Understanding the Importance of Saving for Long-Term Goals

Saving for long-term goals is a crucial aspect of securing a stable financial future. Whether it’s retirement, buying a house, or funding education expenses, having a dedicated savings plan in place can provide peace of mind and financial security. The question of how much to save can be daunting, but understanding the importance of saving can help individuals make informed decisions about their financial priorities.

Long-term savings can help individuals achieve their goals by providing a dedicated fund for specific expenses. For example, saving for retirement can help individuals build a nest egg that can provide a steady income stream in their golden years. Similarly, saving for a down payment on a house can help individuals achieve their dream of homeownership.

Moreover, saving for long-term goals can also help individuals avoid debt and financial stress. By setting aside a portion of their income each month, individuals can avoid relying on credit cards or loans to cover unexpected expenses. This can help reduce financial stress and anxiety, allowing individuals to focus on their long-term goals.

So, how much should you save for long-term goals? The answer depends on various factors, including your income, expenses, debt, and financial goals. A general rule of thumb is to save at least 10% to 15% of your income towards long-term goals. However, this percentage can vary depending on individual circumstances.

For instance, if you’re saving for retirement, you may want to consider contributing to a 401(k) or IRA. These accounts offer tax benefits and can help your savings grow over time. Similarly, if you’re saving for a down payment on a house, you may want to consider setting aside a portion of your income each month in a dedicated savings account.

Ultimately, the key to saving for long-term goals is to start early and be consistent. By setting aside a portion of your income each month, you can build a dedicated fund for specific expenses and achieve your financial goals. Whether you’re saving for retirement, a down payment on a house, or education expenses, having a long-term savings plan in place can provide financial security and peace of mind.

Assessing Your Financial Situation: Income, Expenses, and Debt

To determine how much you should save, it’s essential to assess your current financial situation. This involves evaluating your income, expenses, and debt to understand where your money is going and identify areas for improvement. By taking a close look at your financial situation, you can create a realistic savings plan that works for you.

Start by tracking your income and expenses to see where your money is being spent. You can use a budgeting app, spreadsheet, or simply keep a notebook to record your transactions. Be sure to include all sources of income, such as your salary, investments, and any side hustles. Next, categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies, travel).

Once you have a clear picture of your income and expenses, you can begin to identify areas where you can cut back and allocate more funds towards saving. Consider ways to reduce unnecessary expenses, such as canceling subscription services you don’t use or finding ways to lower your household bills.

Debt can also play a significant role in your financial situation. If you have high-interest debt, such as credit card balances, it’s essential to prioritize debt repayment. Consider consolidating debt into a lower-interest loan or balance transfer credit card, and make a plan to pay off your debt as quickly as possible.

When assessing your financial situation, it’s also important to consider your financial goals. What do you want to save for? Is it a down payment on a house, retirement, or a big purchase? Knowing what you’re saving for will help you determine how much you should save each month.

For example, if you’re saving for a down payment on a house, you may want to consider setting aside a certain percentage of your income each month. A general rule of thumb is to save at least 20% of the purchase price of the home. However, this amount can vary depending on your individual circumstances.

By taking the time to assess your financial situation, you can create a personalized savings plan that works for you. Remember to regularly review and adjust your plan to ensure you’re on track to meet your financial goals.

How to Determine Your Ideal Savings Rate

Determining the right savings rate is crucial to achieving your long-term financial goals. The ideal savings rate varies depending on individual circumstances, such as income, expenses, debt, and financial goals. To calculate a suitable savings rate, consider the 50/30/20 rule, which allocates 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Another approach is to consider the 10% rule, which suggests saving at least 10% of income towards long-term goals, such as retirement or a down payment on a house. However, this percentage can vary depending on individual circumstances. For example, if you’re saving for a specific goal, such as a wedding or a big purchase, you may want to allocate a larger percentage of your income towards saving.

When determining your ideal savings rate, it’s also essential to consider your debt obligations. If you have high-interest debt, such as credit card balances, you may want to prioritize debt repayment over saving. Consider consolidating debt into a lower-interest loan or balance transfer credit card, and make a plan to pay off your debt as quickly as possible.

Additionally, consider your employer-matched retirement accounts, such as a 401(k) or 403(b). Contributing to these accounts can help you save for retirement while also reducing your taxable income. Aim to contribute at least enough to take full advantage of the employer match, as this is essentially free money that can help your savings grow over time.

