What is Market Capitalization and Why Does it Matter?

Market capitalization, often referred to as market cap, is a crucial metric in the stock market that represents the total value of a company’s outstanding shares. It is calculated by multiplying the total number of shares outstanding by the current market price of one share. For instance, if a company has 10 million shares outstanding and the current market price is $100 per share, the market capitalization would be $1 billion.

Understanding market capitalization is essential for investors, as it provides valuable insights into a company’s size, liquidity, and potential for growth. A company’s market capitalization can impact its stock performance, volatility, and investment appeal. For example, large-cap companies tend to be more stable and less volatile, while small-cap companies may offer higher growth potential but also come with higher risks.

In the context of the stock market, market capitalization plays a significant role in shaping investment decisions. It helps investors to evaluate a company’s size and scalability, which can influence their investment choices. For instance, investors seeking stable returns may prefer large-cap companies, while those looking for growth opportunities may opt for small-cap or mid-cap companies.

Moreover, market capitalization is a key factor in determining a company’s market position and competitiveness. It can affect a company’s ability to raise capital, attract investors, and compete with peers. A higher market capitalization can provide a company with a competitive advantage, enabling it to invest in research and development, expand its operations, and make strategic acquisitions.

In the stock market, market capitalization is often used as a benchmark to evaluate a company’s performance. It is a widely followed metric that provides a snapshot of a company’s size and value. By understanding market capitalization, investors can make informed decisions about their investments and navigate the complexities of the stock market.

How to Calculate Market Capitalization: A Step-by-Step Guide

Calculating market capitalization is a straightforward process that requires only two pieces of information: the total number of outstanding shares and the current market price of one share. The formula for calculating market capitalization is:

Market Capitalization = Total Number of Outstanding Shares x Current Market Price per Share

For example, let’s say a company has 10 million shares outstanding and the current market price is $50 per share. The market capitalization would be:

Market Capitalization = 10,000,000 shares x $50 per share = $500,000,000

This means that the company’s market capitalization is $500 million.

It’s essential to note that market capitalization is a dynamic metric that can fluctuate rapidly due to changes in the stock price. Therefore, it’s crucial to use the most up-to-date information when calculating market capitalization.

In addition to the formula, there are also online tools and resources available that can help calculate market capitalization. Many financial websites and stock screeners provide market capitalization data for publicly traded companies.

Understanding how to calculate market capitalization is a fundamental concept in the stock market, and it’s essential for investors to grasp this concept to make informed investment decisions. By following these simple steps, investors can easily calculate market capitalization and gain a deeper understanding of a company’s size and value.

In the context of the stock market, market capitalization is a widely followed metric that provides valuable insights into a company’s financial health and growth potential. By incorporating market capitalization into their investment strategy, investors can make more informed decisions and achieve their financial goals.

Understanding Market Capitalization Categories: From Small-Cap to Large-Cap

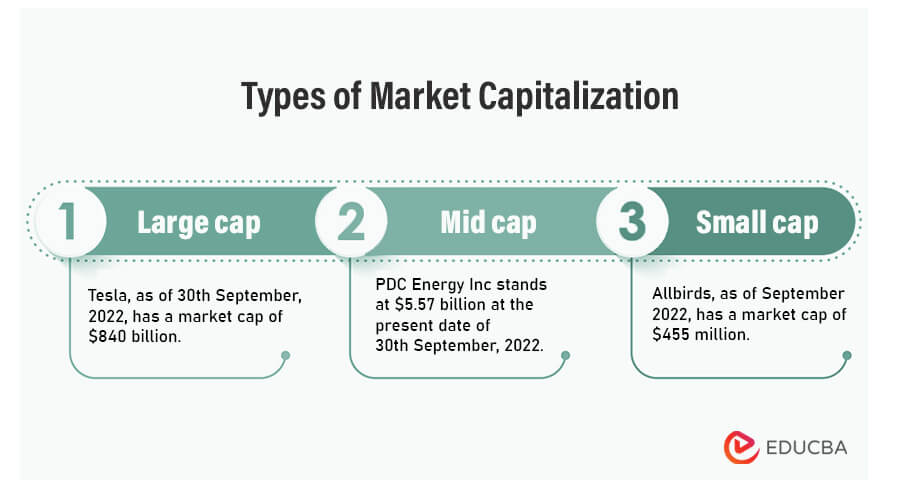

Market capitalization is a widely used metric to categorize companies into different groups based on their market value. The most common market capitalization categories are small-cap, mid-cap, large-cap, and mega-cap. Each category has its unique characteristics, and understanding these differences is essential for investors to make informed decisions.

