors, reducing their risk and increasing their potential for returns.

- Low costs: The S&P 500 Index Fund is generally a low-cost investment option, with expense ratios significantly lower than those of actively managed funds.

- Convenience: The S&P 500 Index Fund is widely available and can be easily purchased through a variety of channels, including online brokerages and financial advisors.

Overall, the historical data and trends suggest that the S&P 500 Index Fund is a strong investment option for those looking to build long-term wealth. By understanding the benefits and risks of the S&P 500 Index Fund, investors can make informed decisions about their investment strategy and achieve their long-term goals.

Common Mistakes to Avoid When Investing in the S&P 500 Index Fund

Investing in the S&P 500 Index Fund can be a great way to build long-term wealth, but it’s essential to avoid common mistakes that can hinder success. By understanding these mistakes and taking steps to avoid them, investors can increase their chances of achieving their financial goals.

One of the most common mistakes investors make when investing in the S&P 500 Index Fund is trying to time the market. This involves attempting to predict when the market will rise or fall and making investment decisions based on these predictions. However, timing the market is notoriously difficult, and investors who try to do so often end up losing money.

Another mistake investors make is not having a long-term perspective. The S&P 500 Index Fund is a long-term investment, and investors should be prepared to hold onto their shares for at least five years. However, many investors get caught up in short-term market fluctuations and sell their shares too soon, missing out on potential long-term gains.

Not monitoring and adjusting the portfolio regularly is also a common mistake. The S&P 500 Index Fund is a diversified investment, but it’s still important to regularly review the portfolio to ensure that it remains aligned with the investor’s goals and risk tolerance. By failing to do so, investors may miss out on opportunities to rebalance their portfolio and optimize their returns.

Other common mistakes to avoid when investing in the S&P 500 Index Fund include:

- Not diversifying the portfolio: While the S&P 500 Index Fund is a diversified investment, it’s still important to diversify the portfolio by investing in other asset classes, such as bonds and international

Common Mistakes to Avoid When Investing in the S&P 500 Index Fund

Investing in the S&P 500 Index Fund can be a great way to build long-term wealth, but it’s essential to avoid common mistakes that can hinder success. By understanding these mistakes and taking steps to avoid them, investors can increase their chances of achieving their financial goals.

One of the most common mistakes investors make when investing in the S&P 500 Index Fund is trying to time the market. This involves attempting to predict when the market will rise or fall and making investment decisions based on these predictions. However, timing the market is notoriously difficult, and investors who try to do so often end up losing money.

Another mistake investors make is not having a long-term perspective. The S&P 500 Index Fund is a long-term investment, and investors should be prepared to hold onto their shares for at least five years. However, many investors get caught up in short-term market fluctuations and sell their shares too soon, missing out on potential long-term gains.

Not monitoring and adjusting the portfolio regularly is also a common mistake. The S&P 500 Index Fund is a diversified investment, but it’s still important to regularly review the portfolio to ensure that it remains aligned with the investor’s goals and risk tolerance. By failing to do so, investors may miss out on opportunities to rebalance their portfolio and optimize their returns.

Other common mistakes to avoid when investing in the S&P 500 Index Fund include:

- Not diversifying the portfolio: While the S&P 500 Index Fund is a diversified investment, it’s still important to diversify the portfolio by investing in other asset classes, such as bonds and international