Ultimately, the key to determining your ideal savings rate is to find a balance between saving for the future and living in the present. By considering your individual circumstances and financial goals, you can create a personalized savings plan that works for you.

For example, let’s say you earn $50,000 per year and want to save for a down payment on a house. You may want to allocate 15% of your income towards saving, which would be $7,500 per year. This amount can be adjusted based on your individual circumstances, such as your debt obligations and financial goals.

By determining your ideal savings rate and creating a personalized savings plan, you can make progress towards your long-term financial goals and achieve financial security and peace of mind.

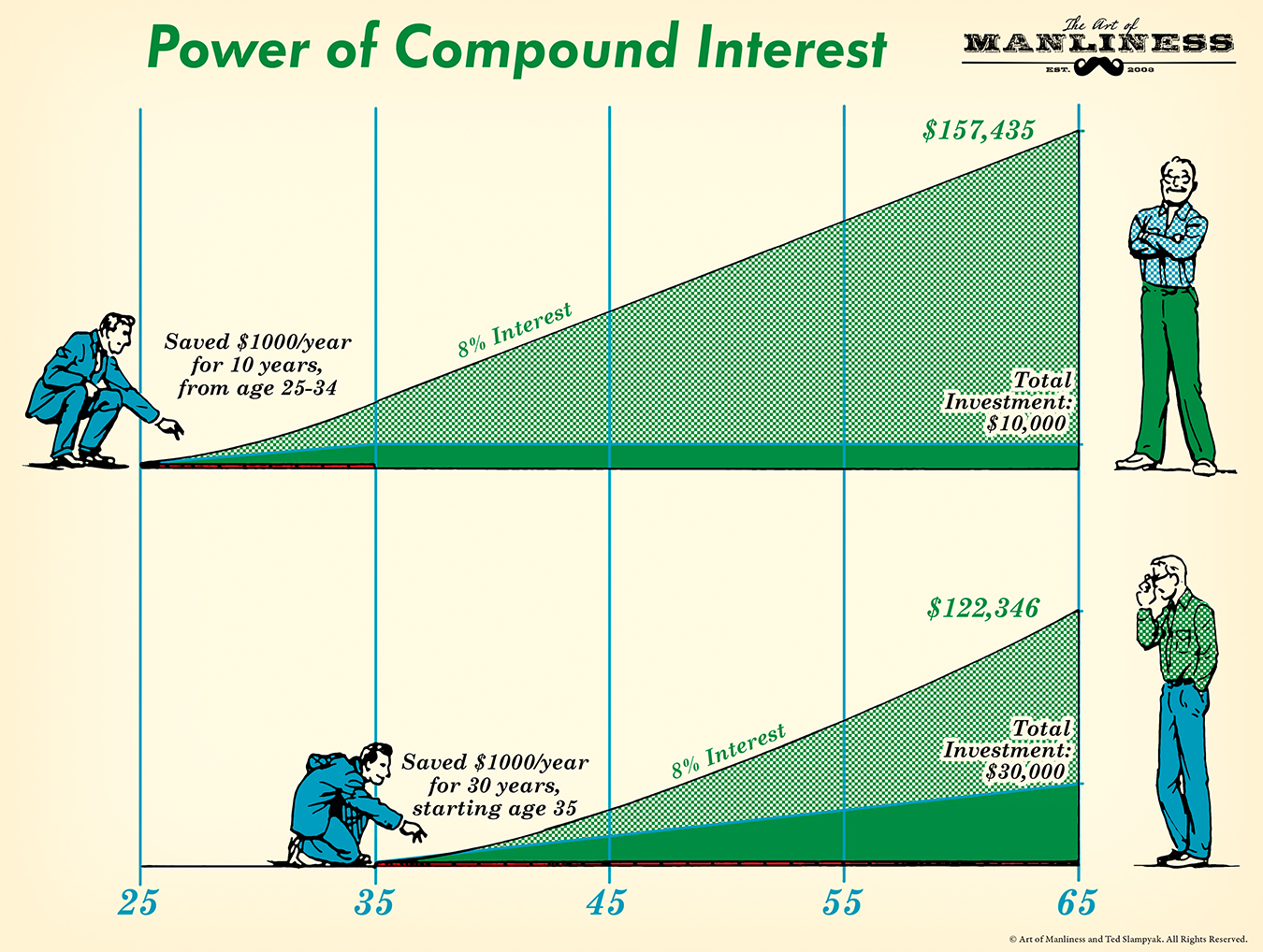

The Power of Compound Interest: Growing Your Savings Over Time

Compound interest is a powerful force that can help grow your savings over time. It’s the idea that the interest earned on your savings can be reinvested to earn even more interest, creating a snowball effect that can help your savings grow exponentially.

