Emergency Funding: Why You Need a Plan

Life is full of unexpected twists and turns, and sometimes, these surprises come with a hefty price tag. Whether it’s a medical emergency, car repairs, or a sudden loss of income, having a plan in place for emergency funding needs can be a lifesaver. Knowing how to come up with $2000 fast can reduce financial stress and provide peace of mind, allowing individuals to focus on what matters most – resolving the crisis at hand.

A well-thought-out emergency funding plan can help individuals avoid going into debt, reduce financial anxiety, and make informed decisions during a crisis. It’s essential to have a plan in place before disaster strikes, as it can be challenging to think clearly and make rational decisions when under pressure. By having a plan, individuals can ensure they have access to the necessary funds to cover unexpected expenses, avoiding the need for costly loans or credit card debt.

So, how can individuals prepare for emergency funding needs? The first step is to create a budget and start building an emergency fund. This fund should cover at least three to six months’ worth of living expenses, providing a cushion in case of unexpected events. Additionally, individuals can explore alternative funding options, such as a home equity line of credit or a personal loan, to ensure they have access to funds when needed.

Having a plan in place for emergency funding needs is crucial for financial stability and peace of mind. By being prepared, individuals can reduce financial stress and focus on resolving the crisis at hand. Whether it’s knowing how to come up with $2000 fast or having a long-term emergency fund in place, being prepared can make all the difference in times of need.

Selling Unwanted Items: A Quick Cash Infusion

When faced with an unexpected expense or financial emergency, selling unwanted items can be a quick and effective way to raise cash. With the rise of online marketplaces and social media, it’s easier than ever to turn unwanted items into cash. For those wondering how to come up with $2000 fast, selling unwanted items can be a viable solution.

One of the most popular platforms for selling unwanted items is eBay. With over 183 million active users, eBay provides a vast marketplace for buying and selling goods. From electronics to clothing, eBay is an ideal platform for selling unwanted items. Another popular option is Craigslist, which allows users to sell items locally. Facebook Marketplace is also a great option, allowing users to sell items to people in their local community.

In addition to online marketplaces, garage sales and consignment shops can also be a great way to sell unwanted items. Garage sales allow individuals to sell multiple items at once, while consignment shops provide a platform for selling gently used items. When selling unwanted items, it’s essential to price items competitively and provide detailed descriptions to attract potential buyers.

Some popular items to sell include:

- Gently used clothing and accessories

- Electronics, such as phones, laptops, and tablets

- Furniture and household items

- Books, CDs, and DVDs

- Sporting goods and equipment

When selling unwanted items, it’s crucial to be realistic about prices and to provide excellent customer service. By doing so, individuals can quickly raise cash and alleviate financial stress. Whether it’s selling unwanted items online or through a garage sale, this method can provide a quick cash infusion to help cover unexpected expenses.

Freelance Work: Monetize Your Skills

For those looking for ways to raise $2000 quickly, freelance work can be a lucrative option. With the rise of the gig economy, it’s easier than ever to monetize your skills and offer services on a freelance basis. Whether you’re a writer, designer, developer, or consultant, there are numerous platforms that can connect you with clients looking for your expertise.

Upwork, Fiverr, and Freelancer are three of the most popular freelance platforms, offering a range of opportunities for freelancers to find work. Upwork, for example, allows freelancers to create a profile, showcase their portfolio, and bid on projects that match their skills. Fiverr, on the other hand, focuses on smaller, one-off projects, while Freelancer offers a range of projects, from small tasks to larger, more complex assignments.

To get started with freelance work, it’s essential to identify your skills and create a profile that showcases your expertise. This includes highlighting your experience, education, and any relevant certifications or training. A strong profile will help you stand out from the competition and attract potential clients.