Small-cap companies have a market capitalization of less than $2 billion. These companies are often in the early stages of development and may have high growth potential. However, they can also be more volatile and riskier than larger companies. Examples of small-cap companies include emerging technology firms and biotech startups.

Mid-cap companies have a market capitalization between $2 billion and $10 billion. These companies are often established players in their industries, but may still have room for growth. Mid-cap companies can offer a balance between growth potential and stability. Examples of mid-cap companies include regional banks and mid-sized retailers.

Large-cap companies have a market capitalization between $10 billion and $50 billion. These companies are often industry leaders and have a strong track record of stability and growth. Large-cap companies can provide a relatively stable source of returns, but may have limited growth potential. Examples of large-cap companies include multinational corporations and established technology firms.

Mega-cap companies have a market capitalization of over $50 billion. These companies are often global leaders in their industries and have a significant impact on the overall market. Mega-cap companies can provide a high level of stability and liquidity, but may have limited growth potential. Examples of mega-cap companies include multinational conglomerates and large technology firms.

Understanding the different market capitalization categories can help investors make informed decisions about their investment strategies. By considering the characteristics of each category, investors can choose companies that align with their risk tolerance, investment goals, and time horizon.

In the context of the stock market, market capitalization categories can also impact the overall performance of a portfolio. By diversifying across different market capitalization categories, investors can reduce their risk and increase their potential returns.

The Impact of Market Capitalization on Stock Performance

Market capitalization has a significant impact on stock performance, affecting volatility, liquidity, and growth potential. Companies with larger market capitalizations tend to be less volatile and more liquid, making them more attractive to investors seeking stable returns. On the other hand, smaller market capitalizations can be more volatile, but may offer higher growth potential.

Historically, large-cap companies have outperformed small-cap companies in terms of stability and returns. According to a study by Fidelity Investments, large-cap stocks have returned an average of 10% per year over the past decade, compared to 8% for small-cap stocks. However, small-cap stocks have been known to outperform large-cap stocks during periods of economic growth and expansion.

Mid-cap companies, with market capitalizations between $2 billion and $10 billion, often offer a balance between growth potential and stability. These companies may have established themselves in their industries, but still have room for expansion and growth. Mid-cap stocks have returned an average of 9% per year over the past decade, according to the same Fidelity Investments study.

Market capitalization also affects liquidity, which is the ability to buy or sell a stock quickly and at a fair price. Large-cap companies tend to have higher liquidity, making it easier for investors to enter and exit positions. Small-cap companies, on the other hand, may have lower liquidity, making it more difficult for investors to trade their shares.

In terms of growth potential, market capitalization can be a significant factor. Small-cap companies may have higher growth potential, but also come with higher risks. Large-cap companies, on the other hand, may have lower growth potential, but offer more stability and lower risk.

Understanding the impact of market capitalization on stock performance is essential for investors to make informed decisions. By considering the characteristics of different market capitalization categories, investors can choose companies that align with their risk tolerance, investment goals, and time horizon.

How Market Capitalization Influences Investment Decisions

Market capitalization plays a significant role in investment decisions, as it affects risk tolerance, diversification, and portfolio allocation. Investors with a low-risk tolerance may prefer large-cap companies, which tend to be more stable and less volatile. On the other hand, investors with a higher risk tolerance may prefer small-cap or mid-cap companies, which offer higher growth potential but also come with higher risks.

Market capitalization also influences diversification, as investors seek to spread their risk across different asset classes and industries. A diversified portfolio may include a mix of large-cap, mid-cap, and small-cap companies, as well as bonds, real estate, and other asset classes.

When it comes to portfolio allocation, market capitalization can help investors determine the optimal mix of stocks and bonds. For example, a conservative investor may allocate a larger portion of their portfolio to large-cap stocks and bonds, while a more aggressive investor may allocate a larger portion to small-cap stocks and other higher-risk assets.

To make informed investment decisions, investors should consider the following tips:

1. Assess your risk tolerance: Determine your comfort level with risk and adjust your investment strategy accordingly.

2. Diversify your portfolio: Spread your risk across different asset classes and industries to minimize losses.

3. Consider market capitalization: Use market capitalization to determine the optimal mix of stocks and bonds in your portfolio.

4. Monitor and adjust: Continuously monitor your portfolio and adjust your investment strategy as needed.

By considering market capitalization and its impact on investment decisions, investors can make informed choices and achieve their financial goals.