For example, let’s say you save $1,000 per year for 10 years, earning an average annual interest rate of 5%. At the end of the 10-year period, you’ll have saved a total of $10,000. However, with compound interest, you’ll have earned an additional $4,917 in interest, bringing your total savings to $14,917.

The key to harnessing the power of compound interest is to start saving early and consistently. The earlier you start saving, the more time your money has to grow. Additionally, making regular deposits into your savings account can help you take advantage of compound interest.

Another way to think about compound interest is to consider the rule of 72. This rule states that to calculate how long it will take for your savings to double in value, you can divide 72 by the interest rate. For example, if you earn an average annual interest rate of 5%, it will take approximately 14.4 years for your savings to double in value.

Compound interest can also help you achieve your long-term financial goals, such as retirement or buying a house. By starting to save early and consistently, you can take advantage of compound interest to grow your savings over time.

For instance, let’s say you want to save for retirement and you start saving $500 per month at age 25. Assuming an average annual interest rate of 7%, you’ll have saved over $1 million by the time you retire at age 65. This is the power of compound interest in action.

In conclusion, compound interest is a powerful force that can help grow your savings over time. By starting to save early and consistently, you can take advantage of compound interest to achieve your long-term financial goals.

Automating Your Savings: Making it Easy and Convenient

Automating your savings can be a game-changer when it comes to building a secure financial future. By setting up automatic transfers from your checking account to your savings account, you can make saving easier and less prone to being neglected.

One of the main benefits of automating your savings is that it takes the decision-making process out of the equation. When you set up automatic transfers, you ensure that a portion of your income is set aside for savings each month, without having to think about it.

Another benefit of automating your savings is that it can help you avoid the temptation to spend money impulsively. When you have to manually transfer money from your checking account to your savings account, you may be more likely to spend it on something else instead. By automating your savings, you can avoid this temptation and ensure that your savings goals are met.

So, how can you automate your savings? One way is to set up automatic transfers from your checking account to your savings account. You can do this through your bank’s online platform or mobile app. Simply set up a transfer schedule and specify the amount you want to transfer each month.

Another way to automate your savings is to take advantage of employer-matched retirement accounts, such as a 401(k) or 403(b). These accounts allow you to contribute a portion of your income to a retirement account, and your employer may match a portion of your contributions.

Additionally, you can also automate your savings by using a savings app, such as Qapital or Digit. These apps allow you to set savings goals and automatically transfer money from your checking account to your savings account.

By automating your savings, you can make saving easier and less prone to being neglected. Remember, saving is a long-term process, and every little bit counts. By making saving a habit, you can build a secure financial future and achieve your long-term goals.

For example, let’s say you want to save $500 per month for a down payment on a house. By setting up automatic transfers from your checking account to your savings account, you can ensure that you save $500 per month without having to think about it. This can help you reach your goal faster and make saving easier and less prone to being neglected.

Avoiding Common Savings Mistakes: Pitfalls to Watch Out For

When it comes to saving, there are several common mistakes that people make that can hinder their progress and prevent them from reaching their financial goals. By being aware of these pitfalls, you can avoid them and stay on track with your savings plan.

One of the most common mistakes people make when it comes to saving is not starting early enough. The earlier you start saving, the more time your money has to grow and compound. Even small, consistent savings can add up to significant amounts over time.

Another mistake people make is not taking advantage of employer-matched retirement accounts, such as a 401(k) or 403(b). These accounts offer a free match on your contributions, which can help your savings grow faster. By not contributing to these accounts, you’re essentially leaving free money on the table.

Additionally, people often make the mistake of not having a clear savings goal in mind. Without a specific goal, it’s easy to get sidetracked and lose focus on your savings plan. By setting a clear goal, you can stay motivated and directed towards your objective.

Another common mistake is not automating your savings. By setting up automatic transfers from your checking account to your savings account, you can make saving easier and less prone to being neglected. This way, you can ensure that you’re saving consistently and making progress towards your goal.