Some popular freelance skills in demand include:

- Writing and content creation

- Graphic design and digital art

- Web development and coding

- Consulting and strategy

- Social media management and marketing

When working as a freelancer, it’s crucial to be proactive and market yourself to potential clients. This includes networking, promoting your services on social media, and reaching out to potential clients directly. By doing so, you can increase your chances of landing projects and earning a steady income.

Freelance work can be a flexible and lucrative way to earn money, especially for those looking for ways to raise $2000 quickly. By identifying your skills, creating a strong profile, and marketing yourself to potential clients, you can monetize your expertise and achieve your financial goals.

Ride-Sharing and Delivery Services: Drive Your Way to Cash

For those looking for ways to raise $2000 quickly, ride-sharing and delivery services can be a lucrative option. With the rise of the gig economy, companies like Uber, Lyft, DoorDash, and Postmates have created opportunities for individuals to earn money by driving and delivering food and packages.

To get started with ride-sharing and delivery services, you’ll need a reliable vehicle, a valid driver’s license, and a smartphone. Most companies require a background check and a minimum age requirement of 21 years old. Once you’ve met the requirements, you can sign up to be a driver and start accepting ride and delivery requests.

The potential earnings for ride-sharing and delivery services vary depending on the company, location, and time of day. However, here are some estimated earnings for each company:

- Uber: $15-$25 per hour

- Lyft: $15-$25 per hour

- DoorDash: $10-$20 per hour

- Postmates: $10-$20 per hour

Keep in mind that these are estimated earnings and may vary depending on your location and the demand for services. Additionally, you’ll need to consider expenses such as gas, maintenance, and vehicle wear and tear.

Some tips for maximizing your earnings with ride-sharing and delivery services include:

- Driving during peak hours (e.g., rush hour, late nights)

- Accepting multiple ride and delivery requests at once

- Providing excellent customer service to increase tips

- Using fuel-efficient vehicles to reduce gas expenses

Ride-sharing and delivery services can be a flexible and lucrative way to earn money, especially for those looking for ways to raise $2000 quickly. By signing up to be a driver and following these tips, you can increase your earnings and achieve your financial goals.

Participating in Online Surveys: Share Your Opinions

For those looking for ways to raise $2000 quickly, participating in online surveys can be a viable option. Many companies are willing to pay individuals for their opinions on various products and services, and there are several websites that can connect you with these opportunities.

Swagbucks, Survey Junkie, and Vindale Research are three popular websites that offer paid online surveys. These websites partner with companies to gather feedback from consumers, and they reward participants with cash, gift cards, or other incentives.

To get started with online surveys, you’ll need to sign up for an account on one of these websites. Most websites require basic demographic information, such as age, location, and interests, to match you with relevant surveys. Once you’ve completed the sign-up process, you can start browsing available surveys and earning rewards.

The pay for online surveys varies depending on the website and the specific survey. However, here are some estimated earnings for each website:

- Swagbucks: $1-$5 per survey

- Survey Junkie: $2-$10 per survey

- Vindale Research: $1-$5 per survey

Keep in mind that these are estimated earnings and may vary depending on the survey and the website. Additionally, some websites may offer additional ways to earn rewards, such as watching videos or shopping online.

Some tips for maximizing your earnings with online surveys include:

- Signing up for multiple websites to increase your chances of finding available surveys

- Completing your demographic profile to ensure you’re matched with relevant surveys

- Being honest and providing thoughtful responses to increase your chances of qualifying for surveys

- Using a dedicated email address to receive survey notifications and avoid cluttering your primary inbox

Participating in online surveys can be a flexible and rewarding way to earn money, especially for those looking for ways to raise $2000 quickly. By signing up for these websites and following these tips, you can increase your earnings and achieve your financial goals.

Borrowing from Friends or Family: A Last Resort

Borrowing from friends or family can be a viable option for raising $2000 quickly, but it should be considered a last resort. This is because borrowing from loved ones can put a strain on relationships and create feelings of guilt and obligation.