In the context of the stock market, market capitalization is a valuable tool for investors to evaluate companies and make informed investment decisions. By understanding the different market capitalization categories and their characteristics, investors can create a diversified portfolio that aligns with their risk tolerance and investment goals.

Real-World Examples of Market Capitalization in Action

Market capitalization is a widely used metric in the stock market, and its impact can be seen in various industries. Let’s take a look at some real-world examples of companies with different market capitalizations to illustrate how it affects their stock performance and investment appeal.

Large-cap companies like Apple (AAPL) and Microsoft (MSFT) have a market capitalization of over $1 trillion. These companies are industry leaders and have a strong track record of stability and growth. Their large market capitalization provides a high level of liquidity and makes them attractive to investors seeking stable returns.

Mid-cap companies like Netflix (NFLX) and Shopify (SHOP) have a market capitalization between $10 billion and $50 billion. These companies are established players in their industries and have a strong growth potential. Their mid-cap market capitalization provides a balance between growth and stability, making them attractive to investors seeking a mix of both.

Small-cap companies like Square (SQ) and DocuSign (DOCU) have a market capitalization of less than $10 billion. These companies are often in the early stages of development and have a high growth potential. Their small-cap market capitalization makes them more volatile, but also provides a higher potential for returns.

These examples demonstrate how market capitalization can impact a company’s stock performance and investment appeal. By understanding the different market capitalization categories and their characteristics, investors can make informed decisions and create a diversified portfolio that aligns with their risk tolerance and investment goals.

In addition to these examples, market capitalization can also be seen in various industries such as finance, healthcare, and technology. Companies like JPMorgan Chase (JPM) and Johnson & Johnson (JNJ) have a large market capitalization and are industry leaders, while companies like Zoom Video Communications (ZM) and Moderna Therapeutics (MRNA) have a smaller market capitalization and are growing rapidly.

These examples illustrate the versatility of market capitalization and its impact on the stock market. By understanding market capitalization, investors can make informed decisions and achieve their financial goals.

Common Misconceptions About Market Capitalization

Market capitalization is a widely used metric in the stock market, but it is often misunderstood or misinterpreted. One common misconception is that market capitalization is the only factor to consider when evaluating a stock. While market capitalization is an important metric, it is not the only factor to consider.

Another misconception is that market capitalization is a perfect measure of a company’s size and value. However, market capitalization only represents the total value of a company’s outstanding shares, and does not take into account other important factors such as revenue, profitability, and growth potential.

Some investors also believe that market capitalization is a guarantee of a company’s success or failure. However, market capitalization is only one factor to consider, and other factors such as management team, industry trends, and competitive landscape also play a crucial role in determining a company’s success or failure.

It is also important to note that market capitalization is not a static metric, and it can fluctuate rapidly due to changes in the stock price. Therefore, it is essential to consider other metrics such as price-to-earnings ratio, dividend yield, and return on equity to get a comprehensive view of a company’s financial health and growth potential.

In conclusion, market capitalization is an important metric in the stock market, but it is not the only factor to consider when evaluating a stock. By understanding the limitations and misconceptions of market capitalization, investors can make more informed decisions and achieve their financial goals.

By considering multiple metrics and factors, investors can get a more comprehensive view of a company’s financial health and growth potential. This can help investors to make more informed decisions and avoid common pitfalls such as overvaluing or undervaluing a company based on market capitalization alone.

Conclusion: Mastering Market Capitalization for Stock Market Success

In conclusion, market capitalization is a crucial metric in the stock market that can help investors make informed decisions. By understanding the concept of market capitalization, its significance, and its impact on stock performance, investors can gain a competitive edge in the market.

Throughout this article, we have discussed the different market capitalization categories, including small-cap, mid-cap, large-cap, and mega-cap. We have also analyzed the relationship between market capitalization and stock performance, including how it affects volatility, liquidity, and growth potential.

Additionally, we have provided real-world examples of companies with different market capitalizations to illustrate how it affects their stock performance and investment appeal. We have also addressed common misconceptions about market capitalization, including the idea that it is the only factor to consider when evaluating a stock.

By mastering market capitalization, investors can make more informed decisions and achieve their financial goals. Whether you are a seasoned investor or just starting out, understanding market capitalization is essential for success in the stock market.

Remember, market capitalization is just one factor to consider when evaluating a stock. It is essential to consider other metrics such as price-to-earnings ratio, dividend yield, and return on equity to get a comprehensive view of a company’s financial health and growth potential.

By incorporating market capitalization into your investment strategy, you can gain a deeper understanding of the stock market and make more informed decisions. So, start mastering market capitalization today and take your investment skills to the next level!