Finally, people often make the mistake of not reviewing and adjusting their savings plan regularly. As your financial goals and circumstances change, your savings plan should too. By regularly reviewing and adjusting your plan, you can ensure that you’re on track to meet your goals and make any necessary adjustments.

For example, let’s say you’re saving for a down payment on a house. If you’re not taking advantage of employer-matched retirement accounts, you may be missing out on free money that could help you reach your goal faster. By avoiding this mistake and taking advantage of these accounts, you can accelerate your savings and reach your goal sooner.

By being aware of these common savings mistakes, you can avoid them and stay on track with your savings plan. Remember, saving is a long-term process, and every little bit counts. By staying motivated and disciplined, you can reach your financial goals and achieve a secure financial future.

Staying Motivated and Disciplined: Tips for Long-Term Savings Success

Staying motivated and disciplined is crucial when it comes to saving for long-term goals. It’s easy to get sidetracked and lose focus on your savings plan, but by incorporating a few simple strategies, you can stay on track and achieve your financial objectives.

One of the most effective ways to stay motivated is to set clear and specific savings goals. By defining what you want to achieve, you can create a roadmap for your savings plan and track your progress along the way. Make sure your goals are measurable, achievable, and aligned with your values and priorities.

Another way to stay motivated is to track your progress and celebrate your milestones. By monitoring your savings progress, you can see how far you’ve come and stay motivated to continue. Celebrate your successes, no matter how small they may seem, and use them as motivation to keep moving forward.

Additionally, consider setting reminders and alerts to help you stay on track with your savings plan. You can set reminders on your phone or calendar to transfer money into your savings account or to review your budget and make adjustments as needed.

It’s also important to avoid temptation and stay disciplined when it comes to saving. Avoid impulse purchases and try to delay gratification by waiting 24 hours before making a non-essential purchase. By staying disciplined and focused on your savings goals, you can avoid common pitfalls and stay on track.

Finally, consider enlisting the help of a savings buddy or accountability partner. Having someone to report to and stay accountable with can help you stay motivated and disciplined when it comes to saving. You can also join a savings group or find an online community to connect with others who share similar savings goals.

For example, let’s say you’re saving for a down payment on a house. By setting clear and specific savings goals, tracking your progress, and celebrating your milestones, you can stay motivated and disciplined throughout the savings process. By avoiding temptation and staying focused on your goals, you can reach your target and achieve your dream of homeownership.

By incorporating these strategies into your savings plan, you can stay motivated and disciplined and achieve long-term savings success. Remember, saving is a marathon, not a sprint, and every step you take towards your goals brings you closer to financial freedom and security.

Reviewing and Adjusting Your Savings Plan: A Regular Check-In

Regularly reviewing and adjusting your savings plan is crucial to ensuring that it remains aligned with your changing financial goals and circumstances. By regularly checking in on your savings progress, you can identify areas for improvement and make adjustments as needed.

One of the most important reasons to review and adjust your savings plan is to ensure that it remains aligned with your changing financial goals. As your financial goals and circumstances change, your savings plan should too. By regularly reviewing your savings plan, you can ensure that you’re on track to meet your goals and make any necessary adjustments.

Another reason to review and adjust your savings plan is to identify areas for improvement. By regularly reviewing your savings progress, you can identify areas where you can improve and make adjustments as needed. For example, you may find that you need to increase your savings rate or adjust your investment strategy.

Additionally, regularly reviewing and adjusting your savings plan can help you stay motivated and disciplined. By regularly checking in on your savings progress, you can see how far you’ve come and stay motivated to continue. You can also use this opportunity to celebrate your successes and make adjustments as needed.

So, how often should you review and adjust your savings plan? It’s a good idea to review your savings plan at least once a year, or more often if your financial goals and circumstances are changing rapidly. You can also use this opportunity to review your budget and make any necessary adjustments.

For example, let’s say you’re saving for a down payment on a house. By regularly reviewing your savings progress, you can ensure that you’re on track to meet your goal and make any necessary adjustments. You can also use this opportunity to review your budget and make any necessary adjustments to ensure that you’re saving enough.

By regularly reviewing and adjusting your savings plan, you can ensure that it remains aligned with your changing financial goals and circumstances. Remember, saving is a long-term process, and every step you take towards your goals brings you closer to financial freedom and security.

.jpg)