However, if you have a good relationship with your friends or family and are confident that you can repay the loan, it may be worth considering. Before approaching a friend or family member for a loan, it’s essential to have a clear plan for repayment and to communicate your intentions clearly.

Some tips for borrowing from friends or family include:

- Being upfront and honest about your financial situation and your need for a loan

- Creating a repayment plan and sticking to it

- Offering collateral or a guarantee to secure the loan

- Keeping the loan amount reasonable and manageable

- Avoiding borrowing from friends or family for non-essential expenses

It’s also essential to consider the potential risks and consequences of borrowing from friends or family, including:

- Damaging your relationship if you’re unable to repay the loan

- Creating feelings of guilt and obligation

- Setting a precedent for future borrowing

- Missing out on other financial opportunities or resources

Before borrowing from friends or family, it’s crucial to explore other options for raising $2000 quickly, such as selling unwanted items, freelancing, or participating in online surveys. If you do decide to borrow from friends or family, make sure to approach the situation with caution and respect, and to prioritize repayment and communication.

Remember, borrowing from friends or family should be a last resort, and it’s essential to have a clear plan for repayment and to communicate your intentions clearly. By being responsible and respectful, you can maintain healthy relationships and avoid financial stress.

Cash Advance Apps: A Quick Fix with a Catch

Cash advance apps like Earnin, Dave, and Brigit offer a quick fix for those who need to come up with $2000 fast. These apps provide an advance on your next paycheck, allowing you to access cash when you need it most. However, it’s essential to understand the potential benefits and drawbacks of using these apps.

The benefits of cash advance apps include:

- Quick access to cash: Cash advance apps can provide an advance on your next paycheck, allowing you to access cash when you need it most.

- Convenience: Cash advance apps are often easy to use and can be accessed through a mobile app.

- No credit check: Cash advance apps typically don’t require a credit check, making them a viable option for those with poor credit.

However, there are also some potential drawbacks to consider:

- Fees: Cash advance apps often charge fees for their services, which can range from 5% to 15% of the advance amount.

- Interest rates: Some cash advance apps charge interest rates on the advance amount, which can range from 10% to 30% APR.

- Repayment terms: Cash advance apps often require repayment within a short period, typically within a few days or weeks.

Some popular cash advance apps include:

- Earnin: Earnin offers an advance on your next paycheck, with fees ranging from 5% to 15% of the advance amount.

- Dave: Dave offers an advance on your next paycheck, with fees ranging from 5% to 15% of the advance amount.

- Brigit: Brigit offers an advance on your next paycheck, with fees ranging from 5% to 15% of the advance amount.

When using cash advance

Creating a Budget: A Long-Term Solution

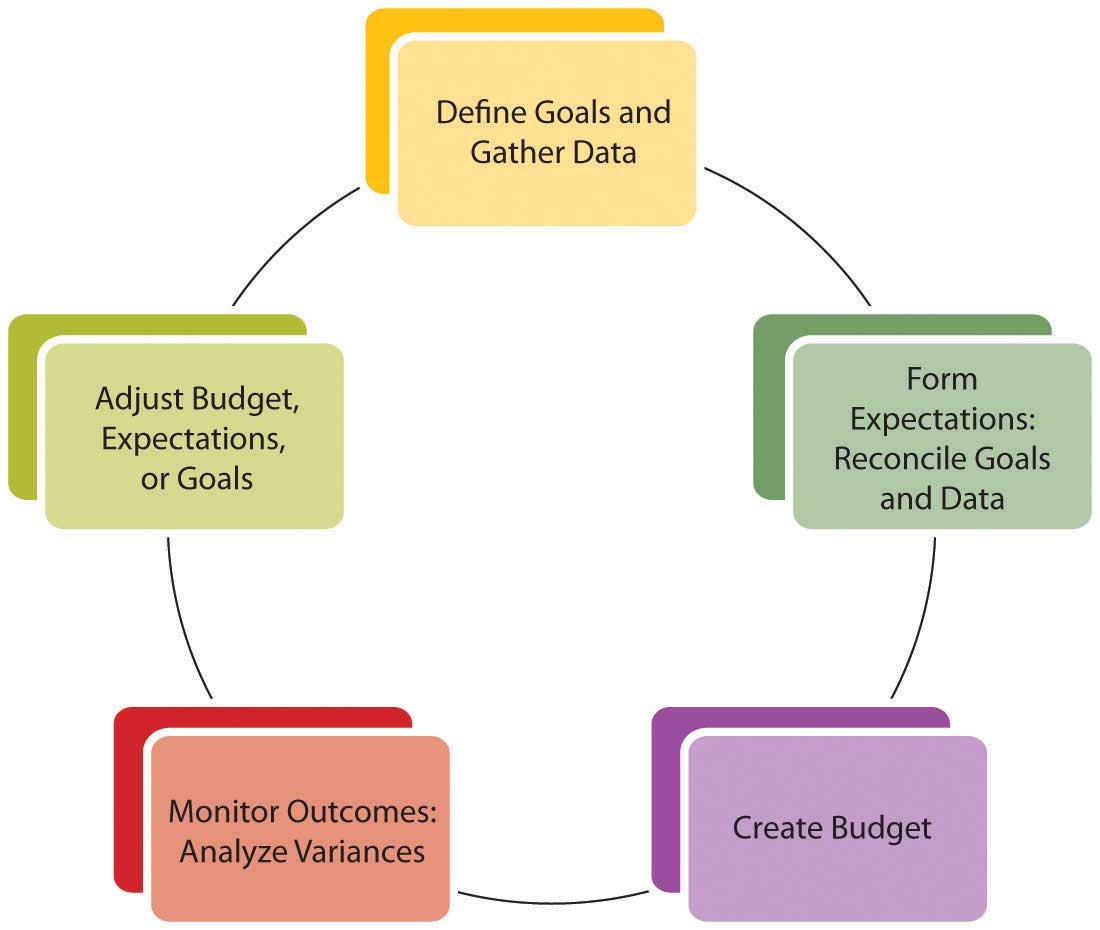

Creating a budget is a long-term solution to managing finances and avoiding future emergency funding needs. By tracking expenses, creating a budget plan, and prioritizing savings, individuals can ensure that they have a financial safety net in place to cover unexpected expenses.

The first step in creating a budget is to track expenses. This involves monitoring every single transaction, including small purchases like coffee or snacks, to get a clear picture of where money is being spent. There are many tools and apps available to help with expense tracking, such as Mint, Personal Capital, or YNAB (You Need a Budget).

Once expenses are tracked, the next step is to create a budget plan. This involves categorizing expenses into needs (housing, food, utilities) and wants (entertainment, hobbies), and allocating a specific amount of money for each category. A budget plan should also include a savings component, where a portion of income is set aside for emergencies and long-term goals.

Prioritizing savings is crucial to avoiding future emergency funding needs. By setting aside a portion of income each month, individuals can build up a financial safety net that can be used to cover unexpected expenses. It’s recommended to save at least 3-6 months’ worth of living expenses in an easily accessible savings account.

Some additional tips for creating a budget include:

- Using the 50/30/20 rule: Allocate 50% of income towards needs, 30% towards wants, and 20% towards savings and debt repayment.

- Avoiding impulse purchases: Create a 30-day waiting period for non-essential purchases to ensure that they are truly necessary.

- Automating savings: Set up automatic transfers from checking to savings to make saving easier and less prone to being neglected.

- Reviewing and adjusting: Regularly review the budget and make adjustments as needed to ensure that it is working effectively.

By creating a budget and prioritizing savings, individuals can avoid future emergency funding needs and ensure that they have a financial safety net in place to cover unexpected expenses. This long-term solution can provide peace of mind and financial stability, making it easier to come up with $2000 fast when